Magnetic Resonance-guided Focused Ultrasound (MRgFUS) technology

- 02 Jul 2025

In News:

India has recently introduced Magnetic Resonance-guided Focused Ultrasound (MRgFUS) technology, marking a significant advancement in non-invasive neurological treatment. This technique is now being offered in select hospitals, providing new hope for patients suffering from Essential Tremor (ET) and Tremor-Dominant Parkinson’s Disease (TD-PD) — two common but debilitating neurological disorders.

What is MRgFUS?

MRgFUS is a non-surgical, incisionless medical intervention that uses high-intensity focused ultrasound energy, guided by real-time MRI, to target and ablate precise regions of brain tissue responsible for tremors, especially in the thalamus, a key brain relay centre.

Unlike traditional procedures like Deep Brain Stimulation (DBS) that require surgery and implants, MRgFUS is performed without any cuts or anaesthesia and allows immediate symptom relief with minimal recovery time.

Key Features of MRgFUS

- Incisionless procedure: No need for surgical opening of the skull

- MRI-guided precision: Real-time monitoring and adjustment

- Rapid recovery: Hospital stay of 1–2 days

- No implants or batteries: One-time treatment

- Immediate results: Visible tremor relief during the procedure itself

Medical Significance

Essential Tremor (ET):

- Affects ~1% of global population

- Incidence increases with age: ~5% of people over 60

- Not life-threatening but impairs daily life — eating, writing, speaking

- Leads to social isolation, anxiety, and functional disability

MRgFUS offers a safe, effective, and non-invasive solution for patients who are unwilling or unfit for brain surgery.

Availability in India

MRgFUS has been introduced in several advanced medical centres:

- Sir Ganga Ram Hospital, Delhi – First private hospital in North India to offer the procedure

- AIIMS, Delhi – First government institution to adopt it

- Royal Care Super Speciality Hospital, Coimbatore – Pioneer centre in India

- KIMS Hospitals, Telangana

As of mid-2025, over 200 patients in India have undergone the procedure successfully, with more than 25,000 globally.

Cost and Duration

- Procedure Cost: ?19–23 lakh

- Duration: 1–3 hours

- Performed by: A multidisciplinary team of neurologists, neurosurgeons, and neuroradiologists

Global Context and Technological Backing

- Insightec, a global leader in MRgFUS technology, is facilitating its expansion in India.

- The company is also exploring new clinical applications for the same technology in other neurological disorders beyond ET and Parkinson’s.

India Energy Stack (IES)

- 02 Jul 2025

In News:

In a transformative move aimed at digitising India’s power sector, the Ministry of Power has announced the conception of the India Energy Stack (IES) — a Digital Public Infrastructure (DPI) initiative designed to build a unified, secure, and interoperable digital ecosystem across the energy value chain.

This effort aligns with India’s goals of achieving a $5 trillion economy and meeting its Net Zero commitments, while addressing the growing complexities of a rapidly evolving energy landscape marked by renewables, electric vehicles, and consumer-centric markets.

What is India Energy Stack (IES)?

The India Energy Stack is envisioned as a standardised, open, and secure digital infrastructure to:

- Streamline operations in the power sector

- Empower consumers with access to real-time, consent-based data

- Integrate renewable energy into the national grid

- Enhance the efficiency of Distribution Companies (DISCOMs)

The initiative is spearheaded by the Ministry of Power, drawing inspiration from successful DPI models like Aadhaar (identity) and UPI (digital payments).

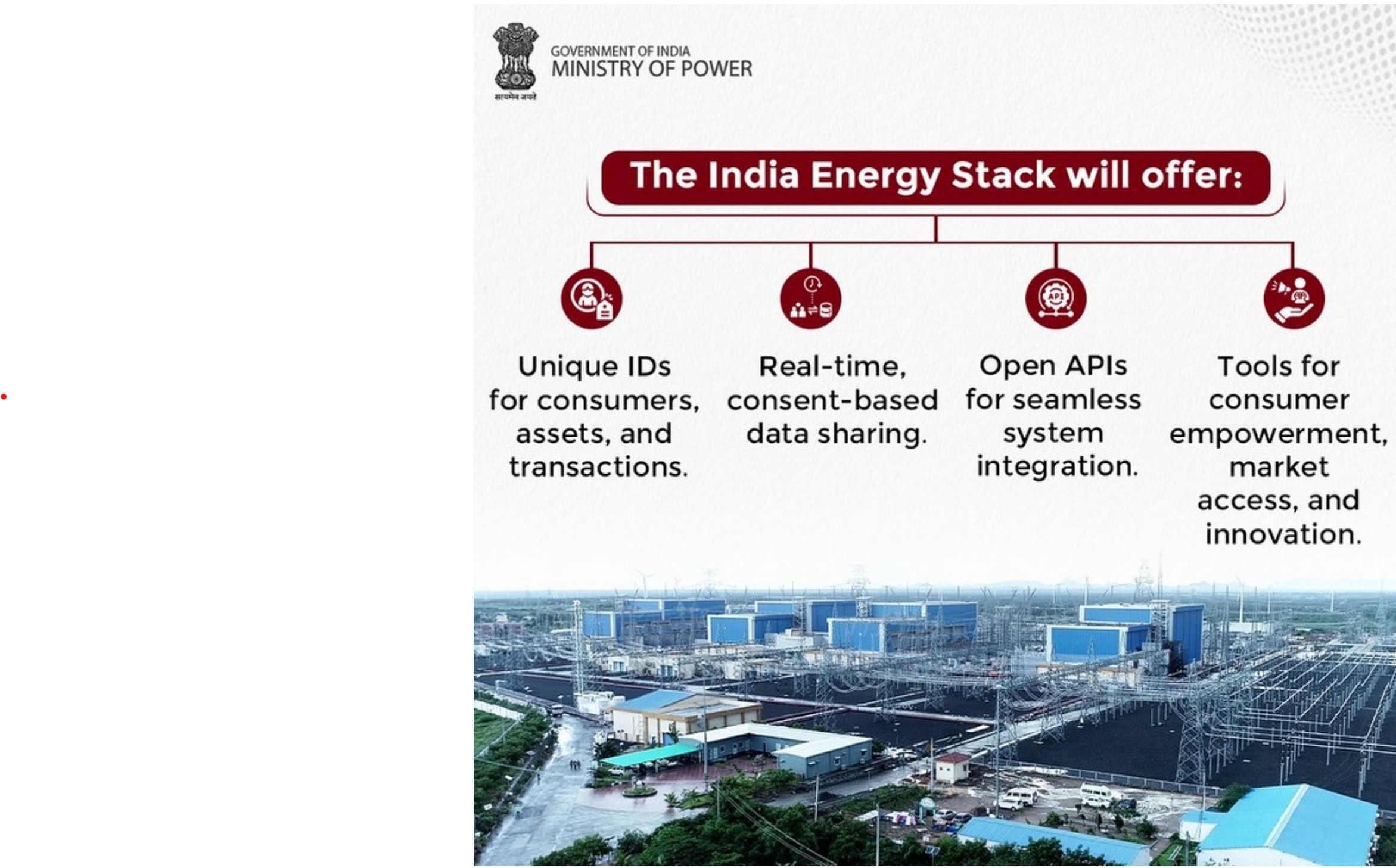

Core Features of IES

- Unique IDs: Assigned to consumers, assets, and energy transactions

- Real-time Data Sharing: Consent-based access for secure and accountable data exchange

- Open APIs: Enabling seamless integration across utility systems and third-party applications

- Consumer Empowerment Tools: Market access platforms, billing transparency, demand response options, and innovation support

- Interoperability: Standardised protocols for all stakeholders in the electricity ecosystem

Implementation Strategy

1. Proof of Concept (PoC) – 12 Months

A year-long pilot phase will test the India Energy Stack using real-world scenarios in partnership with selected utilities and DISCOMs.

2. Utility Intelligence Platform (UIP)

The UIP is a modular, analytics-driven application built on the India Energy Stack. It aims to:

- Provide real-time insights to utilities, policymakers, and regulators

- Enable smart energy management

- Enhance decision-making for grid operations and consumer services

3. Pilot Regions

The PoC will be conducted in collaboration with DISCOMs in:

- Mumbai

- Gujarat

- Delhi

Institutional Framework

- A dedicated Task Force has been established by the Ministry of Power.

- It includes experts from:

- Technology domain

- Power sector operations

- Regulatory bodies

- The Task Force will guide:

- System architecture design

- Pilot implementation

- National scale-up strategy

Expected Outcomes

- India Energy Stack White Paper for public consultation

- UIP deployment in pilot cities

- National roadmap for phased rollout of IES across all states and UTs

- Improved grid stability, energy access, and transparency in service delivery

- Enhanced integration of renewable energy sources into the mainstream grid

Significance for India’s Power Sector

The India Energy Stack has the potential to be a game-changer for the power sector, enabling:

- Modernisation of legacy systems

- Digital empowerment of consumers

- Efficient energy trading and billing

- Decentralised and democratised power governance

As India undergoes its green energy transition, IES will serve as the digital spine supporting clean, accountable, and consumer-centric power distribution.

At Sea Observer Mission

- 02 Jul 2025

In News:

In a major milestone for regional security, the QUAD nations — India, Japan, the United States, and Australia — have launched their first-ever 'At Sea Observer Mission'. This cross-embarkation initiative, conducted under the Wilmington Declaration, seeks to deepen maritime interoperability, operational coordination, and domain awareness in the Indo-Pacific region.

This move signifies the QUAD’s growing shift from diplomatic coordination to practical maritime collaboration, in line with the vision outlined at the QUAD Leaders’ Summit in September 2024.

Key Features of the At Sea Observer Mission

- Participating Nations: India, Japan, USA, and Australia — the four QUAD countries.

- Agencies Involved:

- Indian Coast Guard (ICG)

- Japan Coast Guard (JCG)

- United States Coast Guard (USCG)

- Australian Border Force (ABF)

- Vessel Involved:USCGC Stratton (US Coast Guard Cutter) currently en route to Guam.

- Observer Teams: Two officers from each country, including women officers, embarked for the mission.

- Format:Cross-embarkation, where officers from different countries are hosted on board a partner nation's ship to enable firsthand operational learning.

Objectives and Strategic Relevance

- Strengthening Maritime Security

- Promotes collective surveillance, intelligence sharing, and maritime law enforcement.

- Enhances preparedness against common threats such as illegal fishing, piracy, smuggling, and disaster response.

- Boosting Interoperability and Coordination

- Lays groundwork for real-time joint operations and coordinated patrols.

- Encourages standardization of practices and communication protocols across QUAD navies and coast guards.

- Upholding the Rules-Based Order: Reinforces commitment to a Free, Open, Inclusive, and Rules-Based Indo-Pacific, countering unilateral actions and grey-zone threats in the region.

Indian Perspective: SAGAR and IPOI

India’s participation in the mission reflects its broader strategic vision of SAGAR (Security and Growth for All in the Region). It also aligns with India’s leadership in the Indo-Pacific Oceans Initiative (IPOI), particularly in the pillars of:

- Maritime Security

- Capacity Building and Resource Sharing

- Disaster Risk Reduction and Management

- Maritime Ecology and Maritime Resources

India's active role demonstrates its commitment to multilateral maritime cooperation, gender inclusivity, and regional stability.

Long-Term Implications: Toward a 'QUAD Coast Guard Handshake'

The ‘At Sea Observer Mission’ represents a foundation for the future institutionalisation of QUAD maritime security cooperation, informally dubbed the ‘QUAD Coast Guard Handshake.’ This aims to:

- Foster trust and operational familiarity

- Improve collective resilience against emerging maritime challenges

- Create a responsive, inclusive, and rule-abiding Indo-Pacific maritime domain

Space-Based Surveillance-III Programme

- 02 Jul 2025

In News:

Building on critical lessons from Operation Sindoor, where satellite surveillance played a pivotal role in precision military responses, the Union Government has decided to fast-track the launch of 52 dedicated surveillance satellites. The move is aimed at enhancing real-time, all-weather, and round-the-clock monitoring of India’s land and maritime borders, particularly with China and Pakistan.

The decision comes amid growing emphasis on space-based intelligence, surveillance, and reconnaissance (ISR) capabilities to counter modern threats, including drones and hypersonic weapons.

SBS-III Programme: Overview

The Space-Based Surveillance-III (SBS-III) programme was approved in October 2023 by the Cabinet Committee on Security (CCS) chaired by the Prime Minister. It is India’s most ambitious defence space project to date.

Key Features of SBS-III:

- Total Satellites: 52 dedicated military satellites

- ISRO: Will build and launch 21 satellites

- Private Sector: Will develop 31 satellites

- Launch Timeline:

- First launch by April 2026

- Full constellation targeted by end of 2029

- Project Cost: ?26,968 crore (approx. $3.2 billion)

- Supervising Agency:Defence Space Agency (DSA) under the Integrated Defence Staff (IDS), Ministry of Defence

Strategic Objectives and Capabilities

- Surveillance Reach and Coverage

- Wider coverage of China, Pakistan, and Indian Ocean Region (IOR)

- Reduced revisit times: Faster and more frequent imaging of sensitive areas

- Capability to monitor airfields, military bases, and staging grounds deep inside adversary territory

- Operational Orbits

- Satellites to operate in both Low Earth Orbit (LEO) and Geostationary Orbit (GEO) for layered coverage

- Designed to counter China’s anti-satellite (ASAT) capabilities including kinetic and electronic warfare systems

Technology and Innovations

- Artificial Intelligence (AI) Integration

- Satellites will use AI-powered decision-making to enhance image processing, target detection, and threat identification

- Ability to interact with each other and form a Geo-Intelligence (GeoInt) network for real-time intelligence sharing

- Small Satellite Launch Vehicles (SSLV)

- ISRO to transfer SSLV technology to private players

- Enables rapid satellite deployment during emergencies, ensuring strategic agility and resilience

Lessons from Operation Sindoor

During Operation Sindoor, Indian defence forces used satellite-based surveillance to track drone and missile trajectories, providing precise actionable intelligence. This success underscored the need for:

- High-resolution radar imaging

- Day-night and all-weather capabilities

- Faster intelligence turnaround time

These operational insights directly influenced the SBS-III mission design and its urgency.

Defence Space Agency (DSA)

- Established in 2019, replacing the Integrated Space Cell

- Operates under the Ministry of Defence’s Integrated Defence Staff (IDS)

- Coordinates with ISRO, DRDO, and Armed Forces on:

- Space warfare strategy

- Protection of Indian space assets

- Integration of ISR data with battlefield operations

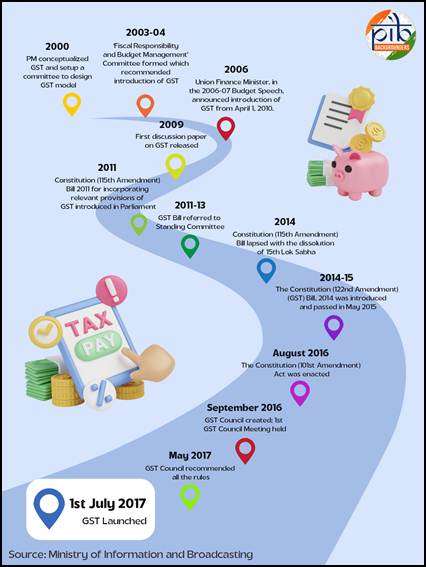

Eight Years of GST

- 02 Jul 2025

In News:

The Goods and Services Tax (GST) was implemented on 1st July 2017, aiming to unify India’s fragmented indirect tax system into a single, nation-wide tax. It replaced multiple central and state levies such as excise duty, service tax, VAT, and others.

By simplifying the tax structure and improving transparency, GST aimed to enhance compliance, remove tax cascading, and create a common national market. As of 1st July 2025, GST has completed eight years.

Key Highlights of 2024–25

- In the financial year 2024–25, GST collections reached an all-time high of ?22.08 lakh crore, representing a growth of 9.4% over the previous year. The average monthly collection was ?1.84 lakh crore. The number of active GST taxpayers crossed 1.51 crore.

- According to the Deloitte GST@8 survey, 85% of respondents across industries reported a positive experience with GST, highlighting improvements in compliance, transparency, and ease of doing business.

Structure of the GST System

Components of GST

GST operates under a dual model:

- Central GST (CGST) and State GST (SGST) for intra-state transactions.

- Integrated GST (IGST) for inter-state transactions and imports.

Rate Structure

The GST Council has approved a multi-tier rate structure:

- Standard slabs of 5%, 12%, 18%, and 28% apply to most goods and services.

- Special lower rates include 0.25% on rough diamonds, 1.5% on cut and polished diamonds, and 3% on gold, silver, and jewellery.

- A Compensation Cess is levied on select goods such as tobacco, aerated drinks, and luxury cars to compensate states for revenue loss during the transition.

Key Features of GST

- Destination-Based Tax: GST is levied at the place of consumption, rather than origin. This ensures equitable revenue distribution and smooth credit flow across the supply chain.

- Input Tax Credit (ITC): Businesses can claim credit for taxes paid on inputs. This eliminates the cascading effect of taxes and reduces overall costs.

- Threshold Exemption: Small businesses with turnover below ?40 lakh for goods and ?20 lakh for services are exempt from GST, reducing the compliance burden on micro-enterprises.

- Composition Scheme: Businesses with turnover up to ?1.5 crore (goods) and ?50 lakh (services) can opt for a simplified tax scheme with fixed rates and minimal paperwork.

- Digital Compliance: All processes—from registration to return filing and payments—are conducted online through the GSTN portal. This digital-first approach enhances transparency and efficiency.

- Sector-Specific Exemptions: Essential sectors such as healthcare and education are either exempt or taxed at concessional rates to ensure affordability.

- Revenue Sharing: GST enables seamless credit transfers and transparent revenue sharing between the Centre and States, strengthening cooperative fiscal federalism.

Impact of GST

On MSMEs

- GST has provided major relief to micro, small, and medium enterprises by raising exemption thresholds and simplifying compliance. The introduction of the composition scheme allows them to pay tax at a flat rate with simplified filing.

- The Trade Receivables Discounting System (TReDS) has also expanded access to credit. As of May 2024, four digital platforms were operational, with over 5,000 buyers and 53 banks and 13 NBFCs registered as financiers.

- Other initiatives include quarterly return filing for businesses with turnover up to ?5 crore and SMS-based NIL return filing, reducing administrative hassle for small taxpayers.

On Consumers

- GST has benefited consumers by lowering tax rates on essential goods such as cereals, edible oils, sugar, and snacks. A study by the Finance Ministry found that GST led to an average household saving of 4% in monthly expenses.

- The expansion of the tax base from 60 lakh registered taxpayers in 2017 to over 1.51 crore in 2025 has enabled the government to rationalize rates further.

On the Logistics Sector

- The removal of inter-state check posts and the introduction of e-way bills have significantly improved logistics efficiency. Transport time has reduced by over 33%, and businesses no longer need to maintain warehouses in every state. This has facilitated the creation of centralized, tech-enabled supply chains.

Revenue Performance Over Time

Since its launch, GST collections have shown consistent growth. In 2020–21, collections stood at ?11.37 lakh crore. They rose to ?14.83 lakh crore in 2021–22, ?18.08 lakh crore in 2022–23, ?20.18 lakh crore in 2023–24, and finally to ?22.08 lakh crore in 2024–25. This reflects improved compliance, economic recovery, and digital enforcement.

GST Council and Its Role

Constitutional Basis: The GST Council was constituted under Article 279A of the Constitution following the passage of the 122nd Constitutional Amendment Act. The Council was formally set up after Presidential assent on 8th September 2016.

Composition: The Council includes:

- Union Finance Minister as Chairperson

- Union Minister of State (Finance/Revenue)

- State Finance Ministers

- Special representation in case of constitutional emergency (Article 356)

Major Decisions: Since its inception, the GST Council has met 55 times and taken several reform-oriented decisions:

- Introduced e-way bills, e-invoicing, and the QRMP scheme

- Reduced GST on under-construction affordable housing from 8% to 1%

- Lowered GST on electric vehicles from 12% to 5%, and exempted large EV buses

- Streamlined compliance through auto-populated returns and QR codes

- Rationalized GST slabs, reducing items in the 28% slab from 227 to 35

- Set up GST Appellate Tribunals with Principal Bench in New Delhi

- Rolled out Aadhaar-based biometric authentication and clarified rules for vouchers

- Recommended full GST exemption on gene therapy and a legal framework for Invoice Management System