The Role of ‘Invisible’ Trade in India’s Foreign Exchange Earnings

- 11 Jul 2025

In News:

India's foreign trade landscape has undergone a fundamental transformation, with "invisible" trade—comprising services exports and private remittance inflows—emerging as a dominant contributor to foreign exchange earnings. Traditionally, international trade is associated with the export and import of physical goods. However, the increasing weight of intangibles such as services and remittances has positioned India as the “office of the world” in contrast to China’s role as the “factory of the world.”

Trends in India’s Visible vs Invisible Trade

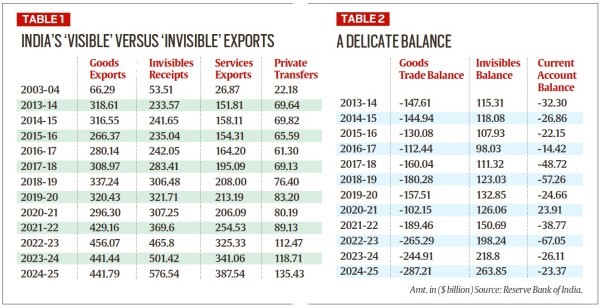

India’s merchandise exports rose from $66.3 billion in 2003–04 to $456.1 billion in 2022–23, before dipping slightly to $441.8 billion in 2024–25. While goods exports have fluctuated with global economic cycles, invisibles have exhibited resilient and consistent growth.

- Invisible receipts increased from $53.5 billion in 2003–04 to $233.6 billion in 2013–14, and further to $576.5 billion in 2024–25.

- In 2024–25, invisible receipts exceeded merchandise exports by $135 billion, reversing the trend from a decade earlier.

Composition of Invisible Earnings

- Services Exports:

- Valued at $387.5 billion in 2024–25, up from $26.9 billion in 2003–04.

- Software services remain dominant ($180.6 billion), but significant growth has also been noted in business, financial, and communication services ($118 billion).

- Private Transfers (Remittances):

- Amounted to $135.4 billion in 2024–25, up from $22.2 billion in 2003–04.

- Reflects the export of Indian human capital, with inflows from expatriates, especially in the Gulf and North America.

Economic Significance

- Current Account Management: India’s merchandise trade deficit ballooned to $287.2 billion in 2024–25, but this was substantially offset by a net invisible surplus of $263.8 billion, keeping the current account deficit at $23.4 billion, lower than 2013–14 levels.

- Geopolitical Immunity: Invisible earnings have remained relatively insulated from global trade tensions, protectionist tariffs, and geopolitical shocks. Unlike goods trade, services have not been significantly impacted by events such as the pandemic or global conflicts.

- Limited Policy Support, High Impact: Despite minimal reliance on FTAs, tariff negotiations, or production-linked incentives, invisibles have flourished—highlighting the natural comparative advantage India holds in the global services and remittances market.

Comparison with China

China recorded a merchandise trade surplus of $768 billion in 2024, but faced a deficit of $344.1 billion on the invisibles front. In contrast, India posted a services trade surplus of $188.8 billion, emphasizing its role as a global service hub rather than a manufacturing powerhouse.

Conclusion

India’s foreign trade narrative has shifted decisively towards intangible exports. With robust growth in services and remittances, invisibles have become the invisible hand stabilizing India’s external sector. For sustained macroeconomic resilience, policymakers must now institutionalize support for the services sector, facilitate human capital mobility, and leverage digital infrastructure to enhance India’s global footprint in knowledge-based trade.