‘Samarth’ Incubation Program

- 19 Jun 2025

In News:

The Centre for Development of Telematics (C-DOT), an autonomous R&D institution under the Department of Telecommunications (DoT), Government of India, has launched ‘Samarth’, a cutting-edge incubation program for startups in the Telecom and ICT sectors. In June 2025, C-DOT formally initiated Cohort-I of the program, selecting 18 startups through a competitive national process.

About the Samarth Program

- Objective: To nurture sustainable and scalable startups from ideation to commercialization in high-tech domains.

- Focus Areas:

- Telecom applications

- Cybersecurity

- 5G/6G technologies

- Artificial Intelligence (AI)

- Internet of Things (IoT)

- Quantum technologies

Key Features

Feature Details

Financial Support Grant of up to ?5 lakh per startup

Infrastructure Fully furnished office space at C-DOT campuses in Delhi and Bengaluru for 6 months

Technical Access Use of C-DOT’s lab facilities

Mentorship Guidance from C-DOT technologists and external domain experts

Format Hybrid (online + physical) delivery

Program Structure Two cohorts per year, each supporting up to 18 startups (max 36 annually)

Further Opportunities Eligible for extended collaboration and funding under C-DOT Collaborative Research Program (CCRP)

Implementation and Partnerships

- Implementation Partners:

- Software Technology Parks of India (STPI)

- TiE (The Indus Entrepreneurs) – Delhi NCR Chapter

- Evaluation Criteria: Startups were selected based on innovation, team strength, execution capability, problem-solution relevance, and commercialization potential.

- A distinguished Selection Committee from academia, industry, and government oversaw the evaluation.

Significance

- Boosts indigenous R&D in critical emerging tech sectors aligned with national priorities.

- Supports Atmanirbhar Bharat by encouraging homegrown innovation.

- Builds a robust startup ecosystem in the strategic telecom and ICT domains.

- Encourages public-private partnerships and collaboration between startups and research institutions.

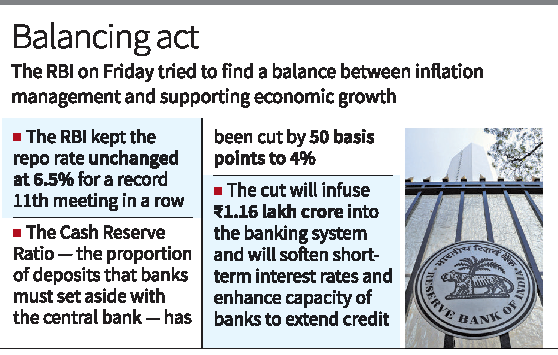

RBI Infuses Rs.23,856 Crore into Banking System via Government Securities Buyback

- 14 Jun 2025

In News:

In a significant move to bolster liquidity in the financial system, the Reserve Bank of India (RBI) has infused ?23,856 crore into the banking system through a buyback of government securities (G-Secs) on June 5, 2025. This marks the second such bond buyback by the central bank in the current financial year (FY 2025–26).

What is a Bond Buyback?

A bond buyback refers to the RBI repurchasing existing government securities before their maturity. Conducted on behalf of the central government, such operations aim to inject durable liquidity into the banking system, improve the liquidity position of banks, and influence interest rates. It is part of the RBI's broader Open Market Operations (OMOs) toolkit.

Broader Liquidity Context

The RBI’s intervention is part of a broader liquidity management strategy, aimed at ensuring stable and surplus liquidity conditions. The central bank has employed various tools in recent months:

- Open Market Operations (OMOs)

- USD/INR Buy/Sell swap auctions

- Variable Rate Repo (VRR) auctions

These tools were especially crucial after the banking system faced a liquidity deficit in late 2024. Since then, the RBI’s operations have restored liquidity, with the system now in surplus mode—estimated at around ?3 lakh crore.

Significance

- Monetary Stability: Enhances the transmission of monetary policy by ensuring banks have sufficient funds to lend.

- Market Functioning: Eases pressure in the bond markets, improves demand for new issuances, and helps manage interest rates.

- Fiscal Management: Supports the government's borrowing program by managing the maturity profile of debt and yields.

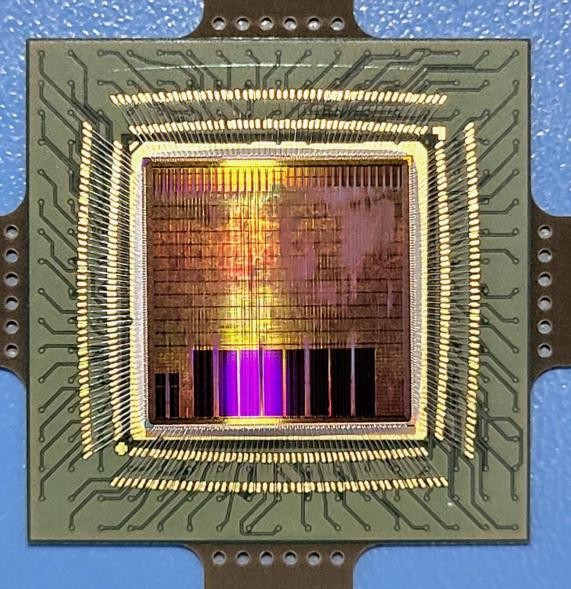

SEZ Reforms to Promote Semiconductor & Electronics Manufacturing

- 11 Jun 2025

In News:

Recently, the Department of Commerce notified key amendments to the SEZ Rules, 2006, to boost semiconductor and electronics component manufacturing. These reforms address the high capital intensity and import dependency of the sector and aim to attract pioneering investments.

Key Rule Amendments:

Rule 5: Minimum Land Requirement Relaxed

- What Changed: Minimum land required for SEZs dedicated to semiconductor/electronics manufacturing reduced from 50 hectares to 10 hectares.

- Why it matters

- Eases land acquisition

- Makes SEZs more feasible, especially in smaller industrial clusters

- Encourages pioneering investments in land-scarce regions

Rule 7: Encumbrance-Free Land Norm Relaxed

- What Changed: SEZ land no longer required to be entirely encumbrance-free, if it is mortgaged/leased to the Central or State Government or authorized agencies.

- Why it matters

- Removes a major legal hurdle in land approvals

- Accelerates SEZ project clearance and development timelines

Rule 18: Domestic Supply Allowed from SEZ Units

- What Changed: Semiconductor/electronics SEZ units can now sell products in the Domestic Tariff Area (DTA) after paying applicable duties.

- Why it matters

- Greater market access

- Enhances revenue and profitability

- Breaks away from traditional export-only SEZ model

Rule 53: Clarity on Free-of-Cost Goods in NFE Calculation

- What Changed: Free-of-cost goods received or supplied will now be included in Net Foreign Exchange (NFE) calculations, using customs valuation rules.

- Why it matters

- Encourages R&D and contract manufacturing

- Promotes transparent reporting of value addition

- Aligns with global manufacturing practices

Significance of Reforms:

- Tailored for High-Tech Sectors: Recognises the long gestation and capital-intensive nature of semiconductor and electronic component industries.

- Encourages Domestic and Global Investment: Makes India an attractive destination for global electronics giants.

- Enables Domestic Market Integration: By allowing DTA sales, it expands market access for SEZ-based units.

- Supports India's Semiconductor Mission: Complements existing initiatives like the Semicon India Programme.

National Investment and Infrastructure Fund (NIIF)

- 11 Jun 2025

In News:

Union Finance Minister chaired the 6th Governing Council (GC) meeting of NIIF in New Delhi. The Council urged NIIF to enhance its global presence, diversify funding sources, and attract international investors by leveraging its sovereign-backed model.

About National Investment and Infrastructure Fund

- A government-anchored investment platform to mobilize long-term institutional capital for infrastructure and strategic sectors.

- Operates as a sovereign wealth fund (SWF)-linked asset manager with independent governance.

- Established: 2015 (Union Budget 2015–16)

- Headquarters: Mumbai

- Nodal Ministry: Ministry of Finance (Department of Economic Affairs)

Functions & Objectives:

- Capital Mobilization: Attract domestic & global institutional investors.

- Investment Management: Deploy equity in commercially viable infrastructure.

- Strategic Partnerships: Collaborate with global sovereign wealth & pension funds.

- Policy Alignment: Support national initiatives like Make in India, green energy, and digital infrastructure.

Key Features:

- Public-Private Structure:

- 49% Government of India

- 51% Global and domestic institutional investors (e.g., ADIA, Temasek, CPPIB)

- SEBI-Registered AIF: Category II Alternative Investment Fund (AIF)

- Assets Under Management (AUM): ?30,000+ crore

- Capital Catalysed: ?1.17 lakh crore

- CEO & MD: Sanjiv Aggarwal (since Feb 2024)

Funds under NIIF:

- Master Fund: Core infrastructure (ports, airports, data centres, logistics)

- Private Markets Fund (PMF): Fund of funds model

- India-Japan Fund: Focused on climate action and sustainability

- Strategic Opportunities Fund: Growth equity in strategic sectors

Governing Council (GC) of NIIF:

- Chair: Union Finance Minister (currently Nirmala Sitharaman)

- Members include Finance Secretary, DEA/DFS officials, SBI Chairman, private sector leaders.

- Provides strategic guidance on:

- Fundraising

- Global positioning

- Operationalisation of new funds

- Annual review of performance

Key Outcomes of the 6th GC Meeting (2024–25):

- Proactive Global Outreach: GC urged NIIF to enhance its global presence and professionalise international engagement.

- Diversified Fundraising: Encouraged exploring multiple funding sources beyond traditional sovereign investors.

- Private Markets Fund II (PMF II): Target corpus: $1 billion; first closing imminent.

- Bilateral Fund with the USA: Under discussion to foster cross-border infrastructure investments.

- Greenfield Investment Success: Master Fund investments directed toward ports, logistics, airports, data centres.

- Strong Global Partnerships: Includes ADIA, Temasek, Ontario Teachers', CPPIB, AIIB, ADB, JBIC, and NDB.

- Annual Meetings: GC to convene once every year to review and guide NIIF’s evolving role.

RBI Revises LTV Ratio for Gold-Backed Loans

- 09 Jun 2025

In News:

- The Reserve Bank of India (RBI) has announced revised guidelines to enhance formal sector lending and ease credit access for small-ticket gold loan borrowers, especially in rural and semi-urban areas.

- The new norms focus on raising the Loan-to-Value (LTV) ratio for gold-backed loans up to ?5 lakh and simplifying appraisal norms for such loans.

What is the Loan-to-Value (LTV) Ratio?

- Definition: The LTV ratio is the percentage of a collateral’s value that a lender offers as a loan.

- Formula:

LTV Ratio= (Loan Amount / Appraised Value of Asset) × 100

- A higher LTV indicates greater credit against the same asset but also entails higher risk for the lender.

- Assets like gold, with a stable value and liquid secondary market, are more "desirable" as collateral, often attracting higher LTVs.

Revised RBI Guidelines (June 2025): LTV Ratio for Gold Loans

Loan Amount Revised LTV Ratio Previous LTV (Draft April 2025)

Up to ?2.5 lakh 85% 75%

?2.5 lakh – ?5 lakh 80% 75%

Above ?5 lakh 75% 75%

- The interest component is included in the LTV calculation.

- The move reverses the uniform 75% LTV cap proposed in the April 2025 draft norms.

Additional Key Features

- No credit appraisal required for loans up to ?2.5 lakh.

- End-use monitoring is necessary only if the borrower wishes to qualify the loan under priority sector lending.

- The average ticket size of gold loans (~?1.2 lakh) is expected to increase due to relaxed norms.

- These loans are crucial for middle-class, lower middle-class, self-employed, and small businesses, often lacking formal income proof.

Rationale and Impact

- The revised norms aim to:

- Enhance credit accessibility.

- Prevent migration of borrowers to informal lenders.

- Boost financial inclusion and formalize rural credit ecosystems.

- Industry experts and NBFCs like Muthoot FinCorp and Shriram Finance have welcomed the move, noting it would benefit women, rural borrowers, and small traders.

- Shares of leading gold loan NBFCs like Muthoot Finance, Manappuram Finance, and IIFL Finance witnessed a sharp increase following the announcement.

India’s Automotive Industry and Global Value Chains

- 14 Apr 2025

In News:

NITI Aayog has recently released a comprehensive report titled “Automotive Industry: Powering India’s Participation in Global Value Chains”. It offers a roadmap to boost India’s role in the global automotive sector by enhancing competitiveness, production capacity, and export potential.

India’s Current Position

India is the world’s fourth-largest automobile producer, with nearly 6 million vehicles manufactured annually. However, its share in the global automotive component trade remains modest at 3%, primarily due to limited penetration in high-precision segments like engine components and drive transmission systems. The country exports auto components worth $20 billion, with major strengths in small cars and utility vehicles.

Global Landscape and Emerging Trends

Globally, 94 million vehicles were produced in 2023, with the automotive components market valued at $2 trillion, of which $700 billion was exported. The industry is witnessing rapid transformation through:

- Electric Vehicles (EVs): Rising demand, regulatory shifts, and battery innovations are reshaping manufacturing.

- Battery Ecosystems: Hubs in Europe and the US are altering global supply chains, focusing on lithium and cobalt.

- Industry 4.0: AI, IoT, robotics, and machine learning are revolutionizing automotive manufacturing through smart factories and digital supply chains.

Challenges to India’s GVC Participation

Despite a strong production base, India faces several hurdles in climbing the Global Value Chain (GVC):

- Low R&D spending and limited innovation

- High operational costs and infrastructural gaps

- Weak IP ecosystem and low brand visibility

- Inadequate skilling and moderate digital adoption

Strategic Interventions Proposed

NITI Aayog recommends a combination of fiscal and non-fiscal measures to address these gaps and strengthen India’s automotive ecosystem.

Fiscal Measures:

- Opex support to scale up production and infrastructure

- Skilling initiatives to build a trained workforce

- R&D incentives and IP transfer support for MSMEs

- Cluster development for shared R&D and testing facilities

Non-Fiscal Measures:

- Promoting Industry 4.0 adoption and quality manufacturing

- Ease of Doing Business reforms in labour, logistics, and regulations

- Global tie-ups and Free Trade Agreements (FTAs) to boost exports

Vision for 2030

By 2030, the report envisions:

- Auto component production to grow from ~$60 billion to $145 billion

- Exports to increase from $20 billion to $60 billion

- GVC share to rise from 3% to 8%

- Trade surplus of around $25 billion

- Employment generation of 2–2.5 million additional jobs

Index of Industrial Production (IIP)

- 14 Apr 2025

In News:

The Index of Industrial Production (IIP), a key barometer of industrial activity in India, registered a growth of just 2.9% in February 2025, the slowest pace in six months. This was below market expectations of around 4% and reflects broad-based slowdown across sectors.

About the IIP

- Published by: Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation (MoSPI)

- Base Year: 2011–12

- Purpose: Measures the short-term changes in volume of production in industrial sectors.

Sectoral Composition and Weights

Sector Weight in IIP No. of Items

Manufacturing 77.63% 809

Mining 14.37% 29

Electricity 7.99% 1

Sector-wise Performance (YoY in February 2025)

Sector Feb 2025 Growth Feb 2024 Growth

Mining 1.6% 8.1%

Manufacturing 2.9% 4.9%

Electricity 3.6% 7.6%

Use-Based Classification Performance

Category Feb 2025 Growth Feb 2024 Growth

Capital Goods 8.2% 1.7%

Intermediate Goods 1.5% —

Consumer Non-Durables -2.1% -3.2%

Observation: Capital goods were the only category to show robust growth. All other segments registered deceleration.

Eight Core Industries (Weight in IIP: 40.27%)

In decreasing order of weight:

- Refinery Products

- Electricity

- Steel

- Coal

- Crude Oil

- Natural Gas

- Cement

- Fertilisers

Key Concerns Highlighted

- Slowing growth across mining, manufacturing, and electricity sectors

- A high base effect from the previous year

- A decline in month-on-month output after five months of sustained growth

- Consumer non-durables in continued contraction, indicating weak rural/household demand

Amrit Bharat Scheme

- 14 Apr 2025

In News:

The Amrit Bharat Station Scheme (ABSS), launched to transform railway stations across India into world-class travel hubs, has achieved a key milestone. Railway Minister Ashwini Vaishnaw announced the completion of redevelopment work at 104 stations out of the planned 1,300 stations under the scheme.

About the Amrit Bharat Station Scheme

- Launched: 2023

- Objective: Comprehensive redevelopment of railway stations to:

- Upgrade passenger amenities

- Enhance multi-modal connectivity

- Modernize infrastructure with sustainable and accessible design

Key Updates (As of April 2025)

- Total stations under ABSS: 1,300

- Stations with completed redevelopment: 104

- Stations in Maharashtra: 132 (significant progress reported)

Major Highlights

Feature Details

Notable Station Project Chhatrapati Shivaji Maharaj Terminus (CSMT), Mumbai

CSMT Redevelopment Cost ?1,800 crore

Modern Facilities Planned Waiting lounges, food courts, clean restrooms, lifts, escalators,

digital signage

International Comparison CSMT post-redevelopment projected to surpass

London’s Kings Cross station

Additional Infrastructure Developments in Maharashtra

- Gondia–Ballarshah Railway Line Doubling:

- Length: 240 km

- Region: Vidarbha

- Approved Investment: ?4,819 crore

- Strategic Importance: Enhances connectivity and freight movement

Centre–State Collaboration

- A Memorandum of Understanding (MoU) was signed between the Government of India and Government of Maharashtra for railway project implementation and coordination.

NaBFIDsigns strategic MoU with New Development Bank (NDB)

- 12 Apr 2025

In News:

The National Bank for Financing Infrastructure and Development (NaBFID) has entered into a strategic Memorandum of Understanding (MoU) with the New Development Bank (NDB) to strengthen cooperation in long-term infrastructure financing and promote clean energy development in India.

About NaBFID (National Bank for Financing Infrastructure and Development)

- Type: Development Finance Institution (DFI)

- Established Under:NaBFID Act, 2021

- Regulated By: Reserve Bank of India (RBI) as an All-India Financial Institution (AIFI)

Objectives:

- Bridge the gap in long-term, non-recourse infrastructure finance

- Support the development of India’s bond and derivatives markets

- Foster sustainable economic growth

- Enable project financing in clean energy, transport, and water infrastructure

Key Features:

- Capital base to be scaled up to ?1 trillion

- Focuses on medium to long-term financing (1–5+ years)

- Promotes Public-Private Partnerships (PPPs) and financial viability of projects

- Engages in joint research, capacity building, and knowledge-sharing with global institutions like NDB

About the New Development Bank (NDB)

- Type: Multilateral Development Bank formed by BRICS nations (Brazil, Russia, India, China, South Africa)

- Proposed: BRICS Summit, New Delhi (2012)

- Established By:Fortaleza Declaration, 15 July 2014

- Became Operational: 21 July 2015

Mandate:

- Mobilize funds for infrastructure and sustainable development

- Finance projects in emerging and developing economies (EMDCs)

- Promote green, inclusive, and resilient growth, particularly in clean energy, transport, and water sectors

Key Features:

- Authorized Capital: $100 billion

- India’s Contribution: $2 billion (paid in 7 tranches, 2015–2022)

- Engagement in India: As of December 2024, NDB has financed 20 projects worth $4.867 billion

SEBI’s Operational Framework for ESG Debt Securities

- 07 Jun 2025

In News:

The Securities and Exchange Board of India (SEBI) has introduced a comprehensive operational framework for the issuance of Environmental, Social, and Governance (ESG) debt securities. This includes instruments such as social bonds, sustainability bonds, and sustainability-linked bonds, aiming to boost responsible financing in India.

Understanding ESG Debt Securities

Definition:

ESG debt securities are financial tools designed to raise capital specifically for projects that yield positive environmental, social, or governance (ESG) outcomes. These instruments are a key part of sustainable finance, with categories including:

- Social Bonds: Focused on projects with direct social impact (e.g., affordable housing, education).

- Sustainability Bonds: Target projects with both environmental and social objectives.

- Sustainability-Linked Bonds: Tied to specific ESG performance indicators or targets.

Salient Features:

- Funds raised must be used exclusively for eligible ESG-aligned projects.

- Bonds must be clearly labelled in line with the project's primary focus.

- Compliance with global ESG norms and standards is mandatory.

- Verification or certification by an independent third-party is required.

- The framework applies to both public and private debt offerings.

Highlights of SEBI’s Framework

1. Classification Guidelines: Issuers are required to categorize their bonds—green, social, or sustainability—based on the core objective of the projects being financed. This ensures transparent communication of the bond's intended impact.

2. Disclosure Norms:

- At the Issuance Stage: Offer documents must detail project eligibility, selection methodology, and a tentative allocation between financing new initiatives and refinancing existing ones.

- Post-Issuance: Issuers must provide annual updates on fund deployment and report impact metrics to demonstrate accountability and transparency.

3. Independent Assurance: Issuers must engage accredited third-party entities to validate the alignment of bonds with ESG principles, thereby enhancing investor confidence and market integrity.

4. Monitoring and Evaluation: There is an obligation for ongoing impact assessment. Issuers must ensure the projects funded effectively contribute to reducing environmental degradation or addressing social challenges.

5. Scope and Enforcement: The framework will come into effect from June 5, 2025, and is aligned with international ESG standards to facilitate greater inflow of sustainable and ethical investments.

Significance for India: This move marks a significant step in mainstreaming ESG finance in India. It aims to improve transparency, attract climate-conscious capital, and reinforce India’s commitment to sustainable development.

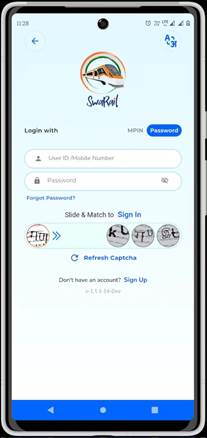

C CARES Version 2.0

- 05 Jun 2025

In News:

The Ministry of Coal recently launched C CARES Version 2.0, a significant upgrade to the Coal Mines Provident Fund Organization’s (CMPFO) digital platform. The new system aims to enhance transparency, efficiency, and accessibility in provident fund (PF) and pension disbursement for coal sector workers.

Key Features of C CARES Version 2.0

- Developed by the Centre for Development of Advanced Computing (C-DAC) in collaboration with the State Bank of India (SBI).

- Provides a unified digital interface for coal workers, coal companies, and CMPFO.

- Enables real-time claim tracking, automated ledger updates, and direct benefit transfers to workers’ bank accounts.

- Includes a mobile application for CMPF members, offering:

- PF balance checks

- Profile viewing

- Grievance redressal

- Claim status tracking

- A chatbot assistant for easy navigation

Benefits to Stakeholders

- For Workers: Faster claim settlement, improved access, and reduced delays in PF/pension disbursement.

- For Coal Companies and CMPFO:

- A prescriptive dashboard to generate custom reports.

- Analytics to track settlement trends.

- Support for data-driven decision-making.

About CMPFO

- Full Form: Coal Mines Provident Fund Organization

- Established: 1948

- Parent Ministry: Ministry of Coal

- Function: Administration of PF and pension schemes for coal sector employees.

- Coverage:

- Serves around 3.3 lakh PF subscribers

- Supports over 6.3 lakh pensioners

Significance

Union Minister for Coal and Mines G. Kishan Reddy launched the portal on June 4, 2025, stating that it aligns with the Government's vision of “Minimum Government, Maximum Governance” under the Digital India initiative. The platform strengthens social security delivery for coal workers and brings administrative reform to a critical sector of the economy.

World Wealth Report 2025

- 05 Jun 2025

In News:

The World Wealth Report 2025, released by the Capgemini Research Institute, highlights a significant surge in global and Indian high-net-worth individual (HNWI) wealth. The report covers 71 countries, representing over 98% of global Gross National Income (GNI) and 99% of world stock market capitalization.

India’s HNWI Landscape in 2024

- HNWI Wealth Growth: India witnessed an 8.8% increase in HNWI wealth in 2024.

- Total Millionaires: The country had 378,810 HNWIs by the end of 2024, with a cumulative wealth of $1.5 trillion.

- Millionaires Next Door: Among them, 333,340 individuals fell under the "Millionaires Next Door" category (investable assets between $1M–$5M), holding $628.93 billion in wealth.

- Ultra HNWIs: India was home to 4,290 Ultra-HNWIs (assets ≥ $30M), with combined assets worth $534.77 billion.

Global Trends in HNWI Wealth

- Global Growth: HNWI population worldwide rose by 2.6%, driven largely by a 6.2% rise in Ultra-HNWI numbers.

- Investment Trends: Alternative investments (private equity, cryptocurrencies) formed 15% of HNWI portfolios, signaling diversification beyond traditional assets.

- Top Contributors:

- United States added 562,000 millionaires, recording a 7.6% rise, reaching a total of 7.9 million HNWIs.

- The U.S. also holds 36% of centi-millionaires (net worth ≥ $100M) and 33% of the world's billionaires.

- India and Japan saw 5.6% growth, while China recorded a 1.0% decline in HNWI population.

Shifting Dynamics in Wealth Management

- A massive “great wealth transfer” is underway globally.

- 81% of global next-gen HNWIs and 85% of Indian next-gen HNWIs plan to switch wealth management (WM) firms within 1–2 years of inheritance.

- Key reasons include:

- Lack of preferred channel services (51%)

- Ineffective digital transaction tools (41%)

- Digital Transformation Need: The evolving expectations of next-gen clients are pushing firms toward AI-enabled advisory models and advanced digital infrastructure.

Offshore Wealth Allocation

- By 2030, 98% of Indian next-gen HNWIs plan to increase their offshore assets by over 10%.

- Motivations include:

- Superior investment options (55%)

- Better wealth management services (65%)

- Improved market connectivity (54%)

- Tax efficiency and political-economic stability (49%)

- Motivations include:

RBI’s Draft Guidelines on Gold Loans

- 03 Jun 2025

Why is the RBI proposing changes to gold loan regulations?

In April 2024, the Reserve Bank of India (RBI) released draft guidelines on loans against gold to harmonise regulations across banks and NBFCs and to address irregularities. The move follows an extraordinary surge in gold-backed loans during FY24:

- Gold loan portfolios grew over 50% across banks and NBFCs.

- For banks, the portfolio more than doubled (104% growth).

This rapid growth, amid rising gold prices and lax lending standards, raised regulatory concerns.

What are the key proposals in the draft guidelines?

- LTV Norms:

- The Loan-to-Value (LTV) ratio remains capped at 75%.

- For bullet repayment loans for consumption, accrued interest must be included in the LTV calculation, effectively lowering the loan amount disbursed.

- Ownership Proof:Borrowers must furnish proof of ownership for the gold pledged.

- Valuation Standards:

- Gold should be valued based on 22-carat price.

- Uniform procedures must be followed to assess the purity and weight.

- Loan Renewal & Fresh Sanctions:

- Renewals or top-ups are permitted only if:

- The existing loan is standard, and

- It complies with the LTV limit.

- Concurrent loans for both consumption and income-generation are disallowed.

- A fresh loan can only be granted after full repayment (principal + interest) of the previous loan.

- Renewals or top-ups are permitted only if:

- Collateral Return Timeline:If the gold is not returned within 7 working days after repayment, the lender must compensate the borrower at ?5,000/day for each day of delay.

Likely Impact on Borrowers and Lenders

Borrowers:

- May face reduced loan amounts and higher documentation requirements.

- Small and rural borrowers, dependent on gold loans for agriculture and allied sectors, may experience reduced accessibility.

NBFCs and Banks:

- NBFCs that frequently renew or top-up gold loans could lose flexibility.

- Compliance costs will rise due to stringent documentation, valuation, and reporting norms.

- Smaller NBFCs relying on re-pledging of gold may face liquidity issues.

- Interest rates may rise to offset higher operational expenses.

Is a uniform policy suitable?

A one-size-fits-all policy may not be practical. Gold loans are a lifeline for rural households with limited access to formal credit. Experts suggest:

- Differentiated norms for micro gold loans (small-ticket loans) and high-value loans.

- Consideration for the informal nature of ownership in many rural households.

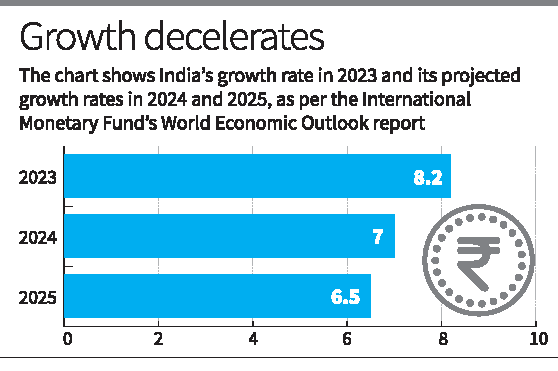

India’s Provisional GDP Estimates for FY 2024–25

- 01 Jun 2025

In News:

The Ministry of Statistics and Programme Implementation (MoSPI) released the Provisional Estimates (PEs) of India’s Gross Domestic Product (GDP) and Gross Value Added (GVA) for the financial year 2024–25 (FY25), providing a comprehensive picture of the country's economic performance.

Understanding GDP and GVA

- GDP (Gross Domestic Product) measures the total expenditure in the economy, including consumption, investment, government spending, and net exports — representing the demand side.

- GVA (Gross Value Added) evaluates the income generated from the production of goods and services in different sectors — representing the supply side.

- The two are related by the formula:GDP = GVA + Taxes – Subsidies

- Both are reported in nominal terms (current prices) and real terms (adjusted for inflation).

Nature of Provisional Estimates

- The estimates are termed provisional because they include data from all four quarters but are subject to revision:

- First Advance Estimates (FAE): January

- Second Advance Estimates (SAE): February

- Provisional Estimates (PE): May

- Revised Estimates: Finalized over the next two years (in 2026 and 2027 for FY25)

Key Economic Indicators for FY 2024–25

- Nominal GDP

- Estimated at ?330.68 lakh crore, showing a 9.8% growth over FY24.

- In dollar terms (?85.559/USD), India’s economy reached $3.87 trillion.

- However, this 9.8% nominal growth marks the third-slowest since 2014.

- Real GDP

- Rose by 6.5%, reaching ?187.97 lakh crore.

- The real GDP growth slowed from 9.2% in FY24, indicating reduced economic momentum.

- Sectoral GVA Performance

- Overall GVA grew by 6.4%, down from 8.6% in FY24.

- Sector-wise real GVA growth:

- Agriculture & Allied Activities: 4.4% (up from 2.7% last year)

- Industry (including Manufacturing & Construction): 6.1%

- Services: 7.5% (notable growth in public admin, trade, and finance)

- Q4 FY25 Trends

- Real GDP growth: 7.4%

- Nominal GDP growth: 10.8%

- Indicates a strong end-of-year performance.

Structural Insights and Concerns

- Manufacturing Weakness:Since FY20, manufacturing GVA CAGR (4.04%) lags behind agriculture (4.72%), signaling industrial stagnation.

- Employment Implications:Manufacturing’s sluggishness contributes to high urban unemployment and labour migration to rural/agricultural sectors.

- Consumption and Investment Revival:

- Private Final Consumption Expenditure (PFCE) grew by 7.2%.

- Gross Fixed Capital Formation (GFCF) increased by 7.1%, indicating investment momentum.

Significance for Policymaking

- The GDP data serves as a basis for fiscal planning, monetary policy decisions, and public investment.

- It highlights India’s position as one of the fastest-growing major economies, while also revealing structural vulnerabilities — particularly in manufacturing.

- For international comparison, real GDP is crucial as it neutralizes inflationary differences across countries.

World’s First 3D-Printed Train Station unveiled in Japan

- 10 Apr 2025

In News:

Japan’s West Japan Railway Company has unveiled the world’s first 3D-printed train station — Hatsushima Station in Arida city. Notably, the station was constructed in less than six hours, highlighting a major advancement in construction technology.

Understanding 3D Printing (Additive Manufacturing)

What is 3D Printing?

3D Printing, or Additive Manufacturing, is a process of creating three-dimensional objects by layering material based on a digital design. Unlike traditional (subtractive) manufacturing, which removes material, this method adds material layer by layer, ensuring reduced waste and the ability to produce complex geometries.

How 3D Printing Works:

- Design Phase: A 3D digital model is created using CAD (Computer-Aided Design) software and saved in formats like .STL or .OBJ.

- Slicing: The model is sliced into horizontal layers using specialized software.

- Printing: The printer deposits material layer-by-layer according to the sliced file. Each layer solidifies to form the final shape.

- Post-Processing: The object is finished through processes such as curing, sanding, or painting.

Major 3D Printing Technologies:

- Fused Deposition Modelling (FDM): Uses melted thermoplastic filaments to build objects layer-by-layer.

- Selective Laser Sintering (SLS): Uses lasers to fuse powdered plastics or metals into solid forms.

- Direct Metal Laser Sintering (DMLS): Employs a laser to fuse metal powders — widely used in aerospace and medical sectors.

- Material Jetting: Deposits photopolymer droplets, cured with UV light — ideal for high-precision and colorful prototypes.

Limitations of 3D Printing:

- Material Restrictions: Only specific plastics, metals, and composites are compatible with given printers.

- Size Constraints: Limited build volume necessitates assembling larger items from smaller parts.

- Structural Weakness: Objects may have weak joints due to the layered structure, reducing suitability for high-stress uses.

- IP Challenges: Digital design files can be easily shared, posing risks of counterfeiting and intellectual property theft.

Electronics Components Manufacturing Scheme (ECMS)

- 10 Apr 2025

In News:

The Ministry of Electronics and Information Technology (MeitY) has notified the Electronics Components Manufacturing Scheme (ECMS) in April 2025. It marks a strategic step in India’s ambition to become a global electronics manufacturing hub.

Key Highlights of ECMS

- Objective: To incentivize domestic production of passive electronic components and capital equipment, thus deepening India's electronics manufacturing value chain.

- Scheme Tenure: Valid for 6 years, with a 1-year gestation period.

- Focus Components: Includes resistors, capacitors, relays, switches, speakers, connectors, inductors, special ceramics, and other passive components.

- Active components are supported separately under the India Semiconductor Mission (ISM).

- Incentive Structure:

- Turnover-linked incentive (based on incremental revenue).

- Capex-linked incentive (for investments in plant and machinery).

- Hybrid model (combining turnover and capex benefits).

Incentive rates range between 1–10%, varying by year and component type.

- Employment Mandate: All applicants—whether component manufacturers or capital equipment makers—must commit to job creation, ensuring broader socio-economic benefits.

Strategic Importance

- Horizontal Sectoral Impact: The scheme is designed to support multiple sectors including automotive, consumer electronics, medical devices, power electronics, and electrical grids, promoting cross-industry multiplier effects.

- Support for Tooling & Capital Equipment Industry: Encourages design and manufacture of capital tools and machinery required for electronics production, in line with models seen under the India Semiconductor Mission.

- Global firms like Linde have begun operations, with more in pipeline.

India’s Electronics Growth Trajectory

- Export Milestone (FY 2024–25):

- Total smartphone exports: ?2 lakh crore

- iPhone exports alone: ?1.5 lakh crore

- Sectoral Growth (Last Decade):

- 5x growth in production.

- 6x growth in exports.

- Export CAGR: >20%

- Production CAGR: >17%

- Manufacturing Base Expansion: Over 400 production units (large and small) now manufacture a wide range of electronic components domestically.

- Value Chain Evolution: India has transitioned from assembling finished goods → sub-assemblies → deep component manufacturing, now entering a value-added, self-reliant phase in electronics

One State, One RRB Policy

- 10 Apr 2025

In News:

The Government of India, through the Ministry of Finance, has implemented the "One State, One RRB" policy effective from May 1, 2025, aimed at consolidating 26 Regional Rural Banks (RRBs) across 10 states and 1 Union Territory, thereby reducing the total number of RRBs to 28. This move follows the recommendation of the Dr. Vyas Committee and is intended to enhance the performance and outreach of RRBs.

Objectives of the Policy

- Improve operational efficiency and governance.

- Rationalize costs and optimize resources (human and technological).

- Eliminate intra-state competition among sponsor banks.

- Promote uniform service delivery through technological integration.

About Regional Rural Banks (RRBs)

- Established: 1975 under the Regional Rural Banks Act, 1976.

- Recommended by: Narasimham Committee (1975).

- Ownership Pattern:

- Government of India – 50%

- State Government – 15%

- Sponsor Bank – 35%

Regulatory Structure

- Regulated by: Reserve Bank of India (RBI)

- Supervised by: NABARD (National Bank for Agriculture and Rural Development)

Role and Objectives

- Provide institutional credit to rural India.

- Support priority sectors like agriculture, MSMEs, and rural artisans.

- Ensure financial inclusion among farmers, labourers, and small entrepreneurs.

Impact of the Reform

- Operational Scale: Enhanced credit delivery across wider geographies.

- Technological Standardization: Easier integration of IT infrastructure.

- Unified Governance: One sponsor bank per state improves accountability.

- Performance: RRBs recorded an all-time high net profit of ?7,571 crore in FY 2023–24.

- Asset Quality: GNPA (Gross Non-Performing Assets) stood at 6.1%, the lowest in a decade.

Niveshak Didi

- 10 Apr 2025

In News:

In a significant push toward inclusive financial literacy, the Investor Education and Protection Fund Authority (IEPFA), under the Ministry of Corporate Affairs, and the India Post Payments Bank (IPPB), under the Department of Posts, Ministry of Communications, have signed a Memorandum of Agreement (MoA) to launch Phase 2 of the “Niveshak Didi” initiative in April 2025.

Objective:

The Niveshak Didi initiative, launched in 2023, is a women-led, community-driven financial literacy program designed to empower rural and underserved populations by fostering responsible financial behavior, promoting digital banking, and spreading fraud awareness.

Key Highlights:

- Target Group: Rural women and semi-urban communities.

- Approach: Local women, especially postal workers, are trained as financial educators (Niveshak Didis).

- Impact of Phase 1:

- Over 55,000 beneficiaries reached, with 60% women, predominantly from deep rural areas.

- Most beneficiaries belonged to the youth and economically active age groups.

Phase 2 (2025 Onward):

- Deployment of 4,000+ financial literacy camps across rural, tribal, and semi-urban areas.

- Training of 40,000 women postal workers to serve as grassroots financial educators.

- Curriculum Focus:

- Savings and budgeting.

- Responsible investing and fraud prevention.

- Digital tools and services provided by IPPB.

- Digital Inclusion: Leveraging India Stack for paperless and presence-less banking; training delivered in 13 regional languages.

About Investor Education and Protection Fund Authority (IEPFA)

- Statutory Body: Functions under the Ministry of Corporate Affairs, Government of India.

- Objective: Ensures informed and protected investors across India.

- Key Role:

- Promotes financial literacy to aid budgeting, saving, and investment decisions.

- Empowers citizens to make sound financial choices.

- Focus Areas:

- Educates citizens on investor rights and responsibilities.

- Special outreach to rural and underserved areas to bridge financial knowledge gaps.

- Vision: To build a financially aware and confident India, where every citizen has the tools to secure their financial future.

About India Post Payments Bank (IPPB)

- Established: On September 1, 2018 under the Department of Posts, Ministry of Communications.

- Ownership: 100% equity owned by the Government of India.

- Mission: To be the most accessible, affordable, and trusted bank for the common man.

- Mandate:

- Bridge financial inclusion gaps for the unbanked and underbanked.

- Leverage the vast postal network of approx. 1.65 lakh post offices (1.4 lakh in rural areas) and 3 lakh postal employees.

- Technology Backbone:

- Based on India Stack: Paperless, Cashless, and Presence-less banking.

- Uses CBS-integrated smartphones and biometric devices.

- Commitment:

- Promotes a less-cash economy.

- Supports the vision of Digital India.

- Motto: Every customer is important, every transaction is significant, every deposit is valuable.

India Skills Accelerator Initiative (2025)

- 09 Apr 2025

In News:

The Ministry of Skill Development and Entrepreneurship (MSDE) has partnered with the World Economic Forum (WEF) to launch the India Skills Accelerator—a national-level public-private collaboration platform aimed at fostering a future-ready and inclusive workforce.

Key Features:

- Purpose: To act as a systemic change enabler in India's skilling ecosystem through a multi-stakeholder, cross-sectoral approach.

- Core Objectives:

- Enhance awareness and shift mindsets about the need for future skills.

- Promote collaboration and knowledge sharing between government, industry, and academia.

- Reform policies and institutional structures for an agile and responsive skilling framework.

- Sectoral Priorities:

- Focus on high-growth areas: AI, robotics, cloud computing, cybersecurity, advanced manufacturing, energy, and Global Capability Centres (GCCs).

- Emphasis on formalizing the informal workforce.

- Lifelong Learning: Mobilize investments in upskilling and reskilling across various life stages to support agile career transitions.

- Data-Driven Governance: Use surveys, mapping tools, and the WEF’s Global Learning Network for peer benchmarking and progress tracking.

- Implementation Strategy:

- Identify 10–12 high-impact priorities with measurable outcomes.

- Establish thematic working groups to ensure coordinated execution.

- Align initiative with the WEF’s Future of Jobs Report 2025.

Significance

- Addresses the fact that 65% of organizations cite skill gaps as a major barrier to growth.

- Positions India to leverage its demographic dividend and become the "Skill Capital of the World".

- Supports India's goal of skilling not just for domestic needs but also for global workforce demand.

- Reinforces federal cooperation, involving institutions like NSDC, NCVET, DGT, UGC, AICTE, NCERT, and CBSE.

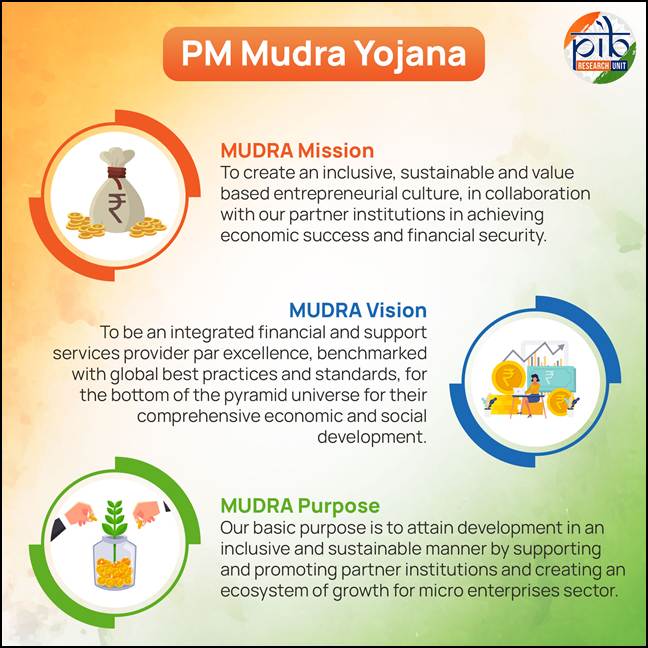

Pradhan Mantri MUDRA Yojana (PMMY)

- 08 Apr 2025

In News:

The Pradhan Mantri MUDRA Yojana (PMMY), a flagship initiative aimed at providing financial support to unfunded micro and small enterprises, has completed 10 years since its launch in 2015.

Overview of PMMY

- Objective: To offer collateral-free institutional credit to non-corporate, non-farm micro and small enterprises.

- Loan Limit: Up to ?20 lakh without any collateral.

- Implementing Institutions (MLIs):

- Scheduled Commercial Banks

- Regional Rural Banks (RRBs)

- Non-Banking Financial Companies (NBFCs)

- Micro Finance Institutions (MFIs)

Categories of MUDRA Loans

Loan Category Loan Amount Range

Shishu Up to ?50,000

Kishor ?50,000 to ?5 lakh

Tarun ?5 lakh to ?10 lakh

Tarun Plus ?10 lakh to ?20 lakh

Key Achievements (2015–2025)

- Boost to Entrepreneurship: PMMY has sanctioned over 52 crore loans amounting to ?32.61 lakh crore, catalyzing a grassroots entrepreneurship revolution.

- MSME Sector Financing: Lending to MSMEs increased significantly:

- From ?8.51 lakh crore in FY14

- To ?27.25 lakh crore in FY24

- Projected to exceed ?30 lakh crore in FY25

- Women Empowerment: 68% of Mudra beneficiaries are women, highlighting the scheme’s impact in fostering women-led enterprises.

- Social Inclusion:

- 50% of loan accounts are held by SC, ST, and OBC entrepreneurs.

- 11% of beneficiaries belong to minority communities, showcasing PMMY’s contribution to inclusive growth.

India’s Sharp Decline in Poverty

- 29 May 2025

In News:

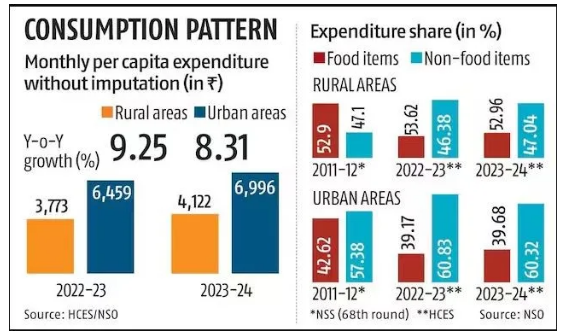

Recent Household Consumption Expenditure Surveys (2022–23 and 2023–24) by the National Statistical Office (NSO), alongside a World Bank Poverty & Equity Brief, highlight a historic decline in poverty in India. This achievement is largely attributed to sustained GDP growth and declining inequality.

Key Findings:

Poverty Reduction Trends (2011–12 to 2023–24)

- All-India Poverty Ratio: Fell from 29.5% (2011–12) → 9.5% (2022–23) → 4.9% (2023–24).

- Extreme Poverty (<$2.15/day, PPP): Declined from 16.2% → 2.3% (2011–12 to 2022–23).

- Lower-Middle Income Poverty (<$3.65/day): Declined from 61.8% → 28.1%.

Updated Poverty Lines (Rangarajan Committee Methodology):

Area 2011–12 2022–23 2023–24

Rural ?972 ?1,837 ?1,940

Urban ?1,407 ?2,603 ?2,736

- For a 5-member urban household, the 2023–24 poverty threshold is ?13,680/month.

Factors Driving Poverty Reduction:

- High GDP Growth: Rose from 7.6% (2022–23) to 9.2% (2023–24).

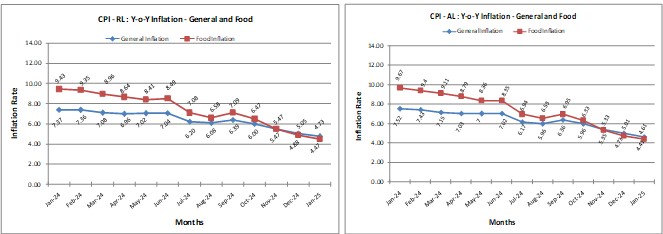

- Moderating Inflation: Consumer Price Index (CPI) inflation dropped from 6.7% to 5.4%, enhancing real incomes. However, food inflation rose to 7.5%, affecting poor households disproportionately.

- Inequality Decline:

- Gini Coefficient fell from 0.310 (2011–12) → 0.282 (2022–23) → 0.253 (2023–24).

- Urban areas saw faster decline in consumption inequality.

Nature and Depth of Poverty:

- Poverty Near the Threshold:

- Over 50% of the poor lie between 75–100% of the poverty line.

- Large share of non-poor lie just above the line (115–125%), making them vulnerable.

- Depth Analysis (Raised Cut-Offs): Even at 125% of the poverty line, poverty fell by 34.2 percentage points (2011–24), showing broad-based gains.

Regional & Structural Challenges:

- Persisting Regional Disparities: States like Bihar, Jharkhand, Odisha still report higher poverty levels.

- Urban Informality & Data Gaps: Recent surveys underrepresent informal workers and migrants, skewing urban poverty estimates.

- Vulnerability to Shocks: Health crises, climate events, or inflation could push the near-poor back into poverty.

- Gaps in Welfare Coverage: Urban poor and migrant populations face limited access to PDS and safety nets.

Policy Imperatives:

- Targeted Cash Transfers: Scale up schemes like PM-GKAY, DBT for LPG, and tailor transfers to those just above the poverty line.

- Strengthen Rural Employment: Enhance MGNREGA funding and integrate climate-resilient jobs.

- Build Urban Safety Nets: Develop a comprehensive urban social protection framework for gig and informal sector workers.

- Education & Nutrition Investments: Bridge human capital gaps via PM POSHAN, Saksham Anganwadi.

- Continuous Poverty Monitoring: Institutionalize annual poverty tracking using real-time and multidimensional indicators.

Modified Interest Subvention Scheme (MISS) – FY 2025–26

- 29 May 2025

In News:

The Union Cabinet has approved the continuation of the Interest Subvention (IS) component under the Modified Interest Subvention Scheme (MISS) for the financial year 2025–26, retaining the existing structure and interest rates.

About the Scheme:

- Type: Central Sector Scheme

- Objective: To provide short-term agricultural credit to farmers at affordable interest rates through Kisan Credit Cards (KCC).

Key Features:

- Loan Coverage:

- Short-term crop loans up to ?3 lakh per farmer through KCC.

- For loans exclusively for animal husbandry or fisheries, the benefit applies up to ?2 lakh.

- Interest Rates:

- Base interest rate: 7%

- 1.5% interest subvention to lending institutions

- 3% Prompt Repayment Incentive (PRI) for timely repayment

- Effective interest rate for prompt payers: 4%

- Implementing & Monitoring Agencies:

- Reserve Bank of India (RBI)

- National Bank for Agriculture and Rural Development (NABARD)

- Operated via Public Sector Banks, Regional Rural Banks, Cooperative Banks, and Private Banks in rural/semi-urban areas.

Recent Updates and Rationale:

- No structural changes have been introduced in the scheme for FY 2025–26.

- The scheme continues amidst rising lending costs, with stable repo rates and MCLR trends.

- It ensures credit access for small and marginal farmers, critical for financial inclusion and agricultural productivity.

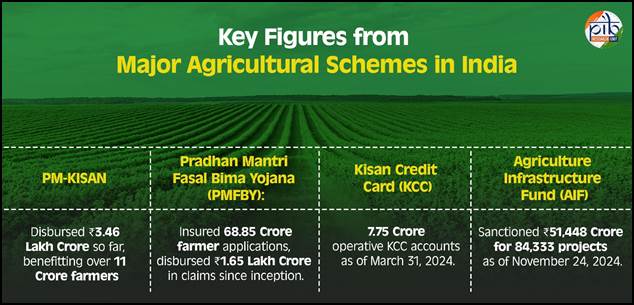

Impact on Agricultural Credit:

- KCC Accounts: Over 7.75 crore active accounts across India.

- Institutional Credit Growth:

- Disbursement via KCC increased from ?4.26 lakh crore (2014) to ?10.05 lakh crore (Dec 2024).

- Total agricultural credit rose from ?7.3 lakh crore (FY 2013–14) to ?25.49 lakh crore (FY 2023–24).

- Digital Reform: Kisan Rin Portal (KRP) launched in August 2023 has improved transparency and efficiency in claim processing.

Significance:

- Helps ensure timely and affordable institutional credit to the farming sector.

- Supports the government's goal of doubling farmers’ income.

- Strengthens the rural credit delivery system and promotes inclusive growth in agriculture.

Dark Patterns and India’s Regulatory Response

- 29 May 2025

In News:

The Ministry of Consumer Affairs, Food, and Public Distribution has initiated a robust crackdown on Dark Patterns—deceptive design practices used on digital platforms to manipulate consumer behavior. A recent high-level stakeholder meeting in Delhi, chaired by Union Minister Prahlad Joshi, brought together representatives from major e-commerce platforms like Amazon, Flipkart, Zomato, and Ola, along with consumer organizations and law institutions, to address the growing concern.

What are Dark Patterns?

Dark Patterns are user interface designs that intentionally mislead or coerce consumers into making decisions they would not have otherwise made. These manipulative tactics exploit psychological principles and cognitive biases to serve the commercial interests of platforms—often at the cost of consumer autonomy.

Types of Dark Patterns Identified by the Government:

The Department of Consumer Affairs has officially recognized 13 types of dark patterns in its November 2023 guidelines. Prominent among them are:

- False Urgency: Creating artificial time pressure (e.g., “Only 1 seat left!”).

- Basket Sneaking: Adding items to the cart without user consent.

- Confirm Shaming: Using guilt-driven language to influence decisions.

- Subscription Trap: Making subscription easy but cancellation difficult.

- Interface Interference: Hiding crucial information or options.

- Bait and Switch: Advertising one offer and switching to another.

- Hidden Costs: Revealing extra charges only at checkout.

- Forced Action: Making users complete unrelated tasks to proceed.

- Disguised Ads, Trick Questions, Nagging, SAAS Billing Abuse, and Rogue Malware Links are other examples.

These practices have been found across multiple digital sectors including e-commerce, travel, OTT platforms, edtech, online banking, and quick commerce.

Consumer Impact and Rising Complaints:

The National Consumer Helpline has witnessed a significant increase in grievances related to dark patterns. Platforms are accused of eroding consumer trust, causing financial harm, breaching privacy, and distorting fair market practices.

According to LocalCircles, based on a survey conducted across 392 districts with feedback from 2.30 lakh consumers, the worst offenders include edtech, airline, and taxi app services. Notably, companies like Uber and Rapido were recently issued notices by the Central Consumer Protection Authority (CCPA) for coercing users into paying tips in advance.

Regulatory Measures in India:

- Consumer Protection Act, 2019: While it prohibits unfair trade practices, it lacks explicit provisions targeting dark patterns, making enforcement challenging.

- 2023 Guidelines on Dark Patterns: Released by the Department of Consumer Affairs, these guidelines define deceptive interfaces as violations of consumer rights and misleading advertisements.

- Self-Audit Mandate: E-commerce companies have been instructed to conduct internal audits and eliminate dark patterns from their platforms.

- Proposed Joint Working Group: A mechanism is being considered to increase industry awareness and enforce compliance.

- Voluntary and Legal Enforcement: The government has urged digital firms to integrate the guidelines into internal policies and consumer grievance redressal systems.

National Apprenticeship Promotion and Training Schemes

- 28 May 2025

In News:

Recently, the 38th Meeting of the Central Apprenticeship Council (CAC), chaired by the Minister of State (Independent Charge) for the Ministry of Skill Development and Entrepreneurship (MSDE), recommended a 36% increase in stipends under two key skilling initiatives—National Apprenticeship Promotion Scheme (NAPS) and National Apprenticeship Training Scheme (NATS). This move aims to enhance apprenticeship attractiveness, reduce dropout rates, and improve youth employability across India.

About NAPS (Launched: 19 August 2016)

- Objective: To build industry-relevant skilled manpower by promoting on-the-job training and bridging the gap between education and employment.

- Administered by: Ministry of Skill Development and Entrepreneurship (MSDE).

- Key Features:

- Provides financial support to establishments for engaging apprentices.

- Encourages MSME participation and focuses on aspirational districts and the North-East.

- Offers partial stipend reimbursement under the Apprentices Act, 1961.

- Apprentices receive a certificate from NAPS, enhancing employability.

- Over 43.47 lakh apprentices engaged across 36 States/UTs till May 2025.

- Female participation reached 20%, with efforts to boost inclusion.

About NATS

- Target Group: Graduates, Diploma holders, and Vocational certificate holders.

- Provisions:

- Offers 6–12 months of practical, hands-on training.

- Employers receive 50% stipend reimbursement.

- Apprentices are issued a Government of India Certificate of Proficiency, valid across employment exchanges.

- FY 2024–25 Stats: Over 5.23 lakh apprentices enrolled.

Key Reforms Recommended by CAC (2025)

- Stipend Enhancement:

- Proposed increase from ?5,000–?9,000 to ?6,800–?12,300.

- To be adjusted biennially based on Consumer Price Index (CPI).

- Inclusive Skilling Framework:

- Definition of “Person with Benchmark Disability” to be added under the Apprenticeship Rules.

- Trades must indicate suitability for PwBDs with reserved training slots.

- Curricular Integration:

- Push for Degree Apprenticeships and Apprenticeship Embedded Degree Programmes (AEDP).

- Definitions added for "Institution", "UGC", and "Contractual Staff".

- Flexible Training Modes: Employers may provide Basic and Practical Training through online, virtual, or blended modes, adhering to standard curricula.

- Decentralized Administration: Proposal to establish Regional Boards to improve scheme outreach and governance.

- Sectoral Expansion:

- Adoption of NIC Code 2008 to replace outdated 1987 list.

- Brings emerging sectors like IT, software, telecom, biotech, and renewable energy under apprenticeship coverage.

- Operational Improvements:

- Align CTS (Craftsmen Training Scheme) courses with apprenticeship notification timelines.

- Consideration of location-based stipend rationalization based on cost of living.

- Proposal for insurance coverage for apprentices during contract periods.

Governance and Stakeholder Involvement

The Central Apprenticeship Council includes representatives from:

- Ministries: Education, Labour, MSME, Railways, Textiles.

- Industry: BHEL, Indian Oil, Tata, Maruti, Reliance.

- Institutions: NSDC, UGC, AICTE.

- State advisors and domain experts from labour and education fields.

RBI Dividend Transfer to Government (FY 2024–25)

- 27 May 2025

In News:

- The Reserve Bank of India (RBI) has approved a record dividend transfer of ?2.69 lakh crore to the Government of India for FY 2024–25.

- This amount is 27% higher than the ?2.10 lakh crore transferred in the previous year (2023–24).

- The transfer follows the Revised Economic Capital Framework (ECF), approved on May 15, 2025.

What is a Dividend in Public Finance?

- A dividend is the non-tax revenue received by the government as the sole shareholder of the RBI.

- It helps bridge the fiscal deficit.

- RBI dividend distribution is governed by the Reserve Bank of India Act, 1934.

- Unlike corporate dividends that require shareholder approval, RBI transfers are governed by policy mechanisms set by the Central Board.

Economic Capital Framework (ECF) and Risk Buffer

- The Contingent Risk Buffer (CRB) has been raised to 7.5% of the RBI’s balance sheet for FY 2024–25.

- Earlier CRB levels:

- 5.5% (2018–22)

- 6% (2022–23)

- 6.5% (2023–24)

- The CRB helps ensure the RBI maintains sufficient capital to absorb financial shocks.

Reasons for Higher Surplus in 2024–25

- Robust foreign exchange (forex) sales, especially in January 2025, with RBI being the top seller among Asian central banks.

- Increased interest income from government securities and foreign investments.

- Gains from forex transactions during high market volatility.

- Forex reserves had peaked at $704 billion in September 2024, from which large volumes of dollars were sold to stabilise the rupee.

Implications for the Union Budget 2025–26

- The Budget had projected ?2.56 lakh crore as dividend income from RBI and PSUs; the actual RBI dividend itself exceeds this estimate.

- Experts expect the fiscal deficit to reduce by 20 basis points (bps) from the budgeted 4.4% to ~4.2% of GDP.

- The surplus provides a non-tax revenue cushion, helping offset shortfalls in tax or disinvestment receipts and manage additional spending.

Expert Views

- Surplus driven by prudent RBI policy, forex gains, and high interest income. CRB increase reduced the possible surplus, otherwise it could have exceeded ?3.5 lakh crore.

- The surplus equals 0.4–0.5 trillion (?40,000–?50,000 crore) or 11–14 bps of GDP, offering fiscal flexibility.

- Market expected ?3 lakh crore; disappointment due to higher risk buffer provisioning.

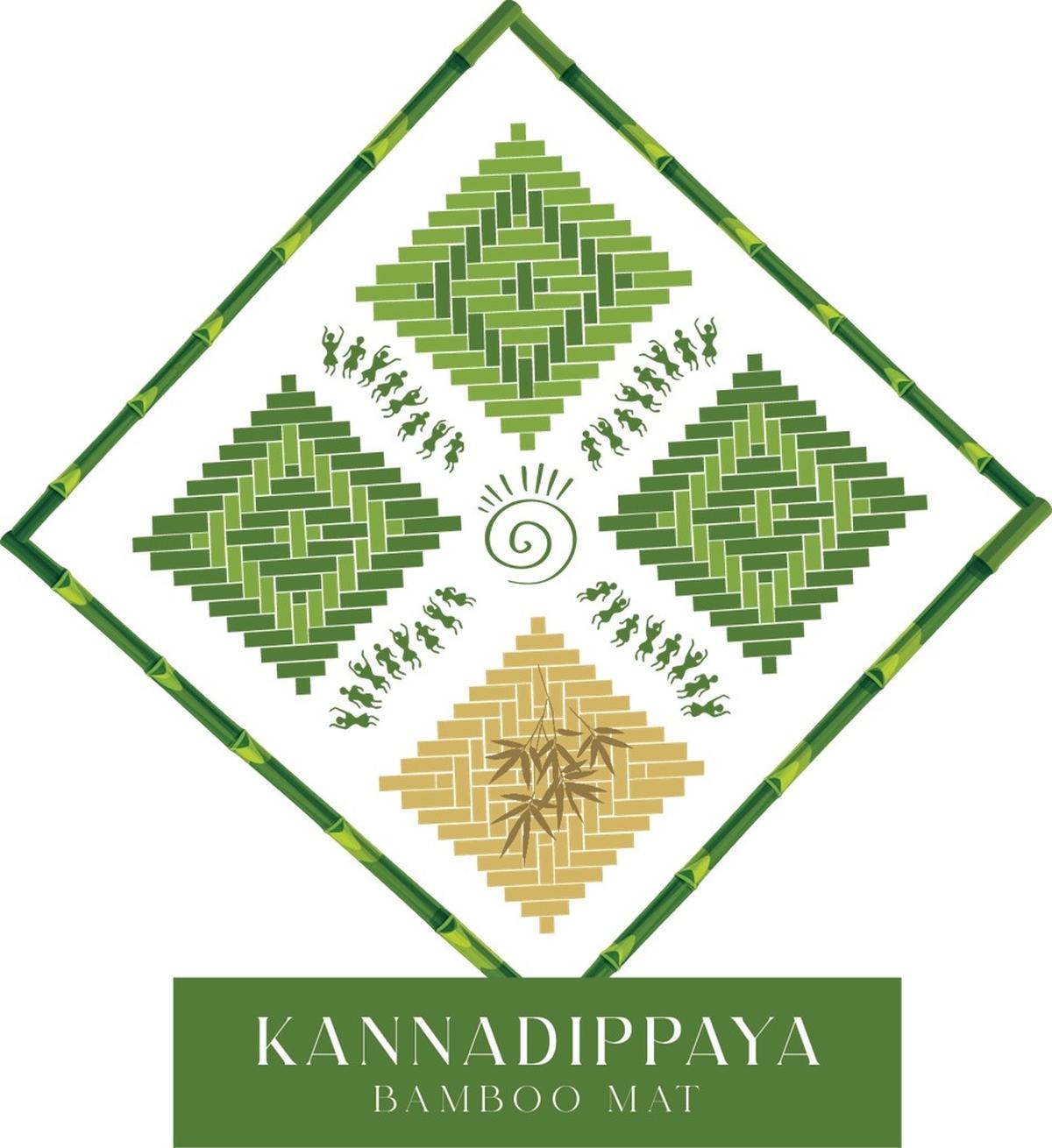

Kannadippaya

- 06 Apr 2025

In News:

The traditional tribal mat Kannadippaya from Kerala has been granted the Geographical Indication (GI) tag, marking a significant milestone in the protection and promotion of India’s tribal handicraft heritage.

About Kannadippaya

- Origin and Craftsmanship:Kannadippaya (literally, mirror mat) is a unique handicraft made by various tribal communities of Kerala, notably the Oorali, Mannan, Muthuvan, Malayan, Kadar, Ulladan, Malayarayan, and Hill Pulaya tribes. The craft is predominantly practiced in Idukki, Thrissur, Ernakulam, and Palakkad districts.

- Raw Material:The mat is woven using the soft inner layers of reed bamboo (Teinostachyumwightii) and other bamboo species such as Ochlandra sp., known locally by various names including Njoonjileetta and Kanjoora.

- Functional and Aesthetic Value:The mat’s reflective design gives it a mirror-like appearance. It offers thermal comfort by providing warmth during winter and cooling during summer, showcasing traditional ecological knowledge.

- Historical Significance:Historically, these mats were offered by tribal communities as a token of honour to kings, reflecting the cultural and symbolic value attached to the craft.

Significance of the GI Tag

- Cultural Recognition:Kannadippaya becomes Kerala’s first tribal handicraft to receive a GI tag, acknowledging its cultural uniqueness and heritage value.

- Economic Empowerment:The GI tag is expected to:

- Provide market protection for tribal artisans.

- Enable branding and certification, enhancing the product's authenticity.

- Open national and international markets, especially for eco-friendly, sustainable products.

- Encourage entrepreneurship among tribal communities, reducing dependency on intermediaries.

- Institutional Support:

- The Kerala Forest Research Institute (KFRI) played a pivotal role in securing the GI tag, along with contributions from experts.

- The application was supported by tribal cooperatives like UnarvuPattikavarghaVividodeshaSahakarana Sangam and Vanasree Bamboo Craft, Idukki.

Challenges and the Way Forward

- Lack of Structured Market:Artisans have highlighted the absence of a robust marketing ecosystem. There is a need for State and Central government interventions to:

- Facilitate marketing infrastructure and e-commerce platforms.

- Provide training and capacity-building for artisans.

- Encourage younger generations to take up the craft through incentives and education.

- Sustainability and Global Demand:Given the rising demand for eco-friendly and sustainable products globally, Kannadippaya has the potential to become a symbol of India’s green and inclusive development model.

Seaweed Farming in India

- 06 Apr 2025

In News:

With growing attention on sustainable marine resources and coastal livelihood enhancement, the Government of India is promoting seaweed cultivation as part of its broader Blue Economy strategy. Recognized for its nutritional, economic, and ecological value, seaweed farming is emerging as a viable livelihood and environmental solution for India's coastal communities.

What is Seaweed?

Seaweed is a nutrient-rich marine plant that grows in shallow ocean waters. It is:

- Rich in vitamins, minerals, amino acids, and 54 trace elements.

- Known to aid in managing non-communicable diseases such as cancer, diabetes, cardiovascular ailments, and hypertension.

- Used in food, cosmetics, fertilizers, medicines, and industrial gelling agents like agar, alginate, and carrageenan.

Global Significance and Industry Potential

- The global seaweed market is valued at US$ 5.6 billion and projected to reach US$ 11.8 billion by 2030 (World Bank).

- Major consumers: Japan, China, and South Korea.

- India possesses vast untapped potential with over 7,500 km of coastline and 844 identified seaweed species, of which ~60 are commercially viable.

Seaweed and the Blue Economy in India

Government Initiatives:

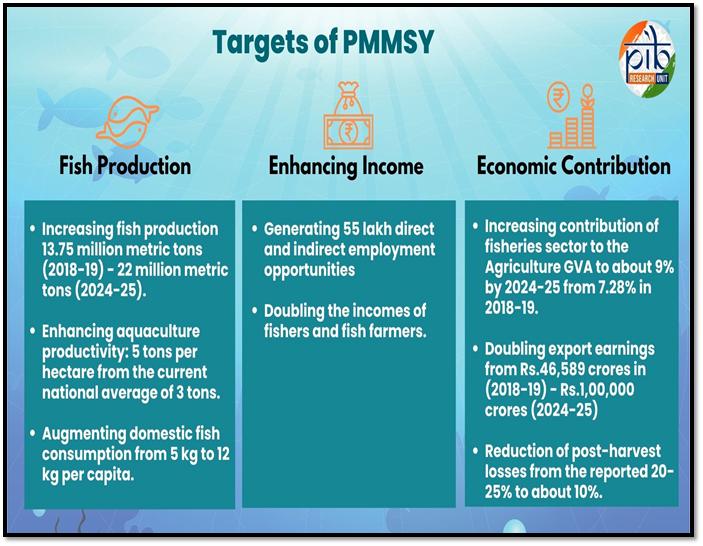

- Pradhan Mantri MatsyaSampada Yojana (PMMSY) (launched in 2020):

- Total Outlay: ?20,050 crore.

- ?640 crore allocated for seaweed development (2020–25).

- Goal: Increase seaweed production to 1.12 million tonnes in five years.

- Projects funded:

- Multipurpose Seaweed Park in Tamil Nadu.

- Seaweed Brood Bank in Daman & Diu.

- Provision of 46,095 rafts and 65,330 monocline tubenets to farmers.

Supportive Regulatory Measures:

- Seaweed-based biostimulants regulated under the Fertilizer (Control) Order, 1985.

- Integrated with Paramparagat Krishi Vikas Yojana (PKVY) and MOVCDNER to promote organic farming.

Economic, Environmental & Social Benefits

Economic:

- Seaweed farming offers high returns — e.g., farming Kappaphycusalvarezii may yield up to ?13.28 lakh/hectare/year.

- Generates foreign exchange through exports of seaweed-based bio-products.

Environmental:

- Requires no land, freshwater, fertilizers, or pesticides.

- Absorbs CO?, combats ocean acidification, and enhances marine biodiversity.

Social:

- Provides alternative livelihoods for fishers.

- Particularly beneficial for women and youth, promoting inclusive growth in coastal regions.

Success Stories and Innovations

Women Empowerment in Tamil Nadu:

Four women from Mandapam, Tamil Nadu, trained under PMMSY, successfully cultivated seaweed, producing 36,000 tonnes despite cyclones and market challenges. Their venture created employment and inspired other women.

Tissue Culture Innovation:

The CSIR-Central Salt and Marine Chemicals Research Institute (CSIR-CSMCRI)developed tissue-cultured Kappaphycusalvareziiseedlings, leading to:

- 20–30% higher growth rates.

- Better carrageenan quality.

- Enhanced farmer productivity in Tamil Nadu’s coastal districts.

Challenges and Way Forward

Challenges:

- Vulnerability to climatic shocks (cyclones, salinity changes).

- Limited market access and value chain infrastructure.

- Need for increased awareness and skill-building in coastal areas.

Recommendations:

- Strengthen public-private partnerships and R&D for better cultivars.

- Expand seaweed farming cooperatives with financial inclusion mechanisms.

- Promote Blue Economy integration in coastal development policies.

Domestically Manufactured Iron & Steel Products (DMISP) Policy – 2025

- 06 Apr 2025

In News:

To address the rising steel imports and strengthen domestic industry under the Atmanirbhar Bharat initiative, the Government of India has notified the DMISP Policy – 2025, mandating the exclusive use of Indian steel in government procurement and incorporating a reciprocity clause against non-cooperative foreign countries.

About the DMISP Policy – 2025

- Nodal Ministry: Ministry of Steel

- Aim:To promote the use of domestically produced iron and steel in government-funded projects, thereby reducing import dependence, enhancing self-reliance, and safeguarding the interests of the Indian steel industry.

- Key Objectives

- Promote Self-Reliance: Advance the vision of Atmanirbhar Bharat by boosting domestic steel production and consumption.

- Curb Imports: Mitigate the adverse impact of rising steel imports on Indian steelmakers.

- Support Domestic Industry: Provide a level playing field to Indian steel manufacturers in public procurement.

- Encourage Value Addition: Increase domestic sourcing and manufacturing of capital goods used in steel production.

Salient Features of the Policy

- Mandatory Use of Indian Steel:

- Applicable across all Union Ministries, PSUs, statutory bodies, and trusts.

- Covers products such as flat-rolled steel, rods, bars, and rails.

- Steel must meet the “Melt and Pour” condition — i.e., must be melted and solidified in India.

- Reciprocity Clause:

- Nations that restrict Indian firms from participating in their public procurement (e.g., China) are barred from Indian government tenders.

- Exceptions can be made only with the approval of the Ministry of Steel.

- Ban on Global Tenders (GTE):

- GTEs for steel products are prohibited.

- GTEs for capital goods (e.g., furnaces, rolling mills) are permitted only for contracts above ?200 crore, with prior clearance.

- Domestic Value Addition Requirement:

- Capital goods used in steel production must have at least 50% local value addition.

- Certification by statutory or cost auditors is mandatory.

- Procurement Applicability:

- Mandatory for all government procurement above ?5 lakh.

- Also extends to centrally funded but state-executed projects.

- Monitoring and Enforcement:

- A Standing Committee chaired by the Secretary (Steel) will:

- Oversee compliance and redress grievances.

- Grant exemptions in case of non-availability of Indian products.

- A Standing Committee chaired by the Secretary (Steel) will:

- Penalties for Non-Compliance:False declarations may result in blacklisting of suppliers and forfeiture of earnest money deposits.

NITI NCAER States Economic Forum Portal

- 02 Apr 2025

In News:

The NITI NCAER States Economic Forum portal, jointly developed by NITI Aayog and the National Council of Applied Economic Research (NCAER), was launched on April 1, 2025, by the Union Finance Minister.

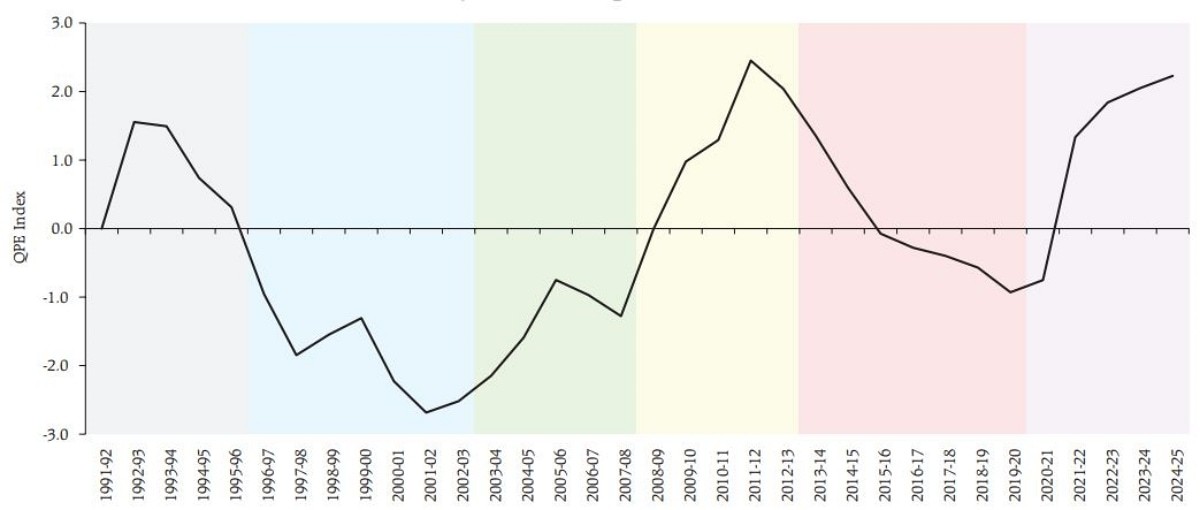

Key Highlights:

The portal serves as a comprehensive digital repository offering over 30 years (1990-91 to 2022-23) of state-wise data on social, economic, and fiscal parameters, promoting evidence-based policymaking and fiscal transparency.

Purpose and Significance

- Objective: To enable policymakers, researchers, and academics to access, compare, and analyze long-term trends in State finances and socio-economic indicators.

- Promotes data-driven governance, facilitates inter-State comparisons, and strengthens cooperative federalism.

- Addresses persistent demands for transparent, centralized, and accessible fiscal data, especially amid concerns of fiscal imbalance between Centre and States.

Core Features of the Portal

The portal is structured around four main components:

- State Reports:

- Covers all 28 Indian States.

- Summarizes macroeconomic and fiscal landscapes based on key indicators—demography, economic structure, social indicators, and fiscal metrics.

- Data Repository:

- Offers access to extensive datasets organized into five verticals:

- Demography

- Economic Structure

- Fiscal

- Health

- Education

- Offers access to extensive datasets organized into five verticals:

- Fiscal and Economic Dashboard:

- Interactive dashboards with graphical representations of vital statistics.

- Enables visualization of trends and download of datasets.

- Research and Commentary:Features expert analyses, research papers, and commentary on fiscal policies and State-level financial management.

Benefits and Policy Implications

- Enhances transparency and informed public debate.

- Supports benchmarking of States' performance against national averages and peer States.

- Aids in planning reforms, improving public finance management, and addressing regional disparities.

- A vital tool for academicians, policy analysts, and government officials working on State-level governance and development planning.

Payments Regulatory Board (PRB)

- 25 May 2025

In News:

The Central Government has notified the Payments Regulatory Board Regulations, 2025, replacing the earlier Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) with a new statutory authority — the Payments Regulatory Board (PRB).

About the PRB

- Legal Basis: Constituted under Section 3 of the Payment and Settlement Systems Act, 2007.

- Objective: To regulate and supervise payment systems in India with broader representation and holistic oversight.

Composition (Total: 6 Members)

- Chairperson: Governor of the Reserve Bank of India (RBI)

- Ex-Officio Members:

- Deputy Governor of RBI in charge of the Department of Payment and Settlement Systems (DPSS)

- One RBI official nominated by the RBI Central Board

- Government Nominees:Three members nominated by the Central Government (previous BPSS had none)

Other Key Features:

- Expert Consultation: PRB can invite experts from fields like law and IT as permanent or ad hoc members.

- Eligibility Criteria:

- Members must be below 70 years of age

- Should not hold any legislative office or have material conflicts of interest

- Governance:

- Board meets at least twice a year

- Decisions are by majority vote; in case of a tie, the Chairperson (or Deputy Governor) casts the deciding vote.

- Delegation: PRB can delegate functions to RBI officers or sub-committees.

Institutional Support

- The PRB will be supported by the RBI’s DPSS, which will report directly to the board.

Significance of the Reform

- Marks a structural reform in the regulation of India’s rapidly growing payments ecosystem.

- Enhances government oversight through its nominees.

- Aims to improve coordination among various departments (e.g., fintech, digital payments).

- Seeks to provide uniform and consolidated regulation across diverse payment systems.

Sagar Mein Samman (SMS) Initiative

- 24 May 2025

In News:

The Government of India launched the Sagar Mein Samman (SMS) initiative on International Day for Women in Maritime (18 May), observed by the International Maritime Organization (IMO). The 2025 theme is “An Ocean of Opportunities for Women.”

About the Initiative:

- Objective: To build a gender-equitable maritime workforce by promoting inclusivity, safety, skill development, leadership, and equal opportunities for women across seafaring and shore-based maritime operations.

- Alignment:

- IMO’s gender inclusion mandate.

- UN SDG-5 (Gender Equality).

- India’s Diversity, Equity, and Inclusion (DEI) framework.

- Maritime India Vision 2030 and Maritime Amrit Kaal Vision 2047.

Key Features:

- Structured Policy Roadmap covering:

- Planning & strategy.

- Training & development.

- Research & innovation.

- Governance & compliance.

- Outreach & communications.

- Financial Support: ~2,989 women received assistance since 2014.

- Incentives for Industry: Shipping companies are incentivized to hire women; scholarships support training.

Achievements:

- 649% growth in women seafarers:From 341 in 2014 to 2,557 in 2024.

- Rise in financial aid beneficiaries:From 45 in 2014-15 to 732 in 2024-25.

- Female representation target:12% in technical maritime roles by 2030.

- Increasing employment of Indian women on Indian and foreign-flagged ships.

Recognition and Outreach:

- Women Leaders Honoured: Ten outstanding women were felicitated for their contributions to maritime.

- Focus on awareness campaigns, onshore job facilitation, and leadership opportunities.

Significance:

- Aims to dismantle gender-based barriers and promote inclusive economic growth.

- Reinforces India’s commitment to gender equity as a strategic enabler of maritime sustainability and national development.

- Aligns with global maritime norms and India’s broader commitment to SDGs.

Other Key Maritime Initiatives:

- SAGAR (Security and Growth for All in the Region): Maritime security and regional cooperation.

- Maritime India Vision 2030: Long-term strategy for port-led development and gender inclusion.

SPICED Scheme

- 22 May 2025

In News:

The Spices Board of India, under the Ministry of Commerce and Industry, has introduced the SPICED Scheme (Sustainability in Spice Sector through Progressive, Innovative and Collaborative Interventions for Export Development) for the financial year 2025–26.

Key Objectives

The SPICED initiative is designed to:

- Promote sustainability and innovation in spice farming.

- Enhance productivity and quality of major spices like small and large cardamom.

- Encourage organic cultivation, GI-tagged spice production, and value addition.

- Improve post-harvest processing standards.

- Ensure compliance with international food safety and phytosanitary regulations.

- Strengthen the export ecosystem and support spice stakeholders, including farmers, SHGs, and MSMEs.

Major Components and Interventions

The scheme extends financial assistance and capacity-building support across the spice value chain, including:

1. Agricultural Support

- Rejuvenation and replanting of cardamom plantations.