India’s First Legal Framework for Contaminated Site Management

- 31 Jul 2025

In News:

The Government of India, through the Ministry of Environment, Forest and Climate Change (MoEFCC), has taken a landmark step toward formalising the management of chemically polluted land. The government notified the Environment Protection (Management of Contaminated Sites) Rules, 2025 under the Environment (Protection) Act, 1986, offering for the first time a legal framework to identify, assess, and remediate contaminated sites across the country.

Understanding Contaminated Sites

Contaminated sites refer to locations where hazardous chemicals or waste have been dumped historically, often prior to the existence of environmental regulation. These sites typically include:

- Abandoned industrial landfills

- Defunct chemical handling units

- Waste storage and spill zones

According to the Central Pollution Control Board (CPCB), 103 such sites have been identified across India, though remediation has been initiated in only 7. The lack of legal clarity and the inability to identify responsible parties have long hindered remediation efforts.

Salient Features of the 2025 Rules

The rules codify a five-step process that places the onus on local administrations and pollution control authorities to address environmental contamination:

- Identification & Reporting: District administrations must compile biannual reports of “suspected contaminated sites” and forward them to the State Pollution Control Boards (SPCBs) or a designated reference agency.

- Preliminary Assessment: Within 90 days, these agencies must assess the site for probable contamination.

- Detailed Site Survey: If contamination is suspected, a follow-up survey—within another 90 days—will test for any of the 189 hazardous chemicals notified under the Hazardous and Other Wastes Rules, 2016.

- Remediation Plan: A scientific reference organisation will draft a remediation strategy. The SPCB must identify the polluter within 90 days of confirming contamination.

- Cost Recovery & Liability: The principle of “polluter pays” is invoked. If the responsible party is untraceable or insolvent, costs will be shared equally by the Centre and State. Criminal liability for severe environmental damage will be addressed under the Bharatiya Nyaya Sanhita, 2023.

Exclusions and Scope Clarity

To prevent regulatory overlap, certain domains remain outside the ambit of these rules:

- Radioactive waste (Atomic Energy Act)

- Mining-related contamination

- Marine oil pollution

- Municipal solid waste landfills

These exclusions ensure that domain-specific legislation governs complex or hazardous waste streams more effectively.

Significance of the Notification

This is the first national-level regulatory framework to manage contaminated land in India. It provides:

- A time-bound process for site assessment and clean-up

- Clear delineation of institutional roles

- Enforceable liability mechanisms

- Legal visibility for public health and ecological risks tied to contaminated land

Earlier, the lack of a structured response mechanism led to regulatory inertia, leaving vulnerable communities at risk.

Implementation Challenges

Despite its promise, implementation will depend on:

- Strengthening technical capacity at district and state levels

- Enhanced coordination among SPCBs, CPCB, and reference agencies

- Financial mechanisms for cases where the polluter is absent

- Public engagement in identifying contaminated areas

Conclusion

The 2025 rules mark a paradigm shift in environmental governance. By embedding scientific assessment, legal accountability, and institutional responsibility into one framework, India takes a decisive step toward sustainable land management and environmental justice. However, effective capacity-building and cooperative federalism will be essential to translate these legal provisions into on-ground success.

China’s Brahmaputra Mega Dam

- 30 Jul 2025

In News:

China’s construction of a $167.8 billion hydropower dam on the Yarlung Zangbo (Brahmaputra) river near the “Great Bend” in Tibet has raised significant geopolitical, ecological, and strategic concerns, particularly for downstream nations like India and Bangladesh. Once completed, this 60,000 MW project—three times the capacity of the Three Gorges Dam—will be the world’s largest.

Strategic and Environmental Concerns

The dam is being built in the seismically active and ecologically fragile Medog region, just before the river enters Arunachal Pradesh as the Siang. The Chief Minister of Arunachal Pradesh has termed the project an “existential threat,” warning that sudden release of water or structural failure could lead to catastrophic flooding and irreversible damage to tribal livelihoods and ecosystems.

Experts reinforce these concerns, citing the risks posed by potential seismic activity, landslides, and unregulated dam operations in a region lacking robust transboundary water governance. Any significant disruption to the river’s natural flow could also affect biodiversity, agriculture, and hydrological patterns in India’s northeast.

The Assam Perspective

Assam, heavily dependent on the Brahmaputra, faces both risks and possible benefits. The state’s Chief Minister has noted that only 30–35% of the river’s flow originates in China, with the majority contributed by monsoon rains and tributaries from Arunachal Pradesh and Bhutan. He suggested that reduced upstream flow might even aid in managing Assam’s annual floods. Nonetheless, the absence of definitive impact assessments necessitates caution.

India’s Diplomatic Position

India, as a lower riparian state, has consistently raised its concerns regarding upstream hydroelectric projects on transboundary rivers. The Ministry of External Affairs (MEA) has reiterated the need for transparency, data-sharing, and prior consultation, aligning with global principles of equitable and reasonable use of international rivers.

China, while asserting its sovereign right to develop its rivers, has claimed it is cooperating with downstream nations through hydrological data sharing and disaster mitigation. However, the lack of a legally binding treaty between India and China on water-sharing limits enforceability and fosters mistrust.

Recent diplomatic engagements—including talks in October 2024 and March 2025—have included discussions on river cooperation. India’s decision to resume visas for Chinese tourists and reinitiate the Kailash Mansarovar Yatra indicates a cautious yet strategic engagement policy amid persistent challenges.

Mitigation and Strategic Preparedness

India’s policy response must be comprehensive. Key mitigation measures include:

- Scientific Assessment and Monitoring: Real-time hydrological monitoring and risk modeling are essential.

- Infrastructure Development: Projects like the Upper Siang hydroelectric dam in Arunachal Pradesh, despite environmental concerns, are strategically vital as buffers against sudden flow variations.

- Interlinking of Rivers: Long-term plans to link Brahmaputra tributaries with the Ganga basin can help redistribute water during surplus and scarcity.

- Regional Cooperation: Coordination with other riparian nations such as Bangladesh, Bhutan, and Myanmar is vital for developing early warning systems and emergency protocols.

Conclusion

The Brahmaputra dam issue encapsulates the complex interplay of sovereignty, ecology, security, and diplomacy in transboundary river management. For India, it presents both a strategic challenge and an opportunity to strengthen its internal preparedness while advancing regional cooperation. A balanced, evidence-driven, and diplomatically assertive approach is critical to safeguarding national interests and promoting regional water security.

NISAR Mission: A Landmark in Indo-US Space Cooperation and Earth Observation

- 29 Jul 2025

In News:

The upcoming launch of the NASA-ISRO Synthetic Aperture Radar (NISAR) satellite represents a landmark in Indo-U.S. collaboration in space science. Scheduled for deployment from Sriharikota onboard a GSLV Mk-II rocket, NISAR is poised to become one of the most sophisticated Earth observation missions globally, with wide-ranging scientific, environmental, and developmental implications.

Background and Mission Overview

NISAR, developed jointly by NASA and ISRO over the past decade at a cost of approximately ?12,000 crore, is designed to provide high-resolution, all-weather, day-and-night radar imaging of the Earth’s surface. It is the first satellite globally to incorporate dual-frequency synthetic aperture radar (SAR)—combining NASA’s L-band radar (1.257 GHz) and ISRO’s S-band radar (3.2 GHz).

This dual-frequency capability enables it to penetrate forest canopies and surface layers, allowing comprehensive monitoring of dynamic Earth processes such as land deformation, biomass change, glacier dynamics, and infrastructure stability.

Technical Capabilities and Orbit

The satellite will operate from a sun-synchronous polar orbit at an altitude of 747 km. It features a 12-metre deployable mesh antenna and uses SweepSAR technology for electronically steering radar beams. With a 240 km swath width and spatial resolution between 3–10 meters, it can revisit every point on Earth every 12 days, facilitating consistent long-term monitoring.

Applications Across Critical Sectors

NISAR’s data will address six broad thematic areas:

- Solid Earth Processes: Detecting earthquakes, landslides, and urban subsidence.

- Ecosystem Dynamics: Estimating forest biomass, carbon stocks, and biodiversity changes.

- Cryosphere Studies: Tracking glacier movements and polar ice thickness.

- Coastal Monitoring: Observing shoreline erosion and marine hazards.

- Disaster Management: Generating damage proxy maps within five hours of events like floods or cyclones.

- Agriculture and Infrastructure: Supporting food security, yield estimation, and infrastructure health monitoring.

India-specific applications include real-time soil moisture analysis, crop forecasting, flood mapping, and disaster relief planning. The S-band will be operated more intensively over Indian territory, addressing national developmental priorities.

Collaborative Contributions

The mission reflects a balanced international partnership. ISRO has provided the spacecraft bus, S-band radar, telemetry systems, and launch services, while NASA has contributed the L-band radar, antenna system, onboard electronics, and global data infrastructure. Final integration and testing were conducted in Bengaluru, reinforcing India's growing capability in complex space missions.

Data Policy and Accessibility

Following an open data policy, NISAR will make its data freely accessible to scientists, governments, and the public. ISRO’s Shadnagar ground station and Antarctica node will handle domestic reception and processing, while NASA will manage global downlink via its Near Earth Network.

Significance for India and the World

NISAR enhances India’s Earth observation portfolio and strengthens climate resilience, agricultural sustainability, and disaster preparedness. It also elevates India’s profile in global space diplomacy, aligning with goals under climate action, SDGs, and science diplomacy.

In conclusion, NISAR is not just a technological achievement but a strategic asset for planetary monitoring and sustainable development, embodying the spirit of science for global good and showcasing India’s capacity to lead in international space cooperation.

PM Modi’s Visit to the Maldives: A Strategic Reset in India’s Indian Ocean Diplomacy

- 28 Jul 2025

In News:

Prime Minister Narendra Modi’s visit to the Maldives in July 2025 marked a significant diplomatic milestone, especially as it came amid shifting regional dynamics. Invited as the Guest of Honour for the 60th Independence Day celebrations, this was his third visit to the Maldives and the first by a foreign Head of Government under President Mohamed Muizzu's tenure. The event also symbolised a remarkable shift from the earlier phase of strained bilateral ties to renewed strategic alignment.

Diplomatic and Developmental Engagements

The visit featured a multifaceted agenda underscoring India’s "Neighbourhood First" and "Vision MAHASAGAR" policies. A commemorative stamp was released jointly by both leaders to mark 60 years of India-Maldives diplomatic relations, symbolised through traditional maritime vessels—India’s Uru boat and Maldives’ Vadhu Dhoni—highlighting shared Indian Ocean heritage.

India handed over two BHISHM Health Cubes—portable medical kits capable of treating 200 casualties and sustaining medical staff for 72 hours—demonstrating commitment to regional humanitarian support. PM Modi also inaugurated the new Ministry of Defence building in Malé, constructed with Indian assistance, enhancing Maldives’ institutional capacity.

A series of high-impact projects were launched, including:

- 3,300 social housing units in Hulhumale under Indian Buyer’s Credit,

- Road and drainage infrastructure in Addu City,

- Six community development initiatives, and

- 72 vehicles and utility equipment to support local governance.

Economic Assistance and Strategic Commitments

India extended a Line of Credit (LoC) worth ?4,850 crore, notably in Indian Rupees—marking the first such transaction for Maldives. This aims to address Maldives’ twin deficit crisis and reduce dependence on foreign currency. Additionally, an agreement was signed to reduce annual debt repayments from $51 million to $29 million, providing significant fiscal relief.

Other announcements included the launch of negotiations for an India-Maldives Free Trade Agreement (IMFTA) and joint climate action through synchronized tree-planting campaigns: India’s Ek Ped Maa Ke Naam and Maldives’ 5 Million Tree Pledge.

Diplomatic Turnaround: From 'India Out' to 'India In'

The symbolism of this visit lies in its contrast to recent tensions. After assuming office in 2023, President Muizzu’s administration aligned more closely with China and ran a vocally anti-India campaign. Early signals—including calls to remove Indian military personnel—suggested a possible strategic rupture. However, India opted for diplomatic engagement over confrontation, facilitating dialogue at COP28 and replacing its military presence with civilian HAL technicians in May 2024.

This calculated patience coincided with Maldives’ economic vulnerabilities, limited Chinese assistance, and the ruling PNC’s consolidation of power. The tide began to turn with high-level Maldivian visits to India and the announcement of a shared vision for maritime and economic cooperation in late 2024.

Conclusion

President Muizzu’s recent statement that "Maldives will not do anything to harm India's security interests" reflects a diplomatic recalibration driven by pragmatism and mutual necessity. The invitation extended to PM Modi for a ceremonial role in Maldives' Independence Day, once unthinkable amid the 'India Out' rhetoric, stands as a testament to the success of India’s calibrated diplomacy in the Indian Ocean region.

Draft National Telecom Policy 2025

- 27 Jul 2025

In News:

- The Government of India has released the Draft National Telecom Policy 2025 through the Department of Telecommunications (DoT), marking a significant update after the 2018 National Digital Communications Policy (NDCP).

- The new draft aims to transform India into a “telecom product nation” through indigenous innovation, sustainable connectivity, and digital inclusion, aligning with broader national goals like Digital India, Make in India, and Atmanirbhar Bharat.

Vision and Strategic Objectives

- The policy envisions universal, meaningful, secure, and sustainable connectivity for all citizens while simultaneously boosting domestic innovation and employment.

- It reflects a shift from viewing telecom as a service enabler to treating it as a critical infrastructure sector capable of driving economic growth and strategic autonomy.

Key Focus Areas

- Universal Connectivity

- Target of 100% 4G coverage and 90% 5G coverage by 2030.

- Increase fiber-connected towers from 46% to 80% to enhance service quality.

- Establish 1 million new public Wi-Fi hotspots.

- Promote satellite internet to bridge digital divides in remote and border areas.

- Employment and Skilling

- Create 10 lakh new jobs in the telecom sector.

- Reskill another 10 lakh existing workers, addressing the evolving demands of the digital economy.

- Strengthening Domestic Manufacturing

- Target a 150% increase in domestic telecom manufacturing by 2030.

- Establish Telecom Manufacturing Zones (TMZs) with integrated infrastructure.

- Support R&D in next-generation technologies, including 6G.

- Include telecom R&D under Corporate Social Responsibility (CSR) activities to encourage private sector investment.

- Cybersecurity and Artificial Intelligence (AI)

- Deploy AI-based tools for proactive cyber threat detection and response.

- Counter generative AI-based attacks and enhance cross-border telecom signal surveillance.

- Use AI-powered chatbots for unified grievance redressal systems.

- Green Telecom and Circular Economy

- Reduce the sector’s carbon emissions by 30%.

- Promote recycling and reuse of telecom equipment to encourage circular economy practices.

- Technological Innovations

- Promote quantum-secure communications to strengthen network security.

- Enable mobile number-based identity verification for secure digital transactions.

- The removal of lawful interception provisions suggests a nuanced approach balancing security and privacy.

Comparative Outlook: 2018 NDCP vs. 2025 Draft Policy

- The 2018 policy had a broader digital communications focus; the 2025 draft is telecom-specific and more targeted.

- Job creation targets are more realistic (10 lakh vs. 40 lakh), reflecting the refined sectoral scope.

- AI, sustainability, and domestic manufacturing receive significantly enhanced attention in the 2025 draft.

- The shift from 10 million to 1 million Wi-Fi hotspot target indicates a pragmatic policy recalibration.

Conclusion

The Draft National Telecom Policy 2025 is a timely and ambitious framework aimed at ensuring digital sovereignty, innovation-driven growth, and inclusive access. By focusing on indigenous technology, sustainable infrastructure, and cybersecurity, it has the potential to position India as a global leader in next-generation telecommunications, including 6G and quantum tech. Effective implementation and coordination with state and private stakeholders will be key to translating this vision into ground reality.

India’s Ethanol Blending Success

- 26 Jul 2025

In News:

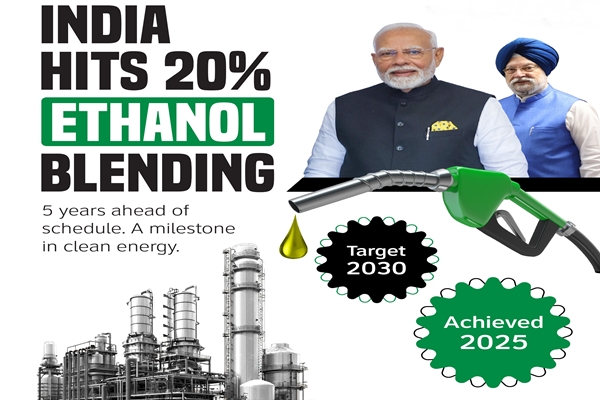

India has achieved a significant milestone by reaching 20% ethanol blending in petrol by March 2025, five years ahead of the original 2030 target under the National Policy on Biofuels (2018). This landmark achievement represents a transformative step in India’s journey toward energy self-reliance, environmental sustainability, and inclusive rural development.

Genesis and Policy Framework

The Ethanol Blended Petrol (EBP) Programme, launched in 2003 and significantly scaled up post-2014, aims to reduce dependence on imported crude oil, promote clean fuels, and support the agricultural economy. The programme is spearheaded by the Ministry of Petroleum and Natural Gas in collaboration with the Ministries of Agriculture and Food Processing. The National Policy on Biofuels expanded the permissible feedstocks for ethanol production, including sugarcane juice, B-molasses, damaged grains, maize, and agricultural residues.

Complementary initiatives like PM-JI-VAN Yojana, SATAT, PLI for ethanol production, and the National Bio-Energy Programme have accelerated infrastructure creation and second-generation (2G) ethanol technologies.

Progress and Scaling

The ethanol blending rate rose from 1.53% in 2014 to 8.17% in 2020–21, then to 12.06% in 2022–23, and reached 14.6% in 2023–24, culminating in the 20% target in early 2025. This scaling was supported by ?40,000 crore in investments and proactive procurement by Oil Marketing Companies (OMCs) at pre-fixed prices, providing market stability for distilleries and farmers.

Over 17,000 fuel retail outlets now offer E20 fuel, with 400 E100 pumps operational. Automakers such as Honda and Hero MotoCorp have ensured vehicle compatibility with E20 fuels, ensuring consumer acceptance.

Economic and Rural Impact

The EBP programme has delivered strong macroeconomic and grassroots benefits. By reducing crude oil imports, India has saved substantial foreign exchange and improved energy security. At the micro level, farmers—particularly sugarcane and maize growers—have benefited from assured off-take and stable prices, reducing rural distress and boosting income security.

Moreover, the ethanol ecosystem has generated rural employment, supported local manufacturing under ‘Make in India’, and catalyzed investment in agro-industrial infrastructure.

Environmental and Climate Gains

India’s ethanol blending drive aligns with its climate commitments, especially its Net Zero by 2070 target. Ethanol blending has helped avoid 698 lakh tonnes of CO? emissions, reduced particulate pollution, and improved urban air quality. The shift also supports circular economy principles by utilizing agricultural surplus, foodgrains unfit for consumption, and residues—converting waste to wealth.

Future strategies emphasize 2G ethanol from non-food biomass and municipal waste, thereby reducing land and water stress associated with first-generation biofuels. Advanced technologies like lignocellulosic processing, sustainable aviation fuel (SAF), and ethanol-to-hydrogen conversion are in focus.

Conclusion

India’s early achievement of 20% ethanol blending demonstrates the success of coordinated policymaking, technological adoption, and stakeholder alignment. It serves as a model of how energy policy can intersect with rural prosperity, environmental stewardship, and industrial growth. Going forward, India’s biofuel roadmap not only reinforces its clean energy leadership but also strengthens its resolve for energy Atmanirbharta, sustainable development, and climate resilience.

India’s Early Achievement of Climate Targets

- 25 Jul 2025

In News:

India has achieved a key milestone in its climate commitments under the Paris Agreement by fulfilling one of its core targets five years ahead of schedule. As of June 2025, non-fossil fuel sources contribute over 50% of India’s installed electricity generation capacity — a significant achievement originally set for 2030.

According to the Ministry of Power, India’s installed capacity reached 484.82 GW, of which 242.78 GW is from non-fossil sources like solar, wind, large hydropower, and nuclear energy. This rapid growth, particularly in solar (24 GW added in 2024 alone), underlines India’s leadership in renewable energy deployment. However, it also highlights key structural challenges in decarbonizing the broader energy economy.

India’s updated Nationally Determined Contributions (NDCs) under the Paris Climate Agreement (2015) comprise three primary targets for 2030:

- At least 50% of installed electricity capacity from non-fossil fuel sources.

- 45% reduction in emissions intensity (GHG emissions per unit of GDP) from 2005 levels.

- Creation of an additional 2.5–3 billion tonnes of CO?-equivalent carbon sink through increased forest and tree cover.

Substantial progress is also evident in the other two targets. By 2020, India had already reduced its emissions intensity by 36%, and given current economic and technological trajectories, the 45% target by 2030 appears achievable. On the forestry front, India added 2.29 billion tonnes of carbon sink by 2021. Given the annual increase of around 150 million tonnes CO? equivalent reported in the India State of Forest Report (ISFR), the carbon sink target may already be met by 2023, although official confirmation is pending.

Yet, these achievements warrant a closer look. Electricity comprises less than 22% of India’s total energy consumption. Most energy use — particularly in transport, industry, and residential sectors — still relies on direct combustion of fossil fuels like coal, oil, and gas. Furthermore, while non-fossil sources account for over 50% of capacity, they contribute only 28% to actual electricity generation due to intermittency in renewables. Consequently, clean energy forms only around 6% of India’s total energy consumption, which though modest, aligns with the global average.

The road ahead is demanding. India must now focus on decarbonizing non-power sectors through accelerated adoption of electric mobility, green hydrogen, energy-efficient technologies, and clean cooking solutions. Scaling stable power sources like nuclear and hydro is crucial to complement solar and wind. India's Small Modular Reactor (SMR) program remains in the R&D phase and is unlikely to contribute significantly by 2030.

Internationally, India’s climate leadership contrasts with the underperformance of many developed nations, especially regarding climate finance and technology transfer. While India has met and even surpassed its targets, its ability to raise ambition depends on receiving support as promised under the Paris Agreement.

In conclusion, India’s early success in achieving climate targets reflects a commitment to sustainable growth, but true climate leadership will require systemic decarbonization across all sectors, just energy transitions, and global equity in climate action.

Matter-Antimatter Asymmetry

- 24 Jul 2025

Context:

One of the most fundamental questions in cosmology and particle physics is: Why does the universe contain more matter than antimatter? The Big Bang, which occurred around 13.8 billion years ago, should have produced equal amounts of matter and antimatter. However, the observable universe today is overwhelmingly composed of matter, with antimatter being nearly absent except in trace amounts created in high-energy environments or particle accelerators. This puzzling imbalance—known as baryon asymmetry—continues to challenge scientists worldwide.

Recent breakthroughs, particularly a discovery made on July 16 at the Large Hadron Collider (LHC) in Europe, have added a significant piece to this puzzle. For the first time, scientists observed CP violation in baryons—heavy subatomic particles such as protons and neutrons made of three quarks. CP stands for Charge Conjugation (C) and Parity (P), which together form a symmetry principle stating that the laws of physics should be the same if a particle is replaced with its antiparticle and viewed in a mirror. A violation of this symmetry implies that matter and antimatter behave slightly differently—a necessary condition for the observed dominance of matter.

The experiment focused on a baryon called Λb0 (lambda-b-zero), which contains one up quark, one down quark, and one bottom quark. Scientists at LHCb measured the decay rates of Λb0 and its antimatter counterpart (Λb0-bar) into a proton, kaon, and two pions. The results showed a CP asymmetry of about 2.45%, with a statistical significance of over 5 sigma, a threshold used in particle physics to confirm a discovery. This historic observation is the first evidence of CP violation in baryons and expands our understanding beyond earlier CP violation detected in mesons (quark-antiquark pairs).

While this asymmetry is still insufficient to fully explain the matter-antimatter imbalance, it marks a critical advancement. It suggests that there could be undiscovered sources of CP violation in other particles or interactions that the Standard Model of particle physics does not yet account for. Theoretical and experimental physicists are now exploring whether other decays exhibit similar asymmetries and whether new physics—beyond the Standard Model—might be at play.

Parallel efforts are also underway deep underground. In Italy, physicists are assembling detectors 1.4 km below the mountains to observe neutrinoless double beta decay, a hypothetical nuclear process that, if confirmed, would indicate that neutrinos are Majorana particles—particles that are their own antiparticles. This would offer a different mechanism for matter creation without equivalent antimatter, further contributing to the asymmetry.

Moreover, U.S. institutions such as the Department of Energy (DOE) support advanced antimatter research through projects like the Deep Underground Neutrino Experiment (DUNE) and experiments at Brookhaven’s Relativistic Heavy Ion Collider, which have created antimatter versions of elements such as helium.

In conclusion, the recent detection of CP violation in baryons and continued investigations into rare decays and neutrino properties are gradually illuminating the deep cosmic mystery of why something exists instead of nothing. This line of inquiry not only bridges particle physics and cosmology but also exemplifies human curiosity’s power in probing the origins of existence itself.

Feeding Community Dogs: Balancing Constitutional Compassion with Public Order in India

- 23 Jul 2025

Context:

The issue of feeding stray or community dogs has evolved into a contentious legal and social debate in India. A recent case involving a Noida resident, allegedly harassed for feeding stray dogs in the common areas of her housing society, once again brought this matter to the judicial spotlight. While the Supreme Court refrained from issuing a specific directive, it observed that citizens should consider feeding strays within their own homes—an observation that, while not binding, reignited debate on reconciling individual compassion with community concerns.

Legal Framework: The ABC Rules, 2023

The Animal Birth Control (ABC) Rules, 2023, framed under the Prevention of Cruelty to Animals Act, 1960, serve as the primary legal instrument governing the care of community animals. These rules replaced the 2001 version and introduced the term “community animals” instead of “stray dogs,” recognizing them as territorial beings who coexist with human residents.

Rule 20 of the ABC Rules mandates that Resident Welfare Associations (RWAs) or local bodies must facilitate the feeding of community dogs if any resident voluntarily chooses to do so. Designated feeding spots must be located away from high-footfall zones like staircases, entrances, and children’s play areas. Cleanliness and fixed feeding times are essential requirements. Additionally, the Rules lay down a dispute resolution mechanism involving veterinary officers, police representatives, and local welfare groups.

Constitutional and Ethical Dimensions

The legal protection of animals finds support in Article 21 of the Constitution. In the 2014 Animal Welfare Board of India vs. A. Nagaraja case, the Supreme Court interpreted the right to life and liberty to include animal life. Further, Article 51A(g) enshrines the fundamental duty of citizens to show compassion to all living beings. Thus, feeding community dogs is not merely an act of personal kindness but a constitutional obligation.

The petitioner in the Noida case was arguably fulfilling this duty. Allegedly harassed by her RWA president—who reportedly destroyed water pots and killed sterilised dogs—she faced institutional apathy when authorities failed to act. Her appeal to the Allahabad High Court was dismissed, citing inconvenience to the "common man," despite the ABC Rules’ clear guidelines.

Judicial Precedents and Clarifications

Contrary to popular media interpretation, the Supreme Court in the current case did not issue an order compelling the petitioner to feed dogs at home. Observations made during hearings are not judicial directions. Notably, the apex court had earlier stayed a 2022 Bombay High Court (Nagpur Bench) order that banned public feeding and required adopters to take dogs home—asserting that such rules violate statutory rights and compassionate duties.

Conclusion

Feeding community dogs intersects with animal rights, public safety, and civic coexistence. The ABC Rules, 2023, strike a legal and ethical balance between compassion and community order. Sterilisation and designated feeding are not only humane solutions but also public health imperatives. Going forward, increased awareness, community dialogue, and strict adherence to legal norms are vital to avoid polarisation and ensure harmonious urban living.

U.S. Designation of The Resistance Front (TRF)

- 22 Jul 2025

In News:

India’s sustained diplomatic campaign against cross-border terrorism received a significant fillip with the United States designating The Resistance Front (TRF) as a Foreign Terrorist Organization (FTO) and a Specially Designated Global Terrorist (SDGT). The decision, announced by U.S. Secretary of State Marco Rubio, marks a strong step in countering global terror networks and reaffirms the deepening Indo-U.S. cooperation in counter-terrorism.

The TRF is widely recognized as a proxy outfit of the Pakistan-based Lashkar-e-Taiba (LeT), formed soon after the abrogation of Article 370 in 2019. Projecting itself as an indigenous, secular “resistance” movement, TRF has sought to legitimize militancy under a veneer of local identity while continuing to rely on the operational, logistical, and financial support of LeT and Pakistan’s Inter-Services Intelligence (ISI). Its rebranding strategy is aimed at evading scrutiny by international watchdogs such as the Financial Action Task Force (FATF).

TRF has claimed responsibility for several high-profile terror attacks in Jammu and Kashmir, including the Pahalgam attack in April 2025, which killed 26 tourists. Other attacks attributed to it include the Ganderbal killings (October 2024), Reasi bus attack (June 2024), and a 2020 shooting in Lal Chowk, Srinagar. Its leadership, including current chief Sheikh Sajjad Gul and spokesperson Ahmad Khalid, operate largely from Pakistani soil.

The group also runs an elaborate digital propaganda and recruitment ecosystem. Portals like KashmirFight and Jhelum Media House disseminate extremist narratives, claim responsibility for attacks, and operate as fronts for psychological operations and radicalization. These digital tools further complicate counter-terrorism efforts, allowing TRF to recruit and spread misinformation under the guise of human rights advocacy.

India banned TRF under the Unlawful Activities Prevention Act (UAPA), 1967, in January 2023, recognizing its existential threat to national security. India has consistently provided evidence of TRF’s linkages with LeT and other Pakistan-backed outfits like Jaish-e-Mohammed (JeM) in its submissions to the UN 1267 Sanctions Committee, responsible for imposing sanctions on terror-linked entities.

The U.S. designation of TRF as an FTO and SDGT is not just symbolic. It imposes concrete legal and financial restrictions, making it illegal for U.S. individuals or entities to provide support to the group. The move mandates American financial institutions to block any assets tied to TRF and enables further actions through the Office of Foreign Assets Control (OFAC). These actions aim to globally isolate the outfit and can also trigger secondary sanctions against foreign entities that deal with it.

India has welcomed this move, calling it a “strong affirmation” of India-U.S. cooperation in the fight against terrorism. The Ministry of External Affairs (MEA) emphasized that such steps are vital to dismantle terror infrastructure and hold proxy actors accountable. The decision also underscores a growing international consensus on the need for zero tolerance towards terrorism.

This development marks a pivotal moment in India’s counter-terror diplomacy and reinforces the need for global synergy in combating the evolving threat of state-sponsored and hybrid terrorism.

The Need to Protect India’s Linguistic Secularism

- 20 Jul 2025

In News:

India’s identity as a democratic and pluralistic society rests not only on its religious diversity but also on its remarkable linguistic heterogeneity. According to the 2011 Census, India is home to 121 languages and 270 mother tongues, with 22 languages recognized under the Eighth Schedule of the Constitution. This linguistic diversity forms a critical part of India’s secular ethos, often overshadowed by the more frequently discussed religious dimension of secularism.

Unlike the Western model of secularism, which advocates a strict separation between religion and state, India’s secularism is inclusive and interventionist. It allows the state to engage positively in ensuring equality among different religious and linguistic groups. The Indian state does not privilege any single religion or language but guarantees all communities the right to preserve their cultural and linguistic identity.

This commitment is constitutionally enshrined. Article 343 declares Hindi in Devanagari script as the official language of the Union, but also provides space for states to choose their own official languages. Article 29 guarantees every section of citizens the right to conserve their distinct language, script, or culture. The Eighth Schedule ensures recognition and development support for 22 scheduled languages, while allowing the space for inclusion of others over time. This decentralized and accommodating approach prevents linguistic hegemony while nurturing India’s cultural mosaic.

However, recent incidents of language-based violence and exclusion — such as attacks on non-Marathi speakers in Maharashtra — signal growing tensions rooted in identity politics. While movements to preserve linguistic heritage are legitimate, they must not mutate into exclusionary practices. Historical resistance to Hindi imposition in Tamil Nadu and similar sentiments in Northeastern states stem from real concerns over cultural erasure and centralisation of linguistic power.

Such developments point to the misuse of linguistic identity as a political mobilization tool, undermining the foundational values of unity in diversity. The imposition of one language, directly or indirectly, poses a threat not just to federalism but also to the democratic fabric of the country. Language cannot be a tool for dominance; it must be a bridge for mutual respect and integration.

It is crucial to note that India does not have a national language, only an official language at the Union level. The Constitution deliberately avoids conferring national status to any language to prevent alienation and protect linguistic plurality. The respect for all languages, including non-scheduled ones and dialects, is central to India’s linguistic secularism.

Therefore, the responsibility lies with political parties, civil society, media, and educational institutions to nurture this ethos. The political class, in particular, must refrain from exploiting linguistic emotions for electoral gains. Instead, they should promote policies that encourage multilingual education, cultural exchange, and preservation of regional languages.

In an increasingly globalized and polarized world, India’s linguistic secularism must be viewed not as a passive principle but as an active commitment — essential for national unity, inclusive development, and constitutional morality. Only by valuing each language equally can India uphold the promise of democratic citizenship and cultural dignity for all.

Safe Harbour Doctrine

- 21 Jul 2025

In News:

In a significant development shaping India’s digital governance framework, the Centre has defended its expanded use of Section 79 of the Information Technology Act and the Sahyog Portal to compel online intermediaries—including social media platforms—to remove or disable unlawful content. The debate, currently before the Karnataka High Court, arises from a challenge by platform X (formerly Twitter), which terms the Sahyog Portal a "censorship portal."

Safe Harbour vs. Government Oversight: The Legal Framework

Section 79 of the IT Act grants “safe harbour” protection to intermediaries from liability over third-party content, provided they act upon government takedown notices. However, failure to comply may lead to the withdrawal of this immunity. By contrast, Section 69A empowers the government to block content under specific grounds such as national security, public order, or foreign relations, in line with Article 19(2) of the Constitution, and backed by procedural safeguards.

Platform X argues that the Centre is bypassing Section 69A’s narrower and more legally constrained provisions by issuing de facto blocking orders under Section 79, without adequate procedural checks. This, it contends, infringes upon digital freedom of expression.

Sahyog Portal and the Government's Rationale

The Sahyog Portal, developed under the Indian Cyber Crime Coordination Centre (I4C) of the Ministry of Home Affairs, has onboarded 38 intermediaries as of March 2025—including Google, Microsoft, Amazon, Telegram, and YouTube. Meta has allowed API-based integration, while X has refused, citing legal overreach.

Defending its stance, the government argues that algorithmic content curation systems—unlike traditional editorial processes—operate at unprecedented speed and scale, without human oversight or transparency. These systems can amplify harmful or misleading content, targeting users individually in ways that traditional media cannot. Moreover, the anonymity and pseudonymity offered by online platforms, along with encrypted messaging, encourage unaccountable and extreme speech, posing serious risks to public order.

Algorithmic Curation vs. Traditional Editorial Control

The government contends that in traditional media, editors and broadcasters act as gatekeepers, ensuring a degree of content quality and moderation. Social media algorithms, however, lack such discretion, often functioning without clear standards, and thereby require regulatory intervention distinct from that applied to conventional media.

This foundational difference, the government argues, justifies a broader interpretive scope under Section 79 to address a wider class of “unlawful content” that may not directly fall under the remit of Section 69A but still demands intervention.

Balancing Freedom of Speech with Public Interest

At the heart of the issue lies the constitutional balancing of free speech (Article 19(1)(a)) with reasonable restrictions (Article 19(2)). While Section 69A aligns with specific constitutional limitations, the government argues that a broader net under Section 79 is needed to tackle content harmful to national security, social harmony, and public order—even if it doesn’t squarely fall within 19(2).

In its submission, the Centre emphasizes that the matter should be viewed not only from the lens of content creators but also from the rights and safety of content recipients and society at large.

Conclusion

This case marks a crucial intersection of digital freedom, platform responsibility, and state regulation. The government's bid to reinterpret Section 79 reflects the growing challenges of algorithmic governance in the digital era. The Karnataka High Court’s verdict will likely set a precedent in defining the limits of intermediary liability, scope of safe harbour, and the State’s role in regulating online content—all central to India’s evolving digital constitutionalism.

Cybersecurity Threats from Southeast Asia: Rising Cyber Frauds Targeting India

- 19 Jul 2025

Introduction

Cybersecurity has emerged as a critical component of national security in the digital era. India, with its expanding digital footprint, is increasingly facing threats from transnational cybercrime syndicates. A recent analysis by the Ministry of Home Affairs (MHA) reveals a staggering Rs 1,000 crore loss per month due to cyber frauds originating from Southeast Asian countries, posing a serious threat to the Indian economy and internal security.

Magnitude of the Threat

- According to the Indian Cyber Crime Coordination Centre (I4C) under MHA: In the first five months of 2025, cyber frauds caused a total loss of around Rs 7,000 crore.

- Over 50% of the losses were attributed to networks operating from Cambodia, Myanmar, Laos, Thailand, and Vietnam.

Modus Operandi

- Fraud Centers: Operate from high-security scam compounds, primarily in Cambodia (45 identified), Laos (5), and Myanmar (1), allegedly run by Chinese operators.

- Forced Labor: Trafficked individuals, including more than 5,000 Indians, were reportedly forced to carry out cyber frauds under coercion.

- Types of Scams:

- Stock trading/investment scams

- Digital arrest scams

- Task-based/investment-based scams

Recruitment Networks and Source States

- Recruitment agents operate largely from:

- Maharashtra (59 agents)

- Tamil Nadu (51)

- Jammu & Kashmir (46)

- Uttar Pradesh (41)

- Delhi (38)

- Travel Routes Tracked:

- Routes include India to Cambodia via Dubai, China, Thailand, Vietnam, Singapore, etc.

- Cities involved include Mumbai, Chennai, Delhi, Jaipur, Lucknow, Kochi, and Kolkata.

Government Response

- Diplomatic Engagement:

- Cambodian officials met Indian authorities (MEA and Central agencies) in Delhi.

- Requested geographical coordinates of scam centers for local enforcement action.

- Inter-Ministerial Committee: Formed to identify systemic loopholes in banking, telecom, and immigration sectors.

- CBI Investigation: Registered FIRs against PoS agents involved in issuing ghost SIM cards aiding cybercrime.

Wider Implications

- Global Human Trafficking Concern: Victims from Africa, East Asia, South Asia, Central Asia, Europe, and the Americas have been found in these compounds.

- Transnational Organized Crime: The scams highlight growing cooperation between international criminal networks, using digital tools to exploit vulnerabilities across borders.

Conclusion

The scale and transnational nature of cyber frauds targeting India from Southeast Asia require a coordinated national and international response. Strengthening cyber intelligence, cross-border cooperation, digital infrastructure resilience, and public awareness are vital to securing India's cyberspace. Proactive steps such as bilateral cooperation, inter-agency coordination, and targeted enforcement are crucial to mitigate this growing internal security threat.

Protection of Civil Rights (PCR) Act

- 18 Jul 2025

Context:

The Protection of Civil Rights (PCR) Act, 1955, a legislative tool to eliminate untouchability as mandated under Article 17 of the Indian Constitution, remains grossly under-implemented. The 2022 report by the Ministry of Social Justice and Empowerment paints a dismal picture of enforcement, revealing structural deficiencies in India's pursuit of social justice, cultural preservation, and inclusive development.

Despite the Act’s objective of eradicating untouchability—manifested in denial of access to public spaces, religious institutions, and essential services—there has been a sharp decline in First Information Reports (FIRs) over the years. Only 13 cases were registered in 2022, compared to 24 in 2021 and 25 in 2020. Alarmingly, no State or Union Territory has declared any area as “untouchability-prone,” raising concerns over administrative apathy and underreporting.

The judicial and police response has been equally lackluster. Out of 1,242 cases pending trial under the PCR Act in 2022, over 97% remain unresolved. Out of 31 cases disposed that year, 30 ended in acquittal, with only one conviction, reflecting a near-total failure in ensuring accountability. Similarly, of the 51 cases pending with police, chargesheets were filed in just 12. This highlights serious procedural and evidentiary lapses, lack of capacity, and perhaps, implicit biases in law enforcement and judicial systems.

In contrast, cases under the Scheduled Castes and Scheduled Tribes (Prevention of Atrocities) Act, 1989 (PoA Act) have shown an increasing trend, suggesting better awareness and enforcement. This disparity calls for equal policy attention to the PCR Act, especially considering its centrality in upholding the constitutional promise of equality and dignity.

What makes the findings even more concerning is their impact on India’s cultural and linguistic diversity. Many communities that are victims of untouchability also belong to linguistic or tribal minorities. These include speakers of endangered languages, regional dialects, and culturally distinct groups. The systemic neglect of untouchability cases undermines not just civil rights but also the preservation of traditional knowledge systems, oral histories, and linguistic secularism enshrined in Article 29 of the Constitution.

The absence of proactive policy measures—such as identification of vulnerable zones, awareness programs, legal aid, or cultural inclusion initiatives—threatens the composite culture of the nation. Moreover, the decline in registration indicates a lack of trust in legal redressal mechanisms and failure to empower marginalized communities through effective grievance redressal.

To address these challenges, a multi-pronged strategy is essential. This includes:

- Strengthening special courts and fast-tracking trials under the PCR Act.

- Capacity-building and sensitization programs for police and judiciary.

- Empowering local governance institutions to report and act on untouchability practices.

- Implementing UNESCO-backed initiatives to preserve linguistic heritage.

- Introducing language training and interpretation services to reduce communication gaps.

- Leveraging multilingual education policies to integrate cognitive development with cultural preservation.

In conclusion, the declining efficacy of the PCR Act undermines India's constitutional ethos of equality, fraternity, and cultural integration. A robust, inclusive, and culturally sensitive legal framework is imperative to protect the rights of the marginalized and to uphold the pluralistic spirit of the Indian nation.

Trump’s Tariff Threats and BRICS

- 17 Jul 2025

In News:

The recent 17th BRICS Summit in Rio de Janeiro (2025) has reignited tensions between the United States and the expanding BRICS grouping. Former U.S. President Donald Trump, who remains a dominant figure in Republican politics, has threatened to impose 10% tariffs on all BRICS nations, framing the bloc as a challenge to American economic hegemony. These threats signal a continuation of Trump's confrontational approach to global trade and reflect deeper anxieties about de-dollarisation efforts emerging from the Global South.

Trump’s concerns stem from what he perceives as an "anti-American" orientation of BRICS. The group's discussions around a common currency, increased use of national currencies, and the development of alternative cross-border payment systems have been interpreted by Trump as an attempt to weaken the U.S. dollar’s central role in international finance. This fear has been intensified post the Russia-Ukraine conflict, which saw several countries reconsider their reliance on dollar-based systems like SWIFT, particularly after Russia’s exclusion from them due to Western sanctions.

In response, Trump has floated punitive trade measures: a 10% tariff on BRICS-aligned nations, 50% on Brazil for its domestic political stance, and 30% on South Africa citing trade disputes and minority rights issues. He is also advocating for the Sanctioning Russia Act, 2025, which proposes an astronomical 500% tariff on Russian oil and related products. Such a move could disrupt oil-importing economies like India and China, both of which have deepened energy ties with Moscow in recent years.

However, BRICS leaders have clarified that de-dollarisation is not about dismantling the dollar-based order but about financial diversification and resilience. The Rio Declaration 2025 stopped short of any anti-U.S. language, instead emphasizing interoperability of payment systems and equitable reform of global institutions. This demonstrates a cautious diplomatic approach aimed at asserting economic agency without triggering direct confrontation.

India, in particular, has taken a measured stance. In Parliament, the Indian government distanced itself from suggestions that BRICS was pursuing an aggressive de-dollarisation agenda. External Affairs Minister S. Jaishankar reiterated that India has no official policy to replace the U.S. dollar, and that BRICS decisions are not monolithic but reflect the diversity of its member states. This is crucial, given India’s strategic balancing between the West and the Global South.

Founded in 2009 amid discontent with Western-dominated financial structures, BRICS has expanded to include 10 members, with new entrants like Iran, Egypt, Ethiopia, UAE, and Indonesia. While united by frustration over Western dominance, internal diversity—economic, political, and strategic—ensures that BRICS does not function as a rigid anti-West alliance.

At the Rio summit, BRICS condemned unilateral tariff practices and expressed concern over attacks on Iranian civilian infrastructure, showcasing solidarity without directly naming the U.S. or its allies. This signals a shift toward multilateral diplomacy grounded in soft balancing rather than confrontation.

In conclusion, while Trump’s tariff threats underline U.S. anxiety over shifting global power structures, BRICS’ response suggests a nuanced recalibration of the international order—not a radical overhaul. For India, the challenge remains to harness BRICS for strategic autonomy without undermining its multi-aligned foreign policy posture.

AI 171 Crash

- 16 Jul 2025

In News:

On June 12, 2025, Air India flight AI 171, a Boeing 787-8 Dreamliner en route from Ahmedabad to London Gatwick, tragically crashed shortly after takeoff, killing 260 people—including 19 on the ground—in what is now the deadliest aviation disaster involving an Indian airline in four decades. A preliminary report by the Aircraft Accident Investigation Bureau (AAIB) has placed the aircraft’s fuel control switches at the centre of the crash investigation.

Fuel Control Switches: Function and Design

Fuel control switches are critical safety components that regulate the flow of fuel to aircraft engines. On a Boeing 787, equipped in this case with two GE engines, these switches are located below the thrust levers and are spring-loaded and bracket-protected to prevent accidental activation. They require a deliberate two-step manual action—lifting the switch and moving it between two positions:

- RUN: Allows fuel flow for engine operation.

- CUTOFF: Cuts fuel flow, effectively shutting down the engine.

These switches are typically used on the ground for engine startup and shutdown, and only in-flight during an engine failure or critical damage. Modern twin-engine aircraft like the 787 are capable of continuing flight on a single engine, making the simultaneous use of both switches highly unusual and dangerous.

Sequence of Events: Preliminary Findings

According to flight data from the Flight Data Recorder (FDR) and Cockpit Voice Recorder (CVR), both engine fuel control switches were moved from ‘RUN’ to ‘CUTOFF’ within seconds of each other, shortly after takeoff. This led to simultaneous loss of thrust in both engines. Moments later, both switches were returned to the ‘RUN’ position, but by then the aircraft had lost critical altitude and control.

The cockpit recording captured one pilot asking the other why the fuel was cut off. The other responded that he had not done so. The pilots—Captain Sumeet Sabharwal with over 8,600 flying hours on the 787, and Co-pilot Clive Kundar with 1,100 hours—were both adequately experienced.

Technical and Human Factors under scrutiny

Aviation experts argue that accidental activation of both switches is nearly impossible due to the stop-lock mechanism and protective brackets. However, speculation persists over a possible technical malfunction, human error, or incorrect engine identification. A theory suggests that one engine may have failed and the pilots mistakenly shut down the working engine, though this remains unconfirmed.

Attention has also turned to the switches themselves, manufactured by Honeywell (Part No. 4TL837-3D). A 2018 FAA advisory had flagged potential issues with their locking mechanisms but did not mandate corrective action. Air India reportedly did not conduct voluntary checks, raising questions about maintenance protocols.

Conclusion:

The AI 171 crash highlights critical lapses in cockpit procedures, technical maintenance, and possibly design flaws. It underscores the need for stringent implementation of safety advisories, thorough crew training, and the use of redundant safety mechanisms. As investigations continue, the incident may prompt global regulatory reviews on cockpit ergonomics and fuel system safety protocols, reinforcing the imperative of fail-safe systems in civil aviation.

Maharashtra’s Special Public Security Bill, 2024

- 15 Jul 2025

In News:

The Maharashtra Special Public Security Bill, 2024, passed by the Legislative Assembly, aims to combat “urban Maoism” and left-wing extremism (LWE). Modeled on the Unlawful Activities (Prevention) Act (UAPA), the Bill introduces stringent provisions to identify and dismantle urban support networks aiding insurgents. However, it has generated significant legal and civil liberty concerns due to its vague definitions, broad executive powers, and pre-trial punitive measures.

Understanding Urban Maoism

Urban Maoism refers to the strategy of the banned CPI (Maoist) to infiltrate cities and mobilise intellectuals, students, professionals, and minorities through NGOs, protests, and media campaigns. This ideology, outlined in the 2004 document Strategies and Tactics of Indian Revolution (STIR), aims to build urban logistical support for rural armed struggles while operating under the legal guise of activism, journalism, or civil society work. Notable examples include the Elgar Parishad case (2018), where activists were arrested for alleged Maoist links following Bhima Koregaon violence.

Key Provisions of the Bill

The Bill allows the government to declare an organisation “unlawful” and penalises individuals associated with it—whether through membership, fundraising, or aiding operations. It defines “unlawful activity” as interference with public order, use of criminal force against officials, incitement to disobedience of the law, or even disrupting communication systems. Punishments range from 2 to 7 years of imprisonment along with fines. All offences are cognizable and non-bailable.

A major provision allows pre-trial forfeiture of property belonging to accused persons or organisations, with only 15 days’ notice. While the affected party can appeal to the High Court within 30 days, the initial declaration is confirmed only by an Advisory Board comprising High Court-qualified persons.

Constitutional and Legal Concerns

Civil society and legal experts argue that the Bill risks criminalising legitimate dissent and peaceful protest, given its ambiguous phrasing like “practising disobedience” or “generating apprehension in the public.” Unlike the UAPA, which requires a higher threshold for proving threat to national integrity, Maharashtra’s Bill introduces lower benchmarks that could conflate dissent with sedition.

The pre-trial forfeiture of property mirrors provisions in the Prevention of Money Laundering Act (PMLA), yet lacks equivalent safeguards like adjudication by a quasi-judicial body. Moreover, principles of natural justice, such as presumption of innocence and burden of proof on the state, appear diluted.

Broader Implications

While the state’s intent to counter urban LWE influence is valid—especially given the shift of Maoist strategies from forested hinterlands to urban centres—the means adopted pose risks to constitutional rights and federal norms. The legislation exemplifies a growing trend where extraordinary laws designed for national threats are adapted at the state level, potentially disrupting the balance between security imperatives and civil liberties.

Conclusion

The Maharashtra Special Public Security Bill reflects the complex challenge of safeguarding national security while upholding democratic freedoms. Any future enactment must incorporate judicial oversight, clearer definitions, and proportionate safeguards to ensure that the fight against extremism does not erode the fundamental rights enshrined in the Constitution.

India’s Reinvigorated Outreach to the Global South

- 14 Jul 2025

In News:

India’s foreign policy has witnessed a dynamic recalibration with Prime Minister Narendra Modi’s expansive visit to Brazil, Ghana, Trinidad & Tobago, Argentina, and Namibia. While participation in the BRICS Summit in Rio de Janeiro was central, the broader aim was to deepen India’s leadership role within the Global South — a diverse group of developing nations in Asia, Africa, Latin America, and Oceania.

Reclaiming Leadership in the Global South

India has long championed the cause of the Global South, grounded in its non-aligned foreign policy legacy and postcolonial solidarity. This identity was rejuvenated through:

- Hosting two Voice of the Global South Summits (2023, 2024), giving a platform to over 125 developing countries.

- Advocating for and securing African Union’s permanent membership in the G20 during its presidency, symbolizing India’s commitment to an inclusive global governance architecture.

These initiatives portray India as a bridge between the Global North and South, positioning itself as a leader that represents the interests of the voiceless in multilateral forums.

Diplomatic Course Correction: The Gaza Challenge

India’s explicit support for Israel during the Gaza conflict (post-October 7, 2023) triggered discomfort among many Global South countries, especially in the Arab and African regions that strongly support the Palestinian cause. Consequences included:

- India’s defeat to Pakistan in the UNESCO Executive Board Vice-Chair election.

- Limited engagement from key Global South nations in the Second Voice of the Global South Summit.

Recognizing these diplomatic setbacks, India recalibrated its stance. At the BRICS Foreign Ministers’ Meeting (2024) and the 2025 Rio BRICS Summit, India joined in expressing grave concern over Israeli military operations in Gaza and condemned strikes on Iran, signaling a return to its balanced, multivector diplomacy.

Strategic Gains at BRICS: Securing Core Interests

India also used the BRICS platform to secure vital national interests. The BRICS Leaders’ Declaration condemned the Pahalgam terror attack in Kashmir and called for combating terrorism, including cross-border terror financing. This was diplomatically significant, given:

- China’s prior reluctance to name Pakistan-based terror actors.

- BRICS’ growing relevance in shaping global narratives.

India’s success in inserting its security concerns into multilateral dialogue marks a maturing assertiveness in diplomacy.

Countering China, Offering Alternatives

India’s proactive outreach also serves to counter China’s rising influence in the Global South. Unlike Beijing’s Belt and Road Initiative, India emphasizes:

- Transparent, demand-driven development assistance.

- Capacity-building and digital partnerships.

- Ethical, sustainable models of cooperation.

Through initiatives like International Solar Alliance, Digital Public Infrastructure partnerships, and humanitarian aid, India offers a democratic, credible alternative to Chinese financing and infrastructure diplomacy.

Conclusion:

India’s current foreign policy trajectory reflects a delicate balancing act—protecting strategic partnerships with global powers while retaining the trust of fellow developing nations. As global multipolarity deepens, India’s role as a consensus builder, ethical voice, and pragmatic actor will shape its success in becoming the leading voice of the Global South.

UNFCCC and the Crisis of Credibility in Global Climate Governance

- 13 Jul 2025

In News:

The United Nations Framework Convention on Climate Change (UNFCCC), signed in 1992 at the Earth Summit in Rio de Janeiro and enforced from 1994, is the central international treaty to combat climate change by limiting greenhouse gas emissions. With 198 member countries and an annual Conference of the Parties (COP), the UNFCCC provides the primary forum for negotiating global climate action. However, in recent years, its credibility has come under scrutiny due to persistent inaction, structural inefficiencies, and failure to deliver climate justice—particularly for developing nations.

The Credibility Crisis: Key Concerns

A major source of discontent is the failure of developed countries to meet both emission reduction targets and financial commitments under the Paris Agreement and earlier protocols. Vulnerable nations—especially small island developing states (SIDS) and low-income countries—have raised concerns over exclusion from critical negotiations, lack of accountability from wealthier nations, and limited progress on equity and justice.

The withdrawal of the United States from the Paris Agreement during the Trump administration further damaged trust in the multilateral climate process, reinforcing perceptions of the UNFCCC as an ineffective and increasingly irrelevant institution.

Bonn Meeting and Brazil’s Role Ahead of COP30

The mid-year climate talks in Bonn (June 2025) aimed to restore faith in the negotiation process ahead of COP30, to be hosted by Brazil. Brazil has taken an active leadership role by proposing a comprehensive 30-point reform agenda, seeking to make negotiations more inclusive, transparent, and results-oriented.

Proposed Structural Reforms

Key reform suggestions emerging from Brazil and other stakeholders include:

- Streamlining negotiation procedures by eliminating repetitive agenda items, reducing negotiation time, and capping delegation sizes to prevent overcrowding and domination by rich nations.

- Restricting host eligibility: Proposals advocate barring countries with poor climate records—particularly fossil fuel-reliant nations—from hosting COPs. This follows criticism over COP28 (UAE) and COP29 (Azerbaijan).

- Mainstreaming climate discourse across other international platforms, such as the UN General Assembly, IMF, and multilateral banks, to enable faster action through complementary mechanisms.

The Unmet Climate Finance Pledge

Climate finance remains the most contentious issue. Under the Paris Agreement, developed countries had pledged $100 billion per year by 2020 to support climate action in developing countries. However, at the Baku (COP29) meeting, a new proposal of $300 billion per year starting 2035 fell far short of the actual requirement—estimated at $1.3 trillion annually.

Developing countries, especially BRICS and G77, have demanded urgent action to define a new climate finance goal. They stressed the need for finance to be predictable, equitable, and accessible to all vulnerable nations.

Role of Civil Society and Observers

There is growing demand from civil society organizations and observer groups for reforms to ensure greater transparency, restrict the influence of fossil fuel lobbies, and democratize the negotiation process.

Conclusion

While significant reforms may face resistance due to entrenched geopolitical and economic interests, Brazil’s proactive approach marks a turning point. If supported, these efforts could rejuvenate the UNFCCC process by embedding inclusivity, accountability, and justice at its core—essential for addressing the escalating global climate crisis.

Tamil Nadu’s TB Death Prediction Model

- 12 Jul 2025

In News:

Tamil Nadu has become the first Indian state to integrate a predictive model for tuberculosis (TB) deaths into its State TB Elimination Programme. This initiative, in partnership with the Indian Council of Medical Research’s National Institute of Epidemiology (ICMR-NIE), marks a significant step in India’s public health innovation, aimed at reducing TB-related mortality through data-driven, early intervention strategies.

The model has been embedded within the existing TB SeWA (Severe TB Web Application) platform, launched under the state’s Tamil Nadu Kasanoi Erappila Thittam (TN-KET), a differentiated care initiative operational since 2022. It enables real-time triaging and prioritisation of severely ill patients at the time of diagnosis, improving early access to hospital care—a crucial step, as over 70% of TB deaths occur within the first two months of treatment.

How the Predictive Model Works

The model is based on five triage indicators:

- Body Mass Index (BMI)

- Pedal oedema (foot/ankle swelling)

- Respiratory rate

- Oxygen saturation

- Ability to stand without support

Healthcare workers input these variables into the TB SeWA app, which calculates a predicted probability of death, ranging from 10% to 50% for severely ill patients. For those not flagged, the risk ranges between 1% and 4%. This objective risk estimate empowers frontline health workers to make urgent and informed decisions about hospital admission and care.

Data used for model development included nearly 56,000 TB patients diagnosed in Tamil Nadu’s public health facilities between July 2022 and June 2023. Notably, 10–15% of adults with TB in the state were found to be severely ill at diagnosis. The model's predictive accuracy has been validated as equivalent to the national Ni-kshay portal, which captures a broader range of data but with a delay of up to three weeks—often too late for timely intervention.

Implementation and Impact

The model is now functional across all 2,800 public health facilities in Tamil Nadu, from Primary Health Centres to Medical Colleges. The average time from diagnosis to hospital admission is already around one day, but delays of 3–6 days still occur in about 25% of cases. By introducing objective, real-time risk assessment, the model aims to eliminate such delays and further reduce early TB deaths.

The TN-KET initiative has shown promising results: nearly two-thirds of districts have documented reduced mortality and losses in the TB care cascade. Tamil Nadu remains the only Indian state to systematically record and act upon these five triage variables at the point of diagnosis.

National and Global Relevance

India carries the highest TB burden globally, with two TB-related deaths every three minutes, according to the WHO. Tamil Nadu’s model aligns with global findings, such as those from Ethiopia, identifying low body weight, age, and TB/HIV co-infection as key mortality predictors. Addressing these early improves outcomes significantly.

This innovation presents a scalable, replicable model for other Indian states and developing nations striving to eliminate TB by 2030, in line with WHO’s End TB Strategy and India’s National Strategic Plan.

The Role of ‘Invisible’ Trade in India’s Foreign Exchange Earnings

- 11 Jul 2025

In News:

India's foreign trade landscape has undergone a fundamental transformation, with "invisible" trade—comprising services exports and private remittance inflows—emerging as a dominant contributor to foreign exchange earnings. Traditionally, international trade is associated with the export and import of physical goods. However, the increasing weight of intangibles such as services and remittances has positioned India as the “office of the world” in contrast to China’s role as the “factory of the world.”

Trends in India’s Visible vs Invisible Trade

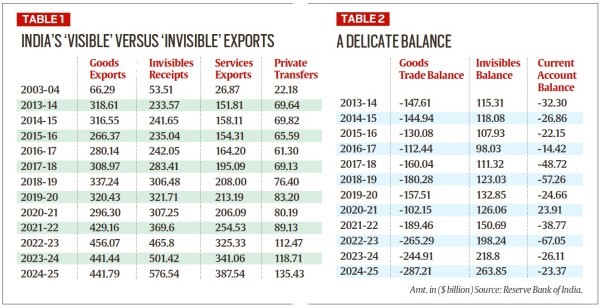

India’s merchandise exports rose from $66.3 billion in 2003–04 to $456.1 billion in 2022–23, before dipping slightly to $441.8 billion in 2024–25. While goods exports have fluctuated with global economic cycles, invisibles have exhibited resilient and consistent growth.

- Invisible receipts increased from $53.5 billion in 2003–04 to $233.6 billion in 2013–14, and further to $576.5 billion in 2024–25.

- In 2024–25, invisible receipts exceeded merchandise exports by $135 billion, reversing the trend from a decade earlier.

Composition of Invisible Earnings

- Services Exports:

- Valued at $387.5 billion in 2024–25, up from $26.9 billion in 2003–04.

- Software services remain dominant ($180.6 billion), but significant growth has also been noted in business, financial, and communication services ($118 billion).

- Private Transfers (Remittances):

- Amounted to $135.4 billion in 2024–25, up from $22.2 billion in 2003–04.

- Reflects the export of Indian human capital, with inflows from expatriates, especially in the Gulf and North America.

Economic Significance

- Current Account Management: India’s merchandise trade deficit ballooned to $287.2 billion in 2024–25, but this was substantially offset by a net invisible surplus of $263.8 billion, keeping the current account deficit at $23.4 billion, lower than 2013–14 levels.

- Geopolitical Immunity: Invisible earnings have remained relatively insulated from global trade tensions, protectionist tariffs, and geopolitical shocks. Unlike goods trade, services have not been significantly impacted by events such as the pandemic or global conflicts.

- Limited Policy Support, High Impact: Despite minimal reliance on FTAs, tariff negotiations, or production-linked incentives, invisibles have flourished—highlighting the natural comparative advantage India holds in the global services and remittances market.

Comparison with China

China recorded a merchandise trade surplus of $768 billion in 2024, but faced a deficit of $344.1 billion on the invisibles front. In contrast, India posted a services trade surplus of $188.8 billion, emphasizing its role as a global service hub rather than a manufacturing powerhouse.

Conclusion

India’s foreign trade narrative has shifted decisively towards intangible exports. With robust growth in services and remittances, invisibles have become the invisible hand stabilizing India’s external sector. For sustained macroeconomic resilience, policymakers must now institutionalize support for the services sector, facilitate human capital mobility, and leverage digital infrastructure to enhance India’s global footprint in knowledge-based trade.

AI-Based Warfare in the Agentic Age

- 10 Jul 2025

In News:

Artificial Intelligence (AI) is transforming the character of warfare, ushering in an era of “agentic warfare”—a paradigm where autonomous systems, not humans, are poised to dominate the battlefield. Military strategies today increasingly hinge on multi-domain operations (MDO) involving land, air, sea, cyber, and space, where decision-making speed, precision, and adaptability are crucial. AI is central to enabling this shift—but it comes with a critical caveat: energy dependency.

AI and the New Battlefield

Modern warfare relies on Big Data analytics, machine learning (ML), predictive modelling, and natural language processing (NLP)—tools that demand not only computational power but also massive energy inputs. Countries like China have already made significant strides. Its military, the People’s Liberation Army (PLA), is actively integrating AI into combat functions under the doctrine of “intelligentised warfare.” Applications range from automating artillery systems to deploying generative AI-enabled drones for radar targeting.

China’s AI developments, such as the DeepSeek model, complement battlefield deployments. Of concern to India is China’s support to Pakistan’s Centre of Artificial Intelligence and Computing (PAIC), which focuses on Cognitive Electronic Warfare. India’s Deputy Chief of Army Staff, Lt Gen Rahul Singh, revealed that Pakistan possibly used real-time Chinese satellite intelligence and AI analytics during Operation Sindoor.

India’s Response and Gaps

India was an early mover, establishing the DRDO’s Centre for Artificial Intelligence and Robotics (CAIR) in 1986 to develop AI applications for target recognition, navigation, logistics, and mine detection. However, the pace of deployment has lagged, especially compared to China. Lt Gen Amardeep Singh Aujla underlined the increasing intensity of warfare, emphasizing the necessity of C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance) and civil-military fusion to enhance readiness.

The Centre for Joint Warfare Studies (CENJOWS) notes the growing global use of AI in weapon systems, battlefield simulation, and cyber defence. For instance, Ukraine’s AI-powered drones have autonomously struck Russian oil facilities. Israel’s “Lavender” AI system has reportedly identified over 37,000 Hamas targets, exemplifying the real-time integration of AI in warfare.

Energy: The Hidden Backbone

While AI’s capabilities are evident, its energy appetite is equally significant. AI infrastructure—data centres, servers, and cooling systems—requires vast amounts of electricity, often from stable sources like nuclear energy. India’s current installed nuclear capacity (~7.5 GW) is starkly inadequate when compared to countries like South Korea (over 22 GW), limiting India's long-term AI defence potential.

Kris P. Singh, CEO of Holtec International, argues that Small Modular Reactors (SMRs) placed near AI data hubs could be the solution. He proposes co-locating SMRs with military or strategic data centres to power next-generation capabilities like drones, smart soldiers, and robotics. India's past policy to limit thermal power and insufficient storage in renewable energy has created grid instability, further compounding the challenge.

Way Forward