National Critical Mineral Mission

- 26 Jul 2025

In News:

The National Critical Mineral Mission (NCMM), launched by the Government of India in 2025, represents a strategic initiative to secure India's access to essential critical minerals, vital for clean energy, advanced electronics, defence, and emerging technologies. It aims to address India’s dependence on imports, strengthen domestic capacity, and build resilient supply chains.

What are Critical Minerals?

Critical minerals are those essential to economic development and national security, often marked by limited domestic availability and a high risk of supply disruption. These include lithium, cobalt, nickel, rare earth elements (REEs), graphite, and silicon, which are central to electric vehicles (EVs), solar panels, semiconductors, wind turbines, and defence applications.

Why NCMM? Strategic Context

- Energy Transition: India is 100% import-dependent for lithium, cobalt, and rare earths—crucial for EVs and energy storage.

- Tech Sovereignty: Strategic autonomy in AI, defence, and semiconductors depends on secure mineral access.

- Geopolitical Concerns: China controls 70–90% of global critical mineral processing. Diversifying supply chains is essential.

- Industrial Push: Schemes like PLI for EVs, electronics, and solar energy require a reliable mineral base.

- Climate Commitments: India aims to reduce emissions intensity by 45% (from 2005 levels) and reach net-zero by 2070.

Components of the National Critical Mineral Mission (NCMM)

Key Features of NCMM

1. Legal and Policy Framework

- Enacted under the Ministry of Mines in 2025.

- 30 critical minerals identified (24 inserted into Part D of the First Schedule of the MMDR Act, 1957).

- The Centre now has exclusive authority to auction mining leases for these minerals.

2. Domestic and Foreign Sourcing Targets (2024–2030)

|

Objective |

Target |

|

Domestic Exploration Projects |

1,200 |

|

Overseas Projects by PSUs |

26 |

|

Overseas Projects by Private Sector |

24 |

|

Recycling Incentive Scheme (in kilotons) |

400 |

|

Strategic Mineral Stockpile |

5 |

3. Capacity Building and Innovation

|

Objective |

Target |

|

Patents in Critical Mineral Tech |

1,000 |

|

Workforce Trained |

10,000 |

|

Processing Parks |

4 |

|

Centres of Excellence |

3 |

Sectoral Applications of Critical Minerals

- Solar Energy: Silicon, tellurium, indium, and gallium in photovoltaic cells; India’s solar capacity is 64 GW.

- Wind Energy: Neodymium and dysprosium in turbine magnets; target capacity: 140 GW by 2030.

- EVs: Lithium, nickel, cobalt in batteries; goal: 6–7 million EVs by 2024.

- Energy Storage: Lithium-ion battery storage systems; key for grid balancing and renewables.

Implementation Highlights

Exploration and Domestic Production

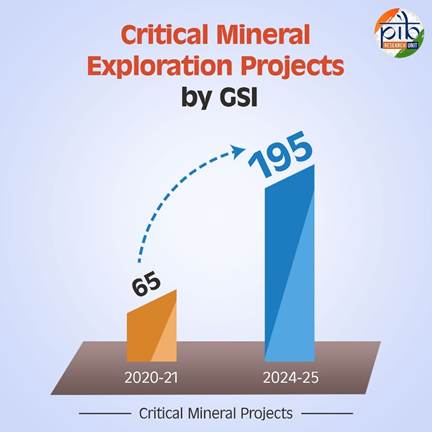

- 195 GSI projects launched in 2024–25, including 35 in Rajasthan.

- Over 100 mineral blocks identified for auction.

- Offshore exploration for polymetallic nodules (cobalt, REEs, nickel, manganese) underway.

- UNFC classification and MEMC Rules, 2015, guide the exploration methodology.

Asset Acquisition Abroad

- KABIL (Khanij Bidesh India Ltd):

- MoU with CAMYEN (Argentina) for lithium over 15,703 hectares.

- Ties with Australia for cobalt/lithium via Critical Mineral Office (CMO).

- Public–Private Partnership support via funding, MEA coordination, and guidelines for overseas investments.

Recycling and Circular Economy

- Incentives for mineral recovery from e-waste, fly ash, and tailings.

- Emphasis on building a formal recycling infrastructure.

- Current battery and electronics recycling sector is informal and lacks scale.

Processing and Midstream Infrastructure

- Development of dedicated Mineral Processing Parks.

- Encourage public–private partnerships and offer PLI-style incentives for refining technologies.

Challenges in India’s Critical Mineral Ecosystem

- High Import Dependence: 100% for lithium, cobalt, REEs.

- Underdeveloped Infrastructure: Lack of domestic refining, separation, and conversion capacity.

- Low Private Sector Participation: Technical and financial barriers deter participation.

- ESG Concerns: Mining zones often overlap with ecologically or tribally sensitive regions.

- Legal Bottlenecks: Environmental clearance delays due to weak ESG compliance.

- Informal Recycling Ecosystem: Fragmented, unregulated battery/e-waste recovery systems.

Strategic Roadmap Ahead

- Strengthen Exploration: Expand GSI capabilities; fund viability gap to attract investment.

- Diversify Global Sources: Engage in “friendshoring” with Australia, Argentina, U.S., etc.

- Build Midstream Capacity: Set up refining zones, mineral parks, and conversion units.

- Sustainable and Inclusive Mining: Implement ESG mandates and tribal welfare frameworks.

- Enhance Circular Economy: Provide tax breaks and subsidies for high-efficiency recovery systems.

Institutional Support

- IREL (India) Limited:

- Produces ilmenite, zircon, sillimanite, and rare earths.

- Operates Rare Earth Extraction Plant (Chatrapur, Odisha) and Refining Unit (Aluva, Kerala).

- Profitable PSU with ?14,625 million turnover (2021–22), including ?7,000 million exports.

Conclusion

India's National Critical Mineral Mission (NCMM) is pivotal for achieving strategic autonomy, industrial growth, and clean energy goals. By integrating domestic exploration, international partnerships, midstream processing, recycling, and regulatory reform, NCMM lays the foundation for a resilient and self-reliant mineral ecosystem. Its success is critical for India’s leadership in green technologies, manufacturing, and strategic geopolitics—making it a cornerstone initiative under Atmanirbhar Bharat and India's 21st-century industrial vision.

National Critical Mineral Mission

- 31 Jan 2025

In News:

The Union Cabinet has launched the National Critical Mineral Mission (NCMM) with a total outlay of ?34,300 crore over seven years, including ?16,300 crore government expenditure and ?18,000 crore investment from PSUs and private players.

Key Highlights:

Objectives of NCMM

- Reduce import dependence on critical minerals vital for clean energy, electronics, defence, and high-tech industries.

- Promote domestic exploration, mining, processing, and recycling of critical minerals.

- Facilitate overseas acquisition of mineral assets.

- Strengthen India’s mineral security and ensure self-reliance (Atmanirbhar Bharat).

Key Features

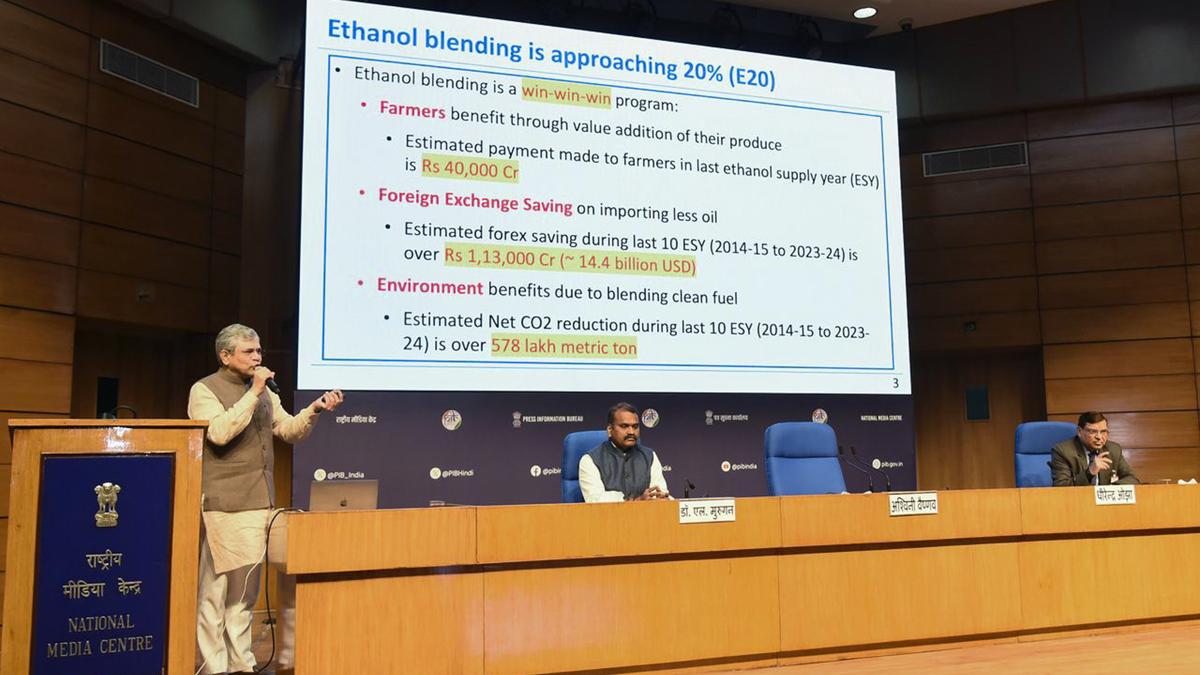

- Value Chain Coverage: Exploration → Mining → Beneficiation → Processing → Recycling of end-of-life products.

- Fast-track regulatory approvals for mining projects.

- Creation of mineral processing parks and promotion of sustainable extraction technologies.

- Establishing a strategic stockpile of critical minerals.

- Development of a Centre of Excellence on Critical Minerals to support R&D.

- Expansion of PRISM initiative to fund startups and MSMEs in the sector.

- Whole-of-government approach: Collaboration among ministries, PSUs, private sector, and research institutions.

Why Critical Minerals Matter

Critical minerals are essential inputs for:

- Green energy: EV batteries, solar panels, wind turbines.

- Electronics: Semiconductors, fiber optics.

- Defence: Aircraft, missile guidance systems.

- Medical technologies: MRI machines, pacemakers.

India’s clean energy transition and manufacturing competitiveness hinge on a steady and secure supply of these minerals.

India’s Import Dependence

India is dependent on imports, especially from China, for several critical minerals like lithium, cobalt, titanium, graphite, and tellurium. This exposes India to supply chain vulnerabilities amid shifting global geopolitics.

List of 30 Critical Minerals for India

Includes: Lithium, Cobalt, Nickel, Graphite, Rare Earth Elements (REEs), Beryllium, Titanium, Tungsten, Gallium, Indium, Selenium, Cadmium, etc.

Strategic and Legislative Initiatives

- Amendment to MMDR Act (1957) in 2023: Enabled auction of 24 critical mineral blocks.

- OAMDR Act (2002) amendment: Introduced transparent offshore mineral exploration.

- Duty waivers in Union Budget 2024–25: Customs duties removed on key critical minerals to promote domestic processing.

- Exploration by GSI: 368 projects in last 3 years; 227 more planned for FY 2025–26.

- KABIL: Acquired 15,703 ha in Argentina for lithium mining.

Global Context

- Global powers (US, EU, Japan) are pursuing strategies for critical mineral security.

- China dominates refining of lithium, cobalt, and REEs.

- India is part of the Minerals Security Partnership (MSP) to diversify global mineral supply chains.

Significance for India

- Ensures long-term resource security for clean technologies.

- Supports EV and renewable energy manufacturing goals.

- Enhances strategic autonomy in defence and electronics.

- Makes India an attractive hub for foreign investment in green technologies.

Challenges and the Way Forward

- Geopolitical risks in overseas asset acquisition.

- Environmental impacts of large-scale mining.

- Need for strong R&D ecosystem, financial incentives, and public-private partnerships.

- Sustainable mining practices and global collaboration are essential for long-term success.