Pradhan Mantri Mudra Yojana (PMMY)

- 22 Sep 2025

In News:

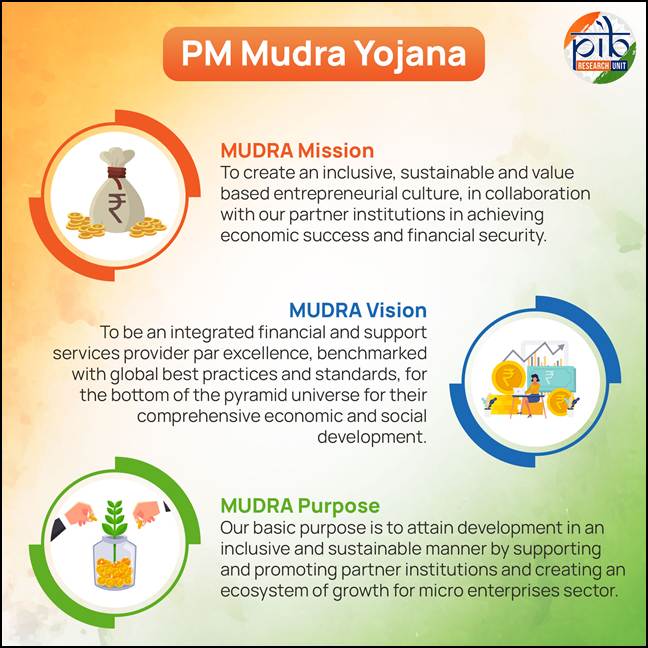

Launched in 2015, the Pradhan Mantri Mudra Yojana (PMMY) is a flagship financial inclusion initiative of the Government of India. The scheme seeks to provide affordable credit to micro and small enterprises (MSEs) engaged in non-farm income-generating activities, thereby integrating them into the formal financial ecosystem.

Objective

- PMMY aims to “fund the unfunded” by facilitating access to institutional credit for small entrepreneurs who traditionally lack collateral or formal financial history.

- The scheme empowers these enterprises through loans provided by Public Sector Banks (PSBs), Regional Rural Banks (RRBs), Cooperative Banks, Private Banks, Foreign Banks, Micro Finance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs).

Key Features and Loan Details

- Loan Amount: Up to ?10 lakh for non-farm income-generating activities across sectors such as manufacturing, processing, trading, and services.

- Eligibility: Any Indian citizen with a viable business plan for such activities can apply for a MUDRA loan through approved institutions.

- Subsidy: PMMY does not directly offer subsidies; however, if linked to other government schemes with capital subsidies, those benefits can be availed concurrently.

Categories of MUDRA Loans

|

Category |

Loan Range |

Target Group |

|

Shishu |

Up to ?50,000 |

New or micro enterprises in the early stage |

|

Kishore |

?50,000 – ?5 lakh |

Businesses seeking growth or consolidation |

|

Tarun |

?5 lakh – ?10 lakh |

Enterprises looking to expand operations |

Achievements under MUDRA 1.0

- Credit Outreach: Over ?27.75 lakh crore has been disbursed to nearly 47 crore beneficiaries, expanding access to formal credit for small entrepreneurs.

- Social Inclusion: Around 69% of loan accounts are held by women, while 51% belong to SC, ST, and OBC categories — strengthening financial inclusion and social equity.

- Employment Generation: The scheme has spurred job creation and self-employment, particularly in rural and semi-urban areas, fostering local entrepreneurship and economic decentralisation.

Vision for MUDRA 2.0

To further enhance the scheme’s reach and impact, the proposed MUDRA 2.0 envisions the following reforms:

- Wider Outreach: Greater focus on underserved rural and semi-urban regions through digital platforms and community-level facilitation.

- Financial Literacy & Mentorship: National-level programmes to improve awareness about budgeting, savings, digital transactions, and credit management to ensure sustainable enterprise growth.

- Enhanced Credit Guarantee Scheme (ECGS): A robust guarantee mechanism to minimise lender risk and encourage more credit flow to micro enterprises.

- Real-Time Monitoring Framework: Technology-driven systems for tracking disbursal, utilisation, and repayment to ensure transparency and reduce misuse.

- Impact Evaluation: Periodic socio-economic assessments to measure outcomes on income generation, employment, and business viability.

Pradhan Mantri MUDRA Yojana (PMMY)

- 08 Apr 2025

In News:

The Pradhan Mantri MUDRA Yojana (PMMY), a flagship initiative aimed at providing financial support to unfunded micro and small enterprises, has completed 10 years since its launch in 2015.

Overview of PMMY

- Objective: To offer collateral-free institutional credit to non-corporate, non-farm micro and small enterprises.

- Loan Limit: Up to ?20 lakh without any collateral.

- Implementing Institutions (MLIs):

- Scheduled Commercial Banks

- Regional Rural Banks (RRBs)

- Non-Banking Financial Companies (NBFCs)

- Micro Finance Institutions (MFIs)

Categories of MUDRA Loans

Loan Category Loan Amount Range

Shishu Up to ?50,000

Kishor ?50,000 to ?5 lakh

Tarun ?5 lakh to ?10 lakh

Tarun Plus ?10 lakh to ?20 lakh

Key Achievements (2015–2025)

- Boost to Entrepreneurship: PMMY has sanctioned over 52 crore loans amounting to ?32.61 lakh crore, catalyzing a grassroots entrepreneurship revolution.

- MSME Sector Financing: Lending to MSMEs increased significantly:

- From ?8.51 lakh crore in FY14

- To ?27.25 lakh crore in FY24

- Projected to exceed ?30 lakh crore in FY25

- Women Empowerment: 68% of Mudra beneficiaries are women, highlighting the scheme’s impact in fostering women-led enterprises.

- Social Inclusion:

- 50% of loan accounts are held by SC, ST, and OBC entrepreneurs.

- 11% of beneficiaries belong to minority communities, showcasing PMMY’s contribution to inclusive growth.