BHIM-UPI Incentive Scheme 2024–25

- 20 Mar 2025

In News:

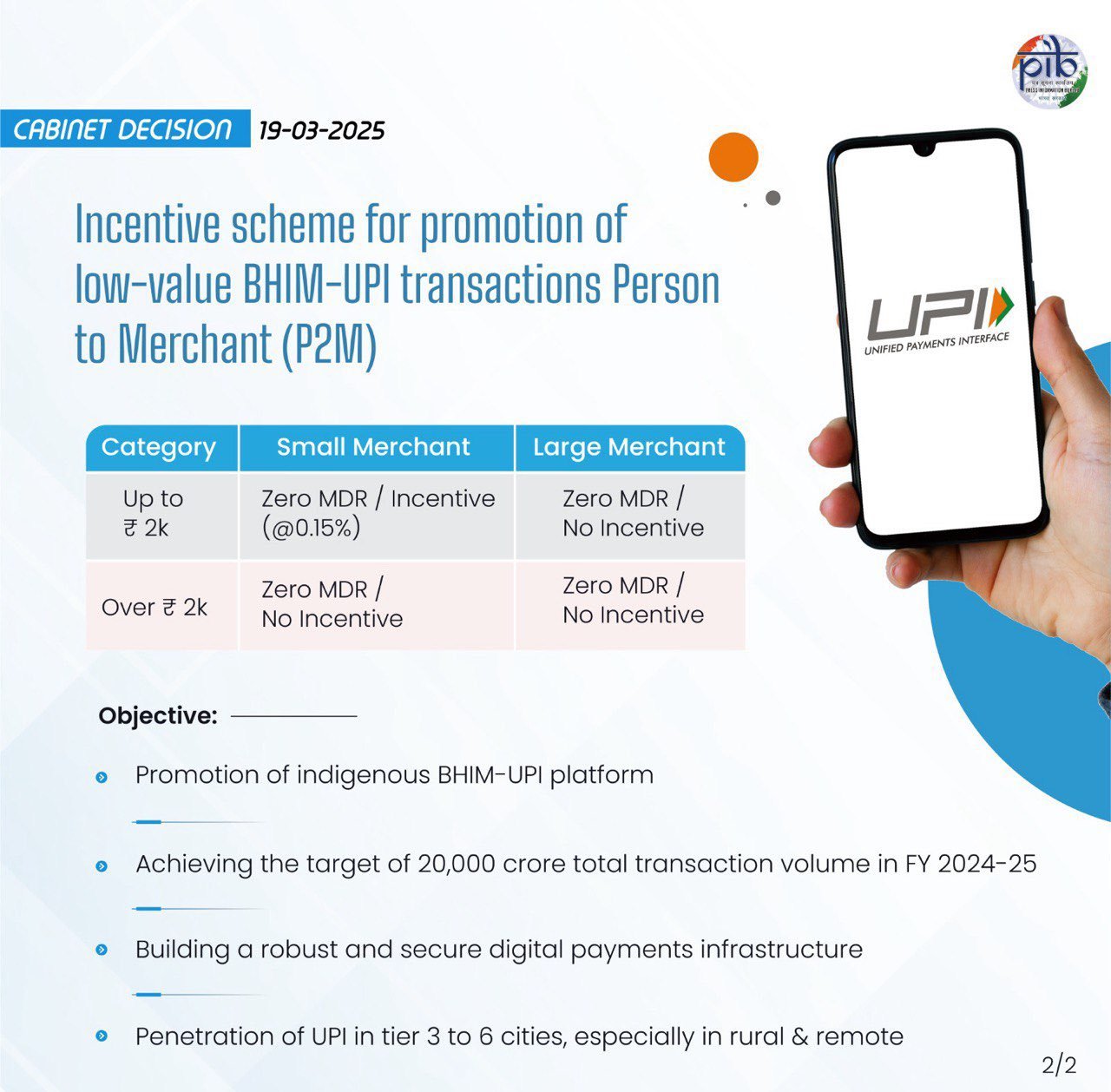

The Union Cabinet, chaired by the Prime Minister, approved the Incentive Scheme for Promotion of Low-Value BHIM-UPI Transactions (Person-to-Merchant or P2M) for FY 2024–25 to encourage digital payment adoption, particularly among small merchants and in rural and remote areas.

Key Features of the Scheme:

- Duration: 1 April 2024 to 31 March 2025

- Outlay: ?1,500 crore

- Coverage: UPI (P2M) transactions up to ?2,000 for small merchants only

- Incentive Rate:0.15% per transaction value

- MDR (Merchant Discount Rate):

- Zero MDR for all UPI P2M transactions

- Incentive applicable only for small merchants on transactions ≤ ?2,000

Incentive Disbursement Conditions:

- 80% of claim amount: Paid upfront each quarter

- Remaining 20%: Conditional on:

- 10%: If acquiring bank’s technical decline < 0.75%

- 10%: If acquiring bank’s system uptime > 99.5%

Objective:

- Promote adoption of indigenous BHIM-UPI platform

- Achieve ?20,000 crore P2M transaction volume in FY 2024–25

- Expand UPI in Tier 3 to Tier 6 cities, especially rural areas

- Promote inclusive tools: UPI 123PAY (for feature phones), UPI Lite/LiteX (offline payments)

Expected Benefits:

- Cost-free UPI usage for small merchants (encouraging cashless transactions)

- Enhanced digital footprint helps merchants access formal credit

- Ensures round-the-clock availability of payment systems

- Strengthens financial inclusion and less-cash economy

- Balanced fiscal support from the government while encouraging systemic efficiency

Digital Payments Background:

- Since January 2020, MDR has been made zero for BHIM-UPI and RuPay Debit Cards via amendments to:

- Payments and Settlement Systems Act, 2007 (Section 10A)

- Income-tax Act, 1961 (Section 269SU)

- Previous incentive outlays (in ? crore):

Financial Year RuPay Debit Card BHIM-UPI Total

2021–22 432 957 1,389

2022–23 408 1,802 2,210

2023–24 363 3,268 3,631

What is BHIM-UPI?

- UPI: Real-time payment system developed by NPCI; allows instant money transfer between bank accounts via mobile apps.

- BHIM-UPI: Government-promoted UPI app launched in 2016.

- NIPL, NPCI’s international arm, is expanding UPI globally. UPI is accepted in Singapore, UAE, France, Sri Lanka, Nepal, and more.