Structural Shift in India’s Remittance Landscape

- 07 Apr 2025

In News:

According to the RBI’s latest Remittances Survey (2023–24), there has been a significant structural transformation in India's inward remittance patterns. Advanced Economies (AEs) — led by the United States, the United Kingdom, Canada, Singapore, and Australia — have overtaken the Gulf Cooperation Council (GCC) nations as the primary sources of remittances. This shift holds major implications for India’s migration, financial inflows, and socio-economic planning.

Changing Source Geography of Remittances

India’s total remittance inflow touched USD 118.7 billion in 2023–24, doubling since 2011. The United States alone accounted for 27.7%, followed by the UAE (19.2%), the UK (10.8%), Saudi Arabia (6.7%), and Singapore (6.6%). This marks a departure from the earlier dominance of the Gulf region, whose collective share has dropped to 38%, while Advanced Economies now contribute over 50%.

The top recipient states of these remittances in India are Maharashtra (20.5%), Kerala, and Tamil Nadu.

Factors Behind the Shift

1. Evolving Migration Trends:There has been a surge in professional, high-skilled Indian migrants heading to AEs, particularly in sectors like STEM, finance, and healthcare. These migrants tend to earn higher wages, have stronger job security, and remit more per capita compared to their low-skilled counterparts in the Gulf.

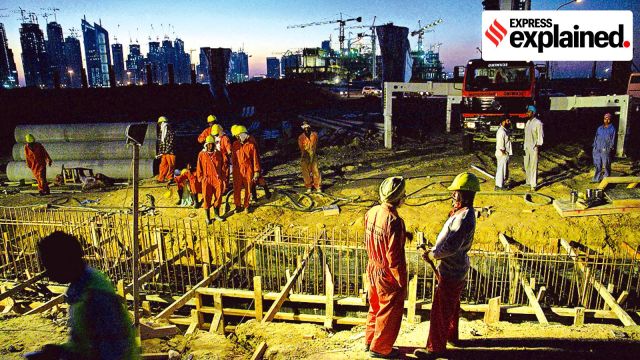

2. Declining Opportunities in the GCC:Several Gulf countries have implemented nationalisation policies like Saudi Arabia’s “Nitaqat,” which prioritise local hiring. Moreover, automation and economic diversification have reduced demand for foreign low-skilled workers. This, combined with COVID-19-induced job losses and return migration, has contributed to the decline in remittances from the region.

3. Education-Driven Migration:Countries like the UK, Australia, and Canada have emerged as popular education destinations. For instance, Indian migration to the UK tripled from 76,000 in 2020 to 250,000 in 2023. Post-study work opportunities and migration partnerships like the India-UK “Migration and Mobility Partnership” (2021) have bolstered this trend.

4. Cost and Mode of Transfers:Digitalisation has reduced remittance costs to India below the global average, although it still exceeds the SDG target of 3% for a US$200 transfer. Nonetheless, cash-based transactions remain significant for smaller amounts.

Economic and Policy Implications

1. Macroeconomic Importance:Remittances contribute about 3–3.5% of India’s GDP, consistently surpassing FDI and Official Development Assistance (ODA). They help finance nearly half of the merchandise trade deficit and act as buffers against external economic shocks.

2. Household-Level Impact:Remittances are pivotal for improving living standards, enabling expenditure on food, healthcare, and education. In Kerala, for instance, remittances account for over 36% of the state's domestic product.

3. Policy Challenges and Recommendations:

- Skill Alignment: Training systems must align with global job markets to prevent ‘wilful deskilling’ — where highly educated migrants take up low-skilled jobs.

- Migration Diplomacy: India must proactively negotiate bilateral/multilateral mobility agreements to secure rights, fair wages, and career progression for migrants.

- Diaspora Engagement: Policies should encourage productive use of remittances (e.g., investments, health, education) and tap diaspora networks for technology and knowledge transfer.

Conclusion

India’s remittance ecosystem is transitioning from Gulf-led low-skilled flows to knowledge-intensive, high-value contributions from Advanced Economies. Sustaining this trend will require strategic migration governance, skill reforms, and deepened engagement with the global Indian diaspora.