GST 2.0

- 23 Sep 2025

In News:

The Government of India launched GST 2.0, marking a significant revamp of the Goods and Services Tax framework. Prime Minister Narendra Modi described the initiative as the “GST Bachat Utsav”, highlighting its focus on savings, simplicity, and growth.

Overview

- GST 2.0 represents the most comprehensive reform since the introduction of the Goods and Services Tax in 2017.

- It focuses on rationalising tax rates, reducing compliance burden, and boosting consumption and investment by lowering tax rates on more than 375 items.

Objectives

- Enhance household savings: By cutting rates on essential goods and services, it seeks to leave more disposable income with consumers, thereby stimulating demand.

- Simplify the tax framework: Aligns similar goods under the same slab to minimise disputes and litigation.

- Promote ease of doing business: Reduces procedural complexities and enhances transparency through digital solutions.

Key Features

- Simplified Tax Structure:Moves towards a broad two-slab system—5% (merit rate) and 18% (standard rate)—with a 40% slab for demerit or luxury goods.

- Consumer-Centric Relief:Tax reductions on essential food items, life and health insurance, and beauty and wellness services.

- Technology-Driven Compliance:Introduces digital registration, pre-filled returns, and automated refund systems, including 90% provisional refunds for Integrated Dispute Settlement (IDS) cases.

- Input-Output Correction:Aligns related goods under the same tax bracket to avoid input-output tax mismatches.

- Support for Key Sectors:Rate cuts to encourage investment and growth in textiles, agriculture, construction, and services industries.

Revised Tax Slabs

|

Rate |

Category / Examples |

|

0.25% |

Rough diamonds, precious stones |

|

1.5% |

Cut and polished diamonds |

|

3% |

Precious metals (gold, silver, pearls) |

|

5% |

516 items including food, agricultural machinery, medical devices, hydrogen vehicles, health & life insurance, salons |

|

18% |

640 items including machinery, chemicals, paints, automobile parts, small cars/bikes |

|

40% (Demerit Rate) |

Pan masala, tobacco, aerated beverages, luxury yachts, private aircraft, high-end vehicles |

|

Special Provision |

Bricks remain under dual option — 6% (without ITC) or 12% (with ITC) |

Significance: GST 2.0 is expected to spur demand, enhance compliance, and boost industrial growth, positioning India’s indirect tax system among the most simplified globally.

Eight Years of GST

- 02 Jul 2025

In News:

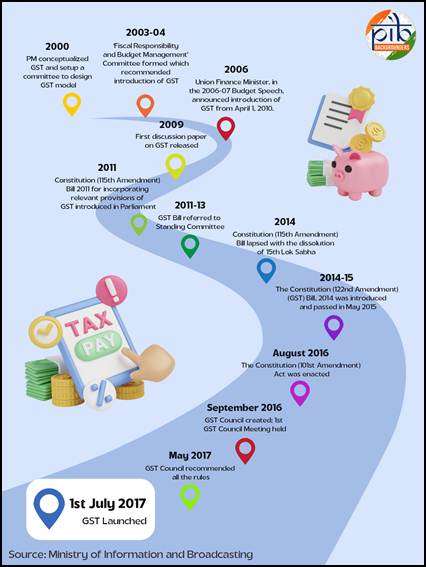

The Goods and Services Tax (GST) was implemented on 1st July 2017, aiming to unify India’s fragmented indirect tax system into a single, nation-wide tax. It replaced multiple central and state levies such as excise duty, service tax, VAT, and others.

By simplifying the tax structure and improving transparency, GST aimed to enhance compliance, remove tax cascading, and create a common national market. As of 1st July 2025, GST has completed eight years.

Key Highlights of 2024–25

- In the financial year 2024–25, GST collections reached an all-time high of ?22.08 lakh crore, representing a growth of 9.4% over the previous year. The average monthly collection was ?1.84 lakh crore. The number of active GST taxpayers crossed 1.51 crore.

- According to the Deloitte GST@8 survey, 85% of respondents across industries reported a positive experience with GST, highlighting improvements in compliance, transparency, and ease of doing business.

Structure of the GST System

Components of GST

GST operates under a dual model:

- Central GST (CGST) and State GST (SGST) for intra-state transactions.

- Integrated GST (IGST) for inter-state transactions and imports.

Rate Structure

The GST Council has approved a multi-tier rate structure:

- Standard slabs of 5%, 12%, 18%, and 28% apply to most goods and services.

- Special lower rates include 0.25% on rough diamonds, 1.5% on cut and polished diamonds, and 3% on gold, silver, and jewellery.

- A Compensation Cess is levied on select goods such as tobacco, aerated drinks, and luxury cars to compensate states for revenue loss during the transition.

Key Features of GST

- Destination-Based Tax: GST is levied at the place of consumption, rather than origin. This ensures equitable revenue distribution and smooth credit flow across the supply chain.

- Input Tax Credit (ITC): Businesses can claim credit for taxes paid on inputs. This eliminates the cascading effect of taxes and reduces overall costs.

- Threshold Exemption: Small businesses with turnover below ?40 lakh for goods and ?20 lakh for services are exempt from GST, reducing the compliance burden on micro-enterprises.

- Composition Scheme: Businesses with turnover up to ?1.5 crore (goods) and ?50 lakh (services) can opt for a simplified tax scheme with fixed rates and minimal paperwork.

- Digital Compliance: All processes—from registration to return filing and payments—are conducted online through the GSTN portal. This digital-first approach enhances transparency and efficiency.

- Sector-Specific Exemptions: Essential sectors such as healthcare and education are either exempt or taxed at concessional rates to ensure affordability.

- Revenue Sharing: GST enables seamless credit transfers and transparent revenue sharing between the Centre and States, strengthening cooperative fiscal federalism.

Impact of GST

On MSMEs

- GST has provided major relief to micro, small, and medium enterprises by raising exemption thresholds and simplifying compliance. The introduction of the composition scheme allows them to pay tax at a flat rate with simplified filing.

- The Trade Receivables Discounting System (TReDS) has also expanded access to credit. As of May 2024, four digital platforms were operational, with over 5,000 buyers and 53 banks and 13 NBFCs registered as financiers.

- Other initiatives include quarterly return filing for businesses with turnover up to ?5 crore and SMS-based NIL return filing, reducing administrative hassle for small taxpayers.

On Consumers

- GST has benefited consumers by lowering tax rates on essential goods such as cereals, edible oils, sugar, and snacks. A study by the Finance Ministry found that GST led to an average household saving of 4% in monthly expenses.

- The expansion of the tax base from 60 lakh registered taxpayers in 2017 to over 1.51 crore in 2025 has enabled the government to rationalize rates further.

On the Logistics Sector

- The removal of inter-state check posts and the introduction of e-way bills have significantly improved logistics efficiency. Transport time has reduced by over 33%, and businesses no longer need to maintain warehouses in every state. This has facilitated the creation of centralized, tech-enabled supply chains.

Revenue Performance Over Time

Since its launch, GST collections have shown consistent growth. In 2020–21, collections stood at ?11.37 lakh crore. They rose to ?14.83 lakh crore in 2021–22, ?18.08 lakh crore in 2022–23, ?20.18 lakh crore in 2023–24, and finally to ?22.08 lakh crore in 2024–25. This reflects improved compliance, economic recovery, and digital enforcement.

GST Council and Its Role

Constitutional Basis: The GST Council was constituted under Article 279A of the Constitution following the passage of the 122nd Constitutional Amendment Act. The Council was formally set up after Presidential assent on 8th September 2016.

Composition: The Council includes:

- Union Finance Minister as Chairperson

- Union Minister of State (Finance/Revenue)

- State Finance Ministers

- Special representation in case of constitutional emergency (Article 356)

Major Decisions: Since its inception, the GST Council has met 55 times and taken several reform-oriented decisions:

- Introduced e-way bills, e-invoicing, and the QRMP scheme

- Reduced GST on under-construction affordable housing from 8% to 1%

- Lowered GST on electric vehicles from 12% to 5%, and exempted large EV buses

- Streamlined compliance through auto-populated returns and QR codes

- Rationalized GST slabs, reducing items in the 28% slab from 227 to 35

- Set up GST Appellate Tribunals with Principal Bench in New Delhi

- Rolled out Aadhaar-based biometric authentication and clarified rules for vouchers

- Recommended full GST exemption on gene therapy and a legal framework for Invoice Management System

Twigstats

- 12 Jan 2025

In News:

The tracing of genetic ancestry remains a challenging task due to the statistical similarity among populations across geographical regions. However, recent advances in genetic analysis, particularly the development of the Twigstats tool, are significantly enhancing our ability to reconstruct genetic histories at a very high resolution.

Key Insights from Genetic Research:

- Ancient DNA (aDNA): Prehistoric human ceremonial burials, mass grave mounds, and war graves are rich sources of ancient genetic material, offering key insights into population dynamics. These samples help us understand past migrations, cultural transitions, and the genetic legacy of ancient groups.

- Challenges in Ancestry Tracing:

- Populations often share many genetic similarities, complicating the task of tracing ancestry across regions.

- Ancient DNA samples are typically of lower quality compared to modern samples, limiting the precision of past genetic studies.

- The movement of genes across time and space, through processes like gene flow, adds complexity to the understanding of population ancestry.

Traditional Genetic Techniques:

- Single Nucleotide Polymorphisms (SNPs): Used to identify natural genetic variations, SNP analysis has been central to reconstructing genetic histories. However, it is limited by its reliance on high-quality samples and struggles with closely related groups.

- Haplotypes and Genealogical Trees: By analyzing shared DNA segments (haplotypes) and rare variants, researchers gain a more comprehensive understanding of population structure and ancestry, which can reveal shifts in population over time.

The Emergence of Twigstats:

- What is Twigstats?

- Twigstats is an advanced analytical tool that enhances the precision of ancestry analysis through time-stratified ancestry analysis, a method that allows for a more fine-grained look at genetic data.

- It is designed to address the limitations of traditional methods by integrating SNPs, haplotypes, and rare genetic variants, providing a more holistic view of ancestry.

- The tool is powered by statistical languages R and C++, which help researchers better manage and analyze complex genetic data.

- How It Works: Twigstats builds family trees by analyzing shared genetic mutations, identifying recent mutations that offer a clearer understanding of historical periods and events. It helps trace the evolution of populations and offers insights into their migrations, mixing, and cultural shifts.

Key Features and Impact of Twigstats:

- Time-Stratified Ancestry Analysis: Allows researchers to study how populations evolved over time, with a focus on specific historical periods.

- Enhanced Precision: Reduces statistical errors and enhances the precision of individual-level ancestry reconstruction.

- Higher-Resolution Mapping: Provides high-resolution genetic maps of migration patterns and admixture events across centuries.

Applications of Twigstats:

- Historical Case Studies: The tool has been used to study ancient genomes from Europe, particularly the Iron, Roman, and Viking Ages (500 BC to 1000 AD). It revealed the fine-scale genetic history of populations in regions like northern and central Europe, including the movement of Germanic and Scandinavian peoples.

- Viking Age Insights: Researchers were able to trace the early presence of Scandinavian-like ancestry in regions such as Britain and the Baltic before the traditionally believed start of the Viking Age. This suggests earlier interactions and migrations from Scandinavia, which aligns with historical records of Anglo-Saxon and Viking movements.

- Cultural Transitions: The analysis identified shifts in population genetics corresponding to cultural changes, such as the shift from the Corded Ware culture to the Bronze Age and the influence of the Wielbark culture.

Genetic Methods Used in the Study:

- Single Nucleotide Polymorphisms (SNPs): Commonly used to trace ancestry but requires high-quality samples.

- Haplotypes and Rare Variants: Offer more nuanced insights into population movements by considering combinations of genetic markers inherited together.

- Genealogical Tree Inference: Applied to both ancient and modern genomes, it provides detailed demographic and ancestry information, supporting the reconstruction of high-resolution genetic histories.

Case Study: India’s Genetic History (2009 Study)

- Researchers used SNP analysis to trace the genetic history of India, revealing two major ancestral groups:

- Ancestral North Indians (ANI): Genetically closer to Central Asian, European, and Middle Eastern populations.

- Ancestral South Indians (ASI): A distinct genetic group, showcasing India’s diverse population structure.

GST COMPENSATION CESS

- 29 Sep 2024

In News:

- GST compensation cess likely to continue beyond January 2026, with potential rebranding and new end-use defined.

- Revenue Collection: Estimated Rs 20,000 crore expected from the cess by February 2026, with recent receipts of Rs 12,068 crore in August 2024.

- Cess Nature: The compensation cess, originally intended for revenue shortfall, cannot merge with the 28% GST slab due to regulatory limitations.

Financial Context

- RBI Study Insights: Weighted average GST rate decreased from 14.4% at launch to 11.6%, now even below 11%, raising concerns among states.

- State Concerns: Many states, including Punjab and Kerala, seek a 2-5 year extension for the compensation period to stabilize finances.

Regulatory Framework

- Cess Legislation: GST Compensation Cess is governed by the Goods and Services Tax (Compensation to States) Act, 2017, initially set for five years.

- Taxpayer Obligations: All suppliers of designated goods/services must collect the cess, except exporters and those under the composition scheme.

Distribution Mechanism

- Calculation of Compensation: Based on projected revenue growth (14%) against actual revenue, with payments distributed bi-monthly.

- Surplus Distribution: Any surplus in the compensation fund post-transition period will be shared between the Centre and states.

Future Considerations

- Ministerial Panel: A panel established by the GST Council will recommend the cess's future and revenue sharing post-compensation.

- Tax Expert Opinions: Some experts argue against pursuing the revenue-neutral rate, suggesting broader tax base expansion instead.

- Revenue Gap Solutions: Options for addressing compensation fund deficits include revising cess formulas, increasing rates, or market borrowing.

Delhi HC Upholds Validity of Anti-profiteering Provision of CGST Act (TOI)

- 30 Jan 2024

Why is it in the News?

Delhi High Court has upheld the constitutional validity of the anti-profiteering clause in the GST law, which mandates companies to pass on the benefit of lower taxes and input tax credits to consumers.

What is an ‘Anti-profiteering’ Activity?

- Any reduction in the rate of GST tax on any supply of goods or services or the benefit of input tax credit should have been passed on to the recipient by way of a commensurate reduction in prices.

- The wilful action of not changing the final price of the good or service by various means, despite the reduction in the rate of the tax for that particular good or service, amounts to “profiteering”.

How is the Anti-profiteering Mechanism Under the CGST Act?

- CGST mandate a 3-tier structure for investigation and adjudication of the complaints regarding profiteering.

- a) National Anti-profiteering

- b) Authority Directorate General of Safeguards

- c) State-level screening committees and standing committee

How Does the Screening Committee and Standing Committee Work?

- GST council may constitute a standing committee, having members from both state and central government.

- Every state shall constitute one state-level screening committee.

- It will have one member from the state government and one member from the central government as nominated by the respective appropriate authority.

- The complaints or issues of local nature will be first examined by the screening committee.

- State-level screening and standing committee will examine the complaint and determine the prime facie evidence to support the validity of the complaint.

- If any committee satisfies that the supplier has contravened section 171 of the CGST Act, the case shall be transferred to DG Safeguards for further investigation.

- The committees shall complete the investigation within a period of a month from the date of the receipt of the application.

What is the Role of DG Safeguards in the Anti-profiteering Mechanism?

- DG safeguards are the main investigation arm in the anti-profiteering mechanism.

- It can summon the interested parties make inquiries or call the relevant documents.

- It can seek help from technical experts in the due course of investigation.

- DG Safeguards shall complete the investigation within a period of three months from the date of receipt of the report from either screening or standing committee.

- The period can be extended for another three months.

Who Can File the Complaint Against Profiteering?

- Any consumer or organisation experiencing a non-reduction in the price of the goods or service despite the reduction in the rate of GST can file a complaint with proper evidence.

- Any supplier, trader, wholesaler or retailer, who could not get the benefit of input tax credit on account of a reduction in the rate of GST, can also file the complaint with proper evidence.

Reliance General gets ?923cr GST notices from the Directorate General of GST Intelligence (DGGI) (TOI)

- 09 Oct 2023

Why in the News?

Reliance General Insurance Company (RGIC), a subsidiary of the Anil Ambani-led Reliance Capital, has received multiple show-cause notices worth Rs 922.58 crore from the Directorate General of GST Intelligence (DGGI).

About Directorate General of GST Intelligence (DGGI):

- Formerly known as the Directorate General of Central Excise Intelligence (DGCEI), the Directorate General of GST Intelligence (DGGI) stands as a premier intelligence organization operating under the Central Board of Indirect Taxes & Customs, within the Department of Revenue, Ministry of Finance.

- Its primary focus is on collecting, collating, and disseminating intelligence pertaining to Goods and Services Tax (GST) evasion and duties related to Central Excise and Service Tax on a pan-India basis.

- Evolution: Originally designated as the Directorate General of Anti-Evasion (DGAE), it was established in 1979 as an independent wing under the Directorate of Revenue Intelligence, New Delhi.

- Became a full-fledged Directorate in 1983, headed by a Director.

- In 1988, attained the status of Directorate General under a Director General.

- Currently comprises 04 offices of the Director General (East, West, North, and South), 26 Zonal Units, and 40 Regional Units.

Key Responsibilities:

- Intelligence Gathering: Collects information from various sources, including GST returns, financial statements, and other documents, to identify potential GST law violations.

- Investigation: Empowered to conduct investigations into suspected cases of GST evasion or non-compliance, involving summoning individuals, examining records, and executing searches and seizures.

- Enforcement: Enforces provisions of the GST law, taking legal action against offenders, imposing penalties, and recovering taxes or duties owed.

- Additional Functions: Collaborates with agencies like the Central Board of Indirect Taxes and Customs (CBIC) and State GST authorities for effective GST law implementation.

- Plays a crucial role in raising awareness about GST compliance and educating taxpayers on their legal obligations.

- Provides technical and legal assistance to field officers and other government entities involved in GST administration.

GST Amnesty Scheme (TOI)

- 06 Nov 2023

Why in the News?

The finance ministry has come out with an amnesty scheme for filing appeals against Goods and Services Tax (GST) demand orders.

What is the GST Amnesty scheme?

- The GST Amnesty scheme was introduced by the Centre to help businesses comply with the Goods and Services Tax laws in the country.

- Every entity that needs to file its GST returns must conduct the process in a sequential manner.

- If the taxpayer misses the last date, they may have to pay penalties for not filing the returns.

- In such a situation, the GST Amnesty scheme helps taxpayers file their returns without hefty penalties.

- The plan also aids businesses whose registration stands canceled for non-filing of returns.

- Under the GST Amnesty scheme, taxpayers can file for the revocation of their cancellation as well.

How can one benefit from the GST Amnesty scheme?

- Taxpayers cannot file the GST return for a particular period without submitting the previous ones.

- A heavy penalty will also be levied on them for missing their filings.

- The GST Amnesty scheme allows taxpayers to file their pending returns without incurring a hefty fine.

- It will help them in complying with the indirect taxation laws of the country.

- It also aids business entities to appeal against the cancellation of their registration if they have not submitted the GST returns for three consecutive quarters.

- The scheme will be open till January 31, 2024.