Eight Years of GST

- 02 Jul 2025

In News:

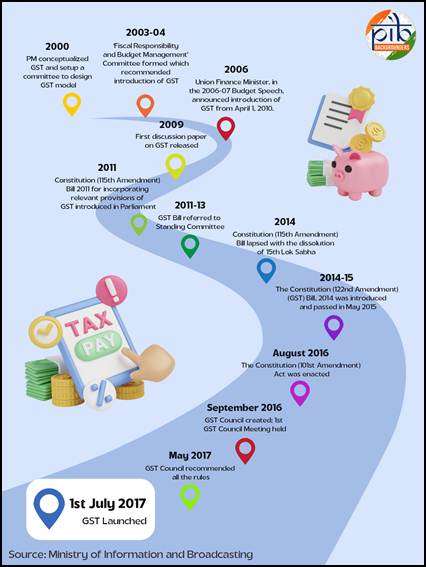

The Goods and Services Tax (GST) was implemented on 1st July 2017, aiming to unify India’s fragmented indirect tax system into a single, nation-wide tax. It replaced multiple central and state levies such as excise duty, service tax, VAT, and others.

By simplifying the tax structure and improving transparency, GST aimed to enhance compliance, remove tax cascading, and create a common national market. As of 1st July 2025, GST has completed eight years.

Key Highlights of 2024–25

- In the financial year 2024–25, GST collections reached an all-time high of ?22.08 lakh crore, representing a growth of 9.4% over the previous year. The average monthly collection was ?1.84 lakh crore. The number of active GST taxpayers crossed 1.51 crore.

- According to the Deloitte GST@8 survey, 85% of respondents across industries reported a positive experience with GST, highlighting improvements in compliance, transparency, and ease of doing business.

Structure of the GST System

Components of GST

GST operates under a dual model:

- Central GST (CGST) and State GST (SGST) for intra-state transactions.

- Integrated GST (IGST) for inter-state transactions and imports.

Rate Structure

The GST Council has approved a multi-tier rate structure:

- Standard slabs of 5%, 12%, 18%, and 28% apply to most goods and services.

- Special lower rates include 0.25% on rough diamonds, 1.5% on cut and polished diamonds, and 3% on gold, silver, and jewellery.

- A Compensation Cess is levied on select goods such as tobacco, aerated drinks, and luxury cars to compensate states for revenue loss during the transition.

Key Features of GST

- Destination-Based Tax: GST is levied at the place of consumption, rather than origin. This ensures equitable revenue distribution and smooth credit flow across the supply chain.

- Input Tax Credit (ITC): Businesses can claim credit for taxes paid on inputs. This eliminates the cascading effect of taxes and reduces overall costs.

- Threshold Exemption: Small businesses with turnover below ?40 lakh for goods and ?20 lakh for services are exempt from GST, reducing the compliance burden on micro-enterprises.

- Composition Scheme: Businesses with turnover up to ?1.5 crore (goods) and ?50 lakh (services) can opt for a simplified tax scheme with fixed rates and minimal paperwork.

- Digital Compliance: All processes—from registration to return filing and payments—are conducted online through the GSTN portal. This digital-first approach enhances transparency and efficiency.

- Sector-Specific Exemptions: Essential sectors such as healthcare and education are either exempt or taxed at concessional rates to ensure affordability.

- Revenue Sharing: GST enables seamless credit transfers and transparent revenue sharing between the Centre and States, strengthening cooperative fiscal federalism.

Impact of GST

On MSMEs

- GST has provided major relief to micro, small, and medium enterprises by raising exemption thresholds and simplifying compliance. The introduction of the composition scheme allows them to pay tax at a flat rate with simplified filing.

- The Trade Receivables Discounting System (TReDS) has also expanded access to credit. As of May 2024, four digital platforms were operational, with over 5,000 buyers and 53 banks and 13 NBFCs registered as financiers.

- Other initiatives include quarterly return filing for businesses with turnover up to ?5 crore and SMS-based NIL return filing, reducing administrative hassle for small taxpayers.

On Consumers

- GST has benefited consumers by lowering tax rates on essential goods such as cereals, edible oils, sugar, and snacks. A study by the Finance Ministry found that GST led to an average household saving of 4% in monthly expenses.

- The expansion of the tax base from 60 lakh registered taxpayers in 2017 to over 1.51 crore in 2025 has enabled the government to rationalize rates further.

On the Logistics Sector

- The removal of inter-state check posts and the introduction of e-way bills have significantly improved logistics efficiency. Transport time has reduced by over 33%, and businesses no longer need to maintain warehouses in every state. This has facilitated the creation of centralized, tech-enabled supply chains.

Revenue Performance Over Time

Since its launch, GST collections have shown consistent growth. In 2020–21, collections stood at ?11.37 lakh crore. They rose to ?14.83 lakh crore in 2021–22, ?18.08 lakh crore in 2022–23, ?20.18 lakh crore in 2023–24, and finally to ?22.08 lakh crore in 2024–25. This reflects improved compliance, economic recovery, and digital enforcement.

GST Council and Its Role

Constitutional Basis: The GST Council was constituted under Article 279A of the Constitution following the passage of the 122nd Constitutional Amendment Act. The Council was formally set up after Presidential assent on 8th September 2016.

Composition: The Council includes:

- Union Finance Minister as Chairperson

- Union Minister of State (Finance/Revenue)

- State Finance Ministers

- Special representation in case of constitutional emergency (Article 356)

Major Decisions: Since its inception, the GST Council has met 55 times and taken several reform-oriented decisions:

- Introduced e-way bills, e-invoicing, and the QRMP scheme

- Reduced GST on under-construction affordable housing from 8% to 1%

- Lowered GST on electric vehicles from 12% to 5%, and exempted large EV buses

- Streamlined compliance through auto-populated returns and QR codes

- Rationalized GST slabs, reducing items in the 28% slab from 227 to 35

- Set up GST Appellate Tribunals with Principal Bench in New Delhi

- Rolled out Aadhaar-based biometric authentication and clarified rules for vouchers

- Recommended full GST exemption on gene therapy and a legal framework for Invoice Management System