Global Environment Outlook–7 (GEO-7), 2025

- 13 Dec 2025

In News:

The 7th edition of the Global Environment Outlook (GEO-7) was released by the United Nations Environment Programme (UNEP) during its session in Nairobi, warning that the world is far off track in meeting climate and environmental goals.

About Global Environment Outlook (GEO)

- The Global Environment Outlook is UNEP’s flagship assessment of the state of the global environment, future risks, and policy solutions. It provides scientific evidence for international environmental decision-making.

Key Findings of GEO-7

Rising Greenhouse Gas Emissions

- Global GHG emissions have grown ~1.5% annually since 1990

- 2024 recorded temperatures around 1.55°C above pre-industrial levels

- Intensifying heatwaves, floods, droughts, and extreme events

Biodiversity Loss

- 1 million species (out of ~8 million) face extinction

- 20–40% of global land is degraded

- Over 3 billion people are affected by land degradation

Economic Costs of Environmental Damage

- Climate-related disasters cost ~USD 143 billion annually

- Air pollution caused USD 8.1 trillion in health damages in 2019 (≈6% of global GDP)

- 9 million deaths per year linked to pollution

Plastic Pollution Crisis

- About 8 billion tonnes of plastic waste pollute ecosystems

- Toxic chemical exposure leads to ~USD 1.5 trillion annual health losses

Projected Impacts if Current Trends Continue

- Temperature thresholds: Likely to exceed 1.5°C in early 2030s and 2°C by 2040s

- Economic decline: Global GDP may fall 4% by 2050 and 20% by 2100

- Loss of fertile land: Equivalent to losing a country-sized fertile area annually

- Food insecurity: Per capita food availability may drop 3.4% by 2050

- Rising hunger, poverty, displacement, and conflict risks

GEO-7 Recommended Transformative Actions

Economy & Finance

- Move beyond GDP to wealth-based indicators

- Price environmental externalities

- Invest in decarbonization, ecosystem restoration, sustainable agriculture

- USD 8 trillion/year investment needed till 2050

- Could generate USD 20 trillion annual benefits by 2070

Materials & Waste

- Promote circular economy models

- Transparent product design and recycling chains

- Shift from linear consumption to regenerative systems

Energy Transition

- Rapid decarbonization of energy

- Improve energy efficiency

- Secure sustainable critical mineral supply chains

- Reduce air pollution → 9 million premature deaths avoidable by 2050

Food Systems

- Promote sustainable diets

- Reduce food loss and waste

- Improve agricultural efficiency

- Could reduce undernourishment by ~200 million people

Ecosystem Protection

- Scale up ecosystem restoration

- Use Nature-based Solutions (NbS) for adaptation

- Stronger mitigation and biodiversity conservation policies

Collaborative & Integrated Governance

- Solutions must involve governments, private sector, civil society, academia, Indigenous communities

- Policies across sectors must be implemented together, not in isolation

About UNEP

- Established in 1972 after the Stockholm Conference

- Headquarters: Nairobi, Kenya

- Leading global authority on environmental issues

- Major reports include:

- Emissions Gap Report

- Adaptation Gap Report

- Global Environment Outlook

- Frontiers Report

IUCN World Heritage Outlook 2025

- 14 Oct 2025

In News:

- The IUCN World Heritage Outlook 4, to be launched at the IUCN World Conservation Congress 2025 in Abu Dhabi, represents the world’s most comprehensive periodic evaluation of the conservation status of UNESCO natural and mixed World Heritage Sites.

- Conducted every 3–5 years by the International Union for Conservation of Nature (IUCN) and the World Commission on Protected Areas (WCPA), it provides an independent, transparent assessment of protection efforts, threats, and future prospects for these globally significant ecosystems.

Purpose and Significance

The Outlook functions as a global conservation barometer designed to:

- Monitor the state of conservation of natural World Heritage Sites

- Highlight exemplary site management and transfer of best practices

- Provide early warnings for ecological degradation and governance failures

- Bridge data gaps through expert-led evaluation and advanced monitoring tools

- Showcase the societal and ecological benefits of natural heritage, including livelihoods, disaster resilience, and carbon storage

This mechanism complements UNESCO’s statutory monitoring under the 1972 World Heritage Convention, strengthening global efforts to realize the Kunming–Montreal Global Biodiversity Framework (KM-GBF) targets by 2030.

Global Conservation Outlook: Key Findings (2025)

- ~65% of sites show stable or improving health since 2020, reflecting enhanced governance and restoration actions. Example: Galápagos Islands, Yellowstone National Park

- Over 80% of sites face direct climate threats—coral bleaching, glacier retreat, wildfires. Example: Great Barrier Reef

- ≈60% experience pressures from invasive species, habitat loss, and unsustainable resource use

- Marine sites like Komodo National Park (Indonesia) and Aldabra Atoll (Seychelles) show progress through sustainable tourism and science-based management

- Technology integration (AI, satellite mapping, eDNA) is improving real-time monitoring. Example: AI-enabled wildlife tracking in Okavango Delta

- Around 15 sites have moved into the Danger List due to conflict, pollution, and climate impacts

- Natural World Heritage sites hold ~10% of global terrestrial carbon, underlining their climate role

Natural World Heritage: Global Profile (2024)

- 271 sites with natural Outstanding Universal Value

- 231 natural, 40 mixed

- 22% of all World Heritage properties (1,223 total)

- Over 470 million hectares protected across land and sea

- Represent ~8% of global protected area coverage

- Spread across 115 countries

- Africa: 47

- Asia-Pacific: 85

- Europe & North America: 83

- Latin America & Caribbean: 47

- Arab region: 9

- 18 transboundary sites; 15 in Danger List

India: Trends and Insights

India hosts 7 natural and mixed World Heritage Sites, spanning the Himalayas to coastal wetlands, constituting ~1.5% of global natural WH coverage.

Positive developments

- Kaziranga&Manas: Improved biodiversity and anti-poaching success through community stewardship and regulated ecotourism

Sites of concern

- Sundarbans: Declining mangroves due to salinity rise, cyclones, and sea-level change

- Western Ghats: Pressures from mining, infrastructure, and land-use conflicts

- Nanda Devi & Great Himalayan National Park: Glacial melt and invasive species affecting Himalayan watersheds

Policy support

- Wildlife (Protection) Amendment Act, 2022

- LiFE Mission for sustainable lifestyles aligned with KM-GBF

- Funding gaps: ~30–40% higher financial allocation needed, especially for marine and transboundary sites

Major Challenges

|

Challenge |

Impact |

|

Climate change |

Coral bleaching, glacial retreat, desertification |

|

Unsustainable development |

Habitat fragmentation, tourism pressure |

|

Funding shortfalls |

Inadequate staffing, weak surveillance |

|

Governance issues |

Overlapping mandates, weak enforcement |

|

Biodiversity data gaps |

Limits adaptive and real-time conservation |

Recommendations

- Climate-resilient planning: Integrate heritage into national climate strategies. Example: Aligning LiFE and National Adaptation Fund with site targets

- Green financing: Carbon credits, biodiversity funds, CSR, eco-investment

UNDP–GEF BIOFIN as model - Local and Indigenous partnership: Community co-management and benefit-sharing. Example: Eco-Development Committees in Manas and Periyar

- Tech-enabled conservation: AI surveillance, remote sensing, eDNA, drones. Example: IUCN Global Ecosystem Atlas initiative

- Transboundary cooperation: Joint research and ecological corridors. Example: India–Nepal Terai Arc Landscape

Global Wetland Outlook 2025

- 20 Jul 2025

In News:

The Global Wetland Outlook (GWO) 2025, released by the Ramsar Convention on Wetlands, highlights alarming degradation trends in global wetlands—especially in Africa, Latin America, and the Caribbean—with implications for climate resilience, biodiversity, and socio-economic wellbeing.

What are Wetlands?

A wetland is a land area saturated with water—either permanently or seasonally—and functions as a distinct ecosystem. Wetlands include:

- Inland: Lakes, rivers, swamps, peatlands

- Coastal: Mangroves, tidal flats, coral reefs, estuaries

- Human-made: Rice paddies, reservoirs, wastewater ponds

Key Findings:

- Produced by: Scientific and Technical Review Panel (STRP) of the Ramsar Convention

- Global Wetland Loss: Since 1970, the world has lost 411 million hectares of wetlands—a 22% decline in extent.

- Current loss rate: ~0.52% annually

- Regional Degradation:

- Most severe in Africa, Latin America, and the Caribbean

- Africa’s wetlands are deteriorating faster than they can be restored, especially in South Africa

- Drivers of degradation:

- Africa, Latin America & Caribbean: Urbanisation, industrialisation, infrastructure development

- Europe: Drought

- North America & Oceania: Invasive species

- Economic Valuation:

- Global value of wetlands: $7.98 to $39.01 trillion/year

- Africa’s wetlands (2023): $825.7 billion, vs Asia’s $10.58 trillion

- Restoration Costs vs Conservation:

- Restoration: $1,000 to $70,000 per hectare/year

- Conservation is cheaper and more effective long-term

- Policy Insight: Most wetlands in Least Developed Countries (LDCs) are in poor condition, while those in high-income countries are in better health.

Africa’s Wetlands: A Deepening Crisis

- Millions depend on wetlands for food, water, disaster protection, and climate resilience.

- The Kafue Flats (Zambia) restoration example shows:

- $300,000 investment revived flooding

- Supported biodiversity and over a million people

- Boosted artisanal fisheries worth $30 million annually

- Warning from Ramsar Secretariat: Loss of wetlands is a major barrier to achieving global climate, biodiversity, food, and poverty targets.

India and Wetlands

- India has ~4.6% of its land as wetlands

- Hosts 91 Ramsar Sites – largest in South Asia and third in Asia

- Wetland types: Himalayan high-altitude lakes, Gangetic floodplains, mangroves (e.g., Sundarbans), coastal lagoons

Importance of Wetlands:

|

Function |

Explanation |

|

Biodiversity Hotspots |

Support endangered and endemic species |

|

Water Purification |

Trap pollutants and sediments |

|

Flood Regulation |

Act as natural buffers |

|

Carbon Sequestration |

Slow decomposition stores carbon |

|

Livelihoods |

Sustain agriculture, fisheries, tourism |

Ramsar Convention on Wetlands

- Adopted: 1971, Ramsar, Iran | Came into force: 1975

- India joined: 1982

- Goal: Conservation and wise use of wetlands globally

- Ramsar Site Criteria: Supports endangered species, ≥20,000 waterbirds, or critical fish spawning grounds

Key Framework: Kunming-Montreal Global Biodiversity Framework (GBF)

- Adopted in 2022 (COP15 to Convention on Biological Diversity)

- Dubbed “Paris Agreement for Nature”

- Targets:

- Halve invasive species spread

- Cut harmful subsidies by $500 billion/year

- 30x30 Target: Protect 30% of land + marine areas by 2030

- Restore 30% of degraded ecosystems by 2030

Recommendations from GWO 2025

- Increase Wetland Financing:

- Incorporate wetlands in KM-GBF finance targets

- Mobilise private-public funding

- Cross-Border Collaboration: Enhance regional conservation partnerships, especially in Africa

- Value Nature in National Accounts: Recognise GDP contributions from wetlands, forests, biodiversity

- Invest in Nature-Based Solutions: Wetlands can buffer climate shocks and reduce disaster response costs

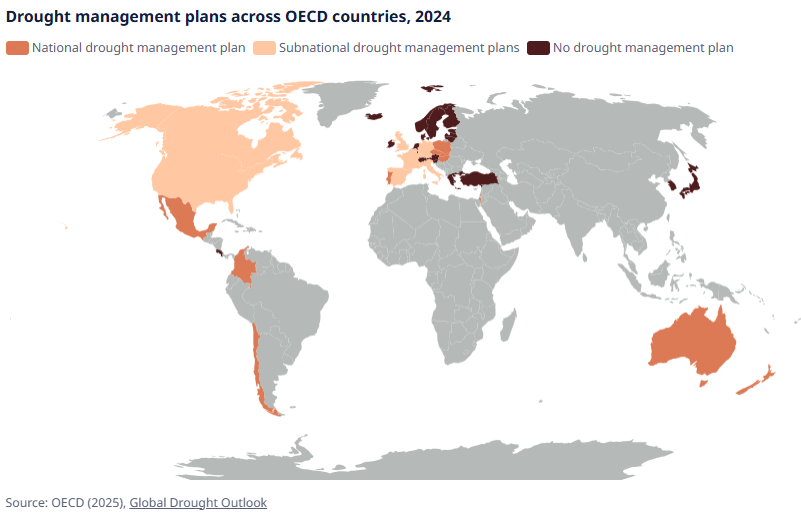

Global Drought Outlook 2025

- 20 Jun 2025

In News:

- The Organisation for Economic Co-operation and Development (OECD) has released the “Global Drought Outlook 2025”, presenting a stark warning about the increasing frequency, severity, and impact of droughts worldwide.

- The report, titled “Global Drought Outlook: Trends, Impacts and Policies to Adapt to a Drier World”, offers a comprehensive assessment of drought patterns, consequences, and adaptation strategies, making it crucial for policymakers and global environmental governance.

Understanding Drought:

Drought is defined as a hydrological imbalance, characterised by prolonged periods of “drier-than-normal” conditions that deplete soil moisture, surface water, and groundwater. The report identifies three main types:

- Meteorological Drought: Caused by significantly below-average rainfall over an extended period.

- Agricultural Drought: Occurs when soil moisture becomes insufficient for crops and vegetation.

- Hydrological Drought: Involves declining water levels in rivers, lakes, and aquifers, affecting supply for human and ecological needs.

Global Trends and Projections

- Drought-Affected Land: The share of global land experiencing drought has doubled since 1900, driven by climate change and unsustainable land use.

- Current Impact (2023): Nearly 48% of the world’s land experienced at least one month of extreme drought.

- Regional Hotspots: Western USA, South America, Europe, Africa, and Australia are increasingly vulnerable.

- Groundwater Stress: Around 62% of monitored aquifers show declining trends.

- Future Risk: At +4°C global warming, droughts could become 7 times more frequent and severe by 2100, posing systemic global threats to food, water, and economic security.

Multidimensional Impacts of Drought

Ecological:

- 37% of global soils have dried significantly since 1980.

- River and groundwater depletion are threatening biodiversity and ecosystem services.

Economic:

- Drought-related losses are increasing by 3–7.5% annually.

- Modern droughts are twice as costly as in 2000; costs may rise 35% by 2035.

- Agriculture is most affected: crop yields drop up to 22% in drought years.

- Drought causes a 40% drop in river-based trade and a 25% decline in hydropower output.

Social:

- Droughts account for 34% of disaster-related deaths, though only 6% of disasters are droughts.

- It is a major driver of food insecurity, internal displacement, and climate migration, especially in Sub-Saharan Africa.

- Political instability and conflict often correlate with drought-induced resource scarcity.

Adaptation and Mitigation Strategies

The OECD emphasizes a multi-sectoral approach to manage drought risks:

- Integrated Water Resource Management (IWRM):

- Balancing water use and renewal.

- Promoting efficient and equitable water allocation.

- Nature-based Solutions (NbS):

- Urban de-sealing to enhance groundwater recharge.

- Landscape restoration to improve water retention and ecosystem resilience.

- Sustainable Agriculture:

- Adoption of drought-resistant crops and micro-irrigation systems.

- Can reduce water use by up to 76%.

- Urban Planning: Permeable infrastructure restores aquifers (e.g., US examples show 780 million m³/year recovery).

- Early Warning Systems: Enhanced drought monitoring, forecasting, and risk mapping.

- Policy Integration: Embedding climate resilience into national water and land-use policies.

- Cross-Sector Coordination: Engaging sectors like agriculture, energy, transport, construction, and health.

- Economic Benefits: Every $1 invested in drought resilience yields $2–$10 in benefits.

India Gas Market Report: Outlook to 2030

- 17 Feb 2025

In News:

The International Energy Agency (IEA), in its report “India Gas Market Report: Outlook to 2030”, has highlighted the transformative potential of natural gas in India’s energy transition.

As India aims to raise the share of natural gas in its primary energy mix from ~6% to 15% by 2030, the report outlines a roadmap for achieving this goal through policy reforms, infrastructure expansion, and market liberalization.

Current Status and Future Outlook

- Demand Growth: India's natural gas consumption is projected to increase by 60%, reaching 103 billion cubic meters (bcm) by 2030. The City Gas Distribution (CGD) sector, which supplies gas to households, transport, and industries, will drive this growth.

- Domestic Production: India produced 35 bcm in 2023, with the Krishna-Godavari deepwater fields contributing a quarter. Production is expected to reach just under 38 bcm by 2030, a modest 8% increase.

- Import Dependency: With domestic supply growth lagging behind demand, LNG imports are expected to more than double, from ~30 bcm in 2023 to around 65 bcm by 2030. India is already the fourth-largest LNG importer globally.

Infrastructure Expansion

India’s natural gas infrastructure has undergone rapid growth:

- Since 2019, the number of CNG stations quadrupled and residential gas connections more than doubled.

- The gas transmission pipeline network expanded by 40%, with another 50% expansion expected by 2030.

- CGD infrastructure is poised for a further boom, supporting increased consumption in urban areas.

Sectoral Trends

- Industry: Heavy industry and manufacturing are expected to add 15 bcm to gas demand by 2030.

- Refining: Gas use in refineries will rise by over 4 bcm as more refineries get connected.

- Transport: Greater CNG adoption, if incentivized, could significantly reduce vehicular emissions.

Challenges Hindering Growth

- Price Distortion: Prices from legacy fields are capped (e.g., USD 6.5–10 per MMBtu), limiting true market-based discovery.

- Monopoly in Transport & Marketing: GAIL’s dominance in both gas marketing and pipeline ownership creates potential conflicts of interest.

- Storage Limitations: India lacks underground gas storage (UGS) and has limited LNG storage capacity, affecting supply security.

- Policy and Regulatory Gaps: Inadequate third-party access and fragmented pricing/taxation systems reduce investor confidence.

Policy Recommendations by IEA

- Gas Pricing Freedom:

- Implement full pricing freedom, in line with Kirit Parekh Committee (2022) recommendations.

- Initially lift ceilings on high-cost deepwater and ultra-deepwater projects.

- Allow producers to sell more output on platforms like the Indian Gas Exchange (IGX).

- Unbundling Supply and Transmission:

- Establish independent gas transmission system operators (TSOs).

- Legally separate marketing from pipeline operations to ensure fair, non-discriminatory access.

- Standardize Gas Sales Agreements (GSAs) and Gas Transmission Agreements (GTAs).

- Infrastructure and Market Development:

- Ensure transparent, regulated third-party access to pipelines.

- Develop strategic gas reserves and expand LNG terminal capacity.

- Improve data transparency on pipeline capacities and tariffs.

- Tax and Regulatory Reforms:

- Harmonize taxes across fuels to create a level playing field.

- Rationalize GST on CNG vehicles and revise import duties on natural gas.

- Offer tax benefits to natural gas similar to electric vehicles to promote adoption.

- Secure Long-Term LNG Contracts:

- With legacy contracts expiring post-2028, proactive procurement is essential to avoid spot market volatility.

Global Investment Trends and India’s FDI Outlook

- 30 Jan 2025

In News:

The Global Investment Trends Monitor Report 2024, released by the United Nations Conference on Trade and Development (UNCTAD), highlights a concerning decline in international project finance and Foreign Direct Investment (FDI), particularly in developing economies. This has significant implications for sustainable development, especially in emerging economies like India.

Key Findings from the UNCTAD Report (2024)

Global FDI Trends:

- Global FDI flows, after adjusting for conduit economies, fell by 8% in 2024, despite a nominal increase to USD 1.4 trillion.

- Developed economies witnessed a 15% drop in FDI (excluding conduit economies like Ireland and Luxembourg), while developing economies saw a 2% decline.

- The decline threatens long-term investment in infrastructure, renewable energy, and other SDG-aligned sectors.

Project Finance and Greenfield Investment:

- International project finance declined by 29% in developed and 23% in developing economies.

- In terms of value, developing economies faced a sharper fall of 33%.

- Key countries like India, China, Brazil, Indonesia, and Mexico reported steeper declines than the global average.

- Greenfield investments fell 6% in developing regions, with Africa and Asia being worst affected.

Sectoral Impacts:

- Investments in SDG-related sectors (e.g., water, sanitation, agrifood systems, and infrastructure) declined by 11%.

- International renewable energy finance fell 16%, with North America (-22%) and developing Asia (-18%) seeing notable contractions.

- Africa was the only region to witness an 8% increase in renewable energy project finance.

India’s FDI Landscape: Trends, Opportunities, and Challenges

Recent Performance:

- Between April 2000 and September 2024, India received over USD 1 trillion in cumulative FDI.

- From 2014 to 2024, India attracted USD 667.4 billion, a 119% increase over the previous decade.

- In 2024, India’s greenfield projects grew, but international project finance fell 23% in number and 33% in value.

Regulatory Framework:

- FDI is regulated under the Foreign Exchange Management Act (FEMA), 1999, administered by DPIIT, Ministry of Commerce and Industry.

- Prohibited sectors: Atomic energy, betting, lotteries, chit funds, tobacco, and real estate (excluding construction development).

Outlook for 2025 and Strategic Opportunities

Global FDI Projections:

- UNCTAD anticipates moderate global FDI growth in 2025.

- Regions like ASEAN, Eastern Europe, and Central America may benefit from supply chain realignments.

- India is projected to see a moderate rise in FDI, aided by:

- Improved financing conditions,

- Mergers and acquisitions,

- Ongoing policy reforms.

Key Growth Sectors:

- High potential in AI, cloud computing, cybersecurity, electric vehicles, and green hydrogen.

- FDI will be influenced by geopolitical dynamics, interest rates, GDP growth, and technological transitions.

FDI in India: Opportunities and Challenges

Opportunities:

- Large consumer base (1.4 billion population) and young workforce (65% under 35).

- Government schemes like Make in India and Atmanirbhar Bharat incentivize foreign investment.

- Strategic location positions India as a gateway to South Asia, the Middle East, and Southeast Asia.

Challenges:

- Regulatory complexity, including retrospective taxation and bureaucratic delays.

- Infrastructure deficits, particularly outside urban hubs.

- Rigid labour laws and inconsistent policy enforcement.

Investor Expectations:

- Technology transfer in priority sectors.

- Employment generation to absorb India’s growing labor force.

- Sustainable investments in line with India’s climate commitments under the National Action Plan on Climate Change.

ILO World Employment and Social Outlook 2025

- 20 Jan 2025

In News:

The global economy is slowing down, making it harder for labour markets to recover fully since the outbreak of the COVID 19 pandemic, according to the International Labour Organization’s (ILO) report, World Employment and Social Outlook: Trends 2025, released in Geneva

Global Employment Trends

- Unemployment Rate (2024): Remained steady at 5%.

- Youth Unemployment: High at 12.6%, particularly severe in upper-middle-income countries (16%).

- Global Jobs Gap:

- 402 million people want work but are jobless (2024):

- 186 million unemployed

- 137 million temporarily unavailable

- 79 million discouraged workers

- 402 million people want work but are jobless (2024):

- NEET Population (2024):

- 259.1 million globally:

- 173.3 million young women (28.2%)

- 85.8 million young men (13.1%)

- 259.1 million globally:

Economic Growth and Labour Recovery

- Global Growth (2024): 3.2% (↓ from 3.3% in 2023 and 3.6% in 2022)

- Forecast (2025): Similar growth expected, with gradual deceleration ahead.

- Recovery Remains Uneven:

- High-income countries see rise in labour force participation.

- Low-income countries (LICs) face challenges creating decent jobs, with informal work returning to pre-pandemic levels.

- India’s GDP Growth:

- 6.9% in 2024, forecast at 6.4% in 2025

- Driven by monetary easing, domestic demand, and public investment

- Southern Asia: Growth pegged at 6.2% in 2024, 5.8% in 2025, mainly due to India.

- Labour Participation:

- Significant increase in female labour force participation, especially in India.

Key Labour Market Challenges

- Geopolitical Tensions

- Climate Change Costs

- Unresolved Debt Issues

- ~70 countries at risk of debt distress

- Many LICs spend more on debt servicing than on education/health

- Stagnant Real Wages

- Post-pandemic wage recovery mostly in advanced economies

- Vulnerable Jobs in Developing Regions

- Sub-Saharan Africa: 62.6% households live on <USD 3.65/day

- Employment is mainly informal, lacking security

Green and Digital Transitions

- Green Jobs Growth:

- Employment in renewables rose from 13.7 million (2022) to 16.2 million (2023)

- 46% of green energy jobs are in China

- Digital Economy:

- Offers promise, but infrastructure and skills gap limit benefits in many countries.

ILO Recommendations for Social Justice & SDG 2030 Goals

- Boost Productivity & Job Creation: Invest in skills training, education, and infrastructure

- Expand Social Protection: Better access to social security and safe work conditions

- Leverage Private Capital: LICs should channel remittances and diaspora funds into development

- Structural Transformation: Focus on modern services and manufacturing for quality jobs

- Youth Skill Development: Promote education for emerging sectors like green tech and digital economy

- Global Collaboration: Foster inclusive fiscal and monetary policies for equitable recovery

About ILO

- Established: 1919 | UN Agency

- Members: 187 countries

- Headquarters: Geneva, Switzerland

- Unique Tripartite Structure: Brings together governments, employers, and workers to set labour standards and promote decent work for all.

Global Cybersecurity Outlook 2025

- 18 Jan 2025

In News:

The World Economic Forum (WEF) recently released the Global Cybersecurity Outlook 2025 report. The report examines cybersecurity trends, key challenges, and necessary strategies to enhance global cyber resilience.

About Global Cybersecurity Outlook 2025

Produced in collaboration with Accenture, the report highlights major cybersecurity issues influenced by geopolitical tensions, emerging technologies, supply chain complexities, and cybercrime advancements.

Key Issues Highlighted

- Geopolitical Conflicts:

- Ongoing conflicts, such as the Russia-Ukraine war, have increased cyber vulnerabilities in critical sectors like energy, telecommunications, and nuclear power.

- Nearly 60% of organizations state that geopolitical tensions have impacted their cybersecurity strategies.

- Cybersecurity Readiness:

- Two-thirds of organizations foresee AI impacting cybersecurity, yet only one-third have the tools to assess AI-related risks.

- Smaller organizations face significant challenges in adopting AI-driven security measures.

- Cyber Skills Gap:

- As of 2024, there is a shortage of 4.8 million cybersecurity professionals globally.

- Only 14% of organizations have a skilled workforce to manage current cybersecurity threats.

- Public-sector organizations are notably impacted, with 49% reporting a shortage in cybersecurity talent.

- Supply Chain Interdependencies:

- Over 50% of large organizations identify supply chain complexity as a barrier to cyber resilience.

- Vulnerabilities in third-party software, cyberattacks, and enforcement issues in security standards are key concerns.

- Cybercrime Sophistication:

- Cybercriminals are increasingly leveraging generative AI tools for automated and personalized attacks, including phishing and social engineering.

- In 2024, 42% of organizations experienced phishing and deepfake attacks.

- Regulatory Challenges: 70% of organizations reported that complex cybersecurity regulations cause compliance issues.

Impacts

- Critical Infrastructure:

- Cyberattacks on essential infrastructure, such as water utilities, satellites, and power grids, pose severe risks to public safety.

- Example: A 2024 cyberattack on a U.S. water utility disrupted operations, highlighting vulnerabilities in critical infrastructure systems.

- Biosecurity Risks:

- Advancements in AI, cyberattacks, and genetic engineering create risks for bio-laboratories and research institutions.

- Incidents in South Africa and the UK underscore these threats.

- Economic Disparities: Developed regions like Europe and North America demonstrate stronger cyber resilience compared to emerging economies such as Africa and Latin America.

- Transition Issues to Renewable Energy (RE): The shift to renewable energy introduces new cybersecurity risks, making power grids attractive targets for cybercriminals.

Factors Increasing Cybersecurity Complexity

- Supply Chain Vulnerabilities: Increasingly complex supply chains create risks with limited oversight, enabling cyberattacks to spread across interconnected systems.

- Geopolitical Tensions: Conflicts have driven advanced cyber strategies targeting critical infrastructure.

- AI-Driven Threats: Generative AI enables scalable malware deployment and sophisticated multilingual social engineering attacks.

- Cyber Skills Gap: A growing 8% skills gap leaves two-thirds of organizations unable to meet cybersecurity demands.

- Convergence of Cybercrime and Organized Crime: Rising cyber-enabled fraud has attracted organized crime groups, amplifying social impact.

- Climate-Linked Cyber Risks: Energy grids are increasingly targeted due to their reliance on evolving energy systems.

- Quantum Vulnerabilities: Quantum computing poses risks to public-key encryption, which is essential for securing digital systems.

Way Forward

Strategic Investment:

- Cybersecurity must be viewed as a strategic investment rather than a technical expense.

- Governments are encouraged to modernize legacy systems and upgrade operational technologies to protect critical sectors.

Public-Private Collaboration:

- Collaboration between business and cybersecurity leaders is essential for sharing threat intelligence and enhancing resilience.

- Small and medium enterprises (SMEs) may require government incentives to enhance cybersecurity.

Skills Development: Expanding specialized training programs, certifications, and incentives is crucial to addressing the cybersecurity skills gap.

Focus on Resilience Over Prevention: Nations must prioritize resilience by enhancing response mechanisms, crisis management frameworks, and ensuring continuity of services.

International Cooperation:

- Collaborative efforts through forums like the United Nations (UN) and G20 can strengthen global cybersecurity frameworks.

- Developed nations should assist emerging economies in improving cyber resilience.

Current Framework for Cybersecurity in India

- Legislative Measures:

- Information Technology Act, 2000 (IT Act)

- Digital Personal Data Protection Act, 2023

- Institutional Framework:

- Indian Computer Emergency Response Team (CERT-In)

- National Critical Information Infrastructure Protection Centre (NCIIPC)

- Indian Cyber Crime Coordination Centre (I4C)

- Cyber Swachhta Kendra

- Strategic Initiatives:

- Bharat National Cybersecurity Exercise 2024

- National Cyber Security Policy, 2013

- Sector-Specific Regulations:

- Cybersecurity Framework for SEBI Regulated Entities

- Telecommunications (Critical Telecommunication Infrastructure) Rules, 2024

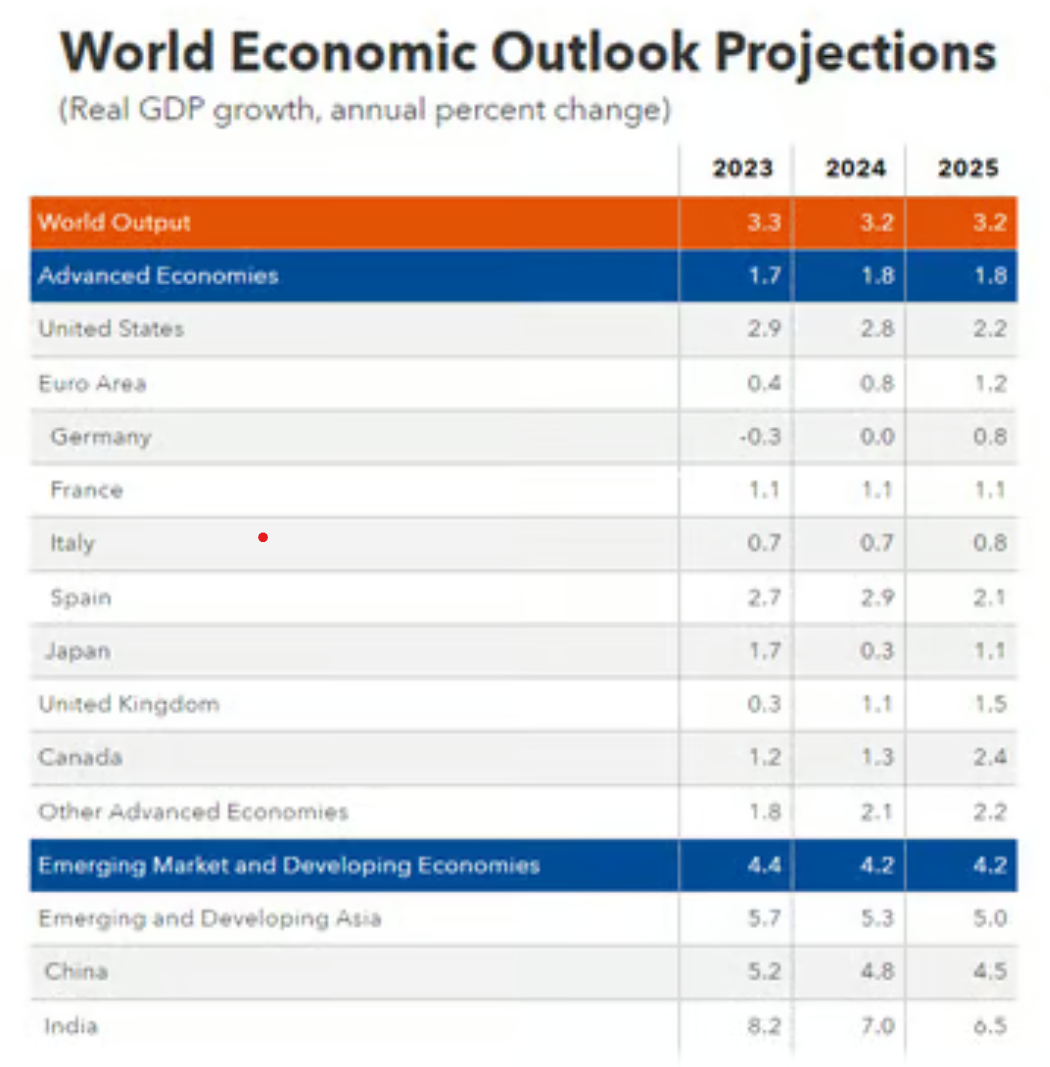

IMF's World Economic Outlook (WEO)

- 24 Oct 2024

In News:

- The International Monetary Fund (IMF) has maintained India’s GDP growth forecast at 7% for FY2024, marking a moderation from 8.2% in 2023.

- FY2025 Projection: Growth is expected to slow further to 6.5% in FY2025.

- India’s growth is expected to be stronger than most other large economies, yet the downward revision reflects challenges in the global economy and moderation in domestic economic momentum.

Global Economic Growth Projections:

- Global Growth (2024-2025): Global growth is projected at 3.2% in 2024 and 2025, which is stable but modest. This growth rate is largely unchanged from previous IMF forecasts.

- Long-Term Outlook: The IMF's long-term projection for global growth is 3.1%, which is considered subpar compared to pre-pandemic growth rates, signaling a potential era of low growth.

Key Risks and Uncertainties:

- The IMF highlights several downside risks to global growth, including:

-

- Monetary tightening: Central banks' high-interest rate policies to combat inflation could have long-term negative effects on economic growth and financial stability.

- Geopolitical Tensions: Ongoing conflicts, such as the Russia-Ukraine war, could disrupt global supply chains and trade, exacerbating inflation and slowing growth.

- China’s Economic Slowdown: China, the world’s second-largest economy, is facing a slower growth trajectory, especially in its real estate sector, which is dragging down its overall growth.

- Structural Challenges: The aging population and weak productivity are long-term growth inhibitors in many advanced economies, adding uncertainty to future growth prospects.

-

- Inflation and Monetary Policy:

- The IMF's inflation forecast shows global inflation cooling:

- 2023: Global inflation is expected to reach 6.7%.

- 2024: It is forecast to fall to 5.8%, with advanced economies expected to return to inflation targets sooner than emerging markets.

- 2025: A further decline to 4.3%.

- The primary driver of disinflation is not interest rate hikes but the unwinding of pandemic-related shocks, supply chain improvements, and the gradual return of labor supply.

- Monetary Policy: Central banks are likely to ease policies once inflation nears target levels, but risks of further commodity price spikes or geopolitical tensions could delay this.

- The IMF's inflation forecast shows global inflation cooling:

US and Europe Growth:

- Emerging Markets and Developing Economies:

- Growth Outlook: The IMF forecasts growth in emerging markets and developing economies at 4.2% for 2024 and 2025, with a slight moderation to 3.9% by 2026.

- Emerging Asia: Growth in emerging Asia (led by India and China) is expected to slow, from 5.7% in 2023 to 5% in 2025.

- India’s Relative Strength: India’s growth continues to outperform many emerging economies, though the slowdown from 8.2% in 2023 to 7% in 2024 reflects global economic headwinds.

- Income Inequality Risks:

- The IMF warns that low growth over an extended period (4+ years) could exacerbate income inequality within countries, as sluggish growth affects job creation and wage growth.

- Countries with slow economic recovery are likely to see a widening gap between rich and poor, undermining social cohesion and stability.

World Energy Outlook 2024

- 17 Oct 2024

In News:

The International Energy Agency's (IEA) World Energy Outlook 2024 offers an in-depth analysis of global energy trends, emphasizing the shift towards clean energy, growing energy demand, and the effects of geopolitical conflicts.

Key Highlights:

- Economic Growth:

- India was the fastest-growing major economy in 2023 with a 7.8% growth rate.

- On track to become the world’s third-largest economy by 2028.

- Surpassed China in 2023 to become the most populous country globally, despite a fertility rate below replacement level.

- Energy Demand Surge:

- India is projected to experience the highest increase in energy demand over the next decade.

- By 2035, India’s total energy demand is expected to rise by 35%, driven by rapid industrialization, urbanization, and increased living standards.

- Urbanization and Infrastructure Growth:

- Over 12,000 cars are expected to be added to Indian roads daily by 2035.

- Built-up space is set to increase by over 1 billion square meters annually, surpassing the total built space of South Africa.

- Industrial Expansion:

- Iron and steel production is expected to grow by 70% by 2035.

- Cement output is set to increase by 55%.

- Air conditioner stock to grow more than 4.5 times, with electricity demand from cooling expected to exceed Mexico’s total consumption in 2035.

- Energy Supply & Coal:

- India’s electricity generation capacity is projected to nearly triple to 1,400 GW by 2035.

- Coal remains a dominant energy source despite growth in renewables:

- Coal-fired power capacity will increase by 60 GW by 2030.

- Coal will continue to account for over 30% of electricity generation even as solar PV expands.

- By 2035, coal use in industries like steel and cement will grow by 50%.

- Renewable Energy & Clean Tech:

- India is on track to become a global leader in renewable energy, with a nearly 3x increase in electricity generation capacity.

- The country is expected to have the world’s third-largest installed battery storage capacity by 2030.

- By 2030, low-emission energy sources (solar, wind, nuclear) are expected to generate over 50% of India’s electricity.

- Electric Vehicles & Oil Demand:

- The rapid adoption of electric vehicles (EVs) is expected to peak India’s oil demand by the 2030s, reducing reliance on oil for transportation.

- Oil demand for transport will decline as EVs proliferate, though demand for oil in other sectors (e.g., petrochemicals) will continue.

- Net Zero Target:

- India aims to achieve net-zero emissions by 2070.

- By 2035, clean energy generation could be 20% higher than current policy projections, thanks to electric mobility, hydrogen use, and improved energy efficiency.

- CO2 emissions are projected to be 25% lower than under the Stated Policies Scenario (STEPS).

- Policy Support:

- India’s clean energy goals are backed by government initiatives, such as:

- PM-KUSUM scheme for solar energy in agriculture.

- National Solar Mission.

- Production Linked Incentive (PLI) Scheme to boost domestic solar PV manufacturing.

- India’s clean energy goals are backed by government initiatives, such as:

- Global Energy Trends:

- Geopolitical Risks: Global energy security remains affected by geopolitical tensions (e.g., Russia-Ukraine conflict, Middle East tensions).

- Energy Transition: Global shift toward clean energy, with solar and wind power investments accelerating.

- Oil & Gas Surplus: Oil and LNG supply expected to increase, putting downward pressure on prices by the late 2020s.

- Electric Mobility: EVs projected to account for 50% of new car sales by 2030.

- Energy Efficiency: Despite efforts, global targets for doubling energy efficiency by 2030 are unlikely to be met with current policies.

IEA Overview:

- The International Energy Agency (IEA) provides analysis and policy advice on energy security, economic development, and environmental sustainability.

- Established in 1974, it now includes 31 member countries and 13 association countries, including India.

- Major publications: World Energy Outlook, India Energy Outlook, World Energy Investment Report.

Global Financial Stability Report (GFSR)

- 22 Apr 2024

Why is it in the News?

The International Monetary Fund (IMF) released the latest global financial stability.

About Global Financial Stability Report (GFSR):

- The Global Financial Stability Report (GFSR) is a semiannual report by the International Monetary Fund (IMF).

- It is released twice per year, in April and October.

- The GFSR provides an assessment of the global financial system and markets and addresses emerging market financing in a global context.

- It focuses on current market conditions, highlighting systemic issues that could pose a risk to financial stability and sustained market access by emerging market borrowers.

Key Points from the Report:

- The report highlights significant risks facing the global financial system, including persistent high inflation, increased lending in unregulated credit markets, and a rise in cyber-attacks targeting financial institutions.

- It underscores geopolitical tensions, such as conflicts in West Asia and Ukraine, as potential factors disrupting aggregate supply and driving up prices, possibly constraining central banks from lowering interest rates.

- India emerged as the second-largest recipient of foreign capital in 2023, following the United States, though this trend could shift rapidly if Western central banks signal prolonged high-interest rates.

- Of concern is the expansion of the unregulated private credit market, where non-bank financial institutions extend credit to corporate borrowers, posing potential threats to the broader financial system.

- Many borrowers in this market lack financial stability, with numerous entities unable to cover interest costs with current earnings, highlighting underlying risks.

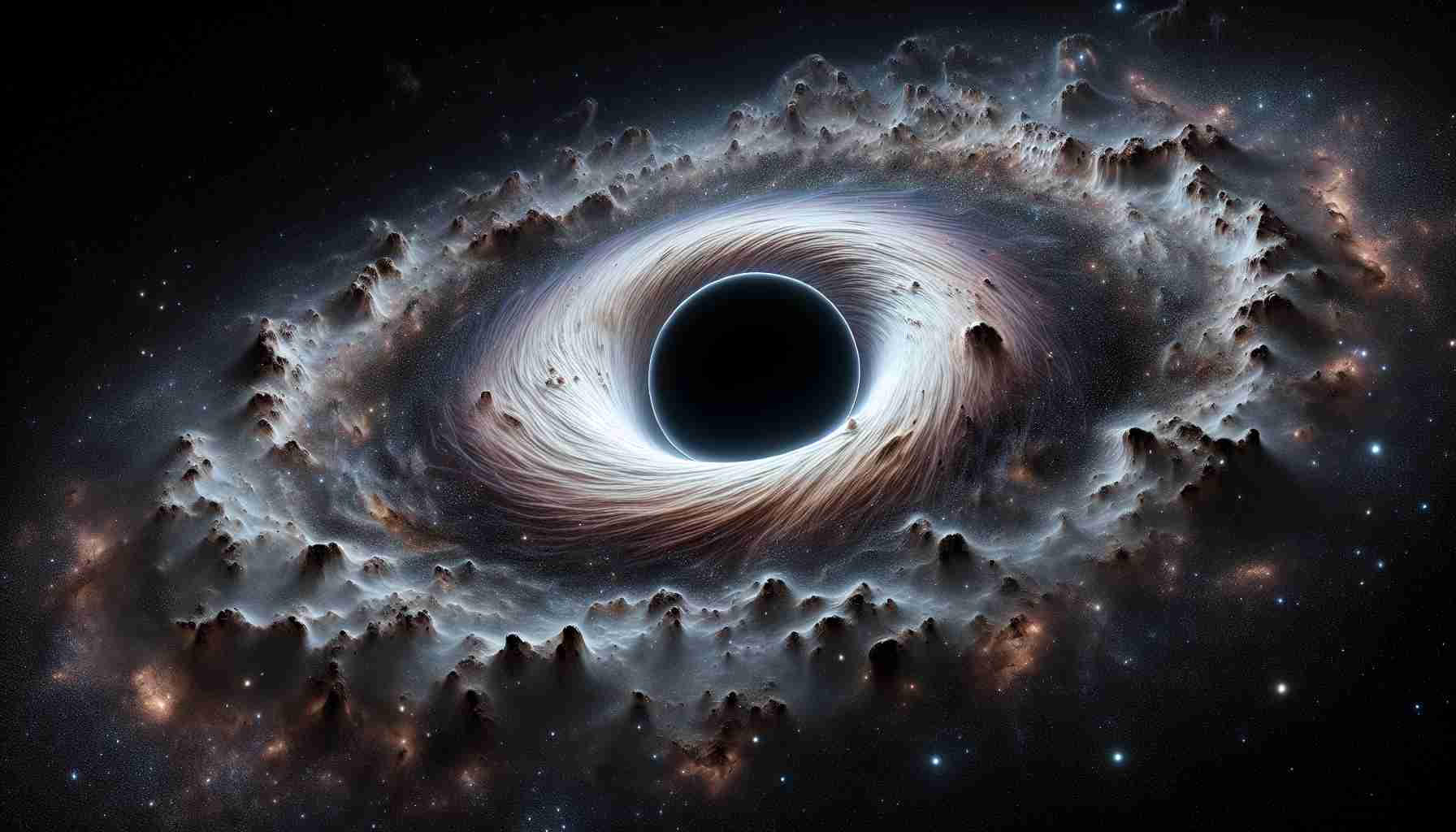

Gaia-BH3

- 17 Apr 2024

Why is it in the News?

European astronomers have made a groundbreaking discovery by identifying Gaia-BH3, a colossal black hole located just 2,000 light years away from Earth within the Milky Way, revolutionizing our comprehension of star formation.

What Is Gaia-BH3?

- Gaia-BH3, a stellar black hole in the Milky Way galaxy, has been identified as the most massive one discovered to date.

- The European Space Agency's Gaia mission detected Gaia-BH3 due to its distinctive 'wobbling' effect on a companion star orbiting it.

- Through the use of the Very Large Telescope at the European Southern Observatory in Chile's Atacama Desert and other ground-based observatories, researchers confirmed its enormous mass.

- With a mass 33 times greater than our sun, Gaia-BH3 is situated in the Aquila constellation at a distance of 1,926 light-years from Earth, earning it the title of the second-closest known black hole.

- Gaia BH1, located about 1,500 light-years away, remains the closest known black hole to Earth with a mass approximately 10 times that of our sun.

- While Gaia-BH3 holds the distinction of being the most massive stellar black hole in our galaxy, it pales in comparison to Sagittarius A*, the supermassive black hole at the Milky Way's center, which boasts a staggering mass of roughly 4 million times that of the sun.

Difference Between Stellar and Supermassive Black Holes:

- Stellar and supermassive black holes are two distinct types of cosmic phenomena, each with unique characteristics and origins.

- Stellar-mass black holes result from the gravitational collapse of a single star or the merger of two neutron stars, resulting in masses comparable to stars.

- Their mass typically ranges from three to fifty times that of our sun.

- In contrast, supermassive black holes boast a mass exceeding 50,000 times the solar mass, often reaching into the millions or billions.

- The formation of supermassive black holes remains a mystery to scientists, as they are too massive to have formed from a single star's collapse.

- Their consistent presence at the center of galaxies suggests a potential connection to galactic formation.

- While our understanding of these cosmic giants continues to evolve, one thing is clear: both stellar and supermassive black holes are awe-inspiring fixtures in our universe.

Revenue-Based Financing

- 18 Mar 2024

Why is it in the News?

Revenue-based financing (RBF) is increasingly popular among startups and digital SMEs due to a lack of venture capital and limited access to traditional credit options.

What Is Revenue-Based Financing?

- Revenue-based financing is a method of raising capital for a business from investors who receive a percentage of the enterprise's ongoing gross revenues in exchange for the money they invested.

- In a revenue-based financing investment, investors receive a regular share of the business's income until a predetermined amount has been paid.

- Typically, this predetermined amount is a multiple of the principal investment and usually ranges between three to five times the original amount invested.

How Revenue-Based Financing Works?

- Capital investment: An investor or a group of investors provides capital to a company (but not as a traditional loan nor in exchange for equity in the company).

- Revenue percentage agreement: In return for the capital, the company agrees to give the investor a fixed percentage of its gross revenues each month.

- Repayment structure: The company repays the invested capital through payments based on monthly or annual revenue.

- The amount paid each month varies as it is directly tied to the company’s revenue for that month.

- Repayment cap or term: There is usually a cap on the total amount to be repaid, often set as a multiple of the original investment (e.g., 1.5x or 2x the initial amount).

- Alternatively, the repayment might continue until a specific term is reached, such as a number of years.

Comparing Revenue-based Financing to Debt and Equity-based Models:

- While revenue-based financing shares similarities with debt financing in terms of regular investor repayments, it differs notably as it doesn't involve interest payments.

- Instead, repayments are based on a predetermined multiple, yielding returns higher than the initial investment.

- Moreover, unlike traditional debt arrangements, revenue-based financing doesn't necessitate collateral.

- Additionally, unlike equity-based models, it doesn't entail transferring ownership stakes in the company to investors.

World Energy Outlook 2023 (IEA)

- 13 Nov 2023

Why in the News?

Recently, the International Energy Agency (IEA) released the World Energy Outlook (WEO) Report 2023.

About World Energy Outlook 2023:

- This flagship publication of the International Energy Agency (IEA) has appeared every year since 1998.

- It provides in-depth analysis and strategic insights into every aspect of the global energy system.

- This year, the report delves into how changes in economies and energy usage are meeting the increasing demand for energy amid geopolitical tensions and fragile energy markets.

- It evaluates the evolution of energy security fifty years after the establishment of the IEA and looks at what's necessary at the COP28 climate conference in Dubai to support the 1.5 °C goal.

- The publication analyzes today's energy trends, covering areas like investment, trade flows, electrification, and energy access.

About the International Energy Agency (IEA):

- The International Energy Agency (IEA) is an independent inter-governmental organization operating within the framework of the Organisation for Economic Co-operation and Development (OECD).

- Its mission involves collaborating with governments and industry to create a secure and sustainable energy future.

- Established in 1974 to safeguard oil supplies, it was a response to the 1973-1974 oil crisis, which exposed the vulnerability of industrialized nations to oil import dependencies due to an oil embargo.

- Comprising 31 member countries and eleven association countries, IEA candidates must be OECD members.

- India joined as an Associate member in 2017.

- The IEA publishes reports such as the World Energy Outlook, World Energy Balances, Energy Technology Perspectives, World Energy Statistics, and Net Zero by 2050.

INTERNATIONAL MIGRATION OUTLOOK 2023 (Down to Earth)

- 25 Oct 2023

What is the News ?

Recently, the Organization for Economic Co-operation and Development (OECD), published the "International Migration Outlook 2023."

Facts About:

- In 2021 and 2022, India had the largest migration flows to nations that are members of the Organization for Economic Co-operation and Development (OECD).

- In terms of citizenship, 0.13 million Indians became citizens of an OECD nation in 2021.

- The ongoing conflict between Russia and Ukraine has caused the greatest level of internal displacement and refugee inflows into the OECD, with over 10 million people becoming internally displaced or refugees.

- In terms of workers, migration flows from India (+172 percent), Uzbekistan (+122 percent), and Turkey (+240 percent) increased dramatically, making them the primary countries of origin after Ukraine.

About the Organization for Economic Co-operation and Development (OECD):

- The OECD is an international group of 38 countries that aims to foster economic development, and cooperation, and combat poverty by promoting economic stability.

- It was founded in 1961, by 18 European nations, the United States, and Canada.

Its headquarters are in Paris, France.

- Primary Goal: The primary goal of the OECD is to create policies that promote prosperity, equality, opportunity, and well-being for everyone.

- They produce economic reports, data, and predictions about global economic growth.

- The OECD also works to combat bribery and financial crimes worldwide, maintaining a list of uncooperative tax havens.

- India is not a member of the OECD, but a key economic partner.