PM Shram Yogi Maandhan Yojana (PM-SYM)

- 04 Feb 2025

In News:

The Union Budget 2025–26 has accorded the highest-ever allocation of ?32,646 crore to the Ministry of Labour and Employment, representing an 80% increase over the previous year's Revised Estimates.

The enhanced funding reflects the government's strategic focus on employment generation and strengthening social security mechanisms for unorganised workers and gig economy participants.

Key Budgetary Highlights:

1. Employment Generation Scheme:

- ?20,000 crore has been allocated to the new Employment Generation Scheme, double the previous year’s allocation.

- The scheme is aimed at fostering large-scale employment opportunities and skilling across various sectors.

2. Employees’ Pension Scheme:

- Allocation increased by ?300 crore, strengthening retirement security for formal sector workers.

3. PM Shram Yogi Maandhan Yojana (PM-SYM):

- Allocation increased by 37% compared to last year.

- The scheme provides old-age social security to unorganised workers through a voluntary, contributory pension model.

About Pradhan Mantri Shram Yogi Maandhan Yojana (PM-SYM)

Objective:

To provide minimum assured pension and social security to unorganised sector workers, including street vendors, construction workers, agriculture laborers, domestic workers, etc.

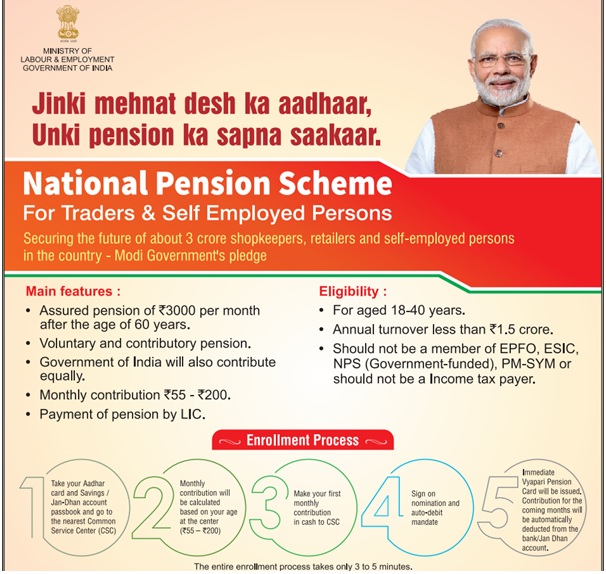

Eligibility:

- Indian citizen aged 18–40 years

- Monthly income below ?15,000

- Not a member of EPFO, ESIC, or NPS

Key Features:

- Minimum Assured Pension: ?3,000 per month after 60 years of age.

- Voluntary and Contributory Scheme:

- Contributions made via auto-debit from bank accounts.

- 50:50 matching contribution by the Central Government.

- Pension Fund Management:

- Administered by the Ministry of Labour and Employment.

- Implemented by LIC and CSC e-Governance Services India Ltd.

- LIC acts as the Pension Fund Manager.

Family Pension Provision:

- In case of subscriber's death:

- Spouse receives 50% of the pension amount as family pension.

- If death occurs before 60 years, the spouse may continue contributions or exit the scheme as per norms.

Exit Provisions:

- Exit before 10 years: Subscriber's share with accrued interest is returned.

- Exit after 10 years but before 60 years: Entire contribution with interest returned to the subscriber.

Social Security for Gig Workers

Recognising the gig economy as a critical pillar of India’s modern workforce, the government has taken key steps to enhance their social security:

- e-Shram registration

- Provision of unique identity cards

- Access to healthcare benefits under PM Jan Arogya Yojana

- Expected to benefit around 1 crore gig workers