Ethanol Blending

- 07 Aug 2025

Introduction:

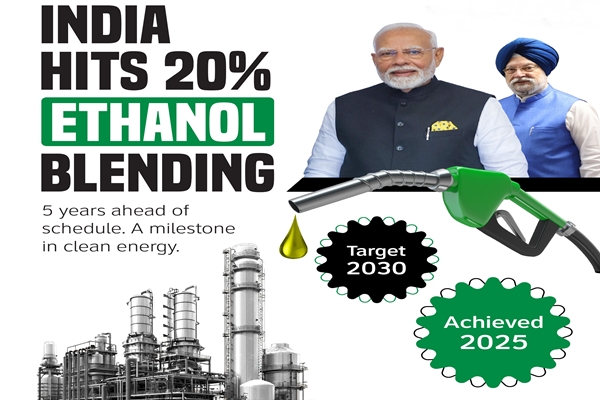

India has achieved a significant milestone in its clean energy transition by rolling out E20 fuel (20% ethanol blended petrol) nationwide in 2025, five years ahead of the original 2030 target. The initiative aligns with the Ethanol Blended Petrol (EBP) Programme, launched in 2003, and marks a sharp rise from just 1.5% ethanol blending in 2014 to 20% in 2025.

The policy aims to enhance energy security, reduce carbon emissions, cut crude oil imports, and support farmers. However, concerns have emerged regarding its impact on vehicle performance, consumer costs, and technical feasibility.

Ethanol Blending: Policy Context

- Nature of Fuel: Ethanol is an alcohol-based biofuel derived mainly from sugarcane, maize, and biomass.

- Benefits:

- Reduces dependency on crude imports (saving ~?1.36 lakh crore in foreign exchange).

- Provides ?1.18 lakh crore to farmers, boosting rural incomes.

- Cuts CO? emissions by ~698 lakh tonnes.

- Strengthens domestic biofuel industry (ethanol production rose from 38 crore litres in 2014 to 661 crore litres in 2025).

- Global Context: Ethanol blending is used in several countries (e.g., USA, Brazil) to curb fossil fuel reliance.

Economic and Environmental Gains

- Macroeconomic Benefits:

- Estimated to lower crude oil imports by ?50,000 crore annually.

- Strengthened India’s energy self-reliance under the National Bio-Energy Programme.

- Environmental Benefits:

- Lower greenhouse gas emissions.

- Promotion of renewable energy use.

- Agricultural Support: Higher demand for sugarcane and related feedstock increases farmer incomes.

Challenges and Concerns

1. Vehicle Compatibility Issues

- Vehicles manufactured before April 2023 are not designed for E20 and risk damage.

- Hero MotoCorp & TVS highlight the need to replace rubber, elastomer, and plastic components (e.g., gaskets, O-rings, fuel tubes) with ethanol-compatible materials.

- Ethanol’s corrosive nature leads to:

- Metal corrosion (fuel tanks, injectors, exhausts).

- Degradation of rubber/plastic parts.

- Moisture absorption (phase separation in fuel).

- Altered air-fuel ratio causing knocking, poor combustion, and reduced performance.

2. Drop in Fuel Efficiency

- Government stance: Mileage loss is “marginal” (1–2% for calibrated vehicles; 3–6% for others), reducible by engine tuning.

- Independent experts: Real-world mileage drop may be 6–7%, raising consumer costs.

- Many consumers report higher fuel consumption, sluggish acceleration, and reduced efficiency in older vehicles.

3. Consumer Concerns

- Rising fuel expenses due to frequent refuelling.

- Lack of consumer choice between E20 and pure petrol.

- Demand for awareness campaigns and clear labelling at fuel stations.

Industry and Policy Response

- Automobile manufacturers are producing E20-compliant vehicles since April 2023.

- Retrofitting advisories issued for older models.

- Government maintains that minor modifications (rubber part replacements, engine recalibration) can mitigate risks at low costs.

Future Outlook: Beyond E20

- Discussions are underway on higher blends (E30, E40).

- Experts warn of greater risks:

- More severe corrosion and efficiency loss.

- Need for dual fuel dispensing infrastructure.

- Retrofitting or phased replacement of older vehicles.

- Policy direction must balance energy security goals with consumer interests.

Conclusion

The rollout of E20 fuel represents a major stride in India’s path toward sustainable energy and reduced import dependence. However, the transition is accompanied by technical, economic, and consumer-level challenges, particularly for pre-2023 vehicles.

Going forward, India’s ethanol blending strategy must ensure:

- Consumer awareness and choice.

- Targeted retrofitting supportfor older vehicles.

- Sustainable ethanol production without compromising food security or causing ecological stress.

Balancing macroeconomic and environmental gains with micro-level consumer impacts will determine the long-term success of India’s ethanol blending programme.

India’s Ethanol Blending Success

- 26 Jul 2025

In News:

India has achieved a significant milestone by reaching 20% ethanol blending in petrol by March 2025, five years ahead of the original 2030 target under the National Policy on Biofuels (2018). This landmark achievement represents a transformative step in India’s journey toward energy self-reliance, environmental sustainability, and inclusive rural development.

Genesis and Policy Framework

The Ethanol Blended Petrol (EBP) Programme, launched in 2003 and significantly scaled up post-2014, aims to reduce dependence on imported crude oil, promote clean fuels, and support the agricultural economy. The programme is spearheaded by the Ministry of Petroleum and Natural Gas in collaboration with the Ministries of Agriculture and Food Processing. The National Policy on Biofuels expanded the permissible feedstocks for ethanol production, including sugarcane juice, B-molasses, damaged grains, maize, and agricultural residues.

Complementary initiatives like PM-JI-VAN Yojana, SATAT, PLI for ethanol production, and the National Bio-Energy Programme have accelerated infrastructure creation and second-generation (2G) ethanol technologies.

Progress and Scaling

The ethanol blending rate rose from 1.53% in 2014 to 8.17% in 2020–21, then to 12.06% in 2022–23, and reached 14.6% in 2023–24, culminating in the 20% target in early 2025. This scaling was supported by ?40,000 crore in investments and proactive procurement by Oil Marketing Companies (OMCs) at pre-fixed prices, providing market stability for distilleries and farmers.

Over 17,000 fuel retail outlets now offer E20 fuel, with 400 E100 pumps operational. Automakers such as Honda and Hero MotoCorp have ensured vehicle compatibility with E20 fuels, ensuring consumer acceptance.

Economic and Rural Impact

The EBP programme has delivered strong macroeconomic and grassroots benefits. By reducing crude oil imports, India has saved substantial foreign exchange and improved energy security. At the micro level, farmers—particularly sugarcane and maize growers—have benefited from assured off-take and stable prices, reducing rural distress and boosting income security.

Moreover, the ethanol ecosystem has generated rural employment, supported local manufacturing under ‘Make in India’, and catalyzed investment in agro-industrial infrastructure.

Environmental and Climate Gains

India’s ethanol blending drive aligns with its climate commitments, especially its Net Zero by 2070 target. Ethanol blending has helped avoid 698 lakh tonnes of CO? emissions, reduced particulate pollution, and improved urban air quality. The shift also supports circular economy principles by utilizing agricultural surplus, foodgrains unfit for consumption, and residues—converting waste to wealth.

Future strategies emphasize 2G ethanol from non-food biomass and municipal waste, thereby reducing land and water stress associated with first-generation biofuels. Advanced technologies like lignocellulosic processing, sustainable aviation fuel (SAF), and ethanol-to-hydrogen conversion are in focus.

Conclusion

India’s early achievement of 20% ethanol blending demonstrates the success of coordinated policymaking, technological adoption, and stakeholder alignment. It serves as a model of how energy policy can intersect with rural prosperity, environmental stewardship, and industrial growth. Going forward, India’s biofuel roadmap not only reinforces its clean energy leadership but also strengthens its resolve for energy Atmanirbharta, sustainable development, and climate resilience.