World Investment Report 2025

- 23 Jun 2025

In News:

The World Investment Report 2025, released recently by the United Nations Conference on Trade and Development (UNCTAD), highlights critical trends in global foreign direct investment (FDI).

Key Details:

Purpose of the Report:

- To track global trends in Foreign Direct Investment (FDI) and international production.

- To guide policymakers and investors on aligning investment flows with sustainable development objectives.

- To monitor progress on the Sustainable Development Goals (SDGs) and Global Digital Compact through investment trends.

Major Global Trends Identified (2024 Data)

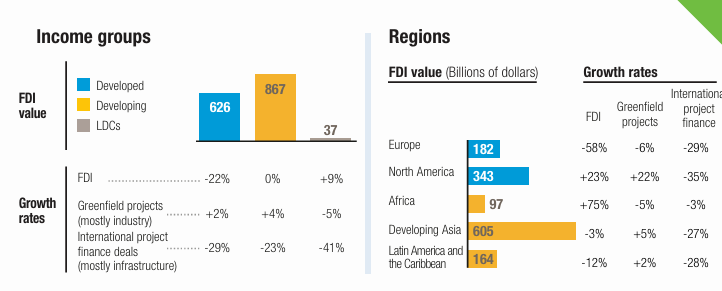

- Overall Decline in Global FDI: FDI declined by 11%, reaching $1.5 trillion, marking the second consecutive year of contraction.

- Digital Economy as a Growth Engine

- Value of digital-sector projects doubled, becoming the primary driver of FDI growth.

- Key growth areas: AI, data centres, cloud computing, semiconductors.

- SDG Investment Crisis: Investment in critical SDG sectors such as renewable energy, water, sanitation, and agrifood fell by 25–33%.

- Regional Divergence

- Africa: FDI surged by 75%, led by Egypt’s $35 billion megaproject.

- ASEAN: Moderate growth of 10% driven by realigned supply chains.

- China: FDI inflows fell by 29%, affected by geopolitical tensions.

- South America: Registered an 18% drop in FDI.

- Collapse in Infrastructure Finance: International Project Finance (IPF) declined by 26%, deepening the infrastructure gap in least developed countries (LDCs).

- Geopolitical Fragmentation

- Rising trade tensions, tariff barriers, and political risks are reshaping FDI flows.

- Emergence of near-shoring and regionalisation as firms relocate to reduce dependence on global supply chains.

Country-Specific Focus: India

- India received $28 billion in FDI inflows in 2024, retaining its rank among top global destinations.

- Key sectors: semiconductors, EV components, digital infrastructure.

- India ranked among top 5 global hubs for greenfield projects.

- Outbound FDI by Indian firms increased by 20%, showing strong outward investment intent.

Assessment of Positive and Negative Trends

Positive Trends:

- Digital FDI Boom: Reflects a global pivot towards a knowledge and tech-driven economy.

- Africa’s Rise: Significant confidence in Africa despite global slowdown.

- Resilient ASEAN & India: Benefitting from global supply chain realignment.

Negative Trends:

- Fall in SDG-Aligned Investments: Threatens progress towards global sustainability targets.

- Infrastructure Finance Crisis: Severely affects LDCs dependent on project finance.

- China’s FDI Decline: Raises concerns about the future of global investment flows amid US-China tensions.

- Geopolitical Fragmentation: Reduces investor appetite for long-term cross-border projects.

Strategic Recommendations

- Strengthen Digital Infrastructure: Scale up investments in broadband, cloud infrastructure, and data hubs through public-private partnerships.

- Bridge SDG Investment Gap: Mobilize development banks, sovereign wealth funds, and climate finance to support SDG sectors.

- Policy Coherence: Align digital, industrial, and sustainability policies at national and international levels.

- De-risking Private Investment: Promote blended finance models to attract global capital to emerging markets.

- Enhance Innovation Governance: Improve IPR frameworks and cross-border data regulations to boost investor confidence in innovation sectors.

- Boost Regional Integration: Strengthen regional trade agreements and infrastructure connectivity to counter global fragmentation.