Orange Economy

- 05 May 2025

In News:

At the World Audio Visual Entertainment Summit (WAVES) held in Mumbai, Prime Minister Narendra Modi highlighted the transformative potential of India's Orange Economy—a sector driven by creativity, content, and culture. With Indian films now screened in over 100 countries and a surge in OTT platform consumption, India is fast emerging as a global content leader.

What is the Orange Economy?

Also known as the Creative Economy, the Orange Economy encompasses industries rooted in individual creativity, talent, and intellectual property. Coined by Colombian economists Felipe Buitrago and Iván Duque, the term “orange” reflects the vibrancy of cultural identity and innovation.

Core Sectors:

- Advertising, architecture, and design

- Arts and crafts, fashion, and publishing

- Film, music, performing arts, and photography

- Animation, gaming, software, and digital media

- Television, radio, and electronic publishing

- Research and development (R&D)

Key Features of the Orange Economy

- Knowledge-driven and innovation-centric

- Promotes cultural diversity and economic inclusivity

- Combines economic, social, and cultural dimensions

- Strong links to technology, tourism, and intellectual property rights

Global and National Significance

- As per UNESCO, the Orange Economy contributes approximately 3% to global GDP and supports over 30 million jobs worldwide.

- The global animation industry alone is valued at $430 billion.

- In India, the creative sector is being nurtured through flagship initiatives like Skill India, Startup India, and platforms such as WAVES, aiming to empower young creators—from Guwahati musicians to Kochi podcasters.

Government Support and Vision

Emphasized that though the "screen may be shrinking, the scope is infinite," underlining the massive potential of digital platforms and content innovation. The government is actively working to build an enabling ecosystem for the creative economy, blending economic growth with cultural preservation.

Vizhinjam International Seaport

- 05 May 2025

In News:

The Vizhinjam International Seaport in Kerala is set to be inaugurated by the Prime Minister, marking a significant milestone in India’s maritime infrastructure.

Key Highlights

- Location: Situated at Vizhinjam, near Thiruvananthapuram in Kerala.

- Type: India’s first dedicated transshipment port and semi-automated seaport.

- Development Model: Built under the Public-Private Partnership (PPP) model at an estimated cost of ?8,900 crore. The port is operated by the Adani Group, while the Kerala Government retains majority ownership.

Technical Features

- Deepest Breakwater in India: Spanning about 3 km with a natural depth of ~20 metres, enabling accommodation of large container vessels.

- Minimal Littoral Drift: Reduced sediment movement along the coast helps lower maintenance costs significantly.

- AI-Powered Vessel Traffic Management: India’s first indigenous VTMS system developed in collaboration with IIT Madras.

- Advanced Automation:

- Fully automated yard cranes.

- Remotely operated ship-to-shore cranes for efficient and safe cargo handling.

Strategic Importance

- Proximity to Global Shipping Lanes: Located just 10 nautical miles from a key international East-West shipping route.

- Boost to Domestic Transshipment:

- Currently, around 75% of India’s transshipment traffic is handled by foreign ports such as Colombo and Singapore.

- Vizhinjam is expected to reduce foreign exchange outflows and increase India's share in global maritime trade.

- International Connectivity: The port is now connected to global maritime hubs like Shanghai, Singapore, and Busan.

Future Prospects

- Multi-Modal Integration:

- Direct linkage to National Highway-66 (NH-66).

- Kerala’s first cloverleaf interchange for seamless traffic movement.

- An upcoming railway link to integrate the port with the national railway grid.

- Vision: Aims to become a major multi-modal logistics hub supporting India’s broader maritime and trade ambitions under Sagarmala and PM Gati Shakti initiatives.

Annual Survey of Services Sector Enterprises (ASSSE)

- 05 May 2025

In News:

The Ministry of Statistics and Programme Implementation (MoSPI) recently released findings from a pilot study on the Annual Survey of Services Sector Enterprises (ASSSE). This initiative aims to fill a crucial data gap regarding India’s incorporated service sector, which is not currently covered by regular surveys like the Annual Survey of Unincorporated Sector Enterprises (ASUSE).

Significance of the Services Sector

- Contribution to Economy: The services sector contributed ~55% of India's Gross Value Added (GVA) in FY 2024–25, up from 50.6% in FY14.

- Employment: It employs around 30% of India’s workforce, spanning industries like IT, finance, education, tourism, and healthcare.

- Trade: India’s services exports stood at USD 280.94 billion (April–Dec 2024). In ICT services, India is the 2nd-largest global exporter, accounting for 10.2% of global exports.

- FDI Magnet: The sector attracted USD 116.72 billion in FDI (April 2000–Dec 2024)—about 16% of total FDI inflows.

- Support to Digital India & Urbanization: The sector underpins the Digital India initiative and Smart Cities Mission by enabling digital payments, urban mobility, e-governance, and waste management.

About the ASSSE Pilot Study

Purpose & Objectives

- To test the suitability of the GSTN (Goods and Services Tax Network) database as a sampling frame.

- To develop robust survey instruments and methodology for a full-scale annual survey starting January 2026.

- To gather data on economic characteristics, employment, and financial indicators from incorporated enterprises under:

- Companies Act, 1956/2013

- Limited Liability Partnership (LLP) Act, 2008

Survey Coverage

- Conducted in two phases:

- Phase I (May–Aug 2024): Verified enterprise data for 10,005 units.

- Phase II (Nov 2024–Jan 2025): Collected detailed data from 5,020 enterprises under the Collection of Statistics Act, 2008.

- Data collected for FY 2022–23 using CAPI (Computer-Assisted Personal Interviewing).

Key Findings:

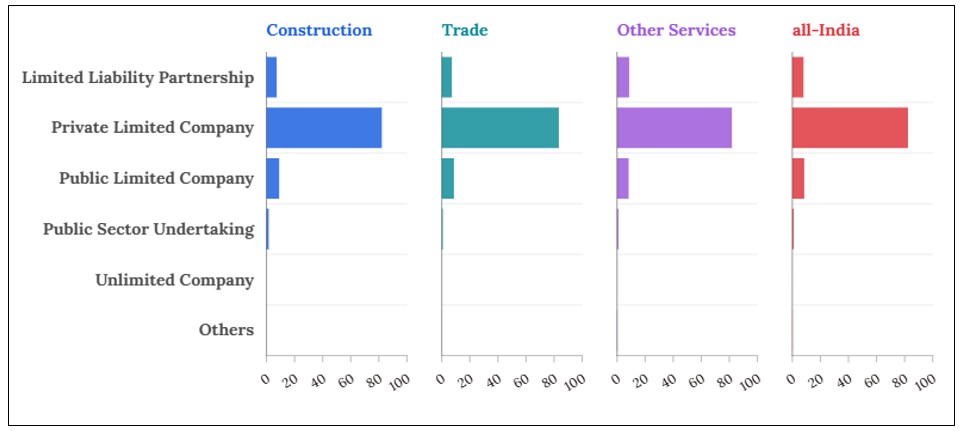

Enterprise Type Distribution

- Private Limited Companies: 82.4%

- Public Limited Companies and LLPs: ~8% each

Size-Class Analysis (FY 2022–23)

Output Class (?) % Share of Gross Value Added (GVA) % Share of Fixed Assets % Share of Employment

< 10 crore 1.19% 2.64% 9.28%

10–100 crore 9.45% 9.58% 20.03%

100–500 crore 19.90% 25.00% 33.73%

> 500 crore 69.47% 62.77% 36.96%

- Large enterprises (output > ?500 crore) dominate in assets, value addition, and compensation paid, but smaller units employ over 63% of the total workforce in the sample.

Additional Establishments

- 28.5% of enterprises reported having additional business locations within the state.

- Highest in the Trade sector (41.8%).

Insights and Challenges from the Pilot

- Suitability of GSTN as Sampling Frame: Confirmed.

- Challenges Faced:

- Data retrieval from enterprises with headquarters in other states.

- Centralized data (CIN-based) posed difficulty in disaggregating state-level data.

- Positive Outcomes:

- High response rate and cooperation.

- Survey instruments found largely clear and functional.

Challenges Faced by the Services Sector

- Skill Gaps:

- Only 51.25% of youth are employable (Economic Survey 2023–24).

- Merely 5% of workforce is formally skilled (WEF).

- Informality:

- About 78% of service jobs were informal in 2017–18.

- Gig workers lack social protection.

- Global Competition:

- Visa restrictions (e.g., H-1B in the US).

- Competing hubs: Philippines, Vietnam.

- Rising IT wage costs in India.

- Infrastructure Deficiencies:

- Inadequate AI/ML adoption.

- Digital divide persists in rural and marginalized MSMEs.

- Post-COVID Recovery:

- Inbound tourism yet to reach pre-pandemic levels (90% of 2019 arrivals in H1 2024).

Way Forward

- Upskilling Initiatives:

- Expand Skill India Digital and PMKVY 4.0.

- Promote Prime Minister Internship Scheme (PMIS) for bridging academia-industry gap.

- Boosting Global Competitiveness:

- Negotiate FTAs with EU, UK, Australia.

- Expand Global Capability Centres (GCCs).

- Digital Infrastructure & Security:

- Strengthen cybersecurity frameworks and promote secure cloud adoption.

- Improve digital literacy, especially in financial services.

- Decentralized Growth:As per NITI Aayog, promote services sector in Tier-2 and Tier-3 cities with better infrastructure and connectivity.

Global Wind Energy Report 2025

- 05 May 2025

In News:

The Global Wind Energy Council (GWEC), in its Global Wind Report 2025, has warned that current global wind energy growth is insufficient to meet the targets aligned with the Paris Agreement and net-zero emissions by 2050. As per the report, at current trends, only 77% of the wind capacity required by 2030 will be achieved — putting the 1.5°C global warming limit at serious risk.

Global Wind Energy Landscape (as of 2024)

- New Capacity Added: 117 GW (up from 116.6 GW in 2023)

- Total Global Capacity: 1,136 GW

- Leading Countries:

- China: 70% of new installations

- USA, Brazil, India, and Germany followed.

- Emerging Markets: Uzbekistan, Egypt, and Saudi Arabia showed significant growth.

- Regional Progress:

- Africa and Middle East: Onshore wind capacity doubled compared to previous years.

- Offshore Wind: Only 8 GW added (down 26% from 2023), the lowest since 2021.

Key Challenges Identified by GWEC

- Policy Uncertainty: Regulatory delays and instability in key markets.

- Grid Infrastructure Deficits: Underinvestment in transmission and distribution systems.

- Financial Constraints: Inflation, high interest rates, trade protectionism.

- Market Inefficiencies: Weak renewable energy auction systems.

Global Commitments & Urgency

- At COP28 (Dubai), countries pledged to triple renewable energy capacity by 2030.

- To align with this goal, annual wind installations must rise to 320 GW by 2030.

- Failure to scale up urgently risks missing a vital climate mitigation window.

Wind Energy in India – Status and Prospects (as of March 2025)

- Total Installed Capacity: 50.04 GW

- Capacity Added (FY 2024–25): 4.15 GW

- (Up from 3.25 GW in FY 2023–24)

- Global Rank: 4th largest wind power producer (after China, USA, Germany)

- Top States:

- Gujarat

- Tamil Nadu

- Karnataka

- Manufacturing Strength: Domestic wind turbine manufacturing capacity is ~18,000 MW/year.

- Offshore Wind Potential:

- Gujarat: 36 GW

- Tamil Nadu: 35 GW

Exercise DUSTLIK

- 05 May 2025

In News:

The 6th edition of Exercise DUSTLIK, a bilateral joint military exercise between India and Uzbekistan, was recently held at the Foreign Training Node in Aundh, Pune. The previous edition (2024) was conducted in Termez, Uzbekistan.

Key Highlights:

- Exercise Theme: Joint Multi-Domain Sub-Conventional Operations in Semi-Urban Terrain.

- Aimed at simulating counter-terrorism operations, especially in scenarios involving territorial capture by terrorist groups.

- Indian contingent: 60 personnel from the JAT Regiment and the Indian Air Force (IAF).

- Uzbek contingent: Personnel from the Uzbekistan Army.

Core Activities:

- Establishment of a Joint Operations Centre at the battalion level.

- Execution of population control, raids, search-and-destroy operations.

- Use of air assets: drones, helicopters for reconnaissance, Special Heliborne Operations (SHBO), Small Team Insertion and Extraction (STIE).

- Focus on counter-UAS (unmanned aerial systems) measures and logistics support in hostile conditions.

Objectives:

- Enhance interoperability, tactical coordination, and operational synergy between the two armies.

- Promote defence cooperation and strengthen bilateral relations between India and Uzbekistan.

- Exchange of best practices in conducting joint sub-conventional operations.

About Uzbekistan:

- Doubly landlocked country in Central Asia, located between the Syr Darya and Amu Darya rivers.

- Borders: Kazakhstan, Kyrgyzstan, Tajikistan, Afghanistan, and Turkmenistan.