Household Debt Dynamics in India

- 04 Nov 2025

In News:

Recent financial accounts released by the Reserve Bank of India for 2024–25 highlight an important shift in household balance sheets: liabilities are expanding at a faster rate than financial assets. This trend has implications for savings behaviour, macroeconomic stability, and the broader investment cycle.

Household Asset and Liability Patterns: Key Findings

1. Asset Accumulation Slowing

Indian households continue to be net savers, yet the pace of asset formation has moderated.

- Annual financial assets increased from ?24.1 lakh crore in 2019–20 to ?35.6 lakh crore in 2024–25, marking a 48% rise.

- As a share of GDP, however, asset formation declined from 12% to 10.8%, reflecting slower savings growth relative to economic expansion.

2. Faster Build-Up of Liabilities

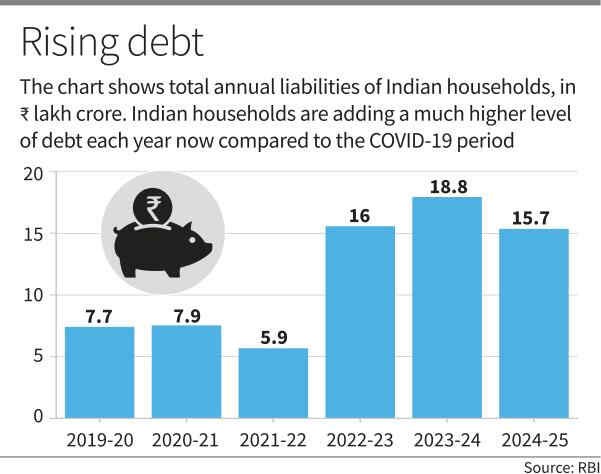

Household borrowing has expanded sharply during the same period.

- Liabilities more than doubled, rising from ?7.5 lakh crore to ?15.7 lakh crore—a 102% increase.

- Their share in GDP rose from 3.9% to 4.7%.

- Household debt peaked at 6.2% of GDP in 2023–24, with a mild moderation in 2024–25, indicating early signs of financial stabilization.

3. Changing Savings Preferences

While bank deposits remain the principal savings instrument, households are increasingly moving toward:

- Mutual funds

- Market-linked products

- Non-traditional financial investments

This diversification points to a maturing financial ecosystem and improving financial literacy, but also increases exposure to market volatility.

Drivers of the Rising Debt Trend

- Post-pandemic consumption recovery, supported by increased reliance on credit.

- Housing and personal loans expanding faster than incomes, especially in urban India.

- Low or moderate interest rate cycles encouraging borrowing.

- Shift toward financialisation of households, with more participation in equity and debt markets.

Implications for the Economy

1. Pressure on the Household Savings Rate

A slower pace of savings growth may:

- Reduce the pool of domestic capital available for investment,

- Affect long-term capital formation,

- Increase dependence on external financing for growth.

2. Vulnerability to Economic Shocks

The rise in consumer leverage heightens exposure to:

- Interest-rate tightening,

- Income disruption due to economic downturns,

- Asset price corrections in financial markets.

3. Mixed Outcomes from Market-Linked Assets

While deeper financial participation is positive, households increasingly carry:

- Higher market risk,

- Greater sensitivity to financial cycles.

Conclusion

The latest RBI data reveal a structural shift in household balance sheets, with liabilities growing more rapidly than assets. Though this reflects rising aspirations and financial deepening, it also signals potential stress points if income growth fails to keep pace or if macroeconomic conditions tighten. Ensuring sustained income growth, robust consumer protection, and balanced credit expansion will be essential to preserve household financial resilience and support long-term economic stability.