Union Budget 2026–27: Growth, Inclusion and Structural Transformation

- 02 Feb 2026

In News:

The Union Budget 2026–27 is anchored in a threefold developmental framework accelerating economic growth, building human capacity, and ensuring inclusive participation. At a time when the global economy faces supply chain realignments, technological disruption, and resource insecurity, the Budget attempts to position India as a resilient, innovation-driven, and socially inclusive economy.

I. Growth Strategy: Investment-Led and Technology-Driven

A defining feature of the Budget is the continued emphasis on public capital expenditure, raised to ?12.2 lakh crore. This reinforces the government’s belief that infrastructure spending crowds in private investment, enhances productivity, and generates employment.

The push spans:

- High-speed rail corridors and freight infrastructure

- Expansion of National Waterways for cost-effective logistics

- Development of City Economic Regions (CERs) to leverage urban agglomeration benefits

These measures reflect a shift from isolated project-based development to integrated regional growth planning.

The Budget also promotes strategic manufacturing and high-technology sectors. The Biopharma SHAKTI initiative (?10,000 crore outlay) aims to develop domestic capabilities in biologics and biosimilars, reducing import dependence while addressing India’s rising non-communicable disease burden. This aligns with the broader push toward knowledge-intensive industrialisation.

Simultaneously, the ?10,000 crore SME Growth Fund recognises MSMEs as drivers of employment and innovation, moving beyond survival support toward scaling globally competitive firms.

II. Human Capital: From Demographic Dividend to Skilled Workforce

The Budget acknowledges that economic growth without skill formation risks jobless expansion. Hence, it invests in education, skilling, and sector-specific workforce creation.

- AVGC labs in schools and colleges support India’s emerging digital content industry.

- Establishment of girls’ hostels in STEM districts addresses gender gaps in higher education.

- A National Institute of Hospitality and guide training scheme link skilling with tourism-led growth.

Healthcare is treated not only as welfare but also as an employment-intensive care economy. The proposal for Regional Medical Hubs integrates healthcare delivery, research, and medical tourism, positioning India as a global health services destination.

III. Inclusive Growth and Social Sector Interventions

The third pillar of the Budget centres on inclusion. Schemes such as Bharat VISTAAR, an AI-based multilingual agricultural advisory, aim to democratise digital infrastructure for farmers, thereby reducing information asymmetry and climate risk.

Similarly, SHE-Marts build on SHG-based mobilisation to promote women’s entrepreneurship, signalling a shift from credit access to market integration and enterprise ownership.

Mental health infrastructure expansion, regional development in the Northeast, and targeted tourism circuits indicate an attempt to address geographical and social imbalances.

IV. Fiscal Prudence with Growth Orientation

Despite higher expenditure, fiscal consolidation remains on track:

- Fiscal deficit projected at 4.3% of GDP

- Debt-to-GDP ratio on a declining trajectory

This suggests a calibrated approach where growth-enhancing capex is prioritised while maintaining macroeconomic credibility.

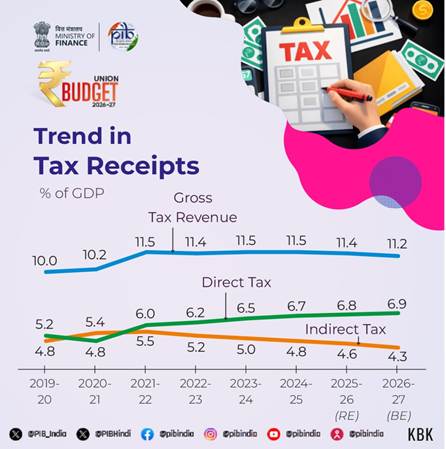

V. Tax Reforms: Simplification and Competitiveness

The introduction of the New Income Tax Act (2025) aims to simplify compliance and reduce litigation. Rationalisation of penalties, decriminalisation of minor offences, and automated safe harbour provisions for IT services improve the ease of doing business.

In a bid to attract global capital, tax incentives for data centres, cloud services, and non-resident investors indicate a strategy to integrate India into global value chains in digital and high-tech domains.

VI. Trade Facilitation and Industrial Policy

Customs reforms reduce duties on inputs for critical minerals, clean energy, aviation, and pharmaceuticals, supporting domestic manufacturing. Digitisation of cargo clearance, AI-based risk assessment, and warehouse reforms enhance trade efficiency and logistics competitiveness.

Conclusion

The Union Budget 2026–27 reflects a structural transition in India’s development model—from consumption-led growth to investment, innovation, and inclusion-led expansion. By combining infrastructure investment, industrial policy, human capital formation, and digital governance, the Budget attempts to align short-term growth impulses with the long-term goal of Viksit Bharat. The key challenge lies in effective implementation and coordination with states, which will determine whether these ambitions translate into broad-based socio-economic transformation.