RBI Discussion Paper on Inflation Targeting

- 27 Aug 2025

In News:

The Reserve Bank of India (RBI), in August 2025, released its discussion paper on reviewing India’s Flexible Inflation Targeting (FIT) framework, which is due for renewal in March 2026. The paper seeks public feedback on key questions such as whether the 4% target remains optimal, whether the 2–6% tolerance band should be revised, and whether the target should be expressed as a point or only a range.

Evolution of the Framework

- Adopted in 2016, the FIT framework formalised inflation targeting in India.

- Current mandate: 4% CPI-based inflation target with a tolerance band of 2–6%, jointly set by the RBI and the Government of India.

- Review cycle: Every five years, with the next mandate to begin April 2026.

Rationale for Retaining the 4% Target

- Credibility with Investors: Raising the target above 4% could be perceived as policy dilution, eroding credibility. Rating agencies like S&P Global recently upgraded India’s rating (BBB), citing the RBI’s strong inflation management.

- Institutional Stability: The framework has strengthened the Monetary Policy Committee (MPC) process and fiscal discipline.

- Domestic Outcomes: Headline CPI inflation has mostly remained within the 2–6% band. In July 2025, it hit 1.55%, the second-lowest since the series began.

- External Balance: Low and stable inflation safeguards the rupee, maintains external competitiveness, and prevents capital outflows.

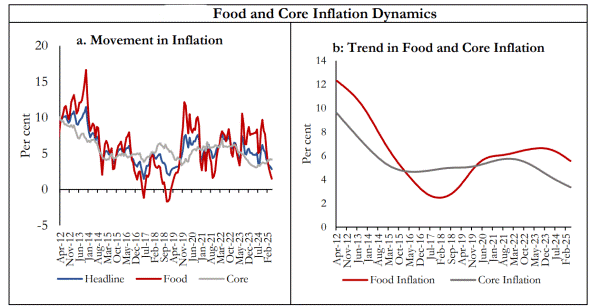

Headline vs Core Inflation Debate

- Economic Survey 2023–24: Suggested targeting core inflation (excluding food and fuel) as food inflation is largely supply-driven and beyond monetary control.

- RBI’s View: Headline CPI should remain the target, as persistent food shocks spill over into wages, rents, and production costs, influencing core inflation.

- Global Norm: Nearly all inflation-targeting countries focus on headline CPI; Uganda is the only exception.

- Indian Context: Food has ~50% weight in CPI. Excluding it would undermine policy relevance for households and workers.

Key Issues Under Review

- Target Level: Lowering below 4% could hurt growth; raising above 4% risks credibility loss.

- Tolerance Band: Debate on retaining the 2–6% range, narrowing it, or removing it. While a band allows flexibility, it may reduce accountability.

- Inflation Volatility: Between 2014–2025, headline CPI ranged from 1.5% to 8.6%, mainly due to food prices, while core inflation remained relatively stable.

Positive Outcomes of the Framework

- Anchored Expectations: Households and firms now base decisions around a credible 4% anchor, reducing uncertainty.

- Investor Confidence: Predictable inflation management has lowered risk premiums on Indian assets, boosting FDI and portfolio inflows.

- Improved Sovereign Ratings: Low inflation stability has supported fiscal credibility, earning global recognition.

- Resilience to Shocks: Despite global supply disruptions and oil price volatility, India avoided runaway inflation.