B-2 Spirit Bomber

- 23 Jun 2025

In News:

In a major escalation of the ongoing US–Iran tensions, the United States deployed the B-2 Spirit stealth bomber to strike Iran’s fortified nuclear infrastructure, including the heavily guarded Fordow enrichment facility, which was described by President Donald Trump as the “crown jewel” of Iran’s nuclear programme. The strikes signal a new phase in the geopolitical standoff, showcasing advanced US airpower and precision capabilities.

What is the B-2 Spirit Bomber?

The B-2 Spirit, developed by Northrop Grumman during the Cold War, is one of the most advanced strategic bombers in the world. Originally built for penetrating heavily defended Soviet airspace, it remains a key asset in the US Air Force due to its stealth capabilities, long range, and precision payload delivery.

Only 21 B-2 bombers were built, each costing an estimated $2.1 billion, making it one of the most expensive aircraft ever developed. Its bat-wing design and radar-absorbent coating significantly reduce its radar cross-section, making it almost invisible to radar and ideal for deep penetration missions in hostile territory. It is operated by a two-person crew and extensively automated to reduce pilot workload.

Why was it used in the Iran strikes?

The B-2 Spirit was chosen for the Iran mission because of its unique combination of stealth, range, and payload capacity. The Fordow facility, built deep within a mountain and protected by sophisticated air defences, required a bomber that could both evade detection and deliver a bunker-busting payload with high precision.

During the mission, the B-2s were reportedly equipped with the GBU-57A/B Massive Ordnance Penetrator (MOP) — a 30,000-pound bomb specifically designed to destroy deeply buried and fortified targets like Fordow. Due to the weapon’s size and weight, a B-2 can carry only one or two MOPs per sortie. Reports indicate that six MOPs were dropped on Fordow, demonstrating the operational effectiveness of the B-2 for such critical missions.

Capabilities and Strategic Role

The B-2 has an unrefueled range of over 6,000 nautical miles (approximately 11,000 km), enabling it to undertake intercontinental missions directly from the United States. Past missions have seen the B-2 operate from Missouri to targets in Afghanistan, Libya, and now Iran, demonstrating its global strike capability.

With a total payload capacity exceeding 40,000 pounds (18,000 kg), the B-2 can carry both conventional and nuclear weapons. It forms a crucial part of the US nuclear triad, capable of delivering up to 16 B83 nuclear bombs. Its ability to carry nuclear and precision-guided munitions gives it unmatched strategic versatility.

Weapon Systems Compatible with the B-2

Beyond the MOP, the B-2 can be armed with a variety of precision and standoff weapons, including:

- JDAMs (Joint Direct Attack Munitions): GPS-guided bombs used for high-accuracy strikes on fixed targets.

- JSOW (Joint Standoff Weapons): Glide bombs launched from a distance, allowing engagement of targets outside enemy air defence range.

- JASSM and JASSM-ER (Joint Air-to-Surface Standoff Missiles): Long-range cruise missiles, with the extended-range variant capable of striking targets up to 500 miles (805 km) away.

This versatility allows the B-2 to adapt to multiple mission profiles, from conventional warfare to nuclear deterrence.

Strategic and Geopolitical Implications

The deployment of the B-2 in this mission has both tactical and symbolic implications. Tactically, it underscores the US military’s ability to deliver precision strikes on highly protected strategic infrastructure. Strategically, it sends a strong signal to adversaries about the technological edge and operational reach of American military power.

From a geopolitical perspective, the strikes could exacerbate tensions in the already volatile West Asian region, heighten concerns about nuclear proliferation, and potentially provoke retaliatory actions by Iran and its regional allies. It also raises questions about the future of US-Iran relations and the fragility of nuclear diplomacy in the region.

Lenacapavir

- 23 Jun 2025

In News:

The United States Food and Drug Administration (FDA) on Wednesday approved Lenacapavir (LEN), the most promising HIV prevention medicine to be made so far.

What is Lenacapavir (LEN)?

- Type: Antiretroviral drug used as Pre-Exposure Prophylaxis (PrEP) for HIV prevention.

- Mechanism: Prevents HIV infection in HIV-negative individuals at high risk.

- Efficacy: Clinical trials show it prevents 99.9% of HIV transmissions.

- Dosage: Injectable form, administered twice a year.

Recent Development

- Approved by: United States Food and Drug Administration (US FDA) – June 2025.

- Brand name: To be marketed as Yeztugo by Gilead Sciences.

- Described as the most promising HIV prevention drug to date.

Global and Indian Context

Global Need

- LEN could be a game-changer in ending the global HIV/AIDS epidemic.

- However, cost remains a barrier—initially priced at over $40,000 per person/year, now reduced to $28,218.

Indian Reality

- Despite India's 92% contribution to global ART supply, PrEP is yet to be rolled out under India’s National AIDS Control Programme (NACP).

- The National AIDS Control Organisation (NACO) has not yet integrated PrEP or LEN into national policy.

India’s Role in Equitable Access

Expert View:

- India must take the lead in making LEN accessible, affordable, and timely.

- Equitable distribution is critical to preventing new infections and achieving AIDS elimination targets.

- Urges Indian regulators and generic companies to fast-track licensing and manufacturing.

Why this matter?

Public Health Impact

- LEN could stop HIV transmission at scale if made widely available in low- and middle-income countries (LMICs).

- Its twice-a-year injectable nature increases adherence, especially in vulnerable populations.

Cost Savings

- Prevention through PrEP like LEN is more cost-effective than providing lifelong ART after infection.

India’s Strategic Position

- India already serves as the global hub for HIV treatment through its generic pharmaceutical capacity.

- India’s leadership is central to global HIV prevention strategies including:

- Treatment as Prevention (TasP)

- Test and Treat

- Post-Exposure Prophylaxis (PEP)

- Pre-Exposure Prophylaxis (PrEP)

Policy Recommendations

- Fast-track regulatory approvals for generic LEN in India.

- Integrate PrEP and injectable LEN into NACO guidelines.

- Ensure price transparency and accessibility through public-private collaboration.

- Collaborate with global health bodies (WHO, UNAIDS, Global Fund) to position India as the equitable access leader.

Samson Option

- 23 Jun 2025

In News:

The Samson Option, Israel’s controversial and undeclared nuclear deterrence doctrine, has returned to global focus amid escalating military strikes on Iran’s nuclear infrastructure under Operation Rising Lion (June 2025). The rising risk of a multi-front conflict involving Iran, Hezbollah, and Houthi actors has revived global concerns over nuclear escalation in the volatile Middle East.

What is the Samson Option?

- Definition: Israel’s nuclear annihilation doctrine of last resort, based on the principle of massive retaliation in case of an existential threat to the state.

- Doctrine Type: Deterrence-by-retaliation, not first use.

- Strategic Intent: Not to deter routine threats, but to ensure mutual destruction if Israel faces annihilation.

- Named After: Samson, a biblical warrior who destroyed himself and his enemies in a final act of vengeance (Judges 13–16).

Key Features

Feature Details

Ambiguity (Amimut) Israel neither confirms nor denies its nuclear arsenal.

Nuclear Capability Estimated 80–400 nuclear warheads, with delivery via land (Jericho missiles), air, and sea.

Indigenous Development Secret nuclear program began in the 1950s under Ben-Gurion with aid from France & Norway.

Delivery Platforms Multi-platform: land-based missiles (Jericho series), aircraft, and submarines.

Psychological Warfare Operates as a psychological deterrent, not an openly declared policy.

Policy Origin Popularized by Seymour Hersh’s 1991 book, built upon disclosures by whistleblower Mordechai Vanunu (1986).

Historical Evolution

- 1950s–60s: Nuclear ambitions began under PM David Ben-Gurion.

- 1967: Believed to have assembled first nuclear weapon by Six-Day War.

- Public Position: “We will not be the first to introduce nuclear weapons in the Middle East” – Shimon Peres to JFK.

- Doctrinal Continuity: Israel remains outside the NPT (Non-Proliferation Treaty) and follows the policy of opacity to this day.

Why It’s in Focus Now: Operation Rising Lion & 2025 Escalations

- Operation Rising Lion (June 2025): Israel’s largest campaign against Iran’s nuclear sites since the 1981 Osirak raid.

- Iran’s Response: Ballistic missile and drone counterstrikes tested Israel’s air defences (Iron Dome, Arrow-3).

- Multi-Front Threats: Escalations from Hezbollah in Lebanon, Houthi threats in the Red Sea, and tension in Gaza heighten risks of a regional conflagration.

- Red Lines: Any mass-casualty attack involving WMDs (chemical/radiological) may activate Israel’s last-resort nuclear doctrine.

Implications for the Region and the World

- Security and Strategic Balance

- Israel’s nuclear ambiguity complicates strategic planning for adversaries.

- Shapes arms acquisition strategies of regional players like Iran, Saudi Arabia, and UAE.

- Geoeconomic and Business Fallout

- Oil Market Volatility: Brent crude hit $102/barrel after Israeli strike on Natanz.

- Defence Sector Boom: Surge in defence procurement by Gulf States; U.S. firms like Raytheon and Lockheed Martin benefit.

- Investor Uncertainty: Rising nuclear rhetoric rattles financial markets and international investors.

- Nuclear Non-Proliferation Challenges

- Israel’s position outside the NPT undermines the credibility of global arms control.

- Inspires double standards debate and pressures nations like Iran to pursue deterrent paths.

- Cyber Deterrence and Intelligence Warfare

- Past cyber ops like Stuxnet (U.S.–Israel malware attack on Iran’s nuclear centrifuges) re-emerging.

- Cyber warfare now considered part of the extended nuclear deterrent architecture.

BSNL Soft Launches Quantum 5G FWA

- 23 Jun 2025

In News:

Bharat Sanchar Nigam Limited (BSNL) announced in Hyderabad, the soft launch of BSNL Quantum 5G FWA. This indigenous, SIM-less fixed-wireless-access solution delivers fibre-like speeds over 5G radio.

What is Quantum 5G FWA?

Quantum 5G FWA (Fixed Wireless Access) is an indigenous, SIM-less, 5G broadband solution that offers fibre-like speeds using wireless 5G radio—eliminating the need for traditional fibre connections.

Key Technical Features:

- SIM-less Connectivity: Uses BSNL’s Direct-to-Device (D2D) platform; Customer Premises Equipment (CPE) auto-authenticates without a SIM card.

- Fully Indigenous Tech Stack: Core network, RAN (Radio Access Network), and CPE developed under the Atmanirbhar Bharat initiative.

- High-Speed Performance:

- Download: Up to 980 Mbps

- Upload: 140 Mbps

- Latency: Under 10 milliseconds

- Plug-and-Play Installation:

- No trenching or fibre required.

- Covers over 85% of Hyderabad households via existing BSNL tower grid.

Significance of the Launch

- India’s First SIM-less 5G FWA solution.

- Marks BSNL as a 5G pioneer in offering 100% made-in-India wireless broadband.

- Showcases Indian R&D strength and self-reliance in advanced telecom under Digital India and Atmanirbhar Bharat.

- Ideal for UHD streaming, cloud gaming, remote work, and smart home services.

- Bridges the digital divide by enabling affordable gigabit-speed internet, even in rural and underserved regions.

Roadmap and Future Expansion

- Pilot Rollouts (By September 2025): Target Cities: Bengaluru, Pondicherry, Visakhapatnam, Pune, Gwalior, Chandigarh

- Tariff Plans:

- ?999/month for 100 Mbps

- ?1499/month for 300 Mbps

- Enterprise Applications: Will support network-sliced, SLA-backed links for MSMEs and smart manufacturing through edge-cloud architecture.

World Investment Report 2025

- 23 Jun 2025

In News:

The World Investment Report 2025, released recently by the United Nations Conference on Trade and Development (UNCTAD), highlights critical trends in global foreign direct investment (FDI).

Key Details:

Purpose of the Report:

- To track global trends in Foreign Direct Investment (FDI) and international production.

- To guide policymakers and investors on aligning investment flows with sustainable development objectives.

- To monitor progress on the Sustainable Development Goals (SDGs) and Global Digital Compact through investment trends.

Major Global Trends Identified (2024 Data)

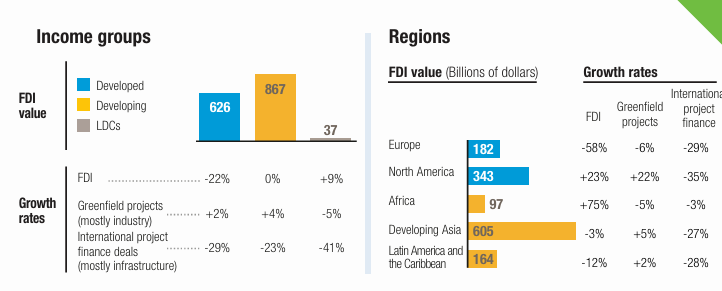

- Overall Decline in Global FDI: FDI declined by 11%, reaching $1.5 trillion, marking the second consecutive year of contraction.

- Digital Economy as a Growth Engine

- Value of digital-sector projects doubled, becoming the primary driver of FDI growth.

- Key growth areas: AI, data centres, cloud computing, semiconductors.

- SDG Investment Crisis: Investment in critical SDG sectors such as renewable energy, water, sanitation, and agrifood fell by 25–33%.

- Regional Divergence

- Africa: FDI surged by 75%, led by Egypt’s $35 billion megaproject.

- ASEAN: Moderate growth of 10% driven by realigned supply chains.

- China: FDI inflows fell by 29%, affected by geopolitical tensions.

- South America: Registered an 18% drop in FDI.

- Collapse in Infrastructure Finance: International Project Finance (IPF) declined by 26%, deepening the infrastructure gap in least developed countries (LDCs).

- Geopolitical Fragmentation

- Rising trade tensions, tariff barriers, and political risks are reshaping FDI flows.

- Emergence of near-shoring and regionalisation as firms relocate to reduce dependence on global supply chains.

Country-Specific Focus: India

- India received $28 billion in FDI inflows in 2024, retaining its rank among top global destinations.

- Key sectors: semiconductors, EV components, digital infrastructure.

- India ranked among top 5 global hubs for greenfield projects.

- Outbound FDI by Indian firms increased by 20%, showing strong outward investment intent.

Assessment of Positive and Negative Trends

Positive Trends:

- Digital FDI Boom: Reflects a global pivot towards a knowledge and tech-driven economy.

- Africa’s Rise: Significant confidence in Africa despite global slowdown.

- Resilient ASEAN & India: Benefitting from global supply chain realignment.

Negative Trends:

- Fall in SDG-Aligned Investments: Threatens progress towards global sustainability targets.

- Infrastructure Finance Crisis: Severely affects LDCs dependent on project finance.

- China’s FDI Decline: Raises concerns about the future of global investment flows amid US-China tensions.

- Geopolitical Fragmentation: Reduces investor appetite for long-term cross-border projects.

Strategic Recommendations

- Strengthen Digital Infrastructure: Scale up investments in broadband, cloud infrastructure, and data hubs through public-private partnerships.

- Bridge SDG Investment Gap: Mobilize development banks, sovereign wealth funds, and climate finance to support SDG sectors.

- Policy Coherence: Align digital, industrial, and sustainability policies at national and international levels.

- De-risking Private Investment: Promote blended finance models to attract global capital to emerging markets.

- Enhance Innovation Governance: Improve IPR frameworks and cross-border data regulations to boost investor confidence in innovation sectors.

- Boost Regional Integration: Strengthen regional trade agreements and infrastructure connectivity to counter global fragmentation.