Revised Income Tax Bill, 2025

- 13 Aug 2025

In News:

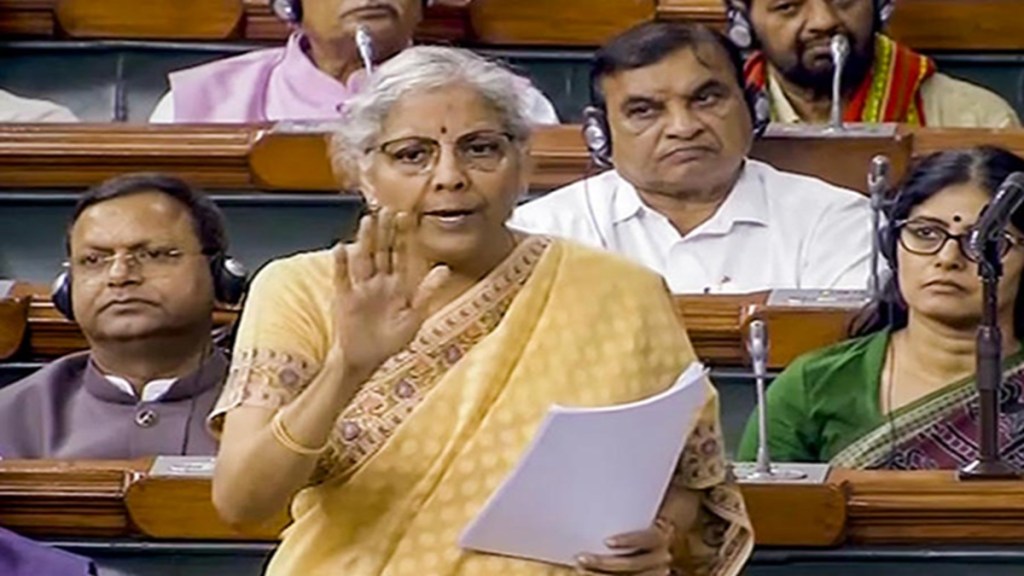

The Income Tax (No. 2) Bill, 2025 was passed in the Lok Sabha in August 2025, replacing the Income Tax Act, 1961 after nearly six decades. The earlier draft of the Bill was withdrawn to incorporate recommendations of the Parliamentary Select Committee and stakeholder feedback. The revised Bill consolidates, simplifies, and modernises India’s direct tax framework.

Background

- Old Act (1961): Complex language, overlapping provisions, and compliance burden.

- New Bill (2025):

- Contains 536 sections and 16 schedules.

- Incorporates over 285 recommendations of the Select Committee, which examined the draft for four months and submitted a 4,500-page report.

- Aims to make the law simpler, clearer, and more aligned with the digital era.

Key Features

- Simplification of Tax Framework

- Single “Tax Year” concept replaces “Previous Year” and “Assessment Year”.

- Outdated and contradictory provisions removed to reduce litigation.

- Clear drafting, structured numbering, and improved terminology for easier interpretation.

- Taxpayer-Friendly Provisions

- Refunds allowed even if returns are filed after the due date.

- NIL-TDS certificates available for taxpayers with no liability.

- Relief on vacant house property – no taxation on notional rent.

- 30% standard deduction (post municipal tax) and interest deduction allowed on rented property.

- Corporate and MSME Reforms

- ?80M deduction on inter-corporate dividends reintroduced.

- MSME definition aligned with the MSME Act for uniformity.

- Institutional & Governance Reforms

- CBDT empowered for flexible, digital-era rule-making.

- Simplified compliance for TDS, PF withdrawals, advance rulings, and penalties.

- Relief to Specific Sectors

- Alternate Minimum Tax (AMT) on LLPs abolished.

- Charitable Trusts – compliance relaxations and reduced regulatory burden.

- Transfer Pricing & Associated Enterprise definitions rationalised.

- Extension of pension benefits – commuted pension deduction available even for non-employee individuals.