Digital Public Infrastructure for Fraud Risk Management

- 29 Jun 2025

In News:

The Reserve Bank of India (RBI) is set to develop a Digital Public Infrastructure for Fraud Risk Management (DPIP) under its supervision to curb rising instances of banking frauds in India. This aligns with broader efforts to enhance security and transparency in India’s financial ecosystem.

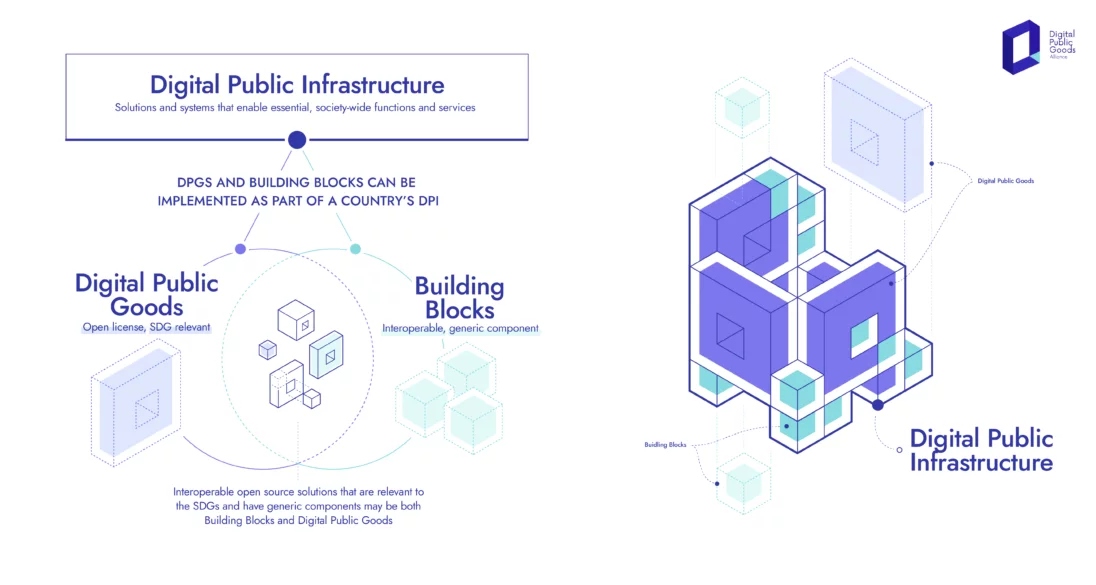

What is Digital Public Infrastructure (DPI)?

- Definition: DPI refers to foundational digital systems that are accessible, secure, interoperable, and designed to deliver essential public services.

- Examples in India:

- Aadhaar (Digital ID)

- Unified Payments Interface (UPI)

- DigiLocker, CoWIN, etc.

About DPIP

- Objective:To enhance fraud risk management through real-time intelligence sharing, data gathering, and interbank coordination using advanced technologies.

- Key Features:

- Will strengthen existing fraud detection systems in the banking ecosystem.

- Enables interoperable intelligence sharing between banks and financial institutions.

- Leverages AI/ML tools and data analytics for better predictive fraud detection.

- Institutional Mechanism:

- A committee under Shri A.P. Hota has been constituted to examine various aspects of DPIP’s implementation.

- RBI Innovation Hub (RBIH) is tasked with developing a prototype, in consultation with 5–10 public and private sector banks.

Need for DPIP

- Rise in Bank Frauds:

- As per RBI’s Annual Report:

- FY 2024: ?12,230 crore in frauds

- FY 2025: ?36,014 crore — almost 3x increase

- Increasing sophistication of cyber threats and fraud techniques necessitates robust preventive digital infrastructure.

- As per RBI’s Annual Report:

Other RBI Initiatives to Combat Bank Frauds

Initiative Description

Multi-Factor Authentication (MFA) Mandatory for all digital/electronic payments to ensure

secure transactions.

Zero Liability Framework Customers are not liable for losses arising from bank’s

negligence or third-party breaches.

bank.in and fin.in domains Reserved for verified bank websites to help customers

avoid phishing and fake sites.

Good Digital Public Infrastructure

- 08 Sep 2024

Good digital public infrastructure (DPI) integrates technology with societal needs, ensuring that it is secure, scalable, and inclusive.

India’s achievement of over 80% financial inclusion in just six years has drawn international praise, particularly as a model for the Global South. This accomplishment underscores India’s success in achieving both digital and financial inclusion for over a billion people. Consequently, the G20 summit in New Delhi in 2023 highlighted the critical role of digital public infrastructure.

In response, India’s G20 task force has released a comprehensive report outlining a global strategy for DPI development. This positions India to support other nations in achieving digital sovereignty, financial inclusion, and self-reliance.

The evolving digital landscape is marked by a variety of stakeholders—including private enterprises, government bodies, non-profits, and think tanks—each working to advance their DPI solutions. This raises two key questions: How can we identify genuine and reliable DPIs from the plethora available? And what differentiates a “good DPI” from a “bad DPI”?

Identifying effective DPI involves assessing how well technology meets societal needs while ensuring security, scalability, and inclusivity. Authenticity and adherence to core principles are essential for evaluating DPIs.

The Citizen Stack Model

Citizen Stack, built upon the proven success of India Stack, emerges as a trusted ecosystem in digital infrastructure. India Stack, a robust digital platform, has demonstrated its effectiveness and security on a vast scale, serving over a billion citizens. This strong foundation enhances Citizen Stack’s credibility and reliability. Unlike DPI manufacturers, Citizen Stack functions as a regulatory body or auditor, certifying and authenticating DPIs to ensure they meet high standards of quality and security.

Citizen Stack’s approach is comprehensive, focusing on security, scalability, and inclusivity. The DPI platforms approved by Citizen Stack are designed to meet the diverse needs of large populations while maintaining stringent security measures to protect user data and privacy. As an auditor, Citizen Stack ensures that certified DPIs are dependable, secure, and beneficial to the public.

In an era of abundant digital solutions and promises, distinguishing genuinely reliable platforms is essential. Citizen Stack offers assurance as a gold standard for DPI solutions.

Guiding Principles of a “Good DPI”

Citizen Stack has established five core principles—referred to as sutras—that define a good DPI:

- Maintain Citizen Relationships: Ensure that digital infrastructure supports a fair relationship between citizens, the market, and the state, free from undue influence.

- Protect Empowerment and Privacy: Implement consent-based data sharing systems that prioritize individual empowerment and privacy.

- Prevent Monopolistic Lock-In: Ensure interoperability to avoid citizens being restricted by monopolistic entities.

- Combine Techno-Legal Regulation: Integrate technology with legal frameworks to govern ethical tech use, ensuring innovation while safeguarding security and societal rights.

- Foster Public-Private Innovation: Encourage collaboration between public and private sectors, while avoiding corporate dominance. The focus should be on public good rather than corporate monopolies, and technology should prevent exploitation by state or corporate actors.