Skill Impact Bond (SIB)

- 01 Aug 2025

In News:

- India is at the cusp of a demographic transition, with a young workforce expected to drive its goal of becoming a $30 trillion economy by 2047.

- Yet, only ~4% of India’s workforce is formally skilled, and nearly 30% of trained individuals remain unemployed. Traditional skilling schemes have struggled, especially with job retention.

- Against this backdrop, Skill Impact Bond (SIB), launched in 2021, marks a paradigm shift in India’s skilling ecosystem by linking financing to actual outcomes.

What is the Skill Impact Bond (SIB)?

- Launched: November 2021.

- Implementing Agency: National Skill Development Corporation (NSDC) under Ministry of Skill Development & Entrepreneurship.

- Partners: British Asian Trust, Children’s Investment Fund Foundation (CIFF), HSBC India, JSW Foundation, Dubai Cares.

- Target: Train 50,000 youth (60% women), ensure sustained employment.

It is India’s first development impact bond focused on employment, not just certification.

How Does SIB Work?

- Risk Investors (Private/Philanthropic): Provide upfront funds to service providers (training institutes).

- Service Providers: Deliver skill training, placement support, and post-placement mentoring.

- Outcome Funders (Govt/Donors): Repay investors if measurable outcomes are achieved (job placement + retention).

- Third-Party Evaluator: Verifies outcomes.

Key Distinction: Funding is tied to placement and retention, not mere enrolment/certification.

Progress So Far

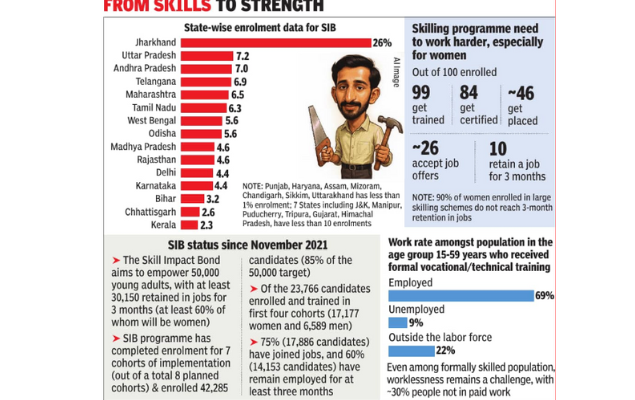

- 23,700 youth trained across 13 sectors & 30 job roles.

- 72% women participation – one of the highest in any skilling programme.

- 75% placed in jobs, and 60% retained beyond 3 months, exceeding national averages (<10% under older schemes).

- Jharkhand, UP, Delhi are leading states in enrolment.

Significance

- Women-led Growth:

- 72% women trainees; many first-generation formal workers (tribal, rural, conservative households).

- Skilling gives women not just jobs but also agency, confidence, and identity.

- Outcome-Based Financing:

- Ensures accountability of training providers.

- Attracts private/philanthropic capital into public welfare.

- Addresses Retention Challenge:

- Traditional skilling: 84% complete training, but <10% stay in jobs beyond 3 months.

- SIB model pushes for long-term impact.

- Replicable Model:

- Can be scaled to health, education, social welfare.

- Example: Project AMBER (apprenticeship-based skilling) also uses this financing.

Challenges Ahead

- Scale vs Depth: Training 50,000 is significant, but India needs millions of skilled youth annually.

- Social Barriers: Women face mobility, safety, and cultural challenges in sustaining employment.

- Monitoring & Evaluation: Requires robust third-party systems to measure outcomes fairly.

- Private Participation: Sustaining investor confidence demands continuous success stories.

Way Forward

- Expand outcome-based financing to more sectors.

- Strengthen ecosystem for women (hostels, childcare, safe mobility).

- Continuous mentoring & alumni networks to ensure retention.

- Use digital platforms for scalable skilling and tracking.