Single Window System for Appointment of State DGPs

- 06 Aug 2025

In News:

The Union Government has notified a Single Window System (SWS) to streamline the appointment of State Directors General of Police (DGPs)/Heads of Police Force (HoPFs). This move seeks to ensure transparency, uniformity, and compliance with Supreme Court directives inPrakash Singh vs Union of India (2006) and the Ministry of Home Affairs (MHA) guidelines.

Key Features of the SWS

- Standardization: Provides a checklist and uniform formats for States to submit proposals.

- Eligibility Certification: A Secretary-rank officer must certify that officers proposed for empanelment fulfill criteria, including a minimum of 6 months residual service.

- Timely Submission: States are mandated to send proposals at least 3 months before the anticipated vacancy of the DGP/HoPF.

Constitutional and Legal Framework

- State Subject: Police is a State subject under the 7th Schedule of the Constitution.

- Superintendence: As per Section 3 of the Police Act, 1861, the superintendence of police lies with the State Government.

- District Level: A dual control system exists—authority is shared between the District Magistrate (executive) and the Superintendent of Police (police administration).

- State Police Leadership: State police forces are generally headed by officers of the DGP rank.

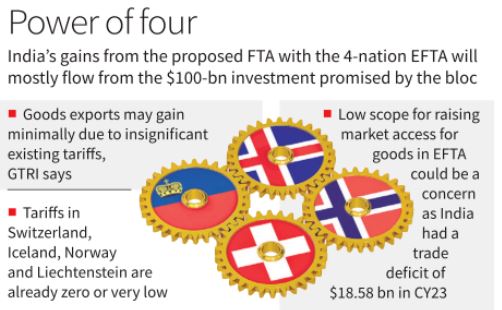

India–EFTA Trade and Economic Partnership Agreement (TEPA)

- 06 Aug 2025

In News:

The Trade and Economic Partnership Agreement (TEPA) between India and the European Free Trade Association (EFTA) — comprising Iceland, Liechtenstein, Norway, and Switzerland — will come into force on 1 October 2025.

Key Features of TEPA

- Strategic Investment Commitment

- Legally binding commitment of USD 100 billion FDI in India over 15 years (USD 50 billion in first 10 years + USD 50 billion in next 5 years).

- Expected to generate 1 million jobs.

- Excludes foreign portfolio investment (FPI); sovereign wealth funds exempted.

- India can withdraw tariff concessions if commitments are not met.

- Market Access & Tariff Concessions

- EFTA: 92.2% tariff lines offered, covering 99.6% of India’s exports (100% non-agri products + concessions on processed agri products).

- India: 82.7% tariff lines offered, covering 95.3% of EFTA exports (including gold, which retains existing duty).

- Duty-free access: Indian basmati and non-basmati rice exports, without reciprocity.

- Exclusions: Dairy, soya, coal, and sensitive agri products; protection given to sectors linked with PLI schemes (e.g., pharma, medical devices, processed food).

- Concessions: Cheaper Swiss chocolates, wines, luxury watches (though wines < USD 5 excluded to protect Indian wineries).

- Services & Professional Mobility

- Boosts Indian services exports: IT, business, cultural, sporting, educational, and audiovisual services.

- Mutual Recognition Agreements (MRAs): Nursing, accountancy, and architecture professionals to gain work access in EFTA countries.

- Legal & Institutional Framework

- Covers 14 chapters: market access, trade facilitation, investment promotion, IPR, sustainable development.

- Protects India’s generic medicines; prevents evergreening of patents.

- Promotes technology collaboration but not compulsory technology transfer.

About the European Free Trade Association (EFTA)

- Established: 1960 (Stockholm Convention).

- Members: Iceland, Liechtenstein, Norway, Switzerland (not part of the EU).

- Aim: Promote free trade and economic integration among members and global partners.

India–EFTA Trade Relations

- India is EFTA’s 5th largest trading partner (after EU, US, UK, China).

- Trade Volume (2024–25): USD 24.4 billion.

- India’s exports: USD 1.96 billion (chemicals, iron & steel, precious stones, sports goods, bulk drugs).

- Imports from EFTA: USD 22.45 billion (mainly gold, silver, coal, pharma, vegetable oil, medical equipment, dairy machinery).

- Deficit: Large trade deficit, primarily due to gold imports from Switzerland (USD 20.7 billion in 2021–22).

- India–EFTA Desk: Set up by Invest India as a single-window platform to facilitate investments under TEPA.

Krasheninnikov Volcano

- 06 Aug 2025

In News:

The Krasheninnikov volcano, located in Russia’s Kamchatka Peninsula, recently erupted for the first time in recorded history. The eruption followed a nearby magnitude 8.8 earthquake and released ash plumes reaching 20,000 ft (≈6,000 m) into the atmosphere. Authorities issued an “orange” aviation hazard code due to potential risks to air traffic.

About Krasheninnikov Volcano

- Type: Active stratovolcano (composite volcano).

- Height: ~1,856–1,886 m.

- Structure: Formed within a 9 km wide collapsed caldera created by a massive eruption ~39,600 years ago that expelled 50 cubic km of dacitic pumice.

- Cones: Contains two eruptive cones; the southern cone has an 800 m wide, 140 m deep crater.

- Past Activity: Last known eruption occurred ~400–600 years ago.

Kamchatka Peninsula – Volcanic Hotspot

- Lies along the Pacific “Ring of Fire”, one of the world’s most seismically active zones.

- Home to 114 Holocene volcanoes (eruptions recorded in the last ~12,000 years).

- Known for frequent explosive eruptions due to subduction of the Pacific Plate beneath the Eurasian Plate.

Stratovolcano – Key Features

- Steep, conical structure with alternating layers of lava and pyroclastic deposits.

- Typically found above subduction zones (e.g., Pacific Ring of Fire).

- Characterized by explosive eruptions due to viscous andesite/dacite lavas that trap gases.

- Account for about 60% of Earth’s volcanoes.

- Example: Mount Fuji (Japan), Mount Vesuvius (Italy), Mount St. Helens (USA).

Significance of 2025 Eruption

- First recorded activity of Krasheninnikov highlights the unpredictability of dormant volcanoes.

- Demonstrates the link between major seismic events and volcanic eruptions in tectonically active zones.

- Raises concerns for aviation safety, regional ecology, and monitoring of Ring of Fire volcanism.

Slovenia

- 06 Aug 2025

In News:

Slovenia has announced a complete ban on the import, export, and transit of weapons to and from Israel in response to Israel’s military actions in Gaza. This makes it the first European Union (EU) member state to enforce a blanket arms embargo on Israel.

Context and Diplomatic Stand

- Slovenia has frequently criticized Israel for alleged atrocities in Gaza.

- In June 2024, Slovenia’s parliament recognisedPalestinian statehood, joining Ireland, Norway, and Spain.

- In July 2024, it barred two far-right Israeli ministers from entering the country, citing “incitement of violence” and “genocidal statements.”

- Although Slovenia’s arms trade with Israel is minimal, the decision carries symbolic diplomatic weight, intended to pressure Israel amid growing international condemnation.

Other European countries have taken partial measures:

- UK (2024): Suspended export of some weapons that could breach international law.

- Spain (2023): Halted arms sales.

- Netherlands, France, Belgium: Tightened regulations or faced legal challenges, but none imposed a total embargo like Slovenia.

Slovenian Prime Minister Robert Golob emphasized that Slovenia would act unilaterally in the absence of collective EU action, accusing the EU of disunity in addressing the humanitarian crisis in Gaza.

About Slovenia

- Location: Central Europe; formerly part of Yugoslavia.

- Capital: Ljubljana.

- Borders: Austria, Hungary, Croatia, Italy; coastline along the Adriatic Sea (Gulf of Venice).

- Memberships: Joined EU and NATO in 2004; uses the Euro.

- Physical Features:

- Alpine Highlands (~40% of territory) – includes Julian Alps, Karavanke, Kamnik-Savinja Alps. Highest peak: Mount Triglav (2,864 m).

- Karst Plateau – globally renowned for caves, sinkholes, underground rivers.

- Subpannonian Plains – fertile alluvial soils; rivers Sava, Drava, Mura drain toward the Danube.

- Slovene Littoral – 47 km coastline; major port Koper.

Financial Sector Changes from August 2025

- 06 Aug 2025

In News:

India’s financial ecosystem is undergoing significant operational changes aimed at strengthening stability, efficiency, and consumer protection. From August 1, 2025, several regulatory and institutional reforms—spanning digital payments, credit cards, fuel pricing, trading hours, and monetary policy—are set to reshape the financial landscape.

UPI Operational Reforms by NPCI

The National Payments Corporation of India (NPCI), which manages the Unified Payments Interface (UPI), has introduced revised operational rules to reduce transaction delays and prevent system overload during peak hours. UPI, India’s flagship digital payment platform, has emerged as the backbone of cashless transactions with over 14 billion monthly transactions (2025 data).

Key reforms effective from August 1, 2025:

- Balance Check Limit: Maximum 50 balance enquiries per day per app.

- Linked Account Enquiries: Limited to 25 per day per app.

- Auto-Pay Transactions: Permitted only during non-peak hours (before 10 AM, 1–5 PM, after 9:30 PM).

- Transaction Status Checks: Restricted to 3 per transaction, with a mandatory 90-second gap.

- Beneficiary Name Display: Recipient’s registered bank name will be shown before confirmation to curb fraud.

These reforms reflect an effort to balance user convenience with systemic efficiency while reducing risks of fraudulent transfers.

Credit Card Insurance Changes by SBI

The State Bank of India (SBI), India’s largest lender, has announced withdrawal of complimentary air accident insurance cover on several co-branded credit cards. Earlier, insurance covers of ?1 crore (ELITE series) and ?50 lakh (PRIME/Platinum series) were provided. The discontinuation reflects banks’ attempts to rationalize costs in a competitive credit market, but it also raises concerns regarding customer protection.

Fuel Price Revisions

Prices of LPG cylinders, CNG, PNG, and aviation turbine fuel (ATF) are subject to monthly review. Effective August 1, 2025, fresh revisions are expected in line with global crude trends and domestic subsidy policies. Given that LPG and CNG are crucial for households and transport, even marginal adjustments influence inflation and consumer spending.

Extension of Trading Hours

The Reserve Bank of India (RBI) has extended trading hours for money market instruments to deepen liquidity and align with global practices:

- Call Money Market: Extended to 9:00 AM – 7:00 PM (effective July 1, 2025).

- Market Repo & Tri-Party Repo (TREPs): Extended to 9:00 AM – 4:00 PM (effective August 1, 2025).

This reform is expected to improve liquidity management for banks and non-banking financial institutions, enhancing the efficiency of short-term borrowing and lending.