Pradhan Mantri Viksit Bharat Rozgar Yojana

- 23 Aug 2025

In News:

In his 12th Independence Day address from the Red Fort (15 August 2025), Prime Minister Narendra Modi announced the launch of the Pradhan Mantri Viksit Bharat Rozgar Yojana (PMVBRY). With an ambitious financial outlay of nearly ?1 lakh crore, the scheme aims to generate over 3.5 crore jobs in two years, representing a landmark initiative to strengthen the bridge from Swatantra Bharat to Samriddha Bharat through massive employment creation.

Objectives

The scheme seeks to:

- Boost formal job creation by offering direct financial incentives to both employees and employers.

- Promote workforce formalisation by bringing more workers under the ambit of the Employees’ Provident Fund Organisation (EPFO).

- Encourage savings and financial literacy among youth entering the workforce for the first time.

- Catalyse employment growth in the manufacturing sector, a critical pillar of Make in India and Atmanirbhar Bharat.

Key Features of the Scheme

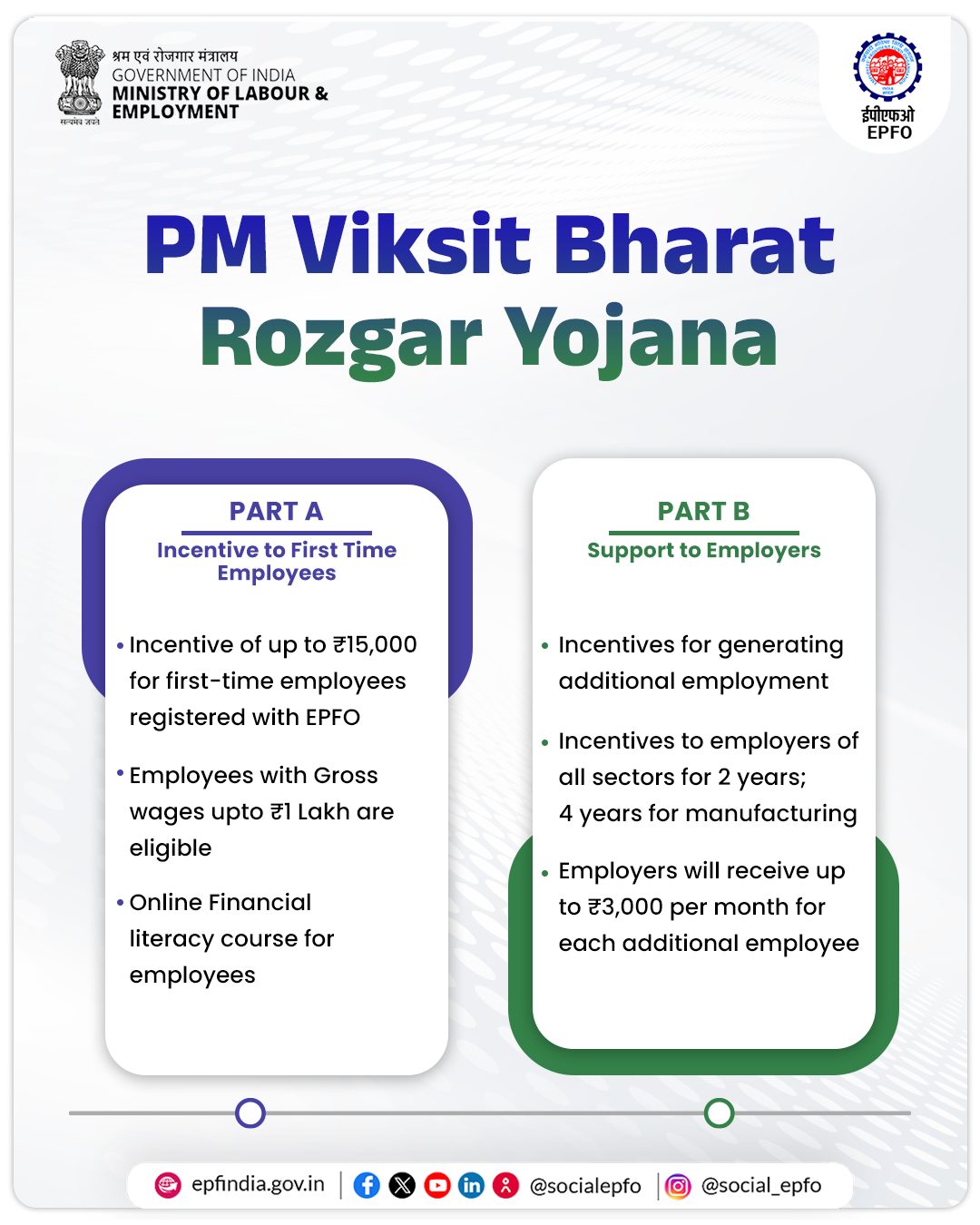

Part A – Support to First-Time Employees

- Targets first-time employees registered with EPFO.

- Provides one month’s EPF wage support up to ?15,000, disbursed in two instalments:

- First instalment after 6 months of continuous service.

- Second instalment after 12 months, subject to completion of a financial literacy programme.

- Incentive is partly locked in a savings/deposit account to encourage long-term financial discipline.

- Employees earning up to ?1 lakh per month are eligible.

- Expected to benefit 1.92 crore first-time employees.

Part B – Incentives for Employers

- Employers will be incentivised to create additional formal jobs, with a focus on manufacturing.

- Incentive: up to ?3,000 per employee per month for two years, provided the employment is sustained for at least six months.

- For the manufacturing sector, support will extend to the 3rd and 4th year as well.

- Expected to facilitate the creation of 2.6 crore jobs.

Incentive Payment Mechanism

- Payments to employees under Part A will be made via Direct Benefit Transfer (DBT) using the Aadhaar Bridge Payment System (ABPS).

- Payments to employers under Part B will be credited directly into PAN-linked accounts.