Insurance Laws (Amendment) Bill, 2025

- 04 Dec 2025

In News:

The proposed Insurance Laws (Amendment) Bill, 2025 represents one of the most far-reaching reform efforts in India’s insurance sector in decades. Scheduled for introduction in Parliament, the Bill aims to modernise a regulatory framework rooted in mid-20th century legislation and address the long-standing problem of low insurance penetration, which stood at 3.7% in 2023–24, far below the global average of around 7%. The reform package seeks to enhance capital inflows, deepen market competition, and expand coverage to underserved segments.

100% FDI: Opening the Sector to Global Capital

A cornerstone of the reform is the decision to raise the Foreign Direct Investment (FDI) cap in insurance from 74% to 100%. This shift is expected to attract global insurers, many of whom have not yet entered India’s market. Greater foreign participation could bring in advanced underwriting practices, digital claims management, and sophisticated risk-assessment tools. By reducing reliance on domestic capital and improving operational efficiency, the move aims to expand product innovation and enhance consumer services. The change requires amendments to the Insurance Act, 1938, the LIC Act, 1956, and the IRDAI Act, 1999, signalling a comprehensive legislative overhaul.

Composite Licensing: Breaking Product Silos

Currently, insurers operate in strict silos—life insurers cannot sell non-life products and vice versa. The Bill proposes composite licences, allowing a single entity to offer life, health, and general insurance products under one umbrella. This integration is expected to foster holistic protection solutions, reduce duplication in distribution networks, and align insurance offerings with consumer demand for bundled financial security products.

Lower Capital Norms and New Entrants

To broaden participation, the Bill proposes reducing minimum capital requirements for insurers and reinsurers. This step could enable specialised, regional, and niche players to enter the market, particularly those targeting rural and informal sectors. Such inclusion aligns with India’s long-term goal of achieving “Insurance for All” by 2047. Simultaneously, differentiated capital norms based on business size and risk profile are expected to replace the current uniform approach, encouraging a more diverse ecosystem.

Boost to Reinsurance and Risk Management

The proposal to reduce the net owned funds requirement for foreign reinsurers aims to attract more global reinsurance firms, diversifying a segment currently dominated by a few players. Additionally, allowing large corporations to establish captive insurance entities would strengthen corporate risk management and reduce dependence on external insurers.

Ease of Doing Business in Distribution

The Bill also seeks to reform the intermediary framework through perpetual registration instead of periodic renewals and permitting agents to represent multiple insurers. These steps could expand distribution networks, increase competition, and improve consumer choice.

Conclusion

The Insurance Laws (Amendment) Bill, 2025 marks a decisive move toward global integration, regulatory flexibility, and market deepening. While higher foreign participation and relaxed norms promise capital infusion and innovation, effective oversight will be crucial to ensure consumer protection and financial stability. If implemented well, the reforms could significantly enhance insurance penetration and resilience in India’s evolving risk landscape.

Entrepreneur-in-Residence (EIR) Programme

- 29 Nov 2025

In News:

India’s innovation landscape is witnessing a gradual but significant shift from laboratory-bound research to market-oriented problem solving. The Entrepreneur-in-Residence (EIR) Programme, highlighted recently by the Union Minister of State for Science and Technology, has emerged as a critical instrument in this transition. Introduced under the National Initiative for Developing and Harnessing Innovations (NIDHI), the EIR Programme reflects the government’s effort to embed entrepreneurship within the country’s public research ecosystem and nurture a new generation of scientist-entrepreneurs.

The EIR Programme is designed to encourage graduate students and young researchers to pursue entrepreneurship as a viable career option. It provides both financial and non-financial support in the form of a structured fellowship, enabling innovators to work on high-risk, high-impact ideas within recognised incubation environments. Selected fellows receive a monthly financial support of up to ?30,000 for a maximum period of 12 months, allowing them to focus on ideation, validation and early-stage development without immediate financial pressures. Beyond funding, the programme offers access to Technology Business Incubators (TBIs), mentoring, technical guidance, business advisory services and industry linkages.

Implemented by the Department of Science and Technology (DST) in association with the NCL Venture Centre, Pune, the EIR Programme seeks to bridge the long-standing gap between academic research and commercial application. By embedding entrepreneurial pathways within research institutions, it addresses a structural weakness of India’s innovation system, strong scientific output but limited translation into scalable products and enterprises.

The programme’s growing relevance was underscored at the annual meeting of the Biotechnology Research and Innovation Council (BRIC), where it was described as a cornerstone of India’s biotechnology innovation ecosystem. BRIC, established as a unified umbrella for multiple biotechnology research institutes, represents a shift toward collaborative and translational research. Within this framework, the EIR Programme has helped cultivate researchers who combine academic rigour with market awareness, encouraging them not just to discover, but to deliver solutions with societal and economic impact.

A notable strength of the EIR Programme lies in its ability to attract private sector participation and venture capital interest. By de-risking the early stages of innovation through public funding and institutional support, it creates a pipeline of credible startups emerging directly from public R&D institutions. This has particular significance in sectors such as biotechnology, healthcare, agriculture, green energy and industrial biotechnology, where long gestation periods and high uncertainty often deter private investment at the ideation stage.

The programme also aligns with broader policy objecttives. From a Science and Technology perspective, it promotes translational research, patenting and commercialization, areas increasingly emphasised in national innovation strategies. From an economic standpoint, it supports startup creation, job generation and the development of knowledge-intensive enterprises, complementing initiatives aimed at strengthening MSMEs and deep-tech startups. Ethically and socially, it reinforces values of scientific temper, innovation for public good, collaboration and responsible risk-taking.

However, sustaining the programme’s impact will require scaling up support, expanding interdisciplinary participation, and ensuring stronger regional spread beyond major research hubs. Continuous evaluation of outcomes such as startup survival rates, technology adoption and societal impact will be crucial.

In conclusion, the Entrepreneur-in-Residence Programme represents a strategic shift in India’s approach to innovation, moving from isolated research excellence to integrated, market-linked problem solving. By empowering young researchers to become entrepreneurs within the public research system, it strengthens India’s journey toward a resilient, innovation-driven economy and a globally competitive biotechnology ecosystem.

India’s Fisheries and Aquaculture: Advancing the Blue Transformation

- 23 Nov 2025

In News:

World Fisheries Day 2025 highlighted India’s remarkable rise as a global fisheries and aquaculture powerhouse, while also underscoring the need for urgent policy and sustainability reforms. The Food and Agriculture Organization (FAO) called for a renewed commitment to India’s Blue Transformationa shift from production-centric growth to value addition, ecosystem sustainability, and inclusive livelihoods.

Growth Trajectory and Global Standing

Over the past four decades, India’s aquatic food production has expanded dramaticallyfrom about 2.4 million tonnes in the 1980s to nearly 17.5 million tonnes in 2022–23. This growth has been driven primarily by inland aquaculture, which has become the backbone of India’s fisheries economy. According to FAO’sState of World Fisheries and Aquaculture (SOFIA) 2024, India is now the world’s second-largest aquaculture producer, contributing over 10 million tonnes of aquatic animals annually, second only to China.

Inland fisheries have recorded particularly strong growth, rising by around 140% over the last decade, while total fish production nearly doubled. Marine products exportsled by high-value shrimpcontinue to strengthen India’s external trade footprint, supported by improvements in processing, cold chains, and value addition. The sector sustains nearly 30 million livelihoods, with coastal fishing villages accounting for over two-thirds of national output, underscoring the close link between fisheries growth and coastal ecosystem health.

Policy Push and Institutional Support

India’s fisheries expansion has been backed by sustained policy and institutional reforms. The Pradhan Mantri MatsyaSampada Yojana (PMMSY), with an outlay exceeding ?20,000 crore, has strengthened infrastructure through cold storages, transport facilities, fish kiosks, and landing centres, while also promoting fisher welfare, digital inclusion, and safety at sea. Complementary initiatives such as climate-resilient coastal fishermen villages, vessel tracking systems, and the Marine Fisheries Census 2025 aim to improve resilience, targeting, and governance.

Regulatory and scientific institutionssuch as ICAR fisheries institutes, the Marine Products Export Development Authority, and the National Fisheries Development Boardhave promoted innovation, best practices, and environmental compliance. FAO-supported projects, including climate-resilient aquaculture models in Andhra Pradesh and ecosystem-based fisheries management initiatives in the Bay of Bengal, further reinforce sustainability-oriented reforms.

Emerging Opportunities

India’s blue economy potential is expanding through deeper engagement with global seafood markets, improved traceability systems, and new rules for the sustainable harnessing of the Exclusive Economic Zone. Digital platforms for traceability and certification can help Indian exports meet stringent international standards, improving price realisation and reducing rejection risks. Women-centric interventions under PMMSY and allied schemes also open avenues for inclusive growth through processing, retail, and value-added activities.

Persistent Challenges

Despite rapid progress, structural challenges remain. Overfishing and juvenile catch continue to stress nearshore stocks, while habitat degradationthrough pollution, sedimentation, and seagrass lossundermines nursery grounds. Illegal, unreported and unregulated (IUU) fishing erodes sustainability and equity. Post-harvest losses remain high, and small-scale fishers often face limited access to credit, insurance, and modern technology. Climate change further amplifies risks through extreme weather, warming waters, and disease outbreaks in aquaculture.

Way Forward

The FAO’s call for renewed commitment emphasisesscience-based stock management, expansion of deep-sea fisheries to reduce coastal pressure, robust traceability and certification, and biosecure, climate-resilient aquaculture systems. Investing in resilient harbours, early warning systems, and ecosystem-based approaches will be critical to safeguard livelihoods and biodiversity.

Conclusion

India’s fisheries and aquaculture sector stands at a pivotal moment. Having achieved scale and global prominence, the next phase of India’s Blue Transformation must prioritise sustainability, value addition, and inclusivity. With coordinated policy action, scientific management, and strong institutional support, India can convert its fisheries momentum into a resilient, competitive, and environmentally responsible blue economy that secures livelihoods, nutrition, and long-term ecological balance.

ATC Automation Failure at Delhi IGI Airport

- 20 Nov 2025

In News:

In November 2025, air traffic operations at Indira Gandhi International Airport, India’s busiest aviation hub, were severely disrupted due to a prolonged technical failure in the Automatic Message Switching System (AMSS). The outage, which lasted for more than 24 hours, delayed over 800 flights and had cascading effects across the national aviation network. While flight safety was not compromised, the incident exposed critical vulnerabilities in India’s air traffic control (ATC) automation infrastructure and underscored the urgency of systemic modernisation.

Role of AMSS in Air Traffic Management

AMSS functions as the core communication backbone of ATC operations in major Indian metros such as Delhi, Mumbai, Chennai and Kolkata. It automatically receives, stores and routes vital aeronautical messages via the Aeronautical Fixed Telecommunications Network (AFTN) and its modern successor, the Aeronautical Message Handling System (AMHS). These messages include flight plans, departure and arrival updates, NOTAMs, meteorological data and coordination messages between airlines and controllers. Crucially, AMSS feeds data into the Flight Data Processing System (FDPS), which enables ATC automation.

When AMSS failed at Delhi, controllers could see aircraft on radar but lacked access to flight plan data such as routes, altitudes and timings. As a result, more than 2,500 daily aircraft movementsincluding scheduled flights and overflightshad to be managed manually, significantly slowing operations and increasing workload.

Causes and Vulnerabilities

Preliminary assessments point to synchronisation failure between primary and standby servers, delayed system switchover and corrupted message queues. These issues were aggravated by structural weaknesses in the system: legacy server architecture supplied by a foreign vendor, outdated message-switching software, limited redundancy and poor integration with automation and network routers. A shortage of specialised local technical expertise further delayed resolution.

The incident corroborated warnings raised earlier by the Air Traffic Controllers’ Guild and echoed in the Parliamentary Standing Committee’s 380th Report (August 2025), which flagged performance degradation, system lag and outdated functionalities in ATC automation at major airports.

Broader Implications

India’s air traffic systems lag behind global benchmarks such as Federal Aviation Administration and Eurocontrol, which deploy AI-enabled conflict detection, predictive traffic flow analytics and seamless real-time data sharing. In India, the absence of such tools forces Air Traffic Controllers to compensate manually, increasing cognitive load and the risk of human error. With air traffic volumes growing rapidly, these technological gaps constrain airspace capacity and operational efficiency.

Compounding concerns were reports of possible GPS spoofing incidents around the same time, prompting an inquiry by national security authorities. Though no direct causal link was established, the coincidence highlighted the need for resilient systems capable of handling concurrent technological disruptions.

Government Response and Way Forward

The Ministry of Civil Aviation directed the Airports Authority of India to conduct a root-cause analysis, install additional backup servers and accelerate migration from AMSS to a modern, nationwide AMHS-based system with automatic failover. Plans also include deploying ADS-B ground stations, enhancing automation tools and shifting towards satellite-based navigation.

Conclusion

The Delhi IGI ATC glitch was not merely a technical failure but a systemic warning. It revealed the risks of operating critical national infrastructure on aging technology amid surging traffic volumes. For India to sustain safe, efficient and globally competitive aviation growth, urgent, comprehensive modernisation of air traffic managementcombining redundancy, advanced analytics and skilled manpoweris indispensable.

Strengthening Regulatory Governance

- 15 Nov 2025

In News:

The Securities and Exchange Board of India (SEBI) has initiated a major reform process aimed at enhancing transparency, accountability, and ethical conduct within the organisation. In response to concerns over conflicts of interest and allegations involving former SEBI Chairperson Madhabi Puri Buch and offshore financial links—claims denied by the individuals involved—the regulator constituted a High-Level Committee (HLC) in March 2025. This six-member panel, led by former Chief Vigilance Commissioner Pratyush Sinha, has proposed a comprehensive set of ten recommendations intended to overhaul SEBI’s internal governance standards and align them with global best practices followed by regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and the European Securities and Markets Authority (ESMA).

A key recommendation of the HLC is the establishment of a multi-tier disclosure framework. The Chairperson, Whole-Time Members (WTMs), and senior officials at the level of Chief General Manager (CGM) and above would be required to publicly disclose their assets and liabilities, covering movable and immovable property, investments, and outstanding liabilities. All other employees would file internal disclosures detailing their financial interests, professional relationships, and connections with relatives as defined under the Companies Act, 2013. This framework aims to strengthen public confidence in the regulator’s independence and integrity.

Another critical reform area involves mandatory conflict-of-interest declarations at the time of appointment. Applicants for top SEBI positions must disclose actual, potential, or perceived conflicts of both financial and non-financial nature. Such early disclosures allow the appointing authority to assess ethical suitability and mitigate risks before onboarding senior personnel.

The committee also recommended stringent investment and trading restrictions for SEBI leadership and employees. New investments should be limited to professionally managed pooled funds regulated by Indian financial regulators. For existing investments held at the time of appointment or joining, senior officials must choose among four options: liquidation, freezing, sale through a pre-approved trading plan, or sale with prior SEBI approval. Further, the HLC has advised that the Chairperson and WTMs be classified as “insiders” under the SEBI (Prohibition of Insider Trading) Regulations, 2015, placing them under enhanced scrutiny and disclosure obligations.

To ensure consistency, the committee proposed a broader definition of ‘family’. The revised definition would include spouses, dependent children, individuals for whom officials are legal guardians, and persons related by blood or marriage who are substantially dependent on the employee. This harmonisation between the SEBI Code of Conduct (2008) and the SEBI Employees’ Service Regulations (2001) seeks to remove ambiguities in assessing indirect conflicts of interest.

The HLC also recommended a blanket ban on acceptance of gifts from entities that have or may have official dealings with SEBI. A structured recusal mechanism must be institutionalised, requiring officials to step aside from decision-making roles in matters where conflicts exist. An annual summary of recusals by top officials should be included in SEBI’s Annual Report to enhance transparency.

Finally, the committee proposed post-retirement restrictions, preventing former members and employees from representing parties before SEBI for two years after exit. It also advocated a secure, confidential, anonymous whistle-blower system open not just to employees but also to market intermediaries and the public, ensuring a broad-based mechanism to detect ethical breaches.

Once approved by the SEBI Board and the Ministry of Finance, these recommendations will be incorporated into SEBI’s revised Code of Conduct with prospective applicability. Collectively, these reforms aim to fortify regulatory governance, restore public trust, and uphold the autonomy and integrity of India’s capital markets ecosystem.

National Household Income Survey and Key Household Finance Surveys

- 10 Nov 2025

In News:

Reliable, granular, and credible data form the backbone of effective economic policymaking. Recognising long-standing gaps in household-level economic statistics, the Ministry of Statistics and Programme Implementation (MoSPI) is preparing to undertake a set of ambitious and methodologically challenging surveys over the coming years. At the centre of this effort is India’s first-ever pan-India National Household Income Survey (NHIS), alongside two major surveys on household finances—the All-India Debt and Investment Survey (AIDIS) and the Situation Assessment Survey (SAS) of Agricultural Households. Together, these exercises aim to significantly strengthen India’s evidence base on income distribution, indebtedness, assets, and rural livelihoods.

National Household Income Survey (NHIS): A Long-Awaited Exercise

The NHIS, slated to begin in February 2026 with results expected by mid-2027, seeks to fill a critical void in India’s statistical system: the absence of a dedicated, nationwide dataset on household income distribution. According to MoSPI Secretary Saurabh Garg, income surveys are globally among the most difficult statistical exercises, and India’s own experience bears this out.

Historical Context and Challenges

India has attempted to measure household incomes multiple times:

- In the 1950s, income questions were embedded experimentally within consumer expenditure surveys.

- The 1960s Integrated Household Survey and feasibility exercises in the 1980s also explored income estimation.

These efforts were discontinued because reported incomes were often lower than the combined estimates of consumption and savings, raising serious concerns about data reliability. Household hesitancy to disclose income from multiple sources, especially informal earnings, has been a persistent obstacle.

Pre-Survey Findings: Trust Deficit

A pre-testing exercise conducted by MoSPI in August 2025 revealed the core challenge facing NHIS:

- 73% of respondents found the questionnaire relevant,

- 84% understood the purpose partially or well,

- Yet 95% considered income-related information “sensitive”,

- 95% felt uncomfortable disclosing income from different sources,

- A majority refused to answer questions on income tax paid.

These findings underline that the success of NHIS will depend less on technical design and more on public trust, awareness, and assurances of anonymity.

Institutional Safeguards

To address concerns of credibility and methodology, MoSPI has constituted a Technical Expert Group (TEG) chaired by Surjit S. Bhalla, former Executive Director for India at the IMF. The TEG will:

- Oversee survey design and implementation,

- Guide validation and finalisation of results,

- Advise on the nature of release—whether as a full national survey, pilot, or experimental dataset.

Given past controversies, such as the non-release of the 2017–18 Consumer Expenditure Survey due to data quality issues, MoSPI has emphasised that the NHIS results will be released only after rigorous expert scrutiny to ensure credibility.

Complementary Surveys: AIDIS and SAS (2026–27)

Alongside NHIS, MoSPI has announced that two nationally representative surveys will be conducted between July 2026 and June 2027, further enriching India’s household-level economic data.

All-India Debt and Investment Survey (AIDIS)

AIDIS is one of India’s most significant surveys on household finance, covering both rural and urban areas. It provides critical data on:

- Household indebtedness,

- Asset ownership and wealth distribution,

- Structure and reach of credit markets.

Its findings are widely used for:

- National accounts preparation,

- Assessing inequality in asset distribution,

- Informing policy decisions of the Reserve Bank of India, MoSPI, and other institutions.

Situation Assessment Survey (SAS) of Agricultural Households

First launched in 2003, the SAS focuses on the economic conditions of farming households. It covers:

- Income and expenditure patterns,

- Indebtedness and access to credit,

- Land and livestock ownership,

- Crop and livestock production, farming practices, and technology use,

- Access to government schemes and crop insurance.

The survey informs policymaking by the Ministry of Agriculture and Farmers Welfare, NITI Aayog, financial institutions, and researchers, particularly in the context of rural distress, farm incomes, and agricultural reforms.

MoSPI has also adopted a consultative approach by placing draft concept notes and schedules of AIDIS and SAS in the public domain, inviting feedback from policymakers, researchers, farmer groups, and financial institutions.

Household Debt Dynamics in India

- 04 Nov 2025

In News:

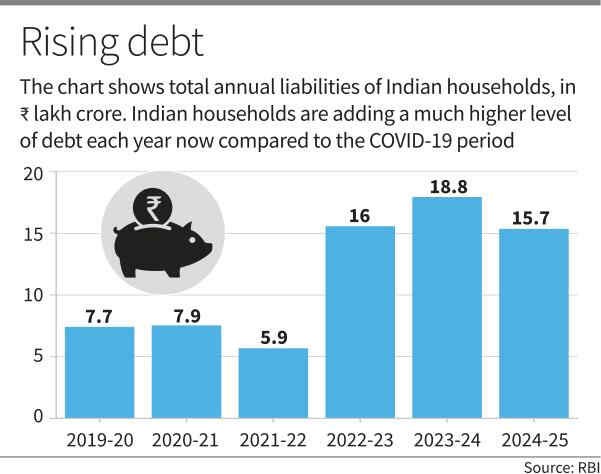

Recent financial accounts released by the Reserve Bank of India for 2024–25 highlight an important shift in household balance sheets: liabilities are expanding at a faster rate than financial assets. This trend has implications for savings behaviour, macroeconomic stability, and the broader investment cycle.

Household Asset and Liability Patterns: Key Findings

1. Asset Accumulation Slowing

Indian households continue to be net savers, yet the pace of asset formation has moderated.

- Annual financial assets increased from ?24.1 lakh crore in 2019–20 to ?35.6 lakh crore in 2024–25, marking a 48% rise.

- As a share of GDP, however, asset formation declined from 12% to 10.8%, reflecting slower savings growth relative to economic expansion.

2. Faster Build-Up of Liabilities

Household borrowing has expanded sharply during the same period.

- Liabilities more than doubled, rising from ?7.5 lakh crore to ?15.7 lakh crore—a 102% increase.

- Their share in GDP rose from 3.9% to 4.7%.

- Household debt peaked at 6.2% of GDP in 2023–24, with a mild moderation in 2024–25, indicating early signs of financial stabilization.

3. Changing Savings Preferences

While bank deposits remain the principal savings instrument, households are increasingly moving toward:

- Mutual funds

- Market-linked products

- Non-traditional financial investments

This diversification points to a maturing financial ecosystem and improving financial literacy, but also increases exposure to market volatility.

Drivers of the Rising Debt Trend

- Post-pandemic consumption recovery, supported by increased reliance on credit.

- Housing and personal loans expanding faster than incomes, especially in urban India.

- Low or moderate interest rate cycles encouraging borrowing.

- Shift toward financialisation of households, with more participation in equity and debt markets.

Implications for the Economy

1. Pressure on the Household Savings Rate

A slower pace of savings growth may:

- Reduce the pool of domestic capital available for investment,

- Affect long-term capital formation,

- Increase dependence on external financing for growth.

2. Vulnerability to Economic Shocks

The rise in consumer leverage heightens exposure to:

- Interest-rate tightening,

- Income disruption due to economic downturns,

- Asset price corrections in financial markets.

3. Mixed Outcomes from Market-Linked Assets

While deeper financial participation is positive, households increasingly carry:

- Higher market risk,

- Greater sensitivity to financial cycles.

Conclusion

The latest RBI data reveal a structural shift in household balance sheets, with liabilities growing more rapidly than assets. Though this reflects rising aspirations and financial deepening, it also signals potential stress points if income growth fails to keep pace or if macroeconomic conditions tighten. Ensuring sustained income growth, robust consumer protection, and balanced credit expansion will be essential to preserve household financial resilience and support long-term economic stability.

Powering India’s Green Transition and Strategic Self-Reliance: The Role of Critical Minerals

- 03 Nov 2025

In News:

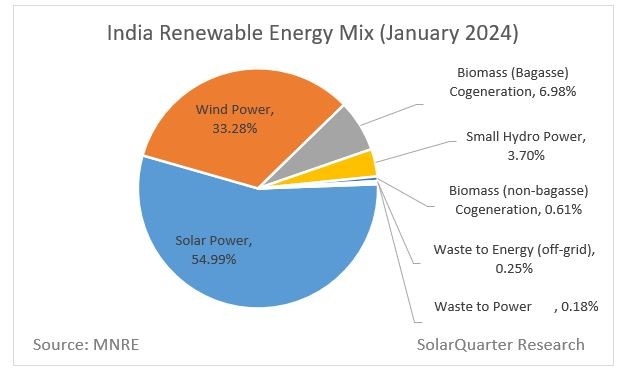

India’s commitment to achieving a low-carbon, technologically advanced economy has sharpened the focus on securing access to rare earths and critical minerals, which underpin clean energy systems, electronics, aerospace, and defence platforms. The launch of the National Critical Mineral Mission (2025) marks a decisive step toward building resilience in mineral supply chains and reducing external dependencies, thereby aligning India’s development trajectory with its climate and strategic objectives.

Significance of Rare Earths and Critical Minerals

Critical minerals are indispensable to the global green transition. They power electric vehicles (EVs), lithium-ion batteries, solar photovoltaics, wind turbines, and semiconductor devices. Their role extends into national security domains, informing the design of precision-guided weapons, jet engines, satellite systems, and next-generation communication networks. Rare earth elements (REEs)—a subset of critical minerals—enable high-strength magnets essential for renewable energy, robotics, and missile guidance. As countries race toward net-zero commitments, the demand for these minerals is projected to increase severalfold, amplifying concerns over supply vulnerabilities.

India’s Context: Climate Goals and Strategic Imperatives

India seeks to reduce the emissions intensity of its GDP by 45% by 2030 and achieve net-zero emissions by 2070. Meeting these targets requires rapid expansion of renewable energy and storage capabilities, both of which depend heavily on minerals such as lithium, cobalt, nickel, graphite, silicon, neodymium, and dysprosium. Despite possessing the fifth-largest rare earth reserves globally, India lacks adequate refining, metallisation, and magnet-manufacturing infrastructure, leading to significant reliance on imports. More than 60% of global processing capacity lies in China, exposing India to supply disruptions and geopolitical risks.

Applications Across Sectors

- Renewable Energy: Silicon, gallium, and indium drive photovoltaic technologies; rare-earth magnets enhance wind turbine efficiency.

- Electromobility & Storage: Lithium, cobalt, and nickel form the backbone of battery chemistry for EVs and grid-scale storage.

- Electronics & Semiconductors: Copper, tungsten, and tin support microprocessors, circuit boards, and high-end computing.

- Defence & Aerospace: Titanium alloys and REE magnets strengthen jet engines, missiles, and satellites.

- Medical Technologies: Critical minerals are used in MRI machines, pacemakers, and imaging equipment.

Challenges in Building a Secure Mineral Ecosystem

India faces multiple hurdles:

- High import dependence for crucial minerals and processing technologies.

- Technological gaps in advanced separation, refining, and recycling processes.

- Environmental concerns over mining-related pollution, requiring stringent safeguards.

- Regulatory delays due to fragmented jurisdiction and slow clearances.

- Skill and financing deficits for large-scale exploration and processing.

Government Initiatives

The National Critical Mineral Mission (2025) aims to create an end-to-end domestic value chain—from exploration to recycling. Reforms under the MMDR Act (2023) introduced 24 critical minerals for centralised auction, improving transparency. The KABIL joint venture has secured lithium assets in Argentina and strengthened partnerships with Australia. Customs duty exemptions on critical minerals (2025), establishment of processing parks, and the promotion of circular-economy-based recycling reflect a multi-pronged strategy.

Way Forward

India must prioritise building a domestic value chain encompassing exploration, processing, magnet manufacturing, and battery component production. Enhanced funding for R&D and startup innovation in refining and recycling technologies is essential. Diversifying imports through strategic partnerships, enforcing sustainable mining norms, and integrating mineral strategy with Make in India, the Green Hydrogen Mission, and energy transition policies will be critical.

Conclusion

Critical minerals form the backbone of India’s green transition and strategic autonomy. The National Critical Mineral Mission represents a shift toward resilience and long-term sustainability. By investing in exploration, innovation, and circularity, India can emerge as a global hub in the clean-tech and critical mineral value chain, strengthening both its climate commitments and national security.

The Employability Crisis in India: Rethinking Academia–Industry Collaboration

- 01 Nov 2025

In News:

India is grappling with a growing employability crisis, underscored by the fact that only 42.6% of graduates are considered job-ready. This mismatch between academic training and labour market needs has become a structural challenge, affecting productivity, economic growth, and youth aspirations. The crisis signals a systemic misalignment rather than a shortage of talent.

Understanding Employability

Employability today goes beyond academic qualifications. It includes the ability to:

- Acquire and apply knowledge in real-world contexts.

- Adapt to evolving technologies and workplace demands.

- Engage in lifelong learning, unlearning, and relearning.

- Demonstrate soft skills, value creation, and ethical behaviour.

Modern industries require graduates who combine technical capability with communication, teamwork, problem-solving, and a growth mindset.

Causes of the Academia–Industry Divide

Academic Factors

- Outdated Curriculum: Syllabi often fail to match rapid technological changes, new job roles, and automation trends.

- Theory-Oriented Pedagogy: Learning remains exam-centric with limited exposure to practical projects, internships, or problem-solving environments.

- Soft Skills Deficit: Institutions provide little training in communication, adaptability, workplace behaviour, and emotional intelligence.

Industry Factors

- High Expectations: Employers expect “ready-to-deploy” graduates but invest minimally in onboarding or mentoring.

- Rapid Technological Shifts: Industry skill needs evolve faster than academia can adjust, widening the skills gap.

- Weak Collaboration: Companies often view academic institutions as outdated, resulting in minimal engagement in curriculum design or research.

- Short-Term Approach: Recruitment is prioritised over building robust, long-term skill ecosystems.

Government and Institutional Initiatives

- National Education Policy (NEP) 2020: Encourages experiential learning, flexibility, internships, and stronger industry linkages.

- AICTE Internship Mandate: Requires engineering students to undergo industrial exposure.

- Skill India Mission: Strengthens vocational education through Sector Skill Councils aligned with market needs.

- NASSCOM FutureSkills PRIME: Upskills youth in digital technologies such as AI, data analytics, and cybersecurity.

These initiatives aim to modernise learning pathways and improve alignment with industry demands.

Challenges in Implementation

Despite reforms, several structural challenges persist:

- Curricular Inertia: Bureaucratic hurdles delay rapid updates in university syllabi.

- Fragmented Skills Ecosystem: Weak coordination among government, academia, and industry limits policy effectiveness.

- Faculty Skill Gaps: Many educators lack exposure to new technologies and contemporary workplace practices.

- Urban–Rural Divide: Smaller and rural institutions suffer from poor infrastructure and limited corporate linkages.

- Low Industry Investment: Companies underinvest in academia–industry partnerships and long-term talent development.

Way Forward

- Structural Reforms

- Curriculum Co-Design: Regular, collaborative revision of syllabi with inputs from employers, universities, and policymakers.

- Dual-Learning Model: Embed apprenticeships, live projects, and work-integrated learning into higher education.

- Faculty Immersion: Promote faculty internships, industry sabbaticals, and continuous upskilling.

- Skills and Ethics

- Soft Skills & Ethics Labs: Establish dedicated centres for communication, workplace ethics, and emotional intelligence.

- Outcome-Based Tracking: Use data to monitor alumni career trajectories and skill relevance.

- Industry Engagement: Incentivise long-term corporate participation in curriculum development, research, and training.

Conclusion

India’s employability challenge is fundamentally an issue of alignment, not ability. Bridging the gap between academia and industry requires shared responsibility, continuous innovation, and sustained collaboration. When education becomes practical, dynamic, ethical, and closely connected to the world of work, India can unlock its demographic potential and build a resilient, future-ready workforce.

Poverty Measurement in India: Revisiting the Rangarajan Line and the Rise of Multidimensional Poverty

- 21 Oct 2025

In News:

The debate on poverty measurement in India has gained renewed significance with the Reserve Bank of India’s Department of Economic and Policy Research (DEPR) updating state-wise poverty estimates using the 2022–23 Household Consumption Expenditure Survey (HCES). This marks the first major recalibration of the C. Rangarajan Committee’s poverty line, originally formulated in 2014, and reflects shifting paradigms in assessing deprivation in India.

Revisiting the Rangarajan Framework

The Rangarajan Committee was tasked with redefining poverty beyond the earlier Tendulkar methodology. It fixed the poverty line at ?972 per capita per month in rural India and ?1,407 in urban areas (2011–12 prices), categorising about 29.5% of the population as poor. Its poverty basket focused on minimum nutritional requirements along with basic spending on health, education, fuel, clothing, and rent. Unlike later approaches, it offered a strict consumption-based benchmark rooted in monetary expenditure.

Updated Poverty Trends: State-wise Insights

RBI economists reconstructed poverty lines for 20 major states based on HCES 2022–23 data using a new price index aligned with the original poverty line basket rather than Consumer Price Index weights. The findings highlight remarkable improvements, with major reductions observed in traditionally backward states:

- Odisha: Rural poverty fell from 47.8% (2011–12) to 8.6% (2022–23)

- Bihar: Urban poverty dropped from 50.8% to 9.1%

- Kerala: Rural poverty declined to 1.4%; Himachal Pradesh’s urban poverty fell to 2%

- Lowest poverty levels: Rural Himachal Pradesh (0.4%) and urban Tamil Nadu (1.9%)

- Highest poverty levels: Chhattisgarh (25.1% rural; 13.3% urban)

These transformations reflect improved rural infrastructure, livelihood programmes, PDS reforms, and social transfers. Yet persistent poverty in central Indian states underscores uneven development and structural gaps in employment quality, agrarian distress, and welfare delivery.

Methodological Continuity and Debate

Poverty estimates vary sharply across institutions, illustrating the sensitivity of measurement frameworks:

- SBI (2023–24): ~4–5% poverty

- World Bank (2022): 10.2% poverty in 2019

- IMF (2022): 0.8% in 2019 (including food transfers)

These disparities stem from differing inflation adjustments, survey datasets, and treatment of welfare subsidies. They also fuel a longstanding debate: can income-based poverty capture human deprivation comprehensively, especially in a transforming economy with evolving consumption patterns?

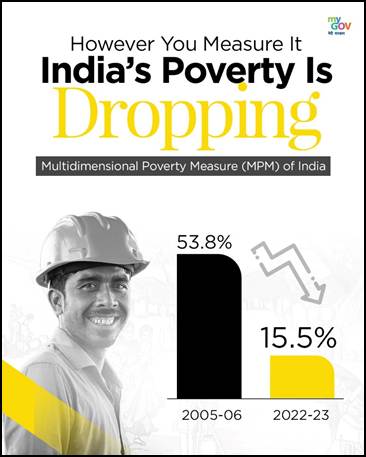

Shift to Multidimensional Poverty

Official focus has now decisively shifted to multidimensional poverty aligned with SDG frameworks. India’s Multidimensional Poverty Index (MPI) evaluates deprivation across twelve indicators spanning health, education, and living standards. According to NITI Aayog (2024), 24.82 crore people exited multidimensional poverty between 2013–14 and 2022–23, reducing MPI from 29.17% to 11.28%. This highlights the impact of welfare architecture—PDS expansion, Ujjwala, Saubhagya, Jal Jeevan Mission, Swachh Bharat, and financial inclusion.

Way Forward

- Regular poverty line updates reflecting new consumption patterns and regional price realities

- Integration of income and multidimensional metrics for balanced welfare planning

- Timely survey releases and transparent data to strengthen evidence-based policymaking

- Targeted interventions for lagging states like Chhattisgarh, Jharkhand, and parts of UP

- Leveraging digital delivery systems to minimise leakages and enhance inclusivity

Conclusion

India’s poverty trajectory reflects a dual narrative—sharp improvements driven by welfare provisioning and growth, yet uneven progress across regions and methodological contestation. While the Rangarajan line continues to serve as a benchmark for monetary poverty, the dominance of multidimensional metrics signals a shift towards understanding deprivation as a matter of human capability, not merely income. Ensuring sustained and equitable poverty reduction will require methodological rigor, policy innovation, and heightened focus on lagging geographies to achieve inclusive development.

Google’s $15 Billion AI Data Centre in Andhra Pradesh

- 18 Oct 2025

In News:

Google’s announcement of a USD 15-billion investment to establish an Artificial Intelligence (AI) data centre in Visakhapatnam marks a transformational moment in India’s digital infrastructure landscape. The initiative, the largest single investment by Google in India, comes amid a geo-economic context of recalibrating India-US relations and the government’s emphasis on technological self-reliance and swadeshi digital systems. The project positions India as an emerging hub in global AI capability and computing power.

Why AI Data Centres Matter

AI-focused data centres differ fundamentally from conventional facilities. While traditional data centres are built around CPU-based servers to support cloud storage, websites, and enterprise applications, AI data centres rely on high-performance GPUs to handle data-heavy and compute-intensive workloads such as generative AI, advanced analytics, image/video processing, and deep-learning models. This makes them significantly more power-intensive and infrastructure-demanding, requiring robust energy supply and advanced cooling systems.

According to estimates cited by Google, the Visakhapatnam AI hub is expected to add at least USD 15 billion to the US GDP between 2026 and 2030 through increased AI adoption and cloud-driven activity, demonstrating the cross-border economic impact of such investments.

Partnerships and Green Infrastructure

The facility is being developed in partnership with AdaniConneX and Airtel, leveraging the same backbone used for Google’s global platforms like Search, YouTube, and Workspace. The project includes building a major subsea cable landing station, linking eastern India to Google’s expansive global cable network, enhancing international data routes and reducing latency.

A key dimension of the partnership lies in sustainable power and energy independence. AdaniConneX, a joint venture between Adani Enterprises and EdgeConneX, will provide 100% clean energy, supported by new transmission lines, renewable generation, and energy storage facilities in Andhra Pradesh. This aligns with India’s climate commitments and enhances grid resilience.

Economic Impact and Capacity Expansion

India’s data centre industry, currently valued at ~USD 10 billion with USD 1.2 billion in FY24 revenue, is projected to add 795 MW of capacity by 2027 — reaching 1.8 GW. Google’s project alone is expected to generate nearly 1.88 lakh direct and indirect jobs, strengthening regional development and high-skilled employment.

However, high capital costs and limited job intensity remain policy concerns. Approximately 40% of capex in data centres goes towards electrical systems, and 65% of operating costs are attributed to electricity, with ~?60–70 crore required per MW of capacity. This necessitates a careful assessment of incentives and long-term strategic benefits.

Energy Security and the Nuclear Option

The International Energy Agency (IEA) predicts that global data-centre electricity demand may double by 2026, raising questions around sustainability. While renewable energy remains the mainstay, its intermittency has prompted policy consideration of nuclear energy as a round-the-clock clean power source — a trend already visible in the United States and now emerging in India’s energy strategy.

Conclusion

Google’s AI hub in Visakhapatnam represents a strategic convergence of digital infrastructure, clean-energy innovation, and global technological cooperation. For India, it underscores the dual challenge of expanding digital capability while ensuring energy security and environmental sustainability. The success of this initiative will influence India’s journey toward becoming a global digital superpower underpinned by resilient, sovereign, and sustainable compute ecosystems.

2025 Nobel Prize in Economic Sciences: Understanding Innovation-Driven Growth

- 16 Oct 2025

In News:

The 2025 Nobel Prize in Economic Sciences has been awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their seminal contributions to explaining how innovation drives long-term economic growth. Their work collectively answers a fundamental question in development economics: why has sustained growth become the norm in the last two centuries, despite millennia of stagnation? While Mokyr approaches the issue through economic history, Aghion and Howitt construct a formal model illustrating the dynamics of innovation and competition in modern economies.

Mokyr’s Framework: Useful Knowledge and Openness to Change

Joel Mokyr argues that economic stagnation persisted through most of human history because innovation lacked a strong scientific foundation. Prior to the Industrial Revolution, technological progress was primarily prescriptive—people knew how to produce goods but not why processes worked as they did. This limited systematic improvement.

The transformation began during the Scientific Revolution (16th–17th centuries) when controlled experimentation, measurement, and reproducibility became central to knowledge creation. This generated “useful knowledge”—a synergy of propositional (scientific principles) and prescriptive (practical techniques) knowledge. Examples include improvements in the steam engine driven by insights into atmospheric pressure and advancements in steel production based on understanding carbon reduction in iron.

However, knowledge alone was not sufficient. Societal openness to change, a hallmark of Enlightenment thought, enabled technological disruption. Acceptance of new ideas, weakening of entrenched elites, and institutional reforms—from the British Parliament curbing aristocratic privileges to society’s rejection of Luddite resistance to machinery—allowed innovations to diffuse widely. According to Mokyr, skills-based human capital and a culture supportive of disruption are crucial pillars of sustained growth.

Aghion–Howitt’s Creative Destruction Model

Drawing on Joseph Schumpeter’s concept of creative destruction, Aghion and Howitt develop a rigorous macroeconomic model explaining how innovation displaces old technologies and firms, generating productivity gains. Their model shows that firms invest in research and development (R&D) to secure temporary monopoly power through patents. This monopoly incentivizes innovation, yet it is continually threatened by newer technologies. Thus, growth emerges from a constant cycle of competition, firm turnover, and technological leaps.

Importantly, their general equilibrium framework links household savings, financial markets, production decisions, and innovation incentives, demonstrating that micro-level disruptions are essential for macro-level stability. Empirical trends—such as high annual firm entry and exit rates in developed economies—support their argument.

Policy Implications

The Nobel findings highlight key contemporary debates:

- R&D Subsidies: Innovation has positive spillovers beyond private profit. Public funding can correct under-investment, but excessive subsidies risk waste where gains are marginal.

- Social Safety Nets: Creative destruction benefits economies but harms displaced workers and firms. A balanced welfare ecosystem ensures societies remain open to technological change.

- Skilling and Human Capital: To convert ideas into output, governments must invest in education, vocational training, and research ecosystems.

Conclusion

The 2025 Nobel laureates collectively establish that economic growth is neither automatic nor guaranteed—it is the result of science-based knowledge creation, institutional openness, and dynamic competition. For emerging economies like India, fostering innovation-driven growth requires strong research systems, regulatory flexibility, investment in human capital, and social policies that cushion transition shocks. Their work underscores that sustainable progress lies in embracing change, not resisting it.

India’s Grain-Driven Ethanol Transition: Shifting Paradigms in Biofuel Policy

- 15 Oct 2025

In News:

India’s ethanol blending programme, originally launched to reduce oil imports and stabilise the sugar industry, is undergoing a transformative shift. What began as a sugarcane-centric initiative has evolved into a grain-based ethanol ecosystem, reflecting structural changes in agricultural markets, energy policy, and rural industrialisation. For the first time, grain-derived ethanol—predominantly from maize—has surpassed sugarcane-based production, marking a pivotal moment in India’s biofuel sector.

Evolution of Ethanol Blending

The Ethanol Blending Programme (EBP) was initially designed to create additional revenue streams for sugar mills and ensure timely payments to cane growers. Early production relied on C-heavy molasses, a by-product of sugar extraction. Policy reforms in 2018 incentivised diversion of B-heavy molasses and even direct cane juice toward ethanol, raising supplies from 38 crore litres in 2013-14 to nearly 189 crore litres by 2018-19, and increasing blending levels from 1.6% to nearly 5%. This stabilised the sugar economy and boosted rural incomes.

Rise of Grain-Based Ethanol

A crucial turning point came when the government permitted ethanol production from grains such as maize, rice, and damaged foodgrains, offering differential pricing to attract investment. Grain-based distilleries rapidly expanded across Punjab, Haryana, Bihar, Madhya Pradesh, Maharashtra, Karnataka, and other states, with over ?40,000 crore invested in facilities capable of using multiple feedstocks.

By 2023-24, of the 672.49 crore litres supplied to Oil Marketing Companies (OMCs), almost 60% came from grains, with maize accounting for the largest share. In 2024-25, grain-based ethanol procurement is expected to reach 620 crore litres, with maize alone contributing about 420 crore litres. Drought-induced sugarcane shortages and more attractive prices—?71.86 per litre for maize-based ethanol versus ?57.97–65.61 per litre for cane-based routes—accelerated the shift.

Capacity and Policy Dynamics

India today hosts 499 distilleries with an annual ethanol capacity of 1,822 crore litres. Against a 20% blending target, OMCs sought 1,050 crore litres for 2025-26, but received offers exceeding 1,776 crore litres—signalling emerging overcapacity. While this capacity enhances energy security and reduces crude imports (over $160 billion annually), it introduces new challenges in balancing supply, food security, and price stability.

Challenges: Food Security, Sustainability, and Market Balance

India now faces a classic food-versus-fuel dilemma. Producing ~420 crore litres of maize ethanol consumes over 11 million tonnes of maize, nearly 26% of national output. With maize being vital for poultry and livestock feed, diversion to fuel can raise feed costs and food inflation. Similarly, viability of rice-based ethanol hinges on surplus FCI stocks—an uncertain variable.

Environmental concerns are also emerging. While ethanol reduces carbon emissions, grain-based production increases pressure on water, land, and fertiliser use, particularly in maize-growing regions.

Way Forward

Policy refinements are underway to ensure a balanced biofuel strategy. A dual-feedstock approach—leveraging both cane and grains—along with scaling second-generation (2G) biofuels from agricultural waste, is expected to drive future growth. Adequate stock monitoring, sustainable cultivation practices, and technological innovation will be critical for achieving the 20% blending target by 2025-26 without compromising food security.

Conclusion

India’s ethanol revolution demonstrates strategic economic diversification, rural industrialisation, and commitment to energy transition. However, sustaining this momentum requires calibrated policies aligning energy security with agricultural sustainability, food availability, and environmental stewardship—critical considerations for a resilient and self-reliant biofuel future.

Credit Reforms to Deepen Financial Markets

- 13 Oct 2025

In News:

India’s journey toward Viksit Bharat 2047 hinges on simultaneously nurturing human capital and modernising financial institutions. Two recent developments reflect this integrated approach: the Viksit Bharat Buildathon 2025 and the Reserve Bank of India’s initiatives to strengthen financial markets and internationalise the rupee. Together, they illustrate India's twin strategy of empowering youth as innovation leaders while deepening economic capacity and regional influence.

Fostering a Culture of Innovation: Viksit Bharat Buildathon 2025

- The Viksit Bharat Buildathon, launched by the Ministry of Education in collaboration with NITI Aayog’s Atal Innovation Mission, is India’s largest school-level hackathon, engaging 1 crore students across classes 6–12.

- Aligned with NEP 2020, it aims to build problem-solving aptitude and innovation competencies from grassroots levels. Students work in teams to design prototypes based on four themes central to India’s development discourse—Atmanirbhar Bharat, Swadeshi, Vocal for Local, and Samriddh Bharat.

- The event adopts a phased structure: registrations (September), nationwide live build on 13 October 2025, and final evaluation by December. With Rs 1 crore award pool and dedicated mentorship from innovation networks and higher education institutions, it incentivises early exposure to experiential learning, creativity, and entrepreneurship. Importantly, it prioritises participation from Aspirational Districts, tribal belts, and frontier regions, promoting inclusivity in innovation ecosystems.

- By integrating rural and underserved communities, the initiative aligns with the principle of technology-enabled social justice and fosters an innovation-ready workforce. It positions schoolchildren not merely as future beneficiaries but as current contributors to nation-building—a step crucial for demographic dividend utilisation.

Rewiring India’s Financial System: RBI’s Strategic Reforms

Parallelly, the Reserve Bank of India has initiated significant policy reforms to bolster India’s financial depth and global standing. It has permitted banks to finance corporate mergers and acquisitions—a domain previously dominated by NBFCs—allowing formal banking channels to support corporate consolidation, expansion, and competitiveness. This move reflects confidence in banking sector resilience and recognises that scale and efficiency are essential for domestic firms in a globalising economy.

In a landmark regional diplomacy initiative, RBI has authorised Indian banks and their overseas branches to provide rupee-denominated loans to residents of neighbouring countries. This step supports rupee internationalisation, reduces dependence on the US dollar for regional transactions, and enhances India’s financial influence, especially amid global currency contestations.

Additional measures—such as raising the limit for loans against shares to Rs 1 crore, enabling investment of surplus Special Rupee Vostro Account balances in corporate bonds, and widening currency benchmarking—will deepen capital markets, enhance liquidity, and improve foreign participation confidence.

Conclusion

The Buildathon and RBI reforms, though sectorally distinct, serve a shared national objective: building a self-reliant, innovation-driven, globally confident India. While one invests in future innovators and inclusive talent pipelines, the other strengthens the institutional financial ecosystem needed to support economic expansion and regional leadership. Together, they represent India’s holistic developmental approach—nurturing minds, empowering markets, and globalising national capabilities in pursuit of Viksit Bharat.

Corporate Average Fuel Efficiency (CAFE) 3 Norms

- 03 Oct 2025

In News:

- India has proposed the Corporate Average Fuel Efficiency (CAFE) 3 norms, drafted by the Bureau of Energy Efficiency (BEE), aiming to tighten fuel efficiency standards, reduce vehicular emissions, and promote electric and alternative fuel vehicles.

- First introduced in 2017, CAFE norms regulate fuel consumption and CO? emissions for passenger vehicles weighing up to 3,500 kg, including petrol, diesel, CNG, LPG, hybrid, and electric vehicles.

- The earlier iteration, CAFE 2 (2022-23), capped fuel consumption at 4.78 litres/100 km and CO? emissions at 113 g/km, with penalties for non-compliance.

Need for CAFE 3

Current Indian norms inadvertently favourheavier vehicles like SUVs while imposing stringent targets on smaller cars, unlike international practices in the USA, EU, China, and Japan, where light vehicles enjoy relaxed emission standards. CAFE 3 seeks to align India with global best practices, revive the small car segment, and incentivisegreen mobility, particularly electric vehicles (EVs) and hybrids.

Key Features of CAFE 3 Norms

1. Applicability

- Targets M1 category passenger vehicles (seating up to nine people, maximum weight 3,500 kg).

- Non-compliance will attract penalties under the Energy Conservation Act, 2001.

2. Efficiency Targets

- Efficiency formula: [0.002 × (W – 1170) + c], measured in petrol-equivalent litres/100 km, where W is fleet weight, 1,170 kg is a fixed constant, 0.002 is a multiplier, and ‘c’ decreases yearly from 3.7264 (FY28) to 3.0139 (FY32).

- Lighter vehicles benefit from easier compliance, motivating manufacturers to focus on small cars.

- Additional relaxation: 3.0 g CO?/km (capped at 9 g/km) for compact cars (<909 kg, ≤1200 cc engine, ≤4,000 mm length).

3. Incentives for EVs and Alternative Fuels

- Super credits: Each EV sold counts three times toward fleet compliance; plug-in hybrids 2.5×, strong hybrids 2×, flex-fuel ethanol vehicles 1.5×.

- Carbon Neutrality Factor (CNF): Offers relaxation based on fuel type (e.g., E20–E30 petrol vehicles 8% CNF; strong hybrids 22.3%).

4. Emissions Pooling

- Up to three manufacturers can form a pool, treated as a single entity for compliance.

- Pool managers are legally responsible for penalties, allowing strategic partnerships, cost-sharing, and smoother adherence to targets.

Policy Complementarities

- GST reforms (GST 2.0) reduced taxes on small cars from 28% to 18%, complementing the relaxation measures under CAFE 3.

- By incentivisingEVs, hybrids, and small vehicles, the norms aim to reduce oil import dependency and advance India’s climate commitments under the Paris Agreement.

Challenges

- Industry adaptation: Transitioning fleets to comply with stricter norms while managing costs.

- Consumer acceptance: Affordability and infrastructure readiness for EVs and hybrids.

- Infrastructure readiness: Charging and fuel infrastructure for alternative vehicles needs significant expansion.

Conclusion

CAFE 3 represents a transformative step in India’s vehicular emission regulation, combining fuel efficiency improvements, emission reductions, and green mobility incentives. By aligning with global practices, reviving the small car segment, and encouraging electric and hybrid vehicles, the norms have the potential to accelerate sustainable transportation while addressing environmental and energy security goals. Successful implementation will require coordinated action between manufacturers, policymakers, and consumers to build a cleaner, efficient, and resilient automotive sector in India.

Reimagining Green Economy through Landscapes

- 02 Oct 2025

In News:

India stands at a critical juncture where the pursuit of economic growth must align with environmental sustainability. The transition to a green economy offers an opportunity to reshape the country’s development paradigm—one that integrates ecological balance, inclusive livelihoods, and technological innovation within a landscape-driven framework.

India’s Green Economy: Growth and Scope

India’s bioeconomy has expanded remarkably from $10 billion in 2014 to $165.7 billion in 2024, growing sixteenfold and accounting for 4.25% of the national GDP. This growth, driven by over 10,000 bio-based start-ups, spans biofuels, bioplastics, pharmaceuticals, and bioinformatics. The industrial bioeconomy contributes nearly half the sectoral share, while India’s achievements—such as 20% ethanol blending in petrol and becoming the third-largest pharmaceutical producer by volume—reflect the scale of progress.

A green economy, however, extends beyond bio-based industries. It encompasses low-carbon growth, circular resource use, ecosystem restoration, and inclusive employment. By 2030, it is estimated to create 35 million green jobs, strengthening India’s resilience against climate shocks and enhancing energy security under Aatmanirbhar Bharat.

Challenges in the Green Transition

Despite this momentum, India’s green growth exhibits deep regional and socio-economic disparities. Urban centers like Maharashtra, Karnataka, and Gujarat dominate green investments, while the North-Eastern and tribal states contribute less than 6% despite abundant natural resources. This spatial imbalance mirrors unequal access to clean energy, irrigation, and digital infrastructure.

Simultaneously, energy transition dilemmas persist. While renewables are expanding, fossil fuel subsidies—still around 40%—undermine emission reduction efforts. In agriculture, solar pump deployment risks groundwater depletion, highlighting the complexity of balancing environmental and livelihood goals. Hard-to-abate sectors such as steel, cement, and power, which contribute nearly 23% of GHG emissions, face prohibitive costs for green technologies—often four times higher than conventional alternatives.

Social inclusion remains another challenge. Women hold only 11% of rooftop solar jobs, and their share in technical green roles is as low as 1–3%. Similarly, tribal and marginalised communities remain passive beneficiaries rather than active stakeholders in climate action.

Reimagining the Green Economy through Landscapes

A landscape-based approach can make India’s green transition more inclusive and ecologically coherent. Landscapes represent interconnected systems of land, water, biodiversity, and human activity. Integrating these systems through participatory planning—from village to national level—can enhance ecosystem services such as air and water regulation, soil fertility, and climate moderation.

Institutionally, leveraging 2.5 lakh Panchayati Raj Institutions (PRIs) and 12 million women-led Self-Help Groups (SHGs) can embed community ownership into green initiatives. Promoting tribal-led bioeconomy models based on non-timber forest produce, agro-waste reuse, and medicinal flora can align conservation with livelihoods.

Technology and fiscal innovation must complement this vision—through green budgeting, public procurement of sustainable products, and expansion of 5G/6G labs for greening digital infrastructure. Decentralised waste management and circular economy practices are vital, especially as urban areas generate 75% of India’s solid waste.

Conclusion

India’s green transformation must evolve from a sectoral to a landscape-driven, community-based model that harmonises economic growth with ecological integrity. Empowering local institutions, mainstreaming gender, and integrating traditional knowledge with modern innovation will be crucial to achieving a just and resilient green future. By 2047, the goal should not merely be higher GDP, but ecological regeneration, social equity, and global climate leadership.

Inflation: A Double-Edged Sword for Economic Growth and Fiscal Stability

- 30 Sep 2025

In News:

Inflation, the sustained rise in general price levels, remains one of the most debated macroeconomic phenomena. While high inflation erodes purchasing power and destabilizes economies, moderate and predictable inflation is often considered essential for sustained growth and fiscal stability. Its impact, however, varies depending on the broader economic context and the balance between price stability and growth objectives.

Understanding Inflation and Its Role

Economists typically define inflation as a result of “too much money chasing too few goods.” Moderate inflation signals expanding demand and healthy economic activity, while very high or negative inflation (deflation) indicates structural imbalances. Central banks, such as the U.S. Federal Reserve and the Reserve Bank of India (RBI), usually target a low but positive inflation rate — around 2% — to maintain price stability and incentivize investment.

Mild inflation helps prevent deflation, which discourages spending and investment as consumers postpone purchases in anticipation of falling prices. The British economist John Maynard Keynes argued that a small amount of inflation encourages consumption, supports employment, and sustains aggregate demand. This aligns with the concept of the Phillips Curve, which once suggested a trade-off between inflation and unemployment, though the relationship has weakened in recent decades.

Economic Benefits of Moderate Inflation

A modest level of inflation can stimulate economic activity when idle capacity and underutilized labor exist. Rising prices encourage producers to expand output, generating more employment and income. Borrowers, including businesses and households, also benefit since debts can be repaid with “cheaper” money, thus encouraging borrowing and spending. Fixed-rate homeowners and long-term debtors gain, as the real value of their obligations declines over time.

For governments, inflation contributes positively to nominal GDP growth, the key denominator in fiscal ratios such as the debt-to-GDP ratio and fiscal deficit. Higher nominal GDP, driven partly by price growth, increases tax collections and helps meet revenue and deficit targets. Hence, inflation, within manageable limits, supports both macroeconomic stability and fiscal sustainability.

Challenges of High or Low Inflation

Excessive inflation, however, leads to declining real incomes, uncertainty, and reduced investment. Rising input and borrowing costs can trigger stagflation — a combination of stagnant growth and high inflation. On the other hand, very low inflation, as seen in India recently with CPI inflation at 2.07% (August 2025) and WPI at 0.52%, presents a different set of challenges.

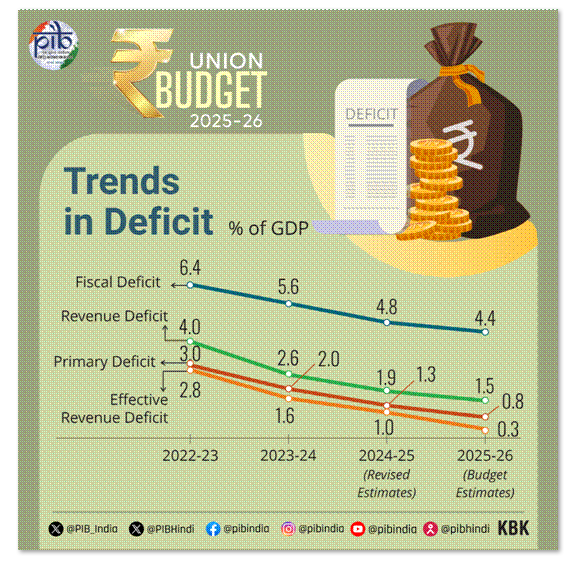

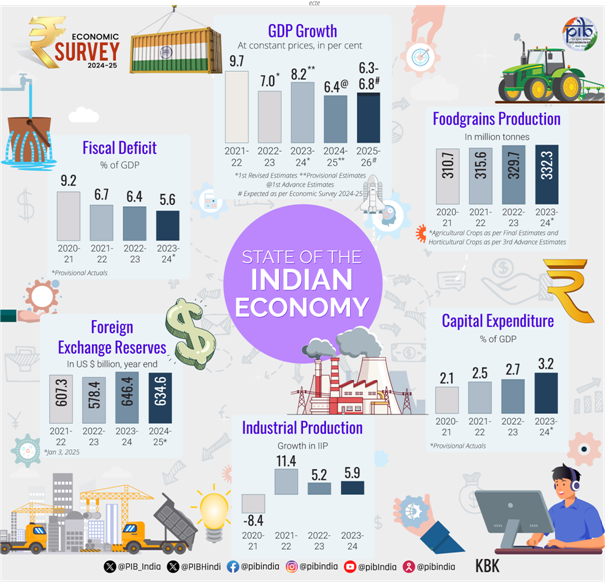

While subdued prices benefit consumers, they constrain the government’s fiscal arithmetic. Lower inflation suppresses nominal GDP growth — the sum of real growth and inflation — reducing tax revenue growth and widening fiscal gaps. The Union Budget 2025–26 projected nominal GDP growth at 10.1%, but with low price levels, actual growth has trailed this target, weakening revenue collection and straining fiscal balances.

Moreover, persistently low inflation can reflect weak demand and investment sentiment. Although corporate profits have risen due to falling input costs, private capital expenditure remains sluggish, suggesting that firms are not reinvesting profits into productive capacity — a sign of demand-side weakness rather than efficiency gains.

Conclusion

Inflation’s impact on an economy depends on its source, magnitude, and persistence. Moderate inflation supports economic dynamism, government finances, and debt sustainability. However, extremes on either side — hyperinflation or deflation — can destabilize the macroeconomic framework. For India, the policy challenge lies in maintaining a delicate balance: ensuring that inflation stays within the target range to protect consumers while sustaining enough price growth to support investment, job creation, and fiscal health.

Rising State Debt in India: CAG’s Decadal Analysis and Fiscal Implications

- 22 Sep 2025

In News:

The Comptroller and Auditor General (CAG) of India has released a first-of-its-kind decadal report (2013–14 to 2022–23) analysing the fiscal health of Indian states, highlighting a worrying surge in public debt and its implications for fiscal sustainability and cooperative federalism.

Understanding Public Debt

- Public debt arises when government expenditure exceeds revenue from taxes and other receipts, prompting borrowing to bridge the fiscal gap. For states, such debt includes liabilities under the Consolidated Fund of the State, comprising internal debt and loans and advances from the Centre.

- Internal debt consists of marketable securities like government bonds and treasury bills, and non-marketable debt such as loans from financial institutions like LIC and NABARD or the Reserve Bank’s Ways and Means Advances (WMA).

- The Debt-to-GSDP ratio is a key indicator of fiscal sustainability, reflecting a state’s capacity to service its debt. A higher ratio implies greater fiscal stress.

- The NK Singh Committee on FRBM (2016) recommended a combined general government debt ceiling of 60% of GDP — 40% for the Centre and 20% for states.

Key Findings of the CAG Report

- The CAG report reveals that the aggregate public debt of 28 states trebled over the past decade — from ?17.57 lakh crore in 2013–14 to ?59.60 lakh crore in 2022–23.

- As a share of combined GSDP, debt rose from 16.66% to 22.96%, with state debt accounting for 22.17% of India’s GDP in FY 2022–23.

Inter-State Variations

Fiscal vulnerability varies widely:

- Highest debt-to-GSDP ratios: Punjab (40.35%), Nagaland (37.15%), and West Bengal (33.70%).

- Lowest ratios: Odisha (8.45%), Maharashtra (14.64%), and Gujarat (16.37%).

As of March 2023, eight states had debt exceeding 30% of GSDP, while six states maintained it below 20%.

Debt Sustainability and Composition

- The states’ debt-to-revenue receipts ratio ranged from 128% (2014–15) to 191% (2020–21), averaging about 150% of total receipts.

- The debt-to-GSDP ratio oscillated between 17–25%, with a sharp rise during the COVID-19 pandemic year (2020–21) due to falling GSDP and increased borrowing for relief and GST compensation.

- Major sources of debt include open market borrowings, RBI advances, institutional loans, and back-to-back loans from the Centre in lieu of GST shortfall and capital assistance.

Fiscal Management Concerns

- The report flags a violation of the “golden rule of borrowing”, which stipulates that governments should borrow only for capital formation, not to finance revenue expenditure.

- Eleven states, including Andhra Pradesh, Punjab, Kerala, and West Bengal, used borrowings to fund current expenses.

- In Andhra Pradesh, only 17% of borrowings went to capital expenditure; in Punjab, 26%.

Such practices threaten fiscal sustainability, crowd out productive investments, and risk pushing states into a debt trap, thereby undermining macroeconomic stability.

Way Forward

- Fiscal Discipline: States must prioritise borrowing for productive infrastructure and avoid financing recurring expenditure.

- Debt Management Reforms:Operationalising the Public Debt Management Agency (PDMA) could ensure transparency and better coordination in debt operations.

- Revenue Strengthening: Enhancing tax buoyancy, rationalising subsidies, and diversifying revenue bases can reduce dependence on central transfers.

- Adherence to FRBM Targets: States should align fiscal deficit and debt ratios with FRBM norms to ensure long-term sustainability.

- Institutional Oversight: Strengthening State Finance Commissions and CAG monitoring can promote accountable and sustainable fiscal federalism.

Conclusion

The surge in state-level debt underscores the growing strain on subnational fiscal capacity. While borrowing is essential for development, unchecked debt accumulation and non-productive spending threaten fiscal stability. Ensuring fiscal prudence, efficient debt management, and adherence to reform frameworks like FRBM are vital to preserving India’s long-term macroeconomic resilience and cooperative federal balance.

WAVES Bazaar 2.0

- 21 Sep 2025

In News:

India’s media and entertainment (M&E) industry is experiencing rapid digital transformation, fueled by rising global collaborations and the growing influence of independent creators. To channel this momentum and establish India as a global content hub, the Ministry of Information and Broadcasting (I&B) launched WAVES Bazaar in January 2025—a first-of-its-kind hybrid content marketplace that connects creators, investors, and distributors across various media segments.

Now entering its second phase, WAVES Bazaar is expanding with AI-driven matchmaking, online pitching sessions, and secure viewing rooms—initiatives aimed at strengthening India’s creative ecosystem and democratizing access for new talent.

About WAVES Bazaar

WAVES Bazaar serves as a digital platform bringing together diverse stakeholders from films, television, animation, gaming, music, radio, advertising, and podcasts. It allows creators to network, pitch ideas, and collaborate with OTT platforms, production houses, distributors, and financiers.

Key Features of the Second Phase

- Online Pitching and Viewing Rooms:Budding creators will now be able to pitch directly to production houses, OTT platforms, and investors through virtual sessions. The addition of secure online viewing rooms will allow content buyers to preview projects safely, ensuring transparency and intellectual property protection.

- AI-Driven Matchmaking and Profiling:Artificial Intelligence will enhance the platform’s efficiency by recommending suitable collaborators—such as financiers, distributors, or genre-specific buyers—based on project details. The system will also support automated profile building, pitch deck creation, and project scoring, guiding creators to improve their market visibility.

- Skill Development and Knowledge Hub:The second phase introduces a knowledge ecosystem comprising webinars and masterclasses by industry experts. These sessions aim to bridge the knowledge gap for emerging creators and provide mentorship on project development, financing, and global trends.

- Global Outreach and Co-Production Opportunities:WAVES Bazaar will expand its international footprint through delegations and participation in global festivals. It also seeks to strengthen co-production treaties with partner countries, promoting cross-border collaboration and investment in India’s creative sectors.

Significance for India’s Creative Economy

The initiative aligns with India’s ambition to become a global content hub by enabling equal opportunities for small and independent creators. It aims to diversify creative exports beyond films into music, gaming, animation, podcasts, and short-form content, while also enhancing India’s soft power and digital cultural economy.

By integrating technology, mentorship, and market access, WAVES Bazaar could emerge as the central gateway for Indian creative exports, fostering innovation and sustainable growth in the sector.

Challenges and Way Forward

While the portal’s potential is immense, its success will depend on addressing data security, ensuring inclusive access for regional creators, and maintaining long-term international partnerships. If implemented effectively, WAVES Bazaar 2.0 can position India as a leading creative powerhouse, bridging the gap between talent and opportunity in the global digital age.

SEBI Announces Major Market Reforms to Enhance Investment and Governance

- 18 Sep 2025

In News:

The Securities and Exchange Board of India (SEBI) recently announced a set of comprehensive reforms aimed at improving foreign investment inflows, easing IPO norms for large issuers, strengthening governance in market infrastructure institutions (MIIs), and promoting financial inclusion. These reforms are introduced amid heightened global uncertainty, with foreign portfolio investors (FPIs) withdrawing over ?63,500 crore from Indian markets since July 2025 due to weak earnings, high valuations, and international trade tensions.