Annual Survey of Services Sector Enterprises (ASSSE)

- 05 May 2025

In News:

The Ministry of Statistics and Programme Implementation (MoSPI) recently released findings from a pilot study on the Annual Survey of Services Sector Enterprises (ASSSE). This initiative aims to fill a crucial data gap regarding India’s incorporated service sector, which is not currently covered by regular surveys like the Annual Survey of Unincorporated Sector Enterprises (ASUSE).

Significance of the Services Sector

- Contribution to Economy: The services sector contributed ~55% of India's Gross Value Added (GVA) in FY 2024–25, up from 50.6% in FY14.

- Employment: It employs around 30% of India’s workforce, spanning industries like IT, finance, education, tourism, and healthcare.

- Trade: India’s services exports stood at USD 280.94 billion (April–Dec 2024). In ICT services, India is the 2nd-largest global exporter, accounting for 10.2% of global exports.

- FDI Magnet: The sector attracted USD 116.72 billion in FDI (April 2000–Dec 2024)—about 16% of total FDI inflows.

- Support to Digital India & Urbanization: The sector underpins the Digital India initiative and Smart Cities Mission by enabling digital payments, urban mobility, e-governance, and waste management.

About the ASSSE Pilot Study

Purpose & Objectives

- To test the suitability of the GSTN (Goods and Services Tax Network) database as a sampling frame.

- To develop robust survey instruments and methodology for a full-scale annual survey starting January 2026.

- To gather data on economic characteristics, employment, and financial indicators from incorporated enterprises under:

- Companies Act, 1956/2013

- Limited Liability Partnership (LLP) Act, 2008

Survey Coverage

- Conducted in two phases:

- Phase I (May–Aug 2024): Verified enterprise data for 10,005 units.

- Phase II (Nov 2024–Jan 2025): Collected detailed data from 5,020 enterprises under the Collection of Statistics Act, 2008.

- Data collected for FY 2022–23 using CAPI (Computer-Assisted Personal Interviewing).

Key Findings:

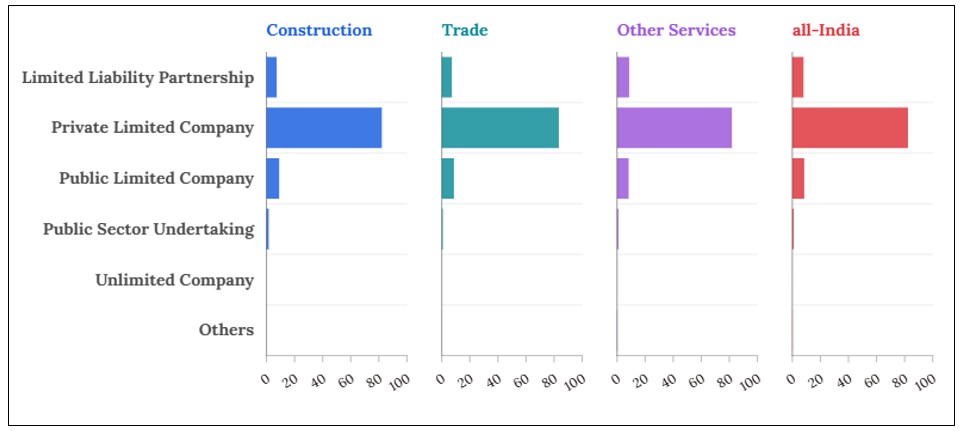

Enterprise Type Distribution

- Private Limited Companies: 82.4%

- Public Limited Companies and LLPs: ~8% each

Size-Class Analysis (FY 2022–23)

Output Class (?) % Share of Gross Value Added (GVA) % Share of Fixed Assets % Share of Employment

< 10 crore 1.19% 2.64% 9.28%

10–100 crore 9.45% 9.58% 20.03%

100–500 crore 19.90% 25.00% 33.73%

> 500 crore 69.47% 62.77% 36.96%

- Large enterprises (output > ?500 crore) dominate in assets, value addition, and compensation paid, but smaller units employ over 63% of the total workforce in the sample.

Additional Establishments

- 28.5% of enterprises reported having additional business locations within the state.

- Highest in the Trade sector (41.8%).

Insights and Challenges from the Pilot

- Suitability of GSTN as Sampling Frame: Confirmed.

- Challenges Faced:

- Data retrieval from enterprises with headquarters in other states.

- Centralized data (CIN-based) posed difficulty in disaggregating state-level data.

- Positive Outcomes:

- High response rate and cooperation.

- Survey instruments found largely clear and functional.

Challenges Faced by the Services Sector

- Skill Gaps:

- Only 51.25% of youth are employable (Economic Survey 2023–24).

- Merely 5% of workforce is formally skilled (WEF).

- Informality:

- About 78% of service jobs were informal in 2017–18.

- Gig workers lack social protection.

- Global Competition:

- Visa restrictions (e.g., H-1B in the US).

- Competing hubs: Philippines, Vietnam.

- Rising IT wage costs in India.

- Infrastructure Deficiencies:

- Inadequate AI/ML adoption.

- Digital divide persists in rural and marginalized MSMEs.

- Post-COVID Recovery:

- Inbound tourism yet to reach pre-pandemic levels (90% of 2019 arrivals in H1 2024).

Way Forward

- Upskilling Initiatives:

- Expand Skill India Digital and PMKVY 4.0.

- Promote Prime Minister Internship Scheme (PMIS) for bridging academia-industry gap.

- Boosting Global Competitiveness:

- Negotiate FTAs with EU, UK, Australia.

- Expand Global Capability Centres (GCCs).

- Digital Infrastructure & Security:

- Strengthen cybersecurity frameworks and promote secure cloud adoption.

- Improve digital literacy, especially in financial services.

- Decentralized Growth:As per NITI Aayog, promote services sector in Tier-2 and Tier-3 cities with better infrastructure and connectivity.