Kolhapuri Chappals

- 04 Jul 2025

In News:

Italian luxury fashion house Prada, after public criticism, has acknowledged that its Men’s Spring/Summer 2026 collection sandals were inspired by India’s traditional handcrafted footwear — the Kolhapuri chappals, a product with Geographical Indication (GI) status.

About Kolhapuri Chappals

Origin:

- Named after Kolhapur city in Maharashtra, India

- Handcrafted tradition dates back to the 13th century

Design & Craftsmanship:

- Made from 100% leather (cow, buffalo, or goat)

- Vegetable-tanned using natural dyes – non-toxic and eco-friendly

- Typicallyopen-toed with a T-strap design

- Traditionally in tan and brown shades with oil, natural, or polish finishes

- Time-intensive craftsmanship – can take up to six weeks per pair

Cultural & Economic Value:

- Recognised under the Geographical Indications (GI) Act of India

- Symbol of sustainable fashion, durability, and local artisanal skill

- Leather molds to feet over time, ensuring custom comfort and longevity

The Controversy: Cultural Appropriation vs Cultural Inspiration

- Criticism emerged after Prada launched sandals resembling Kolhapuris without credit

- Public and media backlash led to acknowledgement of Indian inspiration

- Highlights the importance of:

- Ethical recognition of traditional knowledge and cultural heritage

- Protection of GI-tagged products from unauthorized imitation

- Global awareness of India’s artisanal heritage

Financial Stability Report – June 2025

- 04 Jul 2025

In News:

The Reserve Bank of India (RBI) recently released the Financial Stability Report for June 2025.

What is the Financial Stability Report (FSR)?

- The Financial Stability Report (FSR) is a biannual publication by the Reserve Bank of India (RBI).

- It presents the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC-SC) regarding:

- Resilience of the Indian financial system

- Emerging systemic risks

- Outlook for macro-financial stability

Key Highlights – FSR June 2025

Macroeconomic & Global Outlook

- India remains a key driver of global growth, supported by strong macroeconomic fundamentals and prudent policies.

- Risks to growth include:

- Prolonged geopolitical tensions

- Trade and supply chain disruptions

- Weather-related uncertainties impacting agricultural output

Banking Sector Performance

- Gross Non-Performing Asset (GNPA) ratio:

- Stands at 2.3% as of March 2025, a multi-decadal low

- May rise modestly to 2.5% in baseline and 2.6% under adverse conditions by March 2027 (based on stress tests on 46 banks covering 98% of SCB assets)

- Capital Adequacy Ratios (CAR):

- Remain well above regulatory thresholds across the sector

- Even under severe stress scenarios, banks maintain adequate buffers — indicating robust financial health

Non-Banking Financial Companies (NBFCs)

- NBFCs are in good financial health with:

- Strong capital buffers

- Robust earnings

- Improving asset quality

- Continued financial resilience contributes to the overall stability of the financial system

Domestic Demand and Inflation Outlook

- Growth remains domestically driven

- Food inflation outlook favorable:

- Price moderation observed

- Crop output at record levels, supporting price stability

Significance for Financial Policy

- The report signals that India’s financial institutions are resilient and well-equipped to absorb economic shocks

- RBI's stress-testing framework confirms systemic soundness

- Reinforces India's investor confidence, especially in volatile global conditions

Research Development and Innovation (RDI) Scheme

- 04 Jul 2025

In News:

The Union Cabinet, chaired by the Prime Minister, has approved the Research Development and Innovation (RDI) Scheme with a corpus of ?1 lakh crore to strengthen India’s innovation ecosystem and boostprivate sector R&D investments.

Objective of the RDI Scheme

The scheme is designed to:

- Provide long-term financing or refinancing at low or nil interest rates

- Stimulate private sector investment in R&D and innovation

- Overcome existing funding challenges for private research

- Support sunrise and strategic sectors to drive:

- Innovation

- Technology adoption

- National competitiveness

- Economic security and self-reliance

Key Aims

- Encourage private sector participation in high-TRL (Technology Readiness Level) R&D projects

- Fund transformative innovation in sunrise domains

- Enable acquisition of critical and strategic technologies

- Facilitate the establishment of a Deep-Tech Fund of Funds (FoF)

Funding Structure

The RDI Scheme will operate on a two-tiered funding mechanism:

First Tier: Special Purpose Fund (SPF) under ANRF

- Housed within the Anusandhan National Research Foundation (ANRF)

- Acts as the primary custodian of funds

Second Tier: Fund Allocation & Disbursal

- SPF will allocate funds to multiple 2nd-level fund managers

- Mode of financing:

- Long-term concessional loans (low or nil interest)

- Equity financing, particularly for startups

- Contributions to Deep-Tech Fund of Funds (FoF) or other RDI-focused FoFs

Governance & Implementation

- Governing Board of ANRF (chaired by the Prime Minister): Provides strategic direction

- Executive Council (EC) of ANRF:

- Approves scheme guidelines

- Recommends fund managers

- Determines project types and sectors

- Empowered Group of Secretaries (EGoS):

- Led by the Cabinet Secretary

- Approves scheme changes, sectors, fund managers

- Monitors performance of the scheme

- Nodal Department:Department of Science and Technology (DST) is the nodal ministry for implementation.

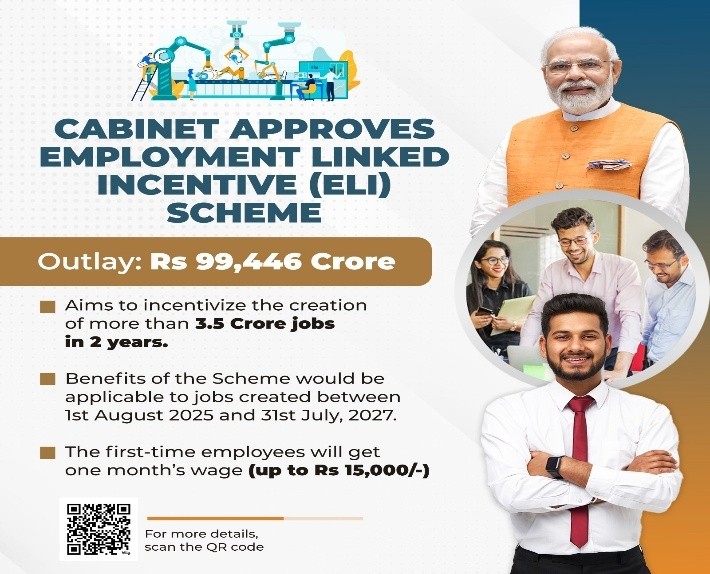

Employment Linked Incentive (ELI) Scheme

- 04 Jul 2025

In News:

The Employment Linked Incentive (ELI) Scheme is a flagship initiative of the Government of India aimed at formal job creation, especially for youth and in the manufacturing sector. It was announced in the Union Budget 2024–25 and came into implementation following cabinet approval.

Recent Update (July 2025 Cabinet Decision)

- EPFO registrationand Aadhaar seeding deadline:30 June 2025

- Job coverage period:1 August 2025 – 31 July 2027

Objectives

- Promote formal employment by incentivising employers

- Encourage first-time EPFO registration for workers

- Target high employment-generating sectors like manufacturing

- Provide direct income support and EPFO reimbursement subsidies

Key Components – 3 Schemes under ELI

|

Scheme |

Focus |

Key Beneficiaries |

Duration |

Central Outlay |

Estimated Beneficiaries |

|

Scheme A |

First-time employment |

New EPFO-enrolled youth |

3 years |

?23,000 crore |

210 lakh |

|

Scheme B |

Job creation in manufacturing |

Employers hiring ≥50 non-EPFO workers |

6 years |

?52,000 crore |

30 lakh |

|

Scheme C |

Support to employers |

All employers creating net new jobs |

6 years |

?32,000 crore |

50 lakh |

Detailed Scheme Benefits & Conditions

Scheme A: First-Time Employment

- Direct cash benefit: ?15,000 (?7,500 x 2 instalments)

- 1st installment: After 6 months of continuous EPFO-linked employment

- 2nd installment: After 12 months + completion of financial literacy course

- Condition: Exit before 12 months = employer must refund benefit

Scheme B: Job Creation in Manufacturing

- Eligibility: Employer must have 3-year EPFO record; hire ≥50 non-EPFO or 25% baseline

- Salary cap for subsidy: ?25,000/month (overall salary ≤ ?1 lakh)

- Incentive structure:

- Year 1: 24% of salary (employee + employer EPFO contribution)

- Year 2: 24%

- Year 3: 16%

- Year 4: 8%

- Refund clause: If employee leaves before 12 months

Scheme C: Support to Employers

- Eligibility:

- Employers with <50 workers: Hire ≥2 net new

- ≥50 workers: Hire ≥5 net new

- Subsidy per employee/month:

- ?1,000 (salary ≤ ?10,000)

- ?2,000 (?10,001–?20,000)

- ?3,000 (?20,001–?1 lakh)

- Duration: 2 years, extendable to 4 years for large job creators

Eligibility Criteria

- Employees:

- Salary < ?1 lakh/month

- Must be EPFO-registered with Aadhaar–UAN–bank linkage

- Employers:

- Must create net new jobs over EPFO baseline

- For Scheme B: 3-year EPFO record required

Application Process (Current Status)

- No dedicated ELI portal yet

- Via EPFO portal:

- UAN activation and Aadhaar seeding

- Employer-led EPFO registration

- Completion of Financial Literacy Course (for Scheme A)

Significance

- Reduces informal employment

- Supports youth entering formal jobs for the first time

- Incentivises hiring in labour-intensivemanufacturing

- Promotes EPFO inclusion and financial literacy

Challenges

- Compliance burden on small enterprises

- Ensuring retention to avoid refund liabilities

- Monitoring duplication between schemes

- Delay in scheme-specific digital portal rollout

E-Voting System

- 04 Jul 2025

In News:

For the first time in India, e-voting through a mobile app was used in the Bihar municipal elections (June 28, 2025) for six municipal councils in Patna, Rohtas, and East Champaran districts.

About the E-Voting System

- App Used:E-SECBHR, developed by Centre for Development of Advanced Computing (C-DAC)

- Target Groups:

- Senior citizens

- Persons with disabilities

- Pregnant women

- Others unable to reach polling booths

How It Works

- Installation: App available for Android users.

- Registration: Voter must link mobile number as per the electoral roll.

- Verification: Through voter ID number and facial recognition.

- Voting: Vote via app or Bihar Election Commission’s website on polling day.

Security Measures to Ensure Fairness

- Limited Logins: One mobile number can be used by only two registered voters.

- Facial Recognition: Used to verify identity during login and voting.

- Blockchain Technology:

- Ensures immutability of vote data.

- Prevents tampering or alteration of records.