India Emerges as Global Leader in Real-Time Digital Payments

- 21 Jul 2025

In News:

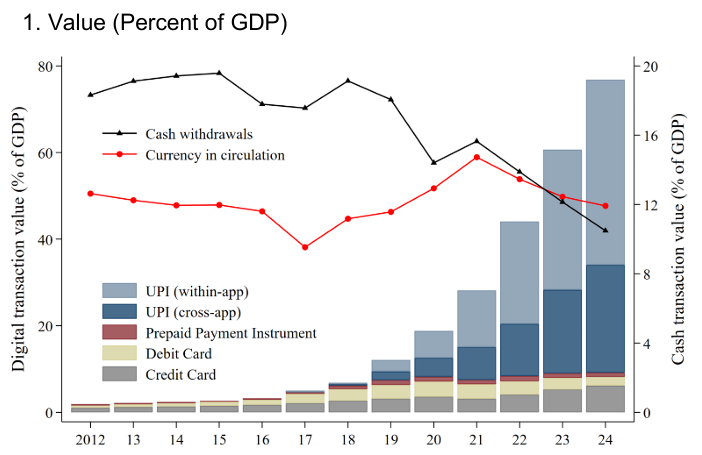

India has cemented its position as the world’s foremost digital payments economy, with the Unified Payments Interface (UPI) registering 18.39 billion transactions in June 2025, according to a report jointly prepared by the International Monetary Fund (IMF) and FIS Global.

About the Report: Fast Payments 2025

- Prepared by: IMF and FIS Global

- Focus: Assessment of digital public infrastructure enabling real-time payments

- Key Metric Introduced: Faster Payment Adoption Score (FPAS) – a benchmark for evaluating the scale and effectiveness of fast payment systems across 30 countries

India’s Standout Performance

- Top Global Rank: India scored 87.5% on FPAS, ranking highest globally—outpacing Brazil, Singapore, the United Kingdom, and the United States.

- UPI Ecosystem Scale:

- Handles over 640 million daily transactions

- Caters to approximately 491 million users and 65 million merchants

- Supported by a network of 675+ banks

- Speed and Cost Efficiency:

- Payment settlement within 5 seconds

- Transactions are virtually cost-free for users

- International Footprint:

- UPI services are now live in seven countries, including France, UAE, and Singapore

- India is advocating its adoption within the BRICS+ grouping as a model for cross-border payment interoperability

Key Strengths of UPI Infrastructure

- Interoperability: Seamless transactions across multiple platforms (PhonePe, Google Pay, Paytm, etc.) and banks

- Inclusivity Features:

- Aadhaar-based linking

- USSD-based services for feature phones

- Multilingual interfaces to facilitate rural access

- Built on India Stack: Utilizes digital infrastructure components like Aadhaar, eKYC, DigiLocker, and Account Aggregator

- Security Framework:

- Real-time fraud detection

- Tokenization and robust regulatory oversight

- Collaborative Ecosystem: A joint effort of NPCI, fintech players, and RBI, ensuring scalability and resilience