Japan Post Bank’s Digital Yen (DCJPY)

- 04 Sep 2025

In News:

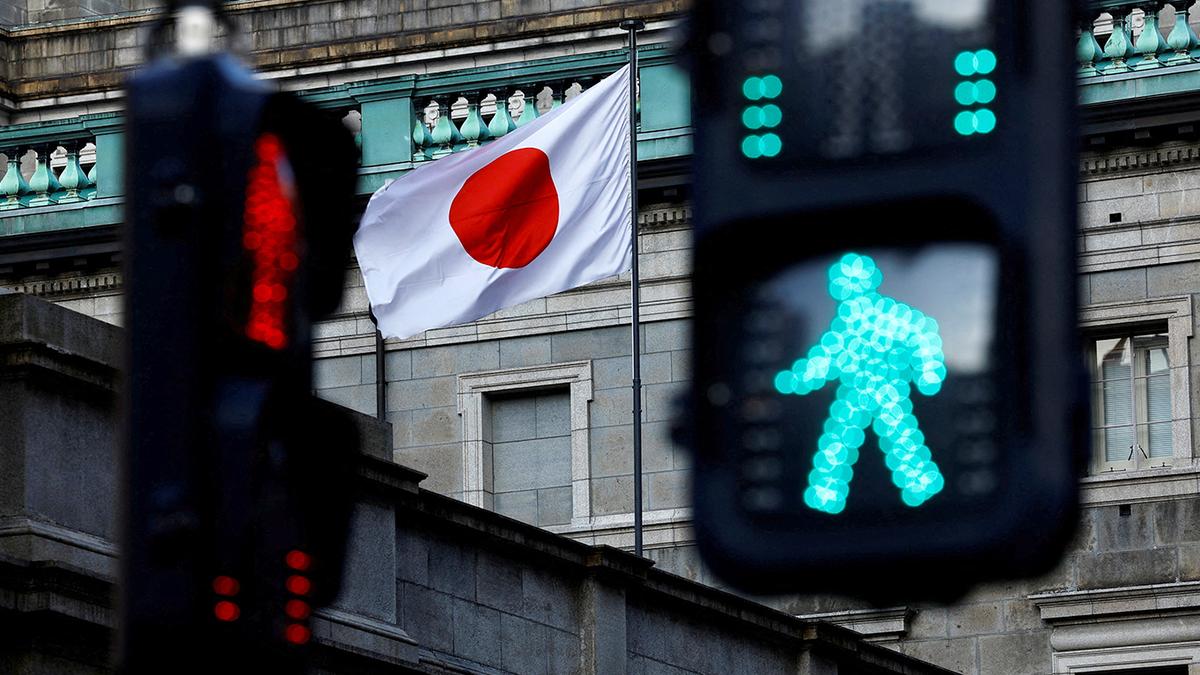

Japan is set to make a significant leap in the digital finance space with the launch of a blockchain-based digital yen (DCJPY) by fiscal 2026. Announced by the Japan Post Bank—a major financial institution with significant government shareholding—this initiative marks one of the largest government-linked ventures into deposit-based digital currencies worldwide.

About DCJPY

- Nature: A blockchain-based deposit currency.

- Backing: Fully backed 1:1 by fiat yen, eliminating volatility risks common to cryptocurrencies.

- Issuer: Japan Post Bank, in collaboration with DeCurret DCP (subsidiary of Internet Initiative Japan).

- Regulation: Issued through the formal banking system, giving it more security, oversight, and credibility compared to private stablecoins.

How It Works

- Customers convert yen deposits into DCJPY tokens.

- These tokens can be used for:

- Real-time digital transactions.

- Settlement of digital securities.

- Asset tokenization and blockchain-based asset transfers.

- Entirely recorded on a blockchain ledger, ensuring traceability, transparency, and instant settlement.

Key Features

- Full Fiat Backing: Maintains stability with zero volatility.

- Blockchain-based: Offers decentralisation, improved security, and transparency.

- Instant Settlement: Removes delays of traditional bank transfers.

- Wider Usability: Designed for ordinary depositors, unlike experimental central bank digital currencies (CBDCs).

- Tokenized Deposit Currency: Positioned distinct from private stablecoins, bridging regulated banking with blockchain innovation.

Strategic Significance

- For Japan’s Financial System

- Strengthens the use of blockchain in mainstream finance.

- Supports digital securities, asset tokenization, and fintech integration.

- Enhances efficiency in payments, settlements, and cross-border transfers.

- Global Context

- Adds momentum to the digital currency race, where China has already advanced with its e-CNY (digital yuan) pilot.

- Offers a regulated alternative to volatile cryptocurrencies, addressing concerns of money laundering, volatility, and lack of oversight.

- Reflects a growing global trend of exploring CBDCs and deposit tokens to safeguard monetary sovereignty against private crypto dominance.