Financialisation

- 01 Feb 2025

In News:

The Economic Survey 2024–25 cautions against the risks of excessive financialisation in India, emphasizing that while finance is a crucial enabler of economic growth, unchecked expansion of the financial sector can pose systemic risks, increase inequality, and divert resources from the real economy.

What is Financialisation?

Financialisation refers to the growing dominance of financial markets, institutions, and motives in shaping economic policies, business decisions, and resource allocation. It involves:

- A shift from productive (real sector) activities like manufacturing to financial activities, including trading, speculation, and asset management.

- Increasing reliance on asset price growth (e.g., stocks, real estate) to stimulate the economy.

- Deep influence of financial motives in corporate governance, economic policies, and household behavior.

Key Drivers of Financialisation in India

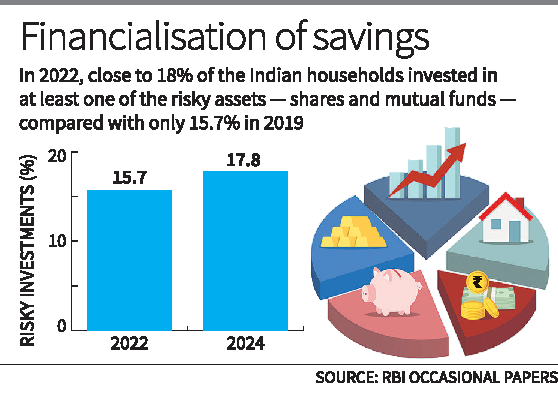

- Increased household savings funneled into stock markets.

- Growing retail investor participation in equities and mutual funds.

- Policy and regulation increasingly influenced by financial market considerations.

- Rising public and private sector debt to leverage economic growth.

Risks Highlighted by the Economic Survey

- Real Sector Crowding Out: Over-expansion of the financial sector may compete with the real economy for scarce resources like skilled labour and capital, potentially depriving productive sectors.

- Unsustainable Booms: Rapid financial growth often favours high-collateral, low-productivity investments (e.g., construction) over innovation and manufacturing, creating unsustainable financial booms.

- Complex Financial Products: Proliferation of opaque and complex financial instruments can increase consumer risk exposure and the probability of a financial crisis, as seen during the 2008 global financial meltdown.

- Increased Inequality: Financialisation tends to transfer income from the real sector to the financial sector, worsening income inequality and contributing to wage stagnation.

- Debt Dependency: Over-reliance on financial leverage (debt) increases macro-financial vulnerabilities, especially if credit growth outpaces productive investment.

Global Lessons and Historical Context

- 2008 Global Financial Crisis: Reckless lending and financial engineering, including mortgage-backed securities, led to a global economic collapse. India was impacted indirectly, prompting RBI intervention to stabilise the economy.

- Examples from Ireland & Thailand: Rapid growth of private credit in these countries led to reduced productivity and economic distortions, serving as cautionary tales.

Balanced View on Finance

The Survey recognizes that a well-regulated financial system plays a vital role in:

- Channeling capital to innovative and high-risk ventures.

- Reducing transaction costs and improving price discovery.

- Alleviating poverty and inequality by enabling shock absorption for households and firms.

- Smoothing consumption across economic cycles.

However, the Survey emphasizes that there is a tipping point beyond which financial development becomes counterproductive.