Employment Linked Incentive (ELI) Scheme

- 04 Jul 2025

In News:

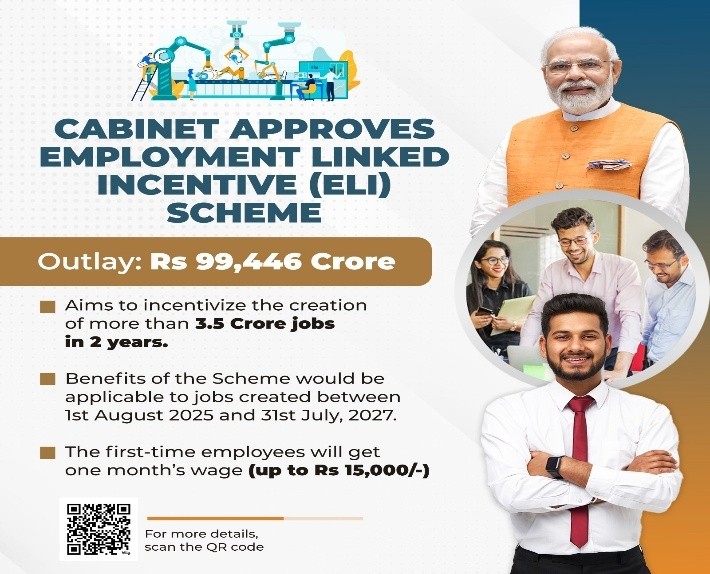

The Employment Linked Incentive (ELI) Scheme is a flagship initiative of the Government of India aimed at formal job creation, especially for youth and in the manufacturing sector. It was announced in the Union Budget 2024–25 and came into implementation following cabinet approval.

Recent Update (July 2025 Cabinet Decision)

- EPFO registrationand Aadhaar seeding deadline:30 June 2025

- Job coverage period:1 August 2025 – 31 July 2027

Objectives

- Promote formal employment by incentivising employers

- Encourage first-time EPFO registration for workers

- Target high employment-generating sectors like manufacturing

- Provide direct income support and EPFO reimbursement subsidies

Key Components – 3 Schemes under ELI

|

Scheme |

Focus |

Key Beneficiaries |

Duration |

Central Outlay |

Estimated Beneficiaries |

|

Scheme A |

First-time employment |

New EPFO-enrolled youth |

3 years |

?23,000 crore |

210 lakh |

|

Scheme B |

Job creation in manufacturing |

Employers hiring ≥50 non-EPFO workers |

6 years |

?52,000 crore |

30 lakh |

|

Scheme C |

Support to employers |

All employers creating net new jobs |

6 years |

?32,000 crore |

50 lakh |

Detailed Scheme Benefits & Conditions

Scheme A: First-Time Employment

- Direct cash benefit: ?15,000 (?7,500 x 2 instalments)

- 1st installment: After 6 months of continuous EPFO-linked employment

- 2nd installment: After 12 months + completion of financial literacy course

- Condition: Exit before 12 months = employer must refund benefit

Scheme B: Job Creation in Manufacturing

- Eligibility: Employer must have 3-year EPFO record; hire ≥50 non-EPFO or 25% baseline

- Salary cap for subsidy: ?25,000/month (overall salary ≤ ?1 lakh)

- Incentive structure:

- Year 1: 24% of salary (employee + employer EPFO contribution)

- Year 2: 24%

- Year 3: 16%

- Year 4: 8%

- Refund clause: If employee leaves before 12 months

Scheme C: Support to Employers

- Eligibility:

- Employers with <50 workers: Hire ≥2 net new

- ≥50 workers: Hire ≥5 net new

- Subsidy per employee/month:

- ?1,000 (salary ≤ ?10,000)

- ?2,000 (?10,001–?20,000)

- ?3,000 (?20,001–?1 lakh)

- Duration: 2 years, extendable to 4 years for large job creators

Eligibility Criteria

- Employees:

- Salary < ?1 lakh/month

- Must be EPFO-registered with Aadhaar–UAN–bank linkage

- Employers:

- Must create net new jobs over EPFO baseline

- For Scheme B: 3-year EPFO record required

Application Process (Current Status)

- No dedicated ELI portal yet

- Via EPFO portal:

- UAN activation and Aadhaar seeding

- Employer-led EPFO registration

- Completion of Financial Literacy Course (for Scheme A)

Significance

- Reduces informal employment

- Supports youth entering formal jobs for the first time

- Incentivises hiring in labour-intensivemanufacturing

- Promotes EPFO inclusion and financial literacy

Challenges

- Compliance burden on small enterprises

- Ensuring retention to avoid refund liabilities

- Monitoring duplication between schemes

- Delay in scheme-specific digital portal rollout