Chemical Industry – Powering India’s Participation in Global Value Chains

- 05 Jul 2025

In News:

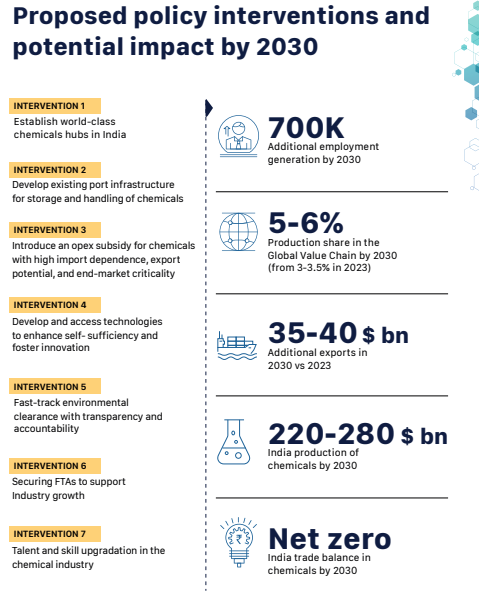

NITI Aayog has released a comprehensive report envisioning India’s transformation into a global chemical manufacturing hub with a projected 12% share in global value chains (GVCs) and USD 1 trillion in output by 2040.

Current Landscape of India’s Chemical Industry

- Significant Economic Contributor: India is the 6th largest chemical producer globally and 3rd in Asia, contributing over 7% to manufacturing GDP. Key linkages: Pharmaceuticals, textiles, agriculture, and construction.

- Fragmented Sector Structure: Dominated by MSMEs, the sector suffers from lack of integrated value chains and modern infrastructure. Example: Cluster-based growth is concentrated in Gujarat, Maharashtra, and Tamil Nadu.

- Low Global Integration: India’s 3.5% share in global chemical value chains reflects weak backward integration and poor export competitiveness. The trade deficit in 2023 was USD 31 billion.

- High Import Dependence: Heavy reliance on China and Gulf countries for feedstocks and specialty chemicals. Example: Over 60% of critical Active Pharmaceutical Ingredients (APIs) are sourced from China.

- Negligible R&D Investment: India invests only 0.7% of industry revenue in R&D, far below the global average of 2.3%, limiting innovation in green and specialty chemicals.

- Regulatory and Procedural Hurdles: Environmental clearance (EC) delays (up to 12–18 months) and procedural bottlenecks lead to cost and time overruns.

- Skilling Deficit:

A 30% shortage of skilled professionals in green chemistry, process safety, and nanotechnology. Example: ITIs and vocational programs lag behind industry requirements.

Emerging Opportunities

- Green Chemistry Revolution: Global shift toward sustainable chemicals presents new market opportunities.

- Geopolitical Realignment: Rising distrust of China globally enables India to emerge as an alternate supplier.

- FTA Leverage: India’s Free Trade Agreements (FTAs) with UAE, EU, and ASEAN can enhance tariff-free access to major markets.

- Make in India Ecosystem: Policy support through PLI schemes, Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs), and chemical parks.

- Job Creation Potential: The sector could generate 7 lakh skilled jobs by 2030, particularly in petrochemicals, research, and logistics.

Persistent Challenges

- Feedstock Vulnerability: Over-dependence on crude oil and naphtha imports poses price and supply risks.

- Outdated Industrial Clusters: Legacy clusters lack modern safety systems, storage infrastructure, and waste treatment facilities.

- High Logistics Costs: Freight costs are 2–3 times higher than global averages, reducing export competitiveness.

- Regulatory Complexities: Absence of single-window clearances, frequent policy shifts, and inter-state inconsistencies deter investments.

- Weak Industry-Academia Linkages: Poor collaboration leads to low patent output and limited skill development.

NITI Aayog’s Recommendations

- Develop World-Class Chemical Hubs: Upgrade existing clusters and establish empowered committees. Suggested hubs: Paradeep, Dahej, Vizag. Introduce a dedicated Chemical Infrastructure Fund.

- Opex-Based Incentives: Offer operational subsidies linked to import substitution and export potential.

- Boost Technology Access & R&D:

- Establish an industry-academia interface under the Department of Science and Technology (DST).

- Enable technology transfer from global MNCs.

- Streamline Environmental Clearances:

- Simplify processes via DPIIT audit mechanisms.

- Ensure greater transparency and faster approvals.

- Strengthen Skill Development:

- Expand and modernize ITIs and specialized institutes.

- Introduce tailored courses in polymer science, green chemistry, and process safety.

- Negotiate Chemical-Specific FTAs:

- Incorporate product-specific clauses.

- Simplify rules of origin and documentation processes.